My Annuity Is Out Of Surrender 2024 marks a significant milestone for many annuity holders, granting them greater flexibility and control over their funds. This pivotal moment signals the end of the surrender period, a time when withdrawing funds typically incurs penalties.

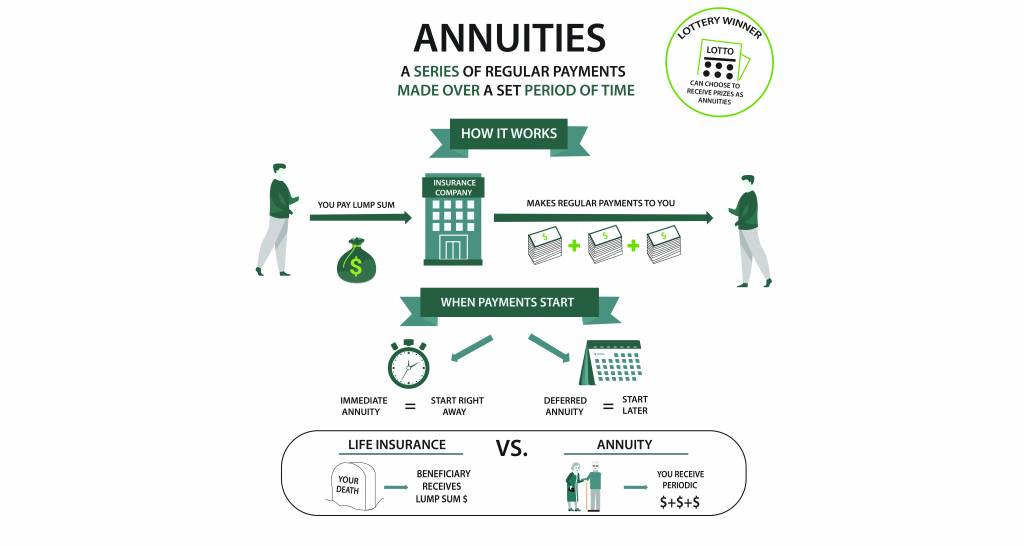

Annuity and life insurance are often confused. While both involve financial planning, they serve distinct purposes. To understand the key differences between annuities and life insurance policies in 2024, it’s helpful to visit Is Annuity A Life Insurance Policy 2024.

As you navigate this new phase, understanding the implications and strategies for managing your annuity becomes crucial. This guide explores the intricacies of annuities, shedding light on the “out of surrender” status, its implications, and how to make informed decisions about your financial future.

The formula used to calculate annuity payments can be complex, but it’s essential for understanding the financial implications. To learn more about the annuity formula and its application in 2024, you can explore Annuity Formula Is 2024.

Annuities are financial instruments that provide a stream of income over a specific period. They are often used for retirement planning, offering a way to secure a steady income stream during those later years. The surrender period, a crucial element of annuity contracts, is the time during which withdrawing funds before maturity incurs penalties.

An annuity certain is a type of annuity that guarantees payments for a fixed period of time. To understand the characteristics of annuity certain and how it differs from other annuity types, you can explore Annuity Certain Is An Example Of 2024.

Once the surrender period ends, your annuity is “out of surrender,” granting you greater flexibility and control over your funds. This means you can withdraw funds without penalty, allowing you to access your money when you need it most.

Annuity, or “annuity,” is a financial instrument that provides regular payments for a set period of time. If you’re unfamiliar with the concept of annuities, you can find a clear explanation in Hindi by visiting Annuity Kya Hai 2024.

Understanding Annuities

Annuities are financial products designed to provide a stream of regular payments, often for a set period of time. They are popular among individuals seeking guaranteed income during retirement or for other long-term financial goals. Annuities are typically purchased with a lump sum of money, and the insurance company then makes payments to the annuitant (the person who purchased the annuity) for a specified period, which could be for life or for a fixed number of years.

Annuity payments are generally considered unearned income, as they represent a return on your initial investment. However, there are specific circumstances where annuities may be treated as earned income. To understand the tax implications of annuity payments in 2024, you can visit Is Annuity Earned Income 2024.

Types of Annuities

Annuities come in various forms, each with its own features and benefits. Here are some common types:

- Fixed Annuities:These provide a guaranteed rate of return, ensuring predictable income payments. The amount of each payment is fixed, and the principal is protected from market fluctuations.

- Variable Annuities:These offer the potential for higher returns, but also carry a greater risk. The payment amount is linked to the performance of a chosen investment portfolio, so the income stream can fluctuate.

- Indexed Annuities:These combine the safety of fixed annuities with the potential for growth tied to a specific market index, such as the S&P 500.

- Immediate Annuities:Payments begin immediately after the annuity is purchased. These are suitable for individuals who need immediate income.

- Deferred Annuities:Payments start at a future date, allowing the annuity to grow tax-deferred until the payout begins.

Surrender Period

A surrender period is a time frame specified in an annuity contract during which the annuitant cannot withdraw funds without incurring penalties. This period is designed to protect the insurance company from early withdrawals that could disrupt the annuity’s financial stability.

The Jaiib (Junior Associate of the Indian Institute of Bankers) exam covers a range of financial topics, including annuities. To understand how annuities are addressed in the Jaiib exam in 2024, you can visit Annuity Jaiib 2024.

Examples of Surrender Periods

The surrender period can vary depending on the type of annuity and the insurance company. Here are some examples:

- Fixed Annuities:Surrender periods typically range from 5 to 10 years.

- Variable Annuities:Surrender periods can be longer, sometimes extending up to 15 years.

- Indexed Annuities:Surrender periods are usually similar to fixed annuities, ranging from 5 to 10 years.

The “Out of Surrender” Status

When an annuity reaches the end of its surrender period, it is considered “out of surrender.” This means the annuitant can withdraw funds without facing penalties, and they have full access to their principal and accumulated earnings.

While annuities are primarily associated with retirement planning, they can also play a role in health careers. To understand how annuities might be relevant to health careers in 2024, you can check out Annuity Health Careers 2024.

Implications of Being Out of Surrender, My Annuity Is Out Of Surrender 2024

The “out of surrender” status offers several advantages to the annuitant, including:

- Penalty-Free Withdrawals:The annuitant can access their funds without incurring surrender charges or other penalties.

- Flexibility:The annuitant has more control over their money and can use it for various purposes, such as unexpected expenses or investment opportunities.

Timeframes for Reaching Out of Surrender

The time it takes for an annuity to reach the “out of surrender” status depends on the specific contract terms. However, it typically ranges from 5 to 15 years, depending on the annuity type and the insurance company’s policies.

Factors Affecting Surrender Periods

Several factors can influence the surrender period of an annuity. Understanding these factors can help individuals make informed decisions when choosing an annuity.

John Hancock is a well-known provider of annuity products, offering a range of options to meet different financial needs. If you’re considering an annuity from John Hancock in 2024, it’s essential to compare their offerings and understand the terms.

You can find more information about John Hancock annuities at Annuity John Hancock 2024.

Annuity Type

The type of annuity plays a significant role in determining the surrender period. For example, fixed annuities typically have shorter surrender periods than variable annuities, which are designed for longer-term investments.

Insurance Company Policies

Insurance companies have their own policies regarding surrender periods. Some companies may offer shorter surrender periods to attract customers, while others may have longer periods to protect their financial interests.

K, as an annuitant, is currently receiving regular payments from their annuity. This means they’ve made an initial investment and are now benefiting from the guaranteed income stream. To learn more about the process of receiving annuity payments in 2024, you can visit K Is An Annuitant Currently Receiving Payments 2024.

Contract Terms

The specific terms of the annuity contract will Artikel the surrender period. It’s crucial to carefully review the contract before purchasing an annuity to understand the surrender period and its implications.

Annuity products are primarily designed to provide a regular income stream, often during retirement. To understand the key purposes of annuities and how they can benefit individuals in 2024, you can visit An Annuity Is Primarily Used To Provide 2024.

Consequences of Early Withdrawal

Withdrawing funds from an annuity before the surrender period ends can result in significant penalties. These penalties are designed to discourage early withdrawals and protect the insurance company’s financial stability.

Kathy’s annuity might be experiencing some fluctuations, which is common in the financial world. It’s important to understand the factors influencing her annuity’s performance and how to navigate potential challenges. For insights into Kathy’s situation, you can check out Kathy’s Annuity Is Currently Experiencing 2024.

Early Withdrawal Penalties

The penalties for early withdrawal can vary depending on the annuity contract and the insurance company. Common penalties include:

- Surrender Charges:These are fees levied on the withdrawn amount, typically decreasing over time as the surrender period progresses.

- Interest Rate Reductions:The interest rate earned on the annuity may be reduced for early withdrawals.

- Loss of Guaranteed Income:Early withdrawals may result in the loss of guaranteed income payments for the remainder of the annuity term.

Table Illustrating Withdrawal Scenarios

| Withdrawal Year | Surrender Charge (%) | Withdrawal Amount ($) | Penalty ($) | Net Withdrawal ($) |

|---|---|---|---|---|

| 1 | 10 | 10,000 | 1,000 | 9,000 |

| 3 | 5 | 10,000 | 500 | 9,500 |

| 5 | 0 | 10,000 | 0 | 10,000 |

This table illustrates a hypothetical example of a $10,000 annuity with a surrender period of 5 years. As you can see, the penalty decreases each year until it reaches zero at the end of the surrender period.

When considering an annuity, it’s natural to wonder if it’s a guaranteed investment. While annuities offer some security, they’re not completely risk-free. To understand the nuances of annuity guarantees in 2024, it’s worth exploring Is Annuity Guaranteed 2024.

Strategies for Managing Annuities: My Annuity Is Out Of Surrender 2024

Managing annuities effectively requires careful planning and consideration of potential withdrawal needs and retirement goals. Here are some strategies to help you navigate the complexities of annuities:

Planning for Retirement

Annuities can play a vital role in retirement planning by providing a steady stream of income. When planning for retirement, consider the following:

- Determine your income needs:Calculate your estimated expenses during retirement to determine the amount of income you will require.

- Consider your investment goals:Determine your risk tolerance and investment objectives to choose an annuity that aligns with your goals.

- Plan for potential withdrawals:Anticipate any potential withdrawal needs during retirement and factor them into your annuity strategy.

Estimating Annuity Growth

To estimate the potential growth of an annuity over time, consider the following factors:

- Interest rates:The interest rate earned on the annuity will significantly impact its growth.

- Surrender periods:Early withdrawals can reduce the growth potential due to surrender charges and other penalties.

- Investment performance:For variable annuities, the performance of the underlying investment portfolio will affect the annuity’s growth.

Seeking Professional Advice

When managing annuities, it is essential to seek professional financial advice. A qualified financial advisor can help you:

- Choose the right annuity:An advisor can help you select an annuity that meets your specific needs and financial goals.

- Develop a withdrawal strategy:An advisor can help you plan for potential withdrawals during retirement, minimizing penalties and maximizing your returns.

- Monitor your annuity:An advisor can help you track the performance of your annuity and make adjustments as needed.

Tax Implications of Annuities

The tax implications of withdrawing funds from an annuity depend on whether the withdrawal is qualified or non-qualified.

Annuity products are available in Hong Kong, offering a way to secure a steady income stream for retirement or other financial goals. To learn more about annuity options in Hong Kong in 2024, you can explore Annuity Hk 2024.

Qualified Withdrawals

Qualified withdrawals are typically made after the annuitant reaches age 59 1/2 and are taxed as ordinary income. These withdrawals are subject to the same tax rates as other forms of income.

Annuity products can be a valuable tool for retirement planning, offering a steady stream of income. To understand if an annuity is a good fit for your financial goals in 2024, it’s helpful to explore the benefits and drawbacks.

For more information, you can visit Annuity Is Good 2024.

Non-Qualified Withdrawals

Non-qualified withdrawals are made before age 59 1/2 or for purposes other than retirement. These withdrawals are subject to a 10% penalty in addition to ordinary income tax. However, there are some exceptions to this penalty, such as for medical expenses, disability, or home purchases.

Tax Treatment of Annuity Withdrawals

| Withdrawal Scenario | Tax Treatment |

|---|---|

| Qualified withdrawal after age 59 1/2 | Taxed as ordinary income |

| Non-qualified withdrawal before age 59 1/2 | Taxed as ordinary income + 10% penalty |

| Withdrawal for qualified expenses (e.g., medical, disability) | May be exempt from the 10% penalty |

It’s important to consult with a tax professional to understand the specific tax implications of your annuity withdrawals.

Closing Summary

Navigating the “out of surrender” status of your annuity can be a complex process. Understanding the implications, exploring your options, and seeking professional guidance are key to maximizing the benefits of your annuity. By understanding the nuances of your contract, you can make informed decisions that align with your financial goals and ensure a secure and prosperous future.

Remember, your annuity is a valuable financial asset, and knowing how to manage it effectively is crucial for achieving financial security and peace of mind.

Annuity home loans can be a great option for those looking to purchase a home in 2024. These loans allow you to make fixed monthly payments for a set period of time, which can help you budget more effectively.

To learn more about how these loans work, you can visit Annuity Home Loan 2024.

Commonly Asked Questions

What happens if I withdraw money from my annuity before the surrender period ends?

You may face penalties for early withdrawal, which can vary depending on your annuity contract and the insurance company’s policies. These penalties can significantly impact your overall return.

How do I know if my annuity is out of surrender?

You can usually find this information in your annuity contract or by contacting your insurance company directly. They can provide you with the specific date when your surrender period ends.

Can I change my annuity contract once it is out of surrender?

Yes, you may have options to adjust your annuity contract, such as changing the payment schedule or withdrawing funds. It’s best to consult with your insurance company or a financial advisor to explore your options.

What are the tax implications of withdrawing funds from an annuity?

The tax treatment of annuity withdrawals depends on whether they are qualified or non-qualified. Qualified withdrawals are generally taxed as ordinary income, while non-qualified withdrawals may be subject to a 10% penalty, in addition to regular income tax. It’s essential to consult with a tax professional to understand the tax implications of your specific situation.