Mortgage Rates 2022 took center stage as a year of significant fluctuations, impacting both homebuyers and sellers. The year began with rates hovering near historic lows, encouraging a surge in homebuying activity. However, as inflation surged and the Federal Reserve embarked on a series of interest rate hikes, mortgage rates climbed steadily, making homeownership more expensive for many.

This shift had a ripple effect on the housing market, slowing down sales and leading to a cooling of prices in some regions. Understanding the forces driving these rate changes and their impact on the housing market is crucial for anyone considering buying or selling a home in the current climate.

USDA loans are designed to help eligible borrowers purchase homes in rural areas. USDA loans offer low interest rates and flexible financing options.

Mortgage Rate Trends in 2022

The year 2022 saw a dramatic shift in the mortgage rate landscape, with rates experiencing a significant climb throughout the year. This upward trend was largely driven by the Federal Reserve’s aggressive interest rate hikes in response to surging inflation.

As the year progressed, mortgage rates steadily increased, impacting both homebuyers and sellers in the housing market.

Home loan rates are constantly changing, so it’s important to stay informed. Home loan rates can vary depending on your credit score, loan type, and other factors.

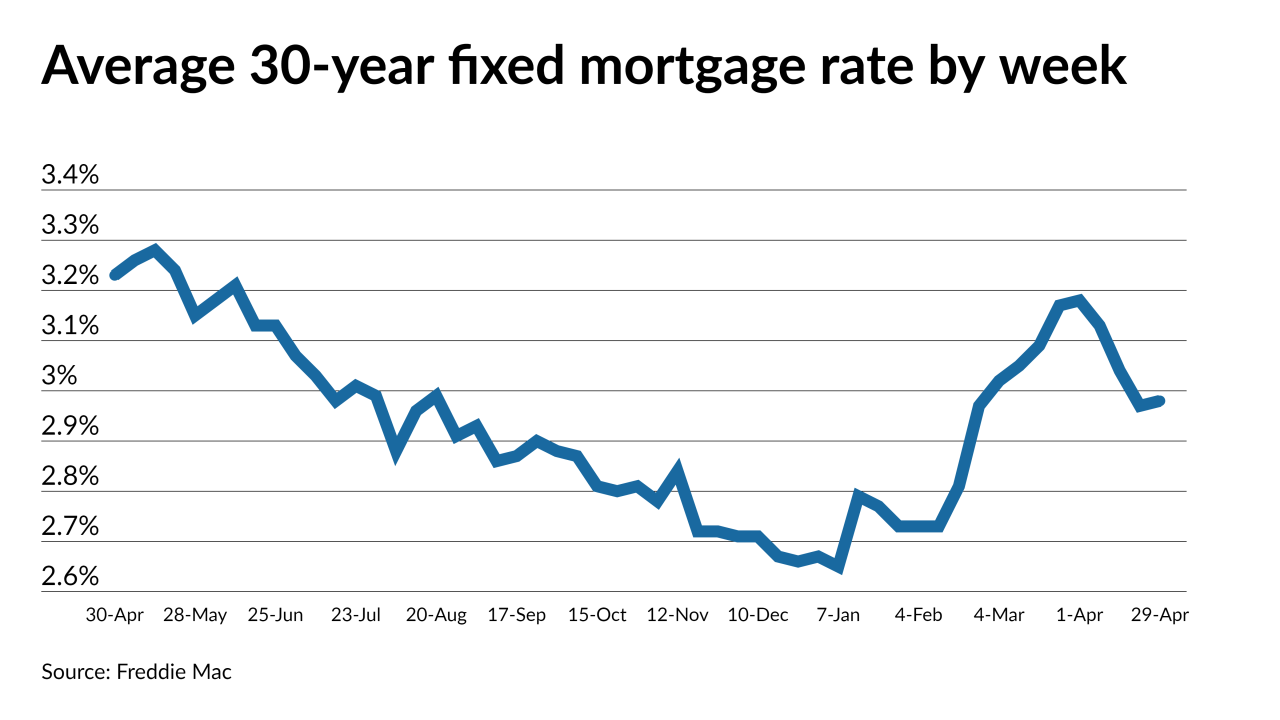

Mortgage Rate Trends Throughout 2022

Mortgage rates began 2022 at relatively low levels, hovering around 3%. However, as the year unfolded, rates began to climb steadily, reaching a peak of over 7% by the end of the year. This sharp increase was unprecedented in recent history and significantly impacted the affordability of homeownership.

A VA construction loan can be a valuable option for veterans looking to build their dream home. VA construction loans offer unique benefits and financing options.

Key Factors Influencing Mortgage Rate Trends

- Inflation and Federal Reserve Interest Rate Hikes:The primary driver of mortgage rate increases in 2022 was the Federal Reserve’s efforts to combat inflation. The Fed raised interest rates several times throughout the year, which directly impacted mortgage rates, as they are closely tied to the broader economy.

An equity loan can be a great way to access the equity you’ve built in your home. Equity loans offer fixed interest rates, which can provide predictable monthly payments and peace of mind.

- Economic Conditions:The overall economic climate, including factors such as unemployment, consumer spending, and economic growth, played a significant role in influencing mortgage rate trends. A strong economy typically leads to higher interest rates, while a weak economy can result in lower rates.

Refinancing your mortgage can be a smart move if interest rates have dropped or your financial situation has changed. Refinancing your mortgage can lower your monthly payments and save you money over time.

- Investor Demand and Supply in the Mortgage Market:The demand for mortgages from investors, such as institutional investors and hedge funds, also influenced rate fluctuations. When investor demand for mortgages is high, rates tend to rise, while lower demand can lead to lower rates.

Comparison of Mortgage Rates at Different Points in 2022

| Time Period | Average 30-Year Fixed Mortgage Rate |

|---|---|

| January 2022 | 3.22% |

| June 2022 | 5.51% |

| December 2022 | 7.08% |

Impact of Rate Fluctuations on the Housing Market, Mortgage Rates 2022

The significant increase in mortgage rates throughout 2022 had a notable impact on the housing market. Rising rates made homeownership less affordable for many buyers, leading to a decrease in demand and a slowdown in home sales. This also caused a shift in the balance of power between buyers and sellers, with sellers often having to adjust their pricing expectations to attract buyers.

Current VA mortgage rates can vary depending on the lender and your individual circumstances. Current VA mortgage rates are typically competitive and offer benefits to eligible veterans.

Factors Affecting Mortgage Rates in 2022

The year 2022 saw a complex interplay of factors that contributed to the dramatic rise in mortgage rates. Understanding these factors is crucial for anyone looking to purchase a home or refinance their mortgage.

Role of Inflation and Interest Rate Hikes

The Federal Reserve’s aggressive interest rate hikes to combat inflation were the primary driver of mortgage rate increases in 2022. When the Fed raises interest rates, it becomes more expensive for lenders to borrow money, which in turn leads to higher mortgage rates.

ARM (Adjustable Rate Mortgage) rates can fluctuate, so it’s important to understand how they work before committing to one. ARM mortgage rates may be attractive initially, but they can rise over time.

The Fed’s actions were aimed at cooling down the economy and reducing inflationary pressures.

Credit unions often offer competitive auto loan rates. Credit union auto loan rates can be a great option for those seeking affordable financing.

Impact of Economic Conditions

The overall economic climate played a significant role in influencing mortgage rates. Factors such as unemployment, consumer spending, and economic growth can impact investor confidence and borrowing costs, ultimately affecting mortgage rates. For example, a strong economy with low unemployment and robust consumer spending can lead to higher interest rates as investors seek higher returns.

Influence of Investor Demand and Supply

Investor demand for mortgages also played a role in rate fluctuations. When institutional investors and hedge funds are actively seeking mortgages, it can drive up demand and push rates higher. Conversely, a decrease in investor demand can lead to lower rates.

The supply of available mortgages can also impact rates. A shortage of mortgages can lead to higher rates, while an abundance of mortgages can lead to lower rates.

Other Significant Factors

- Government Policies:Government policies, such as changes to mortgage regulations or tax incentives, can also influence mortgage rates. For example, changes to the Federal Housing Administration (FHA) loan program can impact the availability and affordability of mortgages for certain borrowers.

- Global Economic Events:Global economic events, such as geopolitical tensions or changes in global interest rates, can also impact mortgage rates in the United States. For instance, a global economic slowdown can lead to lower interest rates, while a global economic boom can lead to higher rates.

No credit check loans are typically associated with higher interest rates and fees. No credit check loans can be a last resort option for those with poor credit.

Types of Mortgages and Their Rates in 2022

Mortgage rates can vary depending on the type of mortgage you choose. Understanding the different types of mortgages and their rate characteristics is crucial for making an informed decision.

Overview of Different Mortgage Types

| Mortgage Type | Rate Characteristics | Pros | Cons |

|---|---|---|---|

| Fixed-Rate Mortgage | Interest rate remains fixed for the entire loan term. | Predictable monthly payments, protection against rising interest rates. | May have a higher initial interest rate compared to adjustable-rate mortgages. |

| Adjustable-Rate Mortgage (ARM) | Interest rate can adjust periodically based on a benchmark index. | Potentially lower initial interest rate compared to fixed-rate mortgages. | Interest rate and monthly payments can fluctuate, making long-term budgeting unpredictable. |

| Jumbo Mortgage | Loan amount exceeds the conforming loan limit set by Fannie Mae and Freddie Mac. | Higher loan amounts for larger homes or properties. | May have higher interest rates and stricter qualifying requirements. |

Impact of Mortgage Rates on Homebuyers and Sellers

The rise in mortgage rates in 2022 had a significant impact on both homebuyers and sellers, affecting their affordability, purchasing power, and overall market dynamics.

Online lenders have become increasingly popular in recent years. Online lenders offer a convenient and streamlined loan application process.

Impact on Homebuyers

| Impact | Description |

|---|---|

| Reduced Affordability | Higher mortgage rates made homes less affordable for many buyers, reducing their purchasing power. |

| Increased Competition | As affordability decreased, competition among buyers intensified, making it more challenging to secure a home. |

| Longer Approval Times | Lenders tightened lending standards in response to rising rates, leading to longer approval times for mortgages. |

Impact on Sellers

| Impact | Description |

|---|---|

| Decreased Demand | Rising rates led to a decrease in demand for homes, resulting in fewer buyers in the market. |

| Slower Sales | The slowdown in demand caused homes to spend more time on the market, leading to longer sales cycles. |

| Price Adjustments | To attract buyers in a cooling market, sellers often had to adjust their asking prices downward. |

Mortgage Rate Predictions for 2023

Predicting mortgage rates is a complex task, as they are influenced by a multitude of factors. However, current market conditions and expert opinions provide insights into potential trends for 2023.

A home equity line of credit (HELOC) allows you to borrow against the equity in your home as needed. Home equity lines of credit provide a revolving line of credit that can be accessed as needed.

Current Market Conditions and Their Impact

The Federal Reserve is expected to continue raising interest rates in 2023, albeit at a slower pace than in 2022. This suggests that mortgage rates could remain elevated, but may not experience the same sharp increases as in the previous year.

Debt consolidation loans can help you simplify your finances and potentially save money on interest. Best debt consolidation loans offer lower interest rates and a single monthly payment.

The overall economic climate, inflation, and investor sentiment will also play a role in shaping future rate movements.

Expert Opinions and Forecasts

Experts are divided on the future trajectory of mortgage rates. Some believe that rates will continue to rise in 2023, while others predict a stabilization or even a slight decline. The ultimate direction will depend on the effectiveness of the Fed’s monetary policy in controlling inflation and the overall economic outlook.

PNC HELOCs (Home Equity Lines of Credit) provide flexible financing options for homeowners. PNC HELOCs can be used for a variety of purposes, including home improvements or debt consolidation.

Key Factors Influencing Future Rate Movements

- Inflation:The Fed’s primary focus is to bring inflation under control. If inflation remains high or continues to rise, the Fed may need to raise interest rates further, which could push mortgage rates higher.

- Economic Growth:Strong economic growth can lead to higher interest rates, as investors seek higher returns. Conversely, a slowing economy can lead to lower rates.

- Investor Sentiment:Investor confidence and appetite for mortgages can influence rate movements. If investors are optimistic about the economy, they may be more willing to invest in mortgages, which could drive up demand and rates.

Advice for Homebuyers and Sellers

Given the uncertainty surrounding future mortgage rates, both homebuyers and sellers should carefully consider their financial situation and market conditions before making any major decisions. For homebuyers, it’s crucial to get pre-approved for a mortgage and understand their affordability limits.

Sellers should consult with a real estate agent to assess market conditions and pricing strategies. Staying informed about economic trends and mortgage rate forecasts can help both buyers and sellers make informed decisions.

Ending Remarks

Navigating the mortgage market in 2022 required careful consideration of the evolving rate landscape. As we look ahead to 2023, it’s essential to stay informed about the factors that could influence future rate movements. Whether you’re a prospective buyer, seller, or simply an interested observer, understanding the dynamics of mortgage rates is key to making informed decisions in today’s housing market.

Question Bank: Mortgage Rates 2022

What are the main factors that influenced mortgage rates in 2022?

If you have a lower credit score, securing a loan can be challenging. Low credit score loans may have higher interest rates, but they can still be an option.

The primary factors driving mortgage rate changes in 2022 were inflation, Federal Reserve interest rate hikes, and economic conditions.

When seeking a home equity loan, it’s wise to compare options from different lenders. Best home equity loans offer competitive terms and rates, so research is key.

How do rising mortgage rates impact homebuyers?

Rising mortgage rates make homeownership more expensive, reducing affordability for buyers. They also lead to higher monthly payments, which can strain budgets and limit purchasing power.

What are some strategies for sellers to navigate a market with rising mortgage rates?

Sellers can adapt to rising rates by pricing their homes competitively, offering incentives like seller concessions, and being flexible with closing dates.