Mortgage Life Insurance 2024 offers a crucial safety net for homeowners, ensuring their families can remain in their homes even if the unexpected happens. This type of insurance acts as a financial shield, paying off the remaining mortgage balance in the event of the policyholder’s death, preventing foreclosure and financial hardship for loved ones.

Getting an auto insurance quote is an important step in finding the right coverage for your vehicle. Explore auto insurance quotes for 2024 here: Auto Insurance Quote 2024.

Understanding the intricacies of Mortgage Life Insurance in 2024 is essential for homeowners seeking peace of mind. From the various policy types and benefits to the factors influencing premiums, this comprehensive guide delves into the key aspects of this vital financial tool.

Vehicle insurance is a legal requirement in most places, and it’s important to have adequate coverage. Find out more about vehicle insurance options for 2024: Vehicle Insurance 2024.

What is Mortgage Life Insurance?

Mortgage life insurance is a type of life insurance designed specifically to cover the outstanding balance of a mortgage loan in the event of the borrower’s death. This type of insurance offers peace of mind to homeowners and their families by ensuring that the mortgage debt is paid off, preventing foreclosure and financial hardship.

Purpose of Mortgage Life Insurance

The primary purpose of mortgage life insurance is to protect the borrower’s family from the financial burden of a mortgage debt in the event of their untimely demise. It provides a lump-sum payment to the beneficiaries, which can be used to cover the outstanding mortgage balance, ensuring that the home remains in the family’s possession.

Self-employed individuals often need to secure their own health insurance. Check out this guide for self-employed health insurance options in 2024: Self Employed Health Insurance 2024.

How Mortgage Life Insurance Works

Mortgage life insurance operates as a simple and straightforward concept. The policyholder pays regular premiums, and in the event of their death, the insurance company pays out a lump-sum benefit equal to the remaining mortgage balance. This benefit is then used to pay off the outstanding mortgage debt, freeing the beneficiaries from financial stress and allowing them to retain ownership of the property.

Liability insurance is essential for protecting yourself from financial losses due to accidents or negligence. Learn more about liability insurance coverage options for 2024 here: Liability Insurance Coverage 2024.

Benefits of Mortgage Life Insurance

- Financial Security:It provides financial security to the borrower’s family by covering the outstanding mortgage debt, preventing foreclosure and ensuring that the home remains in their possession.

- Peace of Mind:It gives homeowners peace of mind knowing that their family will be protected from the financial burden of the mortgage in case of their death.

- Affordability:Mortgage life insurance is typically more affordable than traditional life insurance policies, as it is specifically designed to cover the mortgage debt.

- Simplicity:It is a simple and straightforward product, with a clear purpose and easy-to-understand benefits.

Definition of Mortgage Life Insurance

Mortgage life insurance is a type of life insurance that is specifically designed to cover the outstanding balance of a mortgage loan in the event of the borrower’s death. It provides a lump-sum payment to the beneficiaries, which can be used to pay off the mortgage debt, preventing foreclosure and financial hardship.

Choosing the right life insurance company is a significant decision. This guide highlights the best life insurance companies in 2024: Best Life Insurance Companies 2024.

This type of insurance plays a crucial role in financial planning by providing a safety net for homeowners and their families in the event of an unexpected death.

Short-term health insurance is a good option if you need temporary coverage, especially for gaps in your healthcare plan. Learn more about the specifics of short-term health insurance for 2024 here: Short Term Health Insurance 2024.

Key Features and Benefits of Mortgage Life Insurance in 2024

Mortgage life insurance continues to be a valuable financial tool in 2024, offering several key features and benefits that can provide peace of mind to homeowners. Here are some of the key aspects to consider:

Features of Mortgage Life Insurance

- Decreasing Term Insurance:This is the most common type of mortgage life insurance, where the death benefit decreases over time, mirroring the declining mortgage balance. This ensures that the payout is sufficient to cover the remaining debt.

- Level Term Insurance:This type offers a fixed death benefit throughout the policy term, regardless of the remaining mortgage balance. This can be beneficial if you expect the mortgage balance to remain high for a significant portion of the term.

- Joint Life Insurance:This policy covers two individuals, typically a married couple, ensuring that the mortgage is paid off in the event of either person’s death.

Benefits of Mortgage Life Insurance

- Financial Protection:Mortgage life insurance provides financial protection for the borrower’s family in the event of their death, ensuring that the home remains in their possession.

- Peace of Mind:It offers peace of mind to homeowners knowing that their family will be protected from the financial burden of the mortgage.

- Affordability:Compared to traditional life insurance, mortgage life insurance is generally more affordable, as it is designed specifically to cover the mortgage debt.

- Flexibility:Some policies offer flexibility in terms of coverage amounts and premiums, allowing you to tailor the policy to your specific needs.

Advantages and Disadvantages of Mortgage Life Insurance

Advantages

- Simplicity:Mortgage life insurance is a simple and straightforward product, with a clear purpose and easy-to-understand benefits.

- Targeted Coverage:It provides specific coverage for the mortgage debt, ensuring that the family is protected from this financial burden.

- Affordability:It is generally more affordable than traditional life insurance policies.

Disadvantages

- Limited Coverage:It only covers the mortgage debt, and does not provide any other financial protection for the family.

- Potentially Higher Premiums:While generally more affordable than traditional life insurance, premiums can be higher than other types of life insurance, especially for older borrowers or those with health conditions.

- Limited Flexibility:Some policies may have limited flexibility in terms of coverage amounts and premiums.

Comparison with Other Types of Life Insurance

Mortgage life insurance is often compared to traditional term life insurance and whole life insurance. Here’s a brief comparison:

| Type | Features | Benefits | Cost |

|---|---|---|---|

| Mortgage Life Insurance | Covers outstanding mortgage balance | Provides financial protection for the family, ensures home ownership | Generally more affordable than traditional life insurance |

| Term Life Insurance | Provides temporary coverage for a specific period | Offers a death benefit to the beneficiary | Typically less expensive than whole life insurance |

| Whole Life Insurance | Provides permanent coverage for life | Offers a death benefit and cash value component | Generally more expensive than term life insurance |

Eligibility and Application Process

Eligibility for mortgage life insurance in 2024 is generally straightforward, with most individuals meeting the basic requirements. However, specific criteria and application processes may vary depending on the insurance provider.

Eligibility Criteria

- Age:Most insurers have age limits for eligibility, typically between 18 and 75 years old.

- Health:You will typically need to undergo a health assessment, which may involve a medical questionnaire, a physical examination, or both.

- Mortgage Details:You will need to provide information about your mortgage, such as the loan amount, interest rate, and remaining term.

Application Process, Mortgage Life Insurance 2024

The application process for mortgage life insurance is generally straightforward. You will typically need to:

- Contact an Insurance Provider:You can contact an insurance provider directly or use an online comparison tool to find the best rates.

- Complete an Application:You will need to provide personal information, health information, and mortgage details.

- Undergo a Health Assessment:This may involve a medical questionnaire, a physical examination, or both.

- Receive a Decision:The insurance provider will review your application and make a decision on your eligibility and premium rate.

- Pay the Premium:Once your application is approved, you will need to pay the first premium to activate your policy.

Factors Affecting Eligibility and Premiums

- Age:Older applicants generally face higher premiums, as the risk of death increases with age.

- Health:Applicants with pre-existing health conditions may face higher premiums or even be denied coverage.

- Lifestyle:Factors such as smoking, alcohol consumption, and dangerous hobbies can affect premiums.

- Mortgage Amount:The higher the mortgage amount, the higher the premium will generally be.

- Mortgage Term:A longer mortgage term will typically result in higher premiums, as the coverage period is longer.

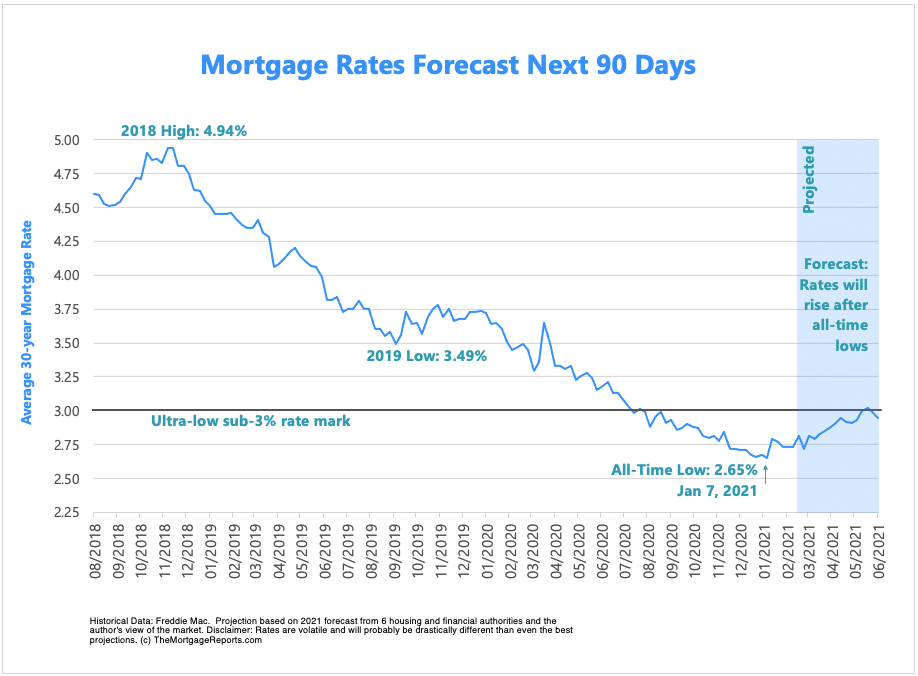

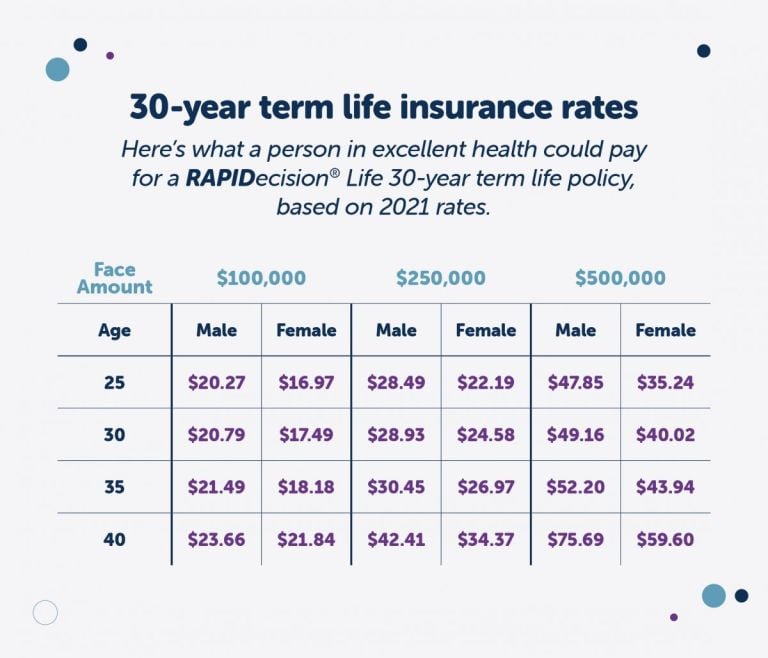

Cost and Premiums

The cost of mortgage life insurance premiums varies depending on several factors, including the applicant’s age, health, lifestyle, mortgage amount, and policy type. Understanding these factors can help you estimate the potential cost of your premiums and make informed decisions about your coverage.

If you’re looking for individual health insurance plans, it’s important to understand your options and find a plan that fits your needs. This resource provides a great starting point for individual health insurance in 2024: Individual Health Insurance 2024.

Factors Influencing Premium Costs

- Age:Younger applicants generally pay lower premiums than older applicants, as the risk of death is lower for younger individuals.

- Health:Applicants with pre-existing health conditions may face higher premiums, as they are considered higher risk by insurers.

- Lifestyle:Factors such as smoking, alcohol consumption, and dangerous hobbies can increase premiums, as these factors can contribute to a higher risk of death.

- Mortgage Amount:The higher the mortgage amount, the higher the premium will generally be, as the insurer is covering a larger amount of debt.

- Mortgage Term:A longer mortgage term will typically result in higher premiums, as the coverage period is longer.

- Policy Type:Different types of mortgage life insurance policies have different premium structures. For example, decreasing term insurance premiums are typically lower than level term insurance premiums.

Typical Premium Rates

It is difficult to provide specific premium rates without knowing the individual’s circumstances. However, here are some general examples of typical premium rates for different age groups and coverage amounts, assuming a healthy applicant with a standard mortgage:

| Age | Coverage Amount | Estimated Monthly Premium |

|---|---|---|

| 30 | $200,000 | $20-$30 |

| 40 | $200,000 | $30-$40 |

| 50 | $200,000 | $50-$60 |

Remember that these are just estimates, and actual premiums may vary significantly based on individual factors.

Allianz is a global insurance company with a strong presence in the car insurance market. Learn more about Allianz car insurance for 2024 here: Allianz Car Insurance 2024.

Impact of Health Conditions and Lifestyle

Health conditions and lifestyle choices can significantly impact premium costs. Applicants with pre-existing health conditions, such as diabetes, heart disease, or cancer, may face higher premiums or even be denied coverage. Similarly, individuals with unhealthy lifestyles, such as smokers or those who engage in dangerous hobbies, may also face higher premiums.

Lemonade Renters Insurance offers a unique and convenient way to protect your belongings as a renter. Learn more about Lemonade Renters Insurance in 2024 here: Lemonade Renters Insurance 2024.

Types of Mortgage Life Insurance Policies

There are several types of mortgage life insurance policies available in 2024, each with its own unique features, benefits, and costs. Understanding the different policy types can help you choose the option that best suits your needs and financial situation.

The General is known for providing affordable insurance options. Get a quote from The General for 2024 here: The General Insurance Quote 2024.

Types of Mortgage Life Insurance Policies

- Decreasing Term Insurance:This is the most common type of mortgage life insurance, where the death benefit decreases over time, mirroring the declining mortgage balance. This ensures that the payout is sufficient to cover the remaining debt. Premiums are typically lower than level term insurance, as the coverage amount decreases over time.

Bluecross Blueshield is a well-known provider of health insurance. Find out more about their offerings for 2024: Bluecross Blueshield 2024.

- Level Term Insurance:This type offers a fixed death benefit throughout the policy term, regardless of the remaining mortgage balance. This can be beneficial if you expect the mortgage balance to remain high for a significant portion of the term. Premiums are typically higher than decreasing term insurance, as the coverage amount remains constant.

Aetna Medicare Advantage plans are popular choices for seniors. Learn more about Aetna Medicare Advantage plans for 2024 here: Aetna Medicare Advantage 2024.

- Joint Life Insurance:This policy covers two individuals, typically a married couple, ensuring that the mortgage is paid off in the event of either person’s death. This can be a good option for couples who want to ensure that their home is protected regardless of who passes away first.

- Whole Life Insurance:While not specifically designed for mortgages, whole life insurance can be used to cover a mortgage debt. This type of insurance provides permanent coverage for life, with a death benefit and a cash value component. Premiums are typically higher than term life insurance, but the policy offers a cash value component that can be borrowed against or withdrawn.

Short-term insurance can provide temporary coverage for specific needs, such as travel or a short-term project. Explore short-term insurance options for 2024 here: Short Term Insurance 2024.

Comparison of Policy Types

| Policy Type | Features | Benefits | Cost |

|---|---|---|---|

| Decreasing Term Insurance | Death benefit decreases over time | Lower premiums, coverage matches declining mortgage balance | Typically the most affordable option |

| Level Term Insurance | Fixed death benefit throughout the term | Higher premiums, provides a fixed payout regardless of mortgage balance | More expensive than decreasing term insurance |

| Joint Life Insurance | Covers two individuals | Provides coverage for both spouses, ensures mortgage is paid off in the event of either person’s death | Premiums are based on the combined age and health of both individuals |

| Whole Life Insurance | Permanent coverage, death benefit and cash value | Provides lifetime coverage, cash value component can be borrowed against | Most expensive option, but offers long-term financial benefits |

Considerations for Choosing Mortgage Life Insurance: Mortgage Life Insurance 2024

Choosing the right mortgage life insurance policy requires careful consideration of several factors, including your individual needs, financial situation, and long-term goals. Here are some key considerations to keep in mind:

Key Factors to Consider

- Coverage Amount:Ensure the policy provides sufficient coverage to cover the outstanding mortgage balance. Consider any potential future increases in the mortgage balance.

- Policy Term:Choose a policy term that aligns with the remaining mortgage term. Consider the possibility of extending the mortgage term in the future.

- Premium Costs:Compare premiums from different insurers and policy types to find the most affordable option that meets your needs.

- Health and Lifestyle:Be honest about your health and lifestyle when applying for insurance. This will help ensure that you are approved for coverage and that your premiums are accurately calculated.

- Financial Situation:Consider your overall financial situation and budget when choosing a policy. Ensure that you can afford the premiums without straining your finances.

Comparing Different Policies and Providers

It is crucial to compare different policies and providers before making a decision. Use online comparison tools or contact insurance brokers to gather quotes from multiple insurers. Consider factors such as premiums, coverage amounts, policy terms, and customer service when making your comparison.

Understanding your insurance policy is crucial, especially in 2024 with changing regulations and market trends. Find out more about insurance policies in 2024 here: Insurance Policy 2024.

Questions to Ask Before Purchasing

- What is the coverage amount offered by the policy?

- What is the policy term?

- What are the monthly premiums?

- What are the eligibility requirements?

- What are the health and lifestyle factors that affect premiums?

- What are the policy exclusions and limitations?

- What is the claims process?

- What is the insurer’s financial stability and reputation?

Final Summary

In conclusion, Mortgage Life Insurance 2024 provides a valuable layer of protection for homeowners, safeguarding their families’ financial stability in the face of unforeseen circumstances. By carefully considering the different policy types, premiums, and factors affecting eligibility, homeowners can make informed decisions to ensure their loved ones are adequately protected and their financial legacy is secured.

Income protection insurance is crucial, especially in 2024, as it helps you maintain your financial stability if you’re unable to work due to illness or injury. You can explore various income protection insurance options by checking out this resource: Income Protection Insurance 2024.

Expert Answers

Is Mortgage Life Insurance mandatory?

No, Mortgage Life Insurance is not mandatory. It’s a personal decision based on your individual financial situation and risk tolerance.

Can I get Mortgage Life Insurance if I have pre-existing health conditions?

Yes, you can usually still get Mortgage Life Insurance even with pre-existing health conditions, but it may affect your premiums or eligibility. You’ll need to disclose your medical history during the application process.

What happens to the policy if I sell my home?

If you sell your home, your Mortgage Life Insurance policy will typically terminate. However, you may be able to convert it to a different type of life insurance policy.