Measuring Inflation Expectations in November 2024 provides a crucial lens for understanding the economic landscape. Inflation expectations are a powerful force, shaping consumer behavior, business investment, and even monetary policy decisions. As we navigate a period of economic uncertainty, understanding how individuals and institutions anticipate future price changes is essential for informed decision-making.

Obtain direct knowledge about the efficiency of CPI November 2024: A Beginner’s Guide to Understanding Inflation through case studies.

The upcoming November 2024 measurement will offer insights into how the recent economic climate, including factors like energy prices, supply chain disruptions, and monetary policy adjustments, are influencing inflation expectations. By analyzing key indicators like the University of Michigan Consumer Sentiment Index and the Survey of Professional Forecasters, we can gain valuable insights into the prevailing sentiment and its potential impact on the economy.

Measuring Inflation Expectations in November 2024

Understanding inflation expectations is crucial for navigating the complex world of economics. These expectations play a significant role in shaping economic decisions, influencing consumer spending, business investments, and even asset prices. By analyzing inflation expectations, we can gain valuable insights into the future direction of the economy and the potential impact of various economic policies.

Expand your understanding about CPI and Consumer Confidence in November 2024 with the sources we offer.

As we approach November 2024, the economic landscape is characterized by ongoing uncertainties. The lingering effects of the global pandemic, the ongoing war in Ukraine, and the Federal Reserve’s aggressive monetary policy tightening have created a dynamic and volatile environment.

Explore the different advantages of CPI and the Treatment of New Products in November 2024 that can change the way you view this issue.

This article will delve into the key indicators of inflation expectations in November 2024, analyzing the factors that are influencing these expectations and their potential implications for the economy.

Key Indicators of Inflation Expectations, Measuring Inflation Expectations in November 2024

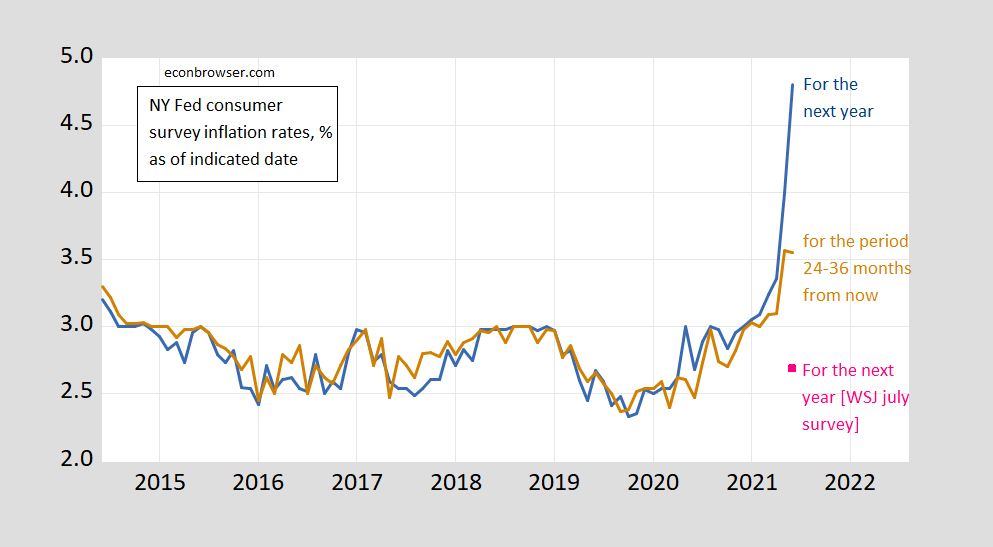

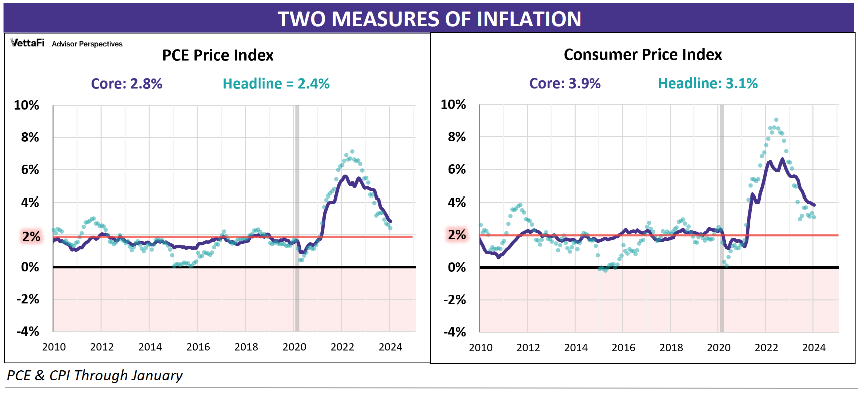

Several key indicators provide valuable insights into inflation expectations. These indicators capture the sentiment of consumers, professional economists, and policymakers, offering a comprehensive view of the prevailing expectations about future inflation.

- University of Michigan Consumer Sentiment Index:This index measures consumer confidence and includes a component that gauges expectations about inflation over the next year. A rising index suggests consumers are optimistic about the economy and anticipate lower inflation, while a declining index indicates concerns about inflation and a potential economic slowdown.

Investigate the pros of accepting The Future of CPI Calculation After November 2024 in your business strategies.

- Survey of Professional Forecasters:Conducted by the Federal Reserve Bank of Philadelphia, this survey collects forecasts from a panel of professional economists about key economic variables, including inflation. The survey provides valuable insights into the consensus view among economists regarding future inflation.

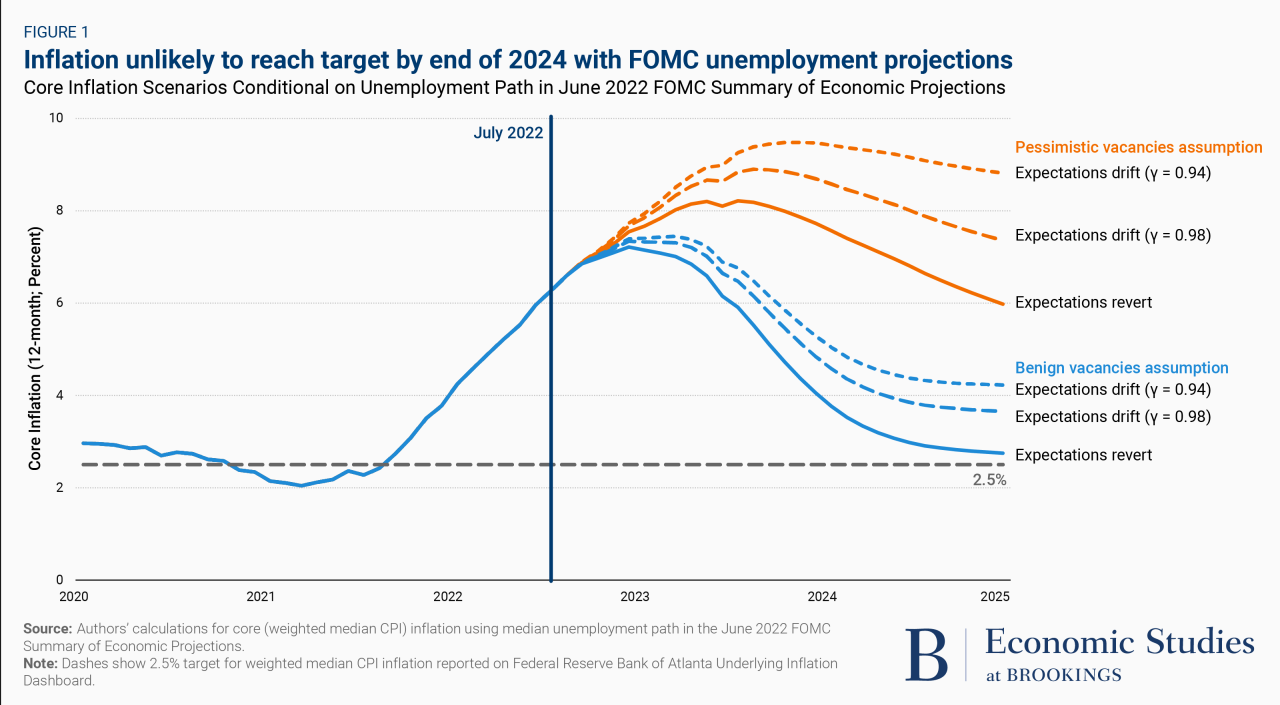

- Federal Reserve’s Summary of Economic Projections (SEP):The SEP, released quarterly by the Federal Reserve, includes projections for inflation from the members of the Federal Open Market Committee (FOMC). These projections provide a glimpse into the Fed’s own expectations for inflation and how they might influence future monetary policy decisions.

Other relevant indicators include the Cleveland Fed’s Inflation Nowcasting, which provides real-time estimates of current inflation, and the Treasury Inflation-Protected Securities (TIPS)market, which reflects market participants’ expectations of future inflation through the difference in yields between TIPS and regular Treasury bonds.

Check CPI Calculation in November 2024: Addressing Substitution Bias to inspect complete evaluations and testimonials from users.

Factors Influencing Inflation Expectations in November 2024

Several factors will likely influence inflation expectations in November 2024, shaping the outlook for the economy.

- Monetary Policy Decisions:The Federal Reserve’s ongoing monetary policy tightening, aimed at curbing inflation, will continue to be a key factor influencing inflation expectations. The Fed’s actions, including interest rate hikes and quantitative tightening, will impact borrowing costs, investment decisions, and overall economic activity.

Obtain recommendations related to Step-by-Step Guide to CPI Calculation for November 2024 that can assist you today.

A more aggressive tightening stance could lead to higher inflation expectations, while a more dovish approach might signal lower inflation expectations.

- Energy Prices and Supply Chain Disruptions:The volatility of energy prices, driven by geopolitical events and supply chain disruptions, remains a significant factor affecting inflation. High energy prices contribute to overall inflation, and persistent supply chain issues can lead to shortages and price increases. The extent to which energy prices stabilize and supply chains improve will significantly influence inflation expectations.

- Labor Market Dynamics:The strength of the labor market, characterized by low unemployment and rising wages, can fuel inflation. As wages rise, businesses may pass on these costs to consumers through higher prices. However, a weakening labor market could lead to lower wage growth and potentially lower inflation expectations.

For descriptions on additional topics like Inflation Targeting and the CPI in November 2024, please visit the available Inflation Targeting and the CPI in November 2024.

- Geopolitical Risks:Geopolitical tensions, such as the war in Ukraine and potential conflicts in other regions, can create uncertainty and disrupt global supply chains, leading to higher inflation. The resolution of these tensions and the impact on global trade will significantly influence inflation expectations.

For descriptions on additional topics like CPI and the Sharing Economy in November 2024, please visit the available CPI and the Sharing Economy in November 2024.

Interpretation of Inflation Expectations Data

Analyzing inflation expectations data requires careful consideration of the different indicators and their potential biases. It is essential to compare and contrast the various indicators to identify any consistency or divergence in their signals. Emerging trends or shifts in inflation expectations can provide valuable insights into the potential trajectory of the economy.

Understand how the union of Challenges in CPI Measurement for November 2024 can improve efficiency and productivity.

For example, if the University of Michigan Consumer Sentiment Index shows declining inflation expectations while the Survey of Professional Forecasters indicates rising inflation expectations, it suggests a divergence in views between consumers and professional economists. Understanding the reasons for this divergence can help policymakers make informed decisions.

Last Word: Measuring Inflation Expectations In November 2024

Ultimately, understanding inflation expectations in November 2024 will be crucial for navigating the economic landscape. The insights gleaned from analyzing key indicators and understanding the factors driving these expectations will provide valuable guidance for businesses, investors, and policymakers alike. By carefully considering the potential implications of these expectations, we can make informed decisions and contribute to a more stable and prosperous future.

Understand how the union of Accuracy and Reliability of the November 2024 CPI Data can improve efficiency and productivity.

Query Resolution

What are the potential implications of high inflation expectations?

High inflation expectations can lead to a vicious cycle where consumers and businesses anticipate further price increases, leading to increased demand and further price rises. This can also prompt businesses to raise prices to maintain profit margins, further fueling inflation.

How can policymakers influence inflation expectations?

Policymakers can influence inflation expectations through communication, transparency, and consistent policy actions. Clear communication about their goals and strategies can help anchor inflation expectations, while consistent policy actions can build credibility and confidence in their ability to manage inflation.

What are the key factors to watch for in November 2024?

Key factors to watch include the latest readings on consumer sentiment, business investment, and the impact of any recent policy changes on inflation expectations. Additionally, monitoring global economic developments and geopolitical events will be crucial for understanding the broader context.