Measuring ESG Performance: Standards and Frameworks sets the stage for this exploration, delving into the critical role ESG considerations play in today’s business landscape. The growing demand for responsible and sustainable practices has propelled ESG into the forefront of investment decisions, consumer behavior, and stakeholder expectations.

Inflation and recessionary pressures are impacting the global financial landscape. Inflation, Recession, and the Future of Finance examines the implications of these macroeconomic factors on financial markets, investment strategies, and the future of the financial industry.

This guide provides a comprehensive overview of ESG principles, standards, and frameworks, highlighting the importance of robust measurement and reporting for achieving sustainable success.

From understanding the three pillars of environmental, social, and governance to navigating the complexities of various ESG standards and frameworks, this exploration offers insights into the multifaceted approach to measuring ESG performance. We will examine the challenges and limitations of traditional metrics, emphasizing the need for a comprehensive and nuanced approach that reflects the diverse nature of ESG issues across different industries.

Furthermore, we will explore the crucial role of transparency and disclosure in building trust and credibility with stakeholders, ultimately demonstrating the strong connection between sustainability and financial performance.

The Rise of ESG: A Global Imperative

ESG (Environmental, Social, and Governance) considerations have gained significant traction in recent years, becoming a central pillar of responsible business practices and investment strategies. This shift is driven by a confluence of factors, including growing awareness of environmental challenges, heightened societal expectations for ethical conduct, and increasing investor interest in sustainable investments.

The Impact of ESG on Business and Investment Decisions

ESG factors are increasingly influencing investment decisions and consumer behavior. Investors are actively seeking companies with strong ESG performance, recognizing the potential for both financial returns and positive societal impact. For instance, the global ESG investment market is projected to reach over $50 trillion by 2025, demonstrating the growing appetite for sustainable investments.

Moreover, consumers are increasingly demanding products and services from companies that demonstrate responsible practices. This trend is evident in the growing popularity of ethical brands, sustainable fashion, and eco-friendly products. For instance, a recent study by Nielsen found that 77% of consumers are willing to pay more for sustainable products.

Stakeholder Pressure for ESG Performance

Companies are facing increasing pressure from stakeholders, including investors, employees, and customers, to demonstrate strong ESG performance. Investors are demanding transparency and accountability on ESG issues, often incorporating ESG metrics into their investment criteria. Employees are seeking companies that align with their values and promote a positive social and environmental impact.

Emerging markets are experiencing rapid growth, presenting exciting opportunities for businesses seeking to expand their reach. The Rise of Emerging Markets: New Opportunities and Challenges explores the potential and challenges associated with these dynamic economies, providing insights for investors and entrepreneurs.

Customers are increasingly making purchasing decisions based on a company’s ESG credentials.

For example, the UN Principles for Responsible Investment (UN PRI) has over 4,000 signatories, representing over $120 trillion in assets under management. These signatories commit to integrating ESG considerations into their investment decisions and reporting practices.

Defining ESG: Understanding the Pillars

ESG encompasses three key pillars: environmental, social, and governance. Each pillar represents a distinct set of factors that contribute to a company’s overall sustainability and responsible conduct.

Building resilience into business models is essential for long-term success. Building Resilient Businesses: Strategies for Long-Term Success outlines strategies for organizations to adapt to changing market conditions, mitigate risks, and ensure sustainable growth.

Environmental

The environmental pillar focuses on a company’s impact on the natural world. It encompasses factors such as:

- Climate Change:Greenhouse gas emissions, energy efficiency, renewable energy adoption

- Resource Management:Water conservation, waste reduction, sustainable sourcing

- Pollution:Air and water pollution, waste management, biodiversity conservation

Social

The social pillar examines a company’s impact on society and its stakeholders. It encompasses factors such as:

- Human Rights:Labor rights, fair treatment of employees, supply chain ethics

- Community Engagement:Local community impact, philanthropy, social responsibility initiatives

- Product Safety:Product safety and quality, responsible marketing practices

Governance

The governance pillar assesses a company’s internal controls and management practices. It encompasses factors such as:

- Corporate Governance:Board diversity, executive compensation, transparency and accountability

- Risk Management:Risk assessment, compliance, fraud prevention

- Ethics and Integrity:Ethical business practices, anti-corruption measures, whistleblowing mechanisms

Visual Representation of ESG Pillars

| ESG Pillar | Key Components | Examples |

|---|---|---|

| Environmental | Climate change, resource management, pollution | Reducing carbon footprint, investing in renewable energy, sustainable sourcing |

| Social | Human rights, community engagement, product safety | Promoting diversity and inclusion, supporting local communities, ensuring product quality |

| Governance | Corporate governance, risk management, ethics and integrity | Board diversity, ethical business practices, transparent reporting |

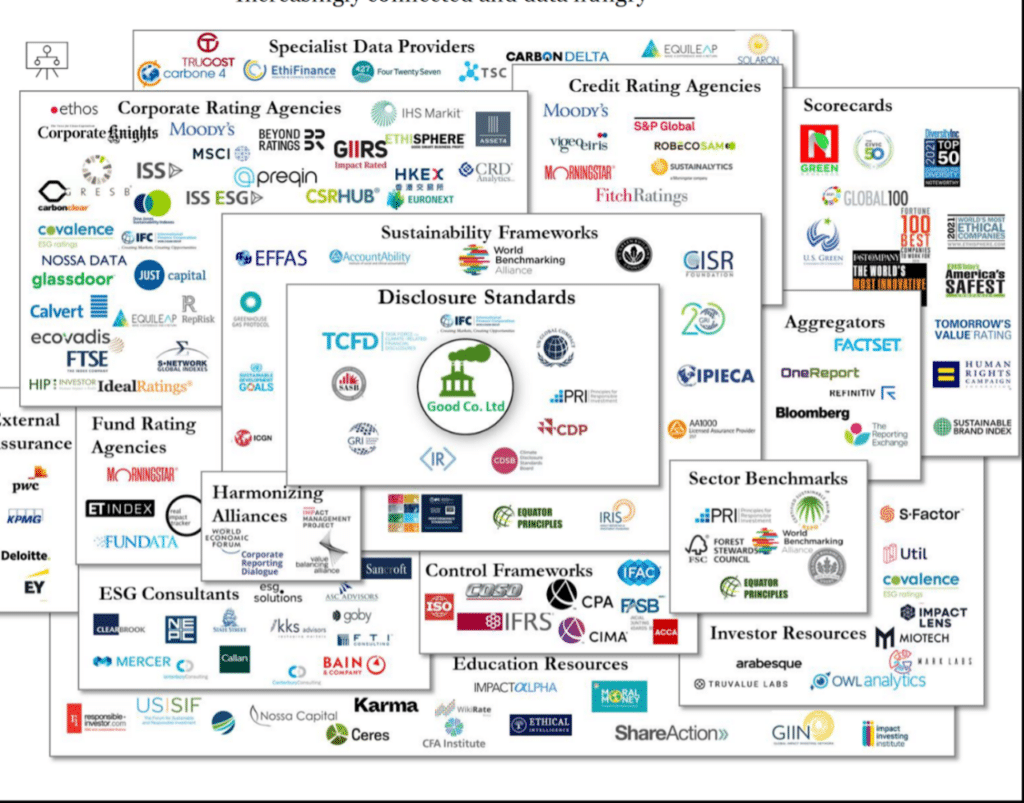

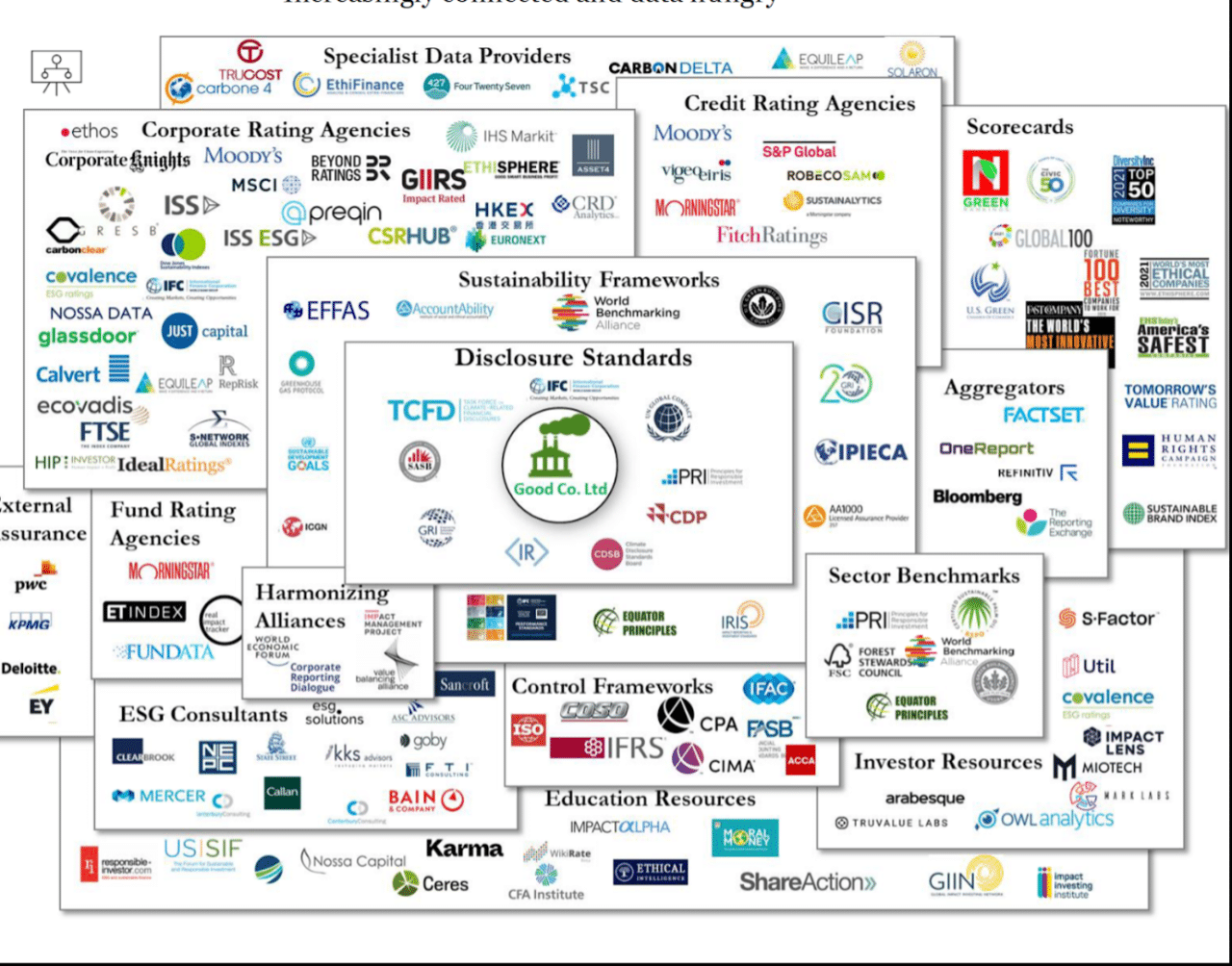

Navigating the Landscape of ESG Standards and Frameworks

A multitude of ESG standards and frameworks have emerged to provide guidance and structure for organizations seeking to measure and report on their ESG performance. These frameworks vary in their scope, focus, and applicability to different industries.

Major ESG Standards and Frameworks

- Global Reporting Initiative (GRI):A widely recognized framework for sustainability reporting, providing comprehensive guidance on environmental, social, and governance issues.

- Sustainability Accounting Standards Board (SASB):A framework that focuses on industry-specific ESG disclosures, providing standardized metrics for investors to compare companies within the same sector.

- United Nations Sustainable Development Goals (UN SDGs):A set of 17 goals adopted by the United Nations to address global challenges such as poverty, inequality, and climate change. Companies can align their ESG initiatives with the SDGs to contribute to a more sustainable future.

Strengths and Weaknesses of ESG Frameworks

Each ESG framework has its own strengths and weaknesses, depending on its scope, focus, and applicability.

The DealBook Summit 2024 will provide a platform for analyzing the global economic outlook. DealBook Summit 2024: Decoding the Global Economic Outlook will bring together leading economists and policymakers to discuss key trends and challenges shaping the global economy.

- GRI:Offers a comprehensive framework, but can be complex and require significant resources to implement.

- SASB:Provides industry-specific metrics, but may not be suitable for all industries or companies.

- UN SDGs:Provides a broad framework for global sustainability, but may not offer detailed guidance for specific ESG issues.

Choosing the Right ESG Framework

Organizations should carefully consider their specific needs and circumstances when choosing the most appropriate ESG framework. Key considerations include:

- Industry:The framework should be relevant to the organization’s industry and align with industry-specific ESG issues.

- Stakeholders:The framework should meet the expectations of key stakeholders, including investors, employees, and customers.

- Resources:The organization should have the necessary resources to implement and report on the chosen framework.

Measuring ESG Performance: A Multifaceted Approach: Measuring ESG Performance: Standards And Frameworks

Measuring ESG performance requires a multifaceted approach that encompasses data collection, analysis, and reporting. Organizations can utilize various methods and tools to assess their ESG impact and track their progress over time.

Methods and Tools for ESG Measurement

- Data Collection:Organizations can collect ESG data from internal sources, such as company records and surveys, and external sources, such as industry benchmarks and regulatory databases.

- Analysis:ESG data can be analyzed using various methods, including statistical analysis, trend analysis, and scenario planning.

- Reporting:ESG performance should be reported transparently and comprehensively to stakeholders, using frameworks such as GRI, SASB, and the UN SDGs.

Challenges and Limitations of Traditional ESG Metrics

Traditional ESG metrics often face challenges in capturing the full complexity of ESG issues. Some limitations include:

- Lack of Standardization:Different organizations may use different metrics and methodologies, making it difficult to compare performance across companies.

- Data Availability:Access to reliable and consistent ESG data can be limited, particularly for smaller companies or emerging markets.

- Focus on Quantifiable Metrics:Traditional ESG metrics often focus on quantifiable data, which may not adequately capture qualitative aspects of ESG performance.

Key Metrics for ESG Performance

| ESG Pillar | Key Metrics | Industry Examples |

|---|---|---|

| Environmental | Greenhouse gas emissions, energy consumption, water usage | Carbon footprint reduction, renewable energy adoption, water conservation |

| Social | Employee satisfaction, diversity and inclusion, community engagement | Employee turnover rates, representation of women and minorities in leadership, philanthropic contributions |

| Governance | Board diversity, executive compensation, risk management practices | Percentage of women and minorities on the board, ratio of CEO compensation to median employee pay, compliance with industry regulations |

The Value of Transparency and Disclosure

Transparent and robust ESG reporting is essential for building trust and credibility with stakeholders. By disclosing their ESG performance, companies can demonstrate their commitment to sustainability and responsible business practices.

The role of government in economic recovery is a critical topic. DealBook Summit 2024: The Role of Government in Economic Recovery will explore the effectiveness of government policies in promoting economic growth and addressing societal challenges.

Importance of ESG Reporting

- Enhanced Transparency and Accountability:ESG reporting provides stakeholders with a clear understanding of a company’s ESG performance, increasing transparency and accountability.

- Improved Stakeholder Engagement:Transparent ESG reporting can foster better communication and engagement with stakeholders, enabling them to hold companies accountable for their actions.

- Enhanced Reputation and Brand Value:Companies with strong ESG performance and transparent reporting can enhance their reputation and brand value, attracting investors, customers, and employees who value sustainability.

Best Practices in ESG Reporting

- Integrated Reporting:Integrating ESG data into financial reporting provides a holistic view of a company’s performance, highlighting the connection between sustainability and financial success.

- Materiality Assessment:Identifying and reporting on the ESG issues that are most material to the company’s business and stakeholders.

- Third-Party Verification:Seeking independent verification of ESG data and reporting to ensure accuracy and credibility.

Benefits of Integrating ESG Data into Financial Reporting

Integrating ESG data into financial reporting can provide valuable insights into a company’s long-term sustainability and financial performance. This approach can:

- Identify Risks and Opportunities:ESG data can help companies identify potential risks and opportunities related to sustainability, enabling them to mitigate risks and capitalize on new markets.

- Improve Investment Decisions:Investors can use ESG data to make more informed investment decisions, allocating capital to companies with strong sustainability profiles.

- Enhance Stakeholder Trust:Integrating ESG data into financial reporting demonstrates a company’s commitment to transparency and accountability, building trust with stakeholders.

Embracing ESG Integration: A Journey of Continuous Improvement

Integrating ESG principles into an organization’s strategy and operations is a continuous journey that requires commitment, collaboration, and a willingness to adapt. This process involves a series of key steps, from setting goals and developing policies to monitoring progress and reporting on results.

Key Steps in ESG Integration, Measuring ESG Performance: Standards and Frameworks

- Define ESG Goals and Objectives:Establishing clear ESG goals and objectives aligned with the organization’s overall strategy and values.

- Develop ESG Policies and Procedures:Implementing policies and procedures to guide the organization’s ESG practices and ensure compliance with relevant standards and regulations.

- Assess and Manage ESG Risks and Opportunities:Identifying and assessing ESG risks and opportunities across the organization’s operations and supply chain.

- Engage Stakeholders:Actively engaging with stakeholders, including investors, employees, customers, and communities, to gather feedback and build consensus on ESG initiatives.

- Monitor and Report on ESG Performance:Regularly monitoring and reporting on ESG performance using appropriate metrics and frameworks, ensuring transparency and accountability.

Stakeholder Engagement and Collaboration

Stakeholder engagement is crucial for successful ESG integration. By involving stakeholders in the process, organizations can gain valuable insights, build consensus, and ensure that their ESG initiatives are aligned with stakeholder expectations. Collaboration with external partners, such as NGOs, industry associations, and government agencies, can also provide valuable expertise and resources.

Examples of Successful ESG Integration Strategies

Numerous companies across different sectors have implemented successful ESG integration strategies. For instance,

- Unileverhas set ambitious sustainability goals, including reducing its environmental footprint and promoting sustainable sourcing practices.

- Applehas implemented a comprehensive program to reduce its carbon footprint, improve its supply chain practices, and promote diversity and inclusion.

- Teslahas focused on developing and manufacturing electric vehicles, contributing to the transition to a low-carbon economy.

The Future of ESG: Emerging Trends and Innovations

The ESG landscape is constantly evolving, driven by emerging trends and innovations. As societal expectations for responsible business practices continue to rise, companies are facing new challenges and opportunities in integrating ESG considerations into their operations.

Emerging Trends in ESG

- Climate Action:The increasing urgency of climate change is driving companies to take bolder action, setting ambitious targets for carbon emissions reduction and investing in renewable energy.

- Social Justice:Companies are increasingly addressing issues of social justice, such as diversity and inclusion, fair labor practices, and human rights in their supply chains.

- Responsible Supply Chains:Companies are taking greater responsibility for their supply chains, ensuring that their suppliers meet ethical and environmental standards.

Role of Technology in ESG

Technology is playing an increasingly important role in enhancing ESG measurement and reporting.

The future of work is being reshaped by advancements in artificial intelligence and automation. The Future of Work: AI, Automation, and the Skills Gap delves into the impact of these technologies on the workforce and the need for upskilling and reskilling initiatives to bridge the emerging skills gap.

- Data Analytics:Advanced data analytics tools can help companies collect, analyze, and report on ESG data more efficiently and effectively.

- Blockchain:Blockchain technology can enhance transparency and traceability in supply chains, improving the accountability of companies for their environmental and social impact.

- Artificial Intelligence (AI):AI can be used to develop predictive models for ESG risks and opportunities, enabling companies to make more informed decisions.

Impact of ESG on Future Business Models and Investment Strategies

ESG considerations are transforming business models and investment strategies. Companies are incorporating sustainability into their core operations, developing innovative products and services that address environmental and social challenges. Investors are increasingly allocating capital to companies with strong ESG performance, recognizing the long-term value of sustainable investments.

Sustainable investing is gaining momentum as investors prioritize environmental, social, and governance (ESG) factors. Investing in a Sustainable Future examines the growing trend of ESG investing and its potential to drive positive impact while delivering long-term returns.

Last Word

As ESG continues to evolve, embracing its principles and integrating them into organizational strategies is no longer a choice but a necessity. This journey of continuous improvement requires a commitment to stakeholder engagement, collaboration, and innovation. By harnessing the power of technology and embracing emerging trends in climate action, social justice, and responsible supply chains, businesses can pave the way for a more sustainable and equitable future.

The integration of ESG principles into business models and investment strategies is a transformative step towards a world where sustainability and profitability go hand in hand.

Helpful Answers

What are the main benefits of adopting ESG principles?

Adopting ESG principles can lead to numerous benefits, including enhanced brand reputation, increased investor confidence, improved risk management, access to new markets and financing opportunities, and attracting and retaining top talent. It can also contribute to a more sustainable and responsible business model, fostering long-term value creation.

How can I choose the right ESG framework for my organization?

In an era of volatility, navigating investment strategies is crucial. The DealBook Summit 2024: Investing in a Volatile Market will bring together industry experts to discuss effective approaches for navigating the current economic landscape and identifying opportunities for growth.

The choice of an ESG framework depends on factors such as industry, size, and specific goals. It’s important to consider the framework’s scope, focus, and applicability to your organization’s operations. Researching different frameworks, consulting with experts, and engaging with stakeholders can help determine the most suitable option.

What are the challenges of measuring ESG performance?

Challenges include data availability and quality, consistency in reporting, and the complexity of measuring intangible factors. It requires a robust data collection and analysis process, as well as a commitment to transparency and continuous improvement.