Mazda Finance sets the stage for this comprehensive guide, offering readers a detailed exploration of financing options for Mazda vehicles. From understanding the history and evolution of Mazda Finance to navigating the various financing options available, this guide provides a thorough overview of the services and benefits offered.

If you need a quick influx of cash, a Fast Loan Advance might be the solution for you. These loans are known for their rapid approval process and can provide the financial assistance you need in a pinch.

Whether you’re a seasoned car buyer or a first-time purchaser, Mazda Finance aims to make the process of acquiring your dream Mazda as smooth and rewarding as possible. This guide will delve into the intricacies of financing, exploring eligibility criteria, application procedures, and customer support resources.

Dreaming of cruising the open water? Boat Loans can make your dream a reality. These loans are specifically designed to finance the purchase of boats, making it easier to own your own vessel.

Additionally, it will compare Mazda Finance with other financial institutions, highlighting its unique strengths and benefits.

Ready to apply for a loan? Apply For A Loan online and see what options are available to you.

Ultimate Conclusion: Mazda Finance

Mazda Finance stands as a testament to the company’s commitment to customer satisfaction, offering a range of financing options tailored to individual needs. By providing competitive rates, flexible terms, and dedicated customer support, Mazda Finance empowers individuals to achieve their automotive dreams.

Unlocking your home’s equity can be a great way to fund home improvements or other financial goals. Check out the Best Home Equity Loan Rates available to find the best deal for your situation.

Whether you’re looking to finance a new Mazda or explore the benefits of pre-owned financing, this guide provides valuable insights and resources to make your car-buying journey a success.

If you’re looking to finance a real estate project, a Hard Money Loan can be a quick and efficient solution. These loans are typically short-term and secured by the property itself, making them a good option for investors and developers.

General Inquiries

What is the minimum credit score required for Mazda Finance?

While Mazda Finance doesn’t publicly disclose a minimum credit score requirement, generally, a good credit score is recommended for loan approval. It’s best to contact Mazda Finance directly for specific eligibility criteria.

For borrowers with less-than-perfect credit, Hard Money Lenders can be a valuable resource. They often consider factors beyond credit scores, making them a good option for those who may struggle to qualify for traditional loans.

Can I refinance my existing car loan through Mazda Finance?

Yes, Mazda Finance offers refinancing options for existing car loans. You can contact their customer support to discuss your refinancing options and eligibility.

Looking for a way to cover unexpected expenses or consolidate debt? Small Personal Loans can offer a flexible and convenient financing option.

What are the typical interest rates offered by Mazda Finance?

Interest rates offered by Mazda Finance vary based on factors like credit score, loan amount, and vehicle model. For a personalized rate quote, contact Mazda Finance or use their online calculator.

In a financial emergency, a $500 Cash Advance No Credit Check can provide the quick cash you need.

Before taking out a personal loan, it’s important to compare Personal Loan Rates from different lenders.

For borrowers seeking alternative financing options, Private Lenders can offer unique loan solutions.

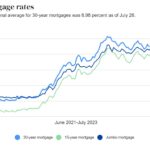

If you’re planning to buy a home, exploring 30 Year Fixed Mortgage Rates can help you make an informed decision.

Stay up-to-date on the latest mortgage rates by checking the Average 30 Year Mortgage Rate Today.

Finding a reliable Mortgage Broker Near Me can make the homebuying process smoother.

When you need money fast, Quick Loans can be a helpful solution.

Planning to purchase a new car? New Car Interest Rates can vary widely, so it’s essential to shop around for the best deal.