Maximum Stimulus Check Payment You Can Receive in Pennsylvania – Pennsylvania Stimulus Check: Maximum Payment Amounts delves into the intricacies of federal economic relief provided to residents of the Keystone State. Understanding the eligibility criteria, factors determining the maximum amount, and payment methods is crucial for maximizing potential benefits.

Obtain access to Ohio Stimulus Check Program Compared to Other States to private resources that are additional.

This guide provides a comprehensive overview of stimulus check eligibility in Pennsylvania, outlining the factors that determine the maximum amount you can receive. We’ll also explore different payment methods and offer valuable resources for further information.

Stimulus Check Eligibility in Pennsylvania

Pennsylvania residents may be eligible to receive stimulus check payments, also known as Economic Impact Payments, from the federal government. The eligibility criteria for these payments are determined by federal guidelines, but some aspects might be relevant to Pennsylvania residents.

Investigate the pros of accepting Expert Opinions on the Ohio Stimulus Check Program in your business strategies.

General Eligibility Requirements

To be eligible for stimulus checks, individuals generally need to meet the following criteria:

- Be a U.S. citizen or a lawful permanent resident.

- Have a valid Social Security number.

- Not be claimed as a dependent on someone else’s tax return.

- Have a gross adjusted gross income (AGI) below certain thresholds.

Pennsylvania-Specific Eligibility Criteria

While there are no specific Pennsylvania residency requirements for stimulus check eligibility, income thresholds and other criteria can impact eligibility.

Remember to click Long-Term Implications of the Ohio Stimulus Check Program to understand more comprehensive aspects of the Long-Term Implications of the Ohio Stimulus Check Program topic.

- Income Thresholds:The maximum income levels for stimulus check eligibility vary based on filing status. For example, single filers with an AGI below a certain amount are eligible, while married couples filing jointly with a combined AGI above a certain threshold may not be eligible.

- Residency:While residency in Pennsylvania itself is not a direct eligibility factor, the state’s tax regulations may affect how income is reported and ultimately impact eligibility for stimulus payments.

Examples of Eligible and Ineligible Individuals

Here are some examples to illustrate potential eligibility scenarios:

- Eligible:A single Pennsylvania resident with an AGI below the threshold for their filing status who is not claimed as a dependent on another person’s tax return.

- Ineligible:A Pennsylvania resident who is claimed as a dependent on their parent’s tax return, regardless of their income level. Another example would be a married couple filing jointly with an AGI exceeding the threshold for their filing status.

Determining Your Maximum Stimulus Check Amount

The maximum stimulus check amount an individual can receive in Pennsylvania is determined by several factors, primarily their income level and filing status.

Factors Affecting Maximum Stimulus Check Amount

- Income Level:The maximum stimulus check amount decreases as income levels rise. Individuals with higher incomes may receive a reduced amount or may not be eligible for any payment at all.

- Filing Status:The maximum stimulus check amount varies based on the individual’s filing status. For example, single filers may receive a different maximum amount than married couples filing jointly.

Income Levels and Maximum Stimulus Check Amounts

The following table provides an overview of income levels and corresponding maximum stimulus check amounts (Note: This table is for illustrative purposes only and may not reflect the most current information. Please refer to official government resources for accurate data.):

| Filing Status | Income Level | Maximum Stimulus Check Amount |

|---|---|---|

| Single | $75,000 or less | $1,400 |

| Married Filing Jointly | $150,000 or less | $2,800 |

| Head of Household | $112,500 or less | $1,400 |

Stimulus Check Payment Methods

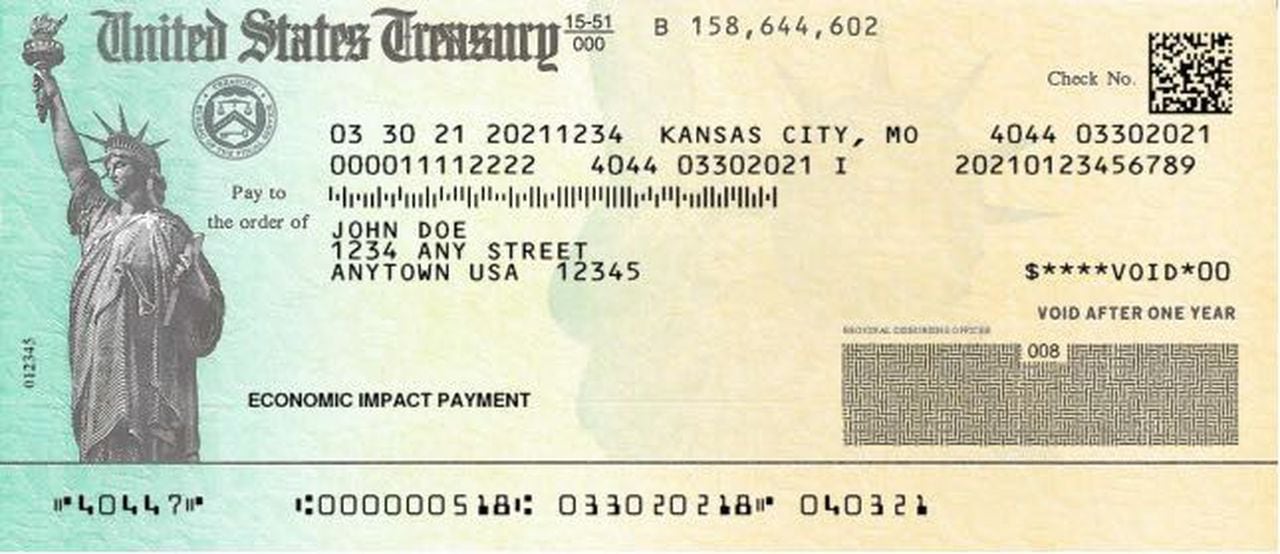

Stimulus checks in Pennsylvania are typically distributed through various methods, including direct deposit, paper checks, and debit cards.

Payment Methods and Tracking

- Direct Deposit:If the IRS has your direct deposit information on file, the stimulus check will be deposited directly into your bank account. You can track the status of your payment using the IRS’s online tool or by contacting the agency directly.

- Paper Check:If the IRS does not have your direct deposit information, you will receive a paper check mailed to your address on file. The IRS provides updates on the status of mailed checks through their website and other communication channels.

- Debit Card:In some cases, the stimulus check may be sent via a prepaid debit card. You can track the status of your debit card payment using the IRS’s online tool or by contacting the agency.

Pennsylvania-Specific Guidance, Maximum Stimulus Check Payment You Can Receive in Pennsylvania

Pennsylvania residents can access information about stimulus check payments through the state’s Department of Revenue website and other official channels. The state may also provide guidance or resources specific to Pennsylvania residents regarding stimulus check eligibility, payment methods, and tracking.

Additional Resources for Stimulus Check Information

Pennsylvania residents can find comprehensive information about stimulus checks through various resources, including government websites, organizations, and agencies.

For descriptions on additional topics like Stimulus Checks Payment Amounts in Pennsylvania, please visit the available Stimulus Checks Payment Amounts in Pennsylvania.

Helpful Resources for Pennsylvania Residents

| Resource | Description | Link |

|---|---|---|

| Internal Revenue Service (IRS) | The IRS is the primary source for information about stimulus checks, including eligibility criteria, payment methods, and tracking. | https://www.irs.gov/ |

| Pennsylvania Department of Revenue | The Pennsylvania Department of Revenue provides information and resources related to state taxes and may offer guidance on stimulus checks. | https://www.revenue.pa.gov/ |

| United States Treasury Department | The Treasury Department is responsible for distributing stimulus check payments and provides updates on the program. | https://www.treasury.gov/ |

Last Word: Maximum Stimulus Check Payment You Can Receive In Pennsylvania

Navigating the complexities of stimulus check eligibility and payment processes can be challenging. By understanding the factors influencing your maximum payment amount, available payment methods, and reliable resources, you can maximize your potential benefits and ensure a smooth experience.

Obtain access to Addressing Concerns and Rumors About Ohio Stimulus Checks to private resources that are additional.

FAQ Section

How do I know if I’m eligible for a stimulus check in Pennsylvania?

You must meet the general eligibility requirements for stimulus checks, which include being a U.S. citizen or resident alien, having a valid Social Security number, and not being claimed as a dependent on someone else’s tax return. Specific Pennsylvania requirements may also apply, such as residency and income thresholds.

What if I didn’t receive a stimulus check but believe I’m eligible?

Browse the multiple elements of Stimulus Check Program and its Impact on Inflation in Ohio to gain a more broad understanding.

You can file an amended tax return (Form 1040-X) to claim any missed stimulus payments. The IRS offers guidance and resources on their website to help you navigate this process.

Are there any specific deadlines for claiming stimulus checks in Pennsylvania?

The IRS has established deadlines for claiming stimulus checks. Refer to their website for the most up-to-date information on deadlines and filing requirements.

Where can I find more information about stimulus checks in Pennsylvania?

The IRS website, the Pennsylvania Department of Revenue website, and local community organizations can provide valuable information and assistance with stimulus check inquiries.