Maximum 401k contribution 2024 with catch-up allows those 50 and over to significantly boost their retirement savings. This strategy empowers individuals to take advantage of increased contribution limits, offering substantial tax advantages and potential for long-term wealth accumulation. This guide delves into the details of these contributions, highlighting the benefits, factors to consider, and effective strategies for maximizing your savings.

Understanding the intricacies of 401(k) contributions, particularly the catch-up provision, can be crucial for achieving your retirement goals. By taking advantage of this opportunity, you can significantly enhance your financial security for the future. Let’s explore the key aspects of maximizing your 401(k) contributions in 2024.

Benefits of Maximizing 401(k) Contributions

Maximizing your 401(k) contributions can offer significant financial advantages, particularly in the long term. By taking advantage of these benefits, you can secure a comfortable retirement and achieve your financial goals.

Tax Advantages

The primary benefit of contributing to a 401(k) is the tax advantages. These contributions are made with pre-tax dollars, meaning you won’t have to pay taxes on them until you withdraw the money in retirement. This can significantly reduce your current tax liability and increase your overall savings.

- Reduced Taxable Income:Contributions to a 401(k) are deducted from your gross income before taxes are calculated. This effectively lowers your taxable income, resulting in lower tax payments in the present.

- Tax-Deferred Growth:Earnings on your 401(k) investments grow tax-deferred. This means that you won’t have to pay taxes on the interest, dividends, or capital gains until you withdraw the money in retirement.

- Potential for Tax-Free Withdrawals:In some cases, you may be able to withdraw funds from your 401(k) tax-free. This is possible for qualified distributions, such as those made for certain medical expenses, disability, or first-time home purchases.

Compound Growth

Maximizing your 401(k) contributions can significantly accelerate your wealth accumulation due to the power of compound growth.

If you’re planning a business trip, you might need to know the mileage rate for October 2024. This rate can be used to deduct your business travel expenses on your tax return.

- The Magic of Compounding:Compounding is the process of earning interest on both your initial investment and the accumulated interest. This creates a snowball effect, allowing your savings to grow exponentially over time.

- Time is Your Ally:The earlier you start contributing to a 401(k), the more time your investments have to compound.

If you’re planning to contribute to a Roth IRA, you’ll want to be aware of the Ira contribution limits for Roth IRA in 2024. These limits can help you maximize your contributions and potentially avoid taxes on your withdrawals in retirement.

Even small contributions made consistently over many years can lead to substantial wealth accumulation.

Retirement Planning

Saving for retirement early and consistently is crucial to ensuring a financially secure future.

Saving for retirement is essential, and understanding the Ira contribution limits for 2024 is a good starting point. These limits can help you maximize your contributions and build a secure financial future.

- Financial Security in Retirement:A well-funded 401(k) can provide a reliable source of income during retirement, allowing you to maintain your lifestyle and pursue your passions.

- Peace of Mind:Knowing that you have a solid retirement plan can provide peace of mind and reduce stress, allowing you to focus on other aspects of your life.

Factors to Consider Before Maximizing Contributions

Before you commit to maxing out your 401(k) contributions, it’s crucial to consider the potential impact on your current financial situation and explore alternative investment options. While maximizing contributions offers significant long-term benefits, it’s essential to ensure it aligns with your overall financial goals and doesn’t negatively affect your present financial stability.

As the October 2024 tax deadline approaches, it’s important to take advantage of any available tax deductions. This can help reduce your tax liability and save you money.

Impact on Current Cash Flow and Expenses

Maximizing 401(k) contributions can significantly impact your current cash flow. It’s essential to analyze your monthly expenses and income to determine if you can comfortably afford the maximum contribution without jeopardizing your ability to meet essential needs. Consider your fixed expenses, such as rent, mortgage payments, and utilities, as well as variable expenses like groceries, entertainment, and travel.

Are you self-employed and looking to save for retirement? The Ira contribution limits for self-employed in 2024 can help you understand how much you can contribute to your retirement account.

For example, if you earn $80,000 annually and your 401(k) contribution limit is $22,500, maximizing your contribution would mean allocating $1,875 per month to your retirement savings. If your monthly expenses are $4,000, this would leave you with $2,125 for other needs.

It’s crucial to ensure you have enough disposable income remaining to cover unexpected expenses, maintain an emergency fund, and contribute to other financial goals, such as paying off debt or saving for a down payment on a house.

If you’re planning to contribute to a traditional IRA, it’s essential to know the maximum contribution amount for a traditional IRA in 2024. This will help you maximize your contributions and potentially save on taxes.

Potential for Withdrawing Contributions Before Retirement

While maximizing contributions offers significant long-term benefits, it’s essential to understand the potential consequences of withdrawing funds before retirement. Early withdrawals from 401(k) accounts are generally subject to a 10% penalty, in addition to your usual income tax rate.

For instance, if you withdraw $10,000 from your 401(k) before age 59 1/2, you’ll likely pay a 10% penalty of $1,000, plus income tax on the $10,000 withdrawal, which could be around $2,000 depending on your tax bracket.

If you’re over 50, you might be eligible for an additional catch-up contribution to your 401k. Find out the maximum 401k contribution for 2024 for over 50 to help you maximize your retirement savings.

This penalty can significantly reduce the value of your savings, making it essential to carefully consider your need for early withdrawal.

If you’re a business owner, it’s important to stay up-to-date on the latest tax requirements. For example, the W9 Form October 2024 requirements for businesses are likely to be different from previous years. Be sure to review the latest guidelines to ensure you’re compliant.

Alternative Investment Options

While 401(k) plans offer tax advantages, they may not always be the most suitable investment option for all financial goals. Consider exploring alternative investment options, such as individual retirement accounts (IRAs) or taxable brokerage accounts, to diversify your portfolio and potentially achieve higher returns.

For instance, if you have a high-deductible health plan, you may be eligible for a health savings account (HSA). HSAs offer tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses, making them a valuable tool for healthcare savings.

Want to know the maximum amount you can contribute to an IRA in 2024? Check out the maximum IRA contribution for 2024. This information can help you plan your retirement savings strategy.

It’s crucial to assess the suitability of each investment option based on your financial goals, risk tolerance, and tax situation. Consulting with a financial advisor can provide personalized guidance and help you make informed decisions.

Knowing the standard deduction in 2024 can help you determine whether itemizing your deductions is beneficial for you. This can make a difference in your tax liability.

Strategies for Catch-Up Contributions

If you’re 50 or older in 2024, you can take advantage of catch-up contributions to boost your retirement savings. These contributions allow you to save more than the regular contribution limit, giving you a significant advantage in building your nest egg.

For estates, the W9 Form October 2024 for estates might be required for certain transactions. Understanding the requirements for estates can help you navigate the tax implications.

Here’s a guide to maximizing your catch-up contributions in 2024.

Designing a Plan for Catch-Up Contributions

To make the most of catch-up contributions, you need a plan. This plan should Artikel your contribution goals, the steps involved in adjusting your contribution schedule, and the potential impact on your retirement savings.

Steps for Adjusting Your Contribution Schedule

- Review your current contribution rate:Start by determining your current contribution percentage to your 401(k) plan. This will serve as a baseline for calculating your catch-up contribution increase.

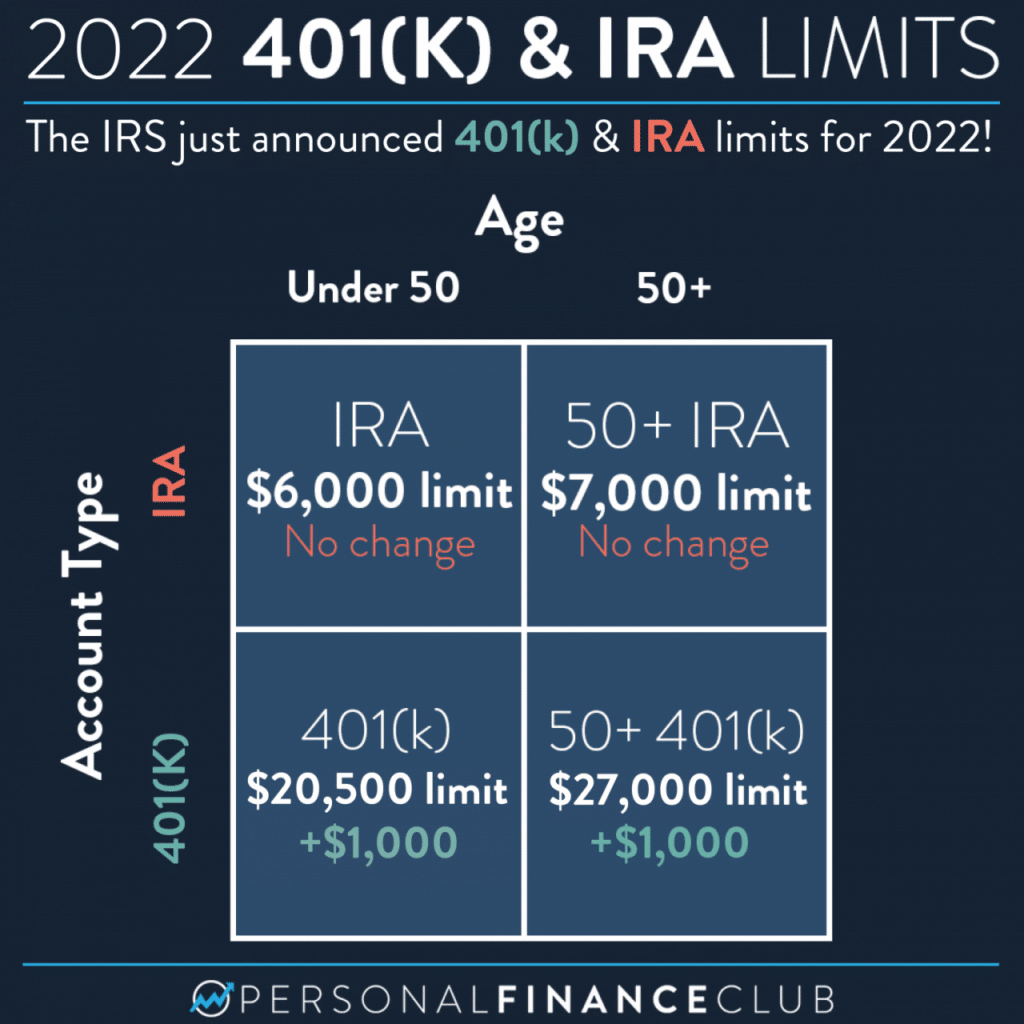

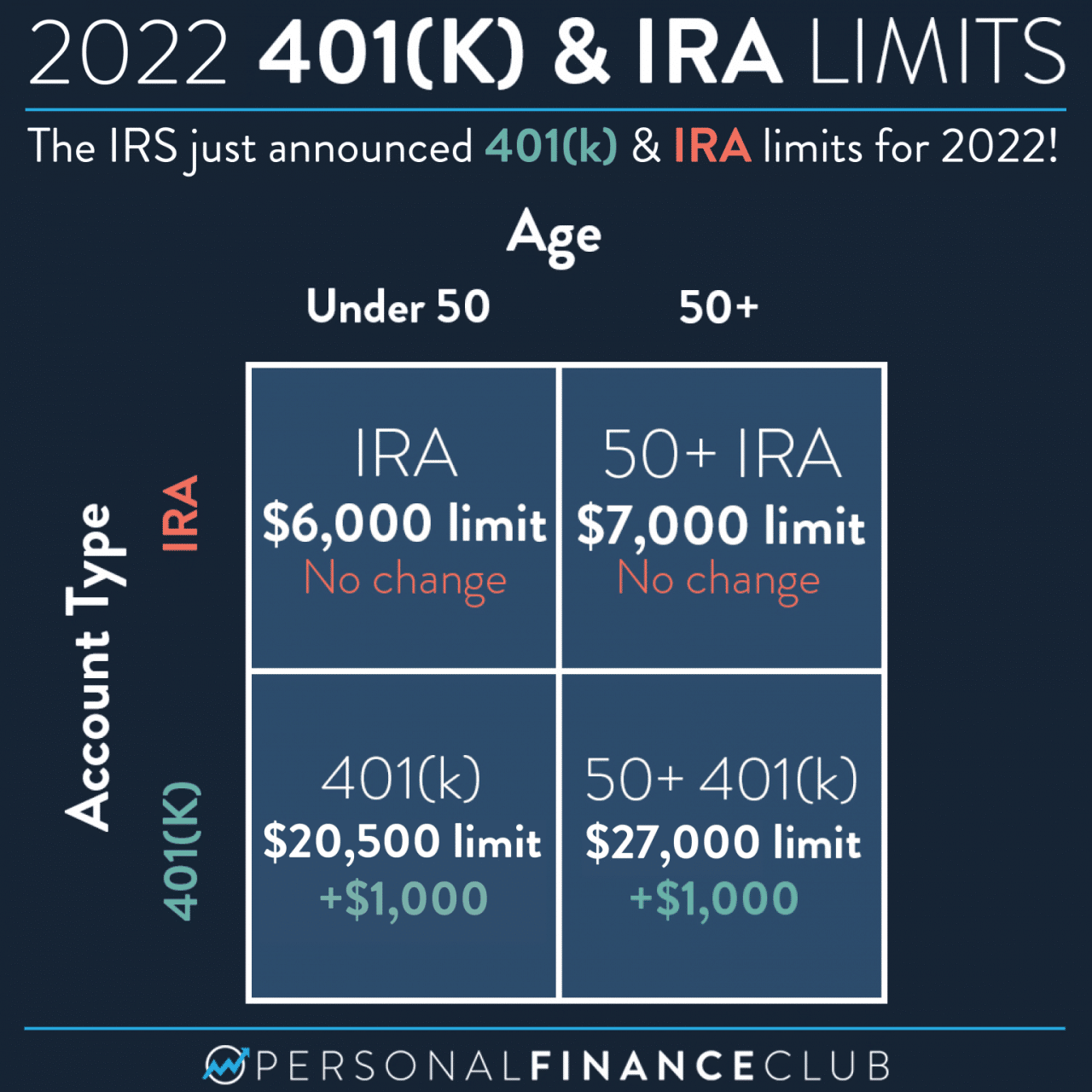

- Determine your catch-up contribution amount:In 2024, the catch-up contribution limit for individuals aged 50 and older is $7,500. This means you can contribute an additional $7,500 on top of the regular contribution limit of $22,500.

- Adjust your contribution schedule:Once you know your target contribution amount, you can adjust your contribution schedule accordingly. You can increase your contribution percentage or make a one-time lump-sum contribution to reach your desired amount.

- Monitor your progress:Regularly review your 401(k) account balance and contribution progress. This will help you stay on track and make necessary adjustments to your contribution schedule if needed.

Potential Impact of Catch-Up Contributions, Maximum 401k contribution 2024 with catch-up

Catch-up contributions can significantly impact your retirement savings. Consider the following:

Example of Catch-Up Contribution Impact

Imagine you’re 50 years old and have been contributing $10,000 annually to your 401(k) for the past 10 years. If you start contributing the maximum catch-up amount of $7,500 annually for the next 15 years, you’ll have contributed an additional $112,500 to your 401(k).

Curious about the highest tax bracket in 2024? You can find the answer by checking the highest tax bracket in 2024. This information can help you estimate your tax liability and plan your finances.

Assuming an average annual return of 7%, this additional $112,500 could grow to over $250,000 by the time you retire. This demonstrates the significant impact catch-up contributions can have on your retirement savings.

Planning for retirement is crucial, and understanding the Ira contribution limits for 2024 and beyond can help you maximize your contributions. It’s a good idea to review these limits regularly to make sure you’re on track for your retirement goals.

Resources and Information for 401(k) Planning

Navigating the world of 401(k) plans can feel overwhelming, but there are numerous resources available to guide you through the process. From government websites to financial institutions, you can find comprehensive information and expert advice to make informed decisions about your retirement savings.

Are you a small business owner looking to contribute to your employees’ retirement plans? You might be interested in the 401k contribution limits for 2024 for small businesses. Knowing these limits will help you plan for your business’s financial future.

Government Websites

Government websites provide valuable information and guidance on 401(k) plans, including contribution limits, withdrawal rules, and tax benefits.

- Internal Revenue Service (IRS):The IRS website offers detailed information on 401(k) plans, including tax deductions, contribution limits, and penalties for early withdrawals. You can find IRS publications, forms, and guidance on various aspects of 401(k) plans. [Link: https://www.irs.gov/retirement-plans/retirement-plans-faqs-for-employees]

- Department of Labor (DOL):The DOL’s website provides information on employee retirement income security, including rules and regulations governing 401(k) plans. You can find resources on plan administration, fiduciary responsibilities, and employee rights. [Link: https://www.dol.gov/agencies/ebsa/retirement-planning]

Financial Institutions

Financial institutions offer a range of resources and tools to help you understand and manage your 401(k) plan.

Tax season is just around the corner, and it’s essential to understand the tax brackets for married filing separately in 2024. This information will help you determine your tax liability and plan accordingly.

- Investment Firms:Investment firms often provide educational materials, calculators, and investment advice on 401(k) plans. They can help you understand investment options, asset allocation, and risk management strategies. [Example: Fidelity Investments, Vanguard, Schwab]

- Banks:Many banks offer 401(k) plan services, including investment options, account management, and rollover services. They can provide guidance on choosing the right plan for your needs. [Example: Bank of America, Wells Fargo, Chase]

Key 401(k) Features, Contribution Limits, and Withdrawal Rules

Here is a summary of key 401(k) features, contribution limits, and withdrawal rules:

| Feature | Description |

|---|---|

| Contribution Limits | The maximum amount you can contribute to your 401(k) plan each year. For 2024, the limit is $22,500. Individuals aged 50 and older can contribute an additional $7,500 as a catch-up contribution, bringing the total to $30,000. |

| Withdrawal Rules | You can generally withdraw money from your 401(k) plan without penalty after age 59 1/2. However, early withdrawals before age 59 1/2 are typically subject to a 10% penalty, plus your usual income tax rate. There are some exceptions to the penalty, such as for certain medical expenses, disability, or home purchases. |

| Tax Benefits | Contributions to a 401(k) plan are typically made with pre-tax dollars, meaning you don’t pay income tax on them until you withdraw the money in retirement. This can result in significant tax savings over time. |

| Investment Options | 401(k) plans offer a variety of investment options, such as stocks, bonds, mutual funds, and ETFs. You can choose investments that align with your risk tolerance and investment goals. |

Ultimate Conclusion

Maximizing your 401(k) contributions in 2024, especially with the catch-up option, can be a powerful tool for building a strong financial foundation for retirement. Remember to carefully consider your individual circumstances and financial goals when deciding on your contribution strategy.

By taking advantage of these opportunities, you can position yourself for a more comfortable and secure future. Consult with a financial advisor to create a personalized plan that aligns with your unique needs and aspirations.

Top FAQs: Maximum 401k Contribution 2024 With Catch-up

Can I contribute to both a 401(k) and a Roth IRA in 2024?

Yes, you can contribute to both a 401(k) and a Roth IRA in 2024, as long as you meet the income limits for Roth IRA contributions.

What happens if I withdraw my 401(k) contributions before retirement?

Withdrawals before age 59 1/2 are generally subject to a 10% penalty, plus your usual income tax rate. However, there are some exceptions, such as for hardship withdrawals or for first-time home purchases.

How do I know if I’m eligible for the catch-up contribution?

You’re eligible for the catch-up contribution if you are age 50 or older by the end of the calendar year.

Are there any limits on how much I can contribute with the catch-up provision?

Yes, there’s a separate limit for catch-up contributions. In 2024, you can contribute an additional $7,500 on top of the regular 401(k) limit.