Lower Mortgage 2024 takes center stage as homeowners seek ways to navigate a changing mortgage landscape. Rising interest rates and economic uncertainty have impacted affordability, prompting many to explore strategies for lowering their monthly payments. This guide delves into the current mortgage market, outlining effective strategies for reducing mortgage costs, and exploring government programs and financial planning tips to help you achieve your homeownership goals.

Looking to buy a home in 2024? You’ll want to understand how to get a mortgage first. It’s the first step in the process and understanding the different types of mortgages available can be a big help.

The article covers various aspects of lowering mortgage payments, including refinancing options, government assistance programs, and personal financial strategies. We’ll examine the impact of current mortgage rates, discuss the benefits of refinancing, and provide tips for improving your credit score and negotiating with lenders.

An adjustable-rate mortgage (ARM) might be a good choice if you think rates might drop in the future. These rates are fixed for a set period and then adjust based on market conditions.

Ultimately, the goal is to empower homeowners with the knowledge and tools needed to make informed decisions about their mortgage and achieve financial stability.

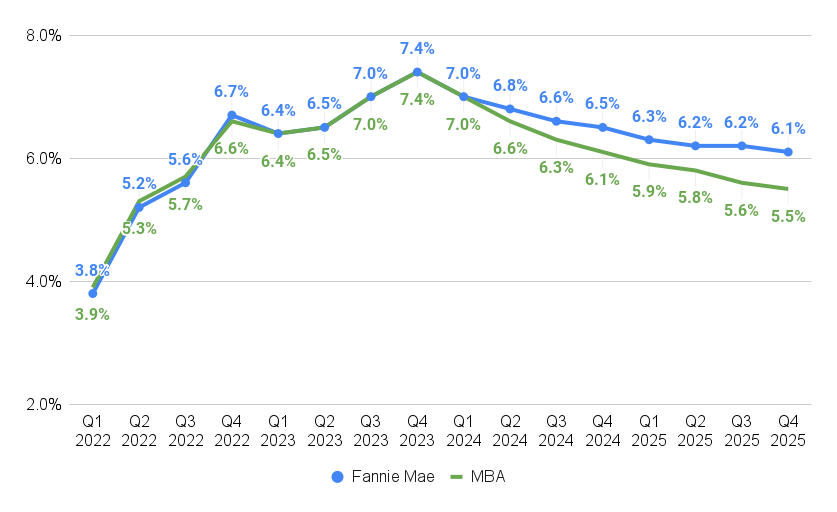

Stay informed about home mortgage rates in 2024. These rates fluctuate, so it’s important to stay up-to-date to get the best deal possible.

Ultimate Conclusion

Lowering your mortgage payment can have a significant impact on your overall financial well-being. By exploring the strategies Artikeld in this guide, you can gain a better understanding of the current mortgage landscape and identify opportunities to reduce your monthly costs.

If you’re seeking stability, a fixed-rate mortgage might be the best option. These rates stay the same for the life of the loan, so you can budget with confidence.

Remember, careful planning, informed decision-making, and proactive steps can help you secure a more affordable mortgage and achieve your long-term financial goals.

Finding cheap home loans can be a challenge, but it’s worth the effort. Shop around and compare rates to find the best deal.

Commonly Asked Questions: Lower Mortgage 2024

What are the current mortgage rates in 2024?

Thinking about getting a mortgage from Bank of America? Check out BOA mortgage rates for 2024 to see if they’re right for you.

Mortgage rates fluctuate daily, and it’s best to check with a lender for the most up-to-date information. However, you can find general trends and averages online from reputable sources like Bankrate or Freddie Mac.

Shopping for a mortgage can be a lot of work, but a mortgage finder can make the process a lot easier. These tools let you compare rates and terms from different lenders in one place.

Is refinancing always a good idea?

Refinancing can be beneficial if you can secure a lower interest rate or shorten your loan term. However, consider the closing costs associated with refinancing and ensure the savings outweigh the expenses.

What are the benefits of a lower mortgage payment?

Lower mortgage payments free up cash flow for other financial goals, such as saving, investing, or paying down debt. It also contributes to overall financial stability and can improve your credit score.

Are you looking to refinance your house in 2024? Refinancing can help you lower your monthly payments or shorten your loan term.

First-time homebuyers often have unique needs. Check out the best mortgage lenders for first-time buyers to find the right fit for you.

If you’re considering refinancing, it’s important to understand refinance rates for 2024. These rates can change frequently, so it’s crucial to stay informed.

Looking to tap into your home equity? Learn about home equity line of credit interest rates in 2024 to see if this option is right for you.

A second charge mortgage can be a good way to access additional funds, but it’s important to understand the terms and conditions before you apply.

Stay up-to-date on mortgage rates in 2024. These rates can fluctuate, so it’s important to monitor them closely to find the best time to lock in a rate.

If you’re eligible, an FHA loan can be a great option for first-time homebuyers. Check out FHA loan rates for 2024 to see if this loan is right for you.

For veterans, Veterans United interest rates can offer competitive rates and loan options. It’s worth checking out what they offer.