Keller Mortgage 2024 takes center stage as the mortgage landscape evolves. This year presents both challenges and opportunities for the company, as interest rates fluctuate and consumer demand shifts. Understanding the current market trends, Keller Mortgage’s unique offerings, and the customer experience are crucial for navigating this dynamic environment.

Keep track of house mortgage rates throughout 2024. These rates can influence your overall borrowing costs, so it’s important to stay informed.

This analysis delves into Keller Mortgage’s history, its target market, and its competitive advantages. We explore the company’s diverse product portfolio, including conventional, FHA, VA, and jumbo loans, and the services they provide to support borrowers throughout the mortgage process.

If you’re planning to buy a home in 2024, it’s crucial to stay informed about average mortgage interest rates. These rates can fluctuate, so understanding the current trends is key to making informed financial decisions.

By examining customer experiences and future outlook, we gain valuable insights into Keller Mortgage’s trajectory in the years to come.

Veterans looking for home financing should explore VA interest rates in 2024. These rates are often very competitive and can help veterans achieve their homeownership goals.

Keller Mortgage Overview

Keller Mortgage is a well-established mortgage lender that has been serving homebuyers and homeowners for many years. They are known for their commitment to providing personalized service and competitive rates. Keller Mortgage has built a strong reputation in the industry by focusing on building long-term relationships with their clients.

For those considering a shorter-term mortgage, 10-year ARM mortgage rates in 2024 can offer a balance between fixed and adjustable rates.

Target Market and Key Offerings

Keller Mortgage caters to a diverse range of borrowers, including first-time homebuyers, seasoned homeowners, and those looking to refinance their existing mortgage. Their key offerings include:

- Conventional Loans

- FHA Loans

- VA Loans

- Jumbo Loans

- Refinancing Options

Unique Selling Propositions and Competitive Advantages

Keller Mortgage distinguishes itself from its competitors through its unique selling propositions:

- Personalized Service:Keller Mortgage prioritizes building strong relationships with their clients, providing dedicated loan officers who guide borrowers through the entire mortgage process.

- Competitive Rates:Keller Mortgage offers competitive interest rates and loan terms, ensuring borrowers get the best possible deal.

- Streamlined Process:Keller Mortgage employs a streamlined and efficient process, making the mortgage application and closing experience smooth and hassle-free.

- Technology-Driven Platform:Keller Mortgage leverages technology to enhance its services, providing borrowers with online tools and resources for managing their mortgage.

2024 Mortgage Market Trends

The mortgage market in 2024 is expected to be influenced by several key trends:

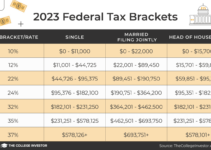

Interest Rate Fluctuations

Interest rates have been on the rise in recent months, impacting the mortgage market. Higher interest rates generally lead to higher monthly mortgage payments, which can make homeownership less affordable for some buyers. However, there are also opportunities for borrowers who can lock in lower rates before they rise further.

Keeping an eye on interest rates right now is crucial for anyone considering a mortgage. Rates can fluctuate daily, so staying informed is essential for making the best decision.

Mortgage Product Options

The mortgage market offers a wide range of product options to suit different borrower needs and financial situations. In 2024, some of the most popular mortgage products include:

- Fixed-Rate Mortgages:These mortgages offer a fixed interest rate for the entire loan term, providing predictable monthly payments.

- Adjustable-Rate Mortgages (ARMs):ARMs have interest rates that adjust periodically based on market conditions. They can offer lower initial rates but may become more expensive over time.

- Government-Backed Loans:FHA and VA loans are backed by the government and offer more flexible eligibility requirements and lower down payment options.

Keller Mortgage Products and Services: Keller Mortgage 2024

Keller Mortgage offers a comprehensive range of mortgage products and services to meet the diverse needs of their clients.

It’s wise to carefully plan your mortgage repayments in 2024. Knowing your monthly payment amount and potential interest charges helps you budget effectively.

Mortgage Products

| Product Type | Key Features | Target Audience |

|---|---|---|

| Conventional Loans | Typically require a higher credit score and down payment, offer competitive interest rates. | Borrowers with good credit and a significant down payment. |

| FHA Loans | Backed by the Federal Housing Administration, offer lower down payment requirements and more flexible eligibility criteria. | First-time homebuyers, borrowers with lower credit scores, or those with limited down payment funds. |

| VA Loans | Guaranteed by the Department of Veterans Affairs, offer no down payment requirements and competitive interest rates for eligible veterans and active-duty military personnel. | Veterans and active-duty military personnel. |

| Jumbo Loans | Designed for borrowers seeking larger loan amounts exceeding conforming loan limits, typically require higher credit scores and down payments. | High-income borrowers purchasing expensive properties. |

Services, Keller Mortgage 2024

Keller Mortgage provides a range of services to support borrowers throughout the mortgage process:

- Pre-Approval:Helps borrowers understand their borrowing power and get a head start in the home buying process.

- Closing Assistance:Provides guidance and support throughout the closing process, ensuring a smooth and efficient transaction.

- Refinancing Options:Offers various refinancing options to help borrowers lower their monthly payments, shorten their loan term, or access cash equity.

Keller Mortgage Customer Experience

Keller Mortgage is committed to providing a positive and seamless customer experience. They strive to make the mortgage process as stress-free as possible for their clients.

A 30-year fixed mortgage offers predictable monthly payments and can be a good option for those seeking long-term stability.

Customer Reviews and Feedback

Customer reviews and feedback consistently highlight Keller Mortgage’s dedication to personalized service, responsiveness, and expert guidance. Customers appreciate the transparency and communication throughout the mortgage process.

An adjustable-rate mortgage (ARM) can be a good option for some borrowers, but it’s important to weigh the risks and benefits. ARMs have a fixed interest rate for an initial period, after which the rate can fluctuate.

Customer Journey Map

The customer journey map for Keller Mortgage would typically involve the following key touchpoints:

- Initial Contact:A borrower may reach out to Keller Mortgage through their website, phone, or referral.

- Pre-Approval Process:Keller Mortgage gathers necessary information from the borrower and provides a pre-approval decision.

- Loan Application:The borrower submits a formal loan application and provides supporting documentation.

- Underwriting:Keller Mortgage reviews the loan application and supporting documents to determine loan eligibility.

- Closing:Keller Mortgage coordinates the closing process and ensures all necessary documents are signed and finalized.

- Post-Closing Support:Keller Mortgage continues to provide support to borrowers after the closing process, answering questions and addressing any concerns.

Future Outlook for Keller Mortgage

Keller Mortgage is well-positioned for continued success in the evolving mortgage market. They are committed to adapting to changing market conditions and customer needs.

Saving for a down payment for a house can be a significant financial goal. Understanding the typical down payment requirements in 2024 can help you set realistic savings targets.

Challenges and Opportunities

Keller Mortgage faces challenges such as fluctuating interest rates, increased competition, and evolving regulatory landscapes. However, they also have opportunities for growth through expanding their product offerings, enhancing their technology platform, and strengthening their customer relationships.

If you’re considering investing in rental properties, understanding investment property loans is essential. These loans have different requirements and terms compared to traditional home loans.

Strategic Goals and Initiatives

Keller Mortgage’s strategic goals include:

- Expanding into New Markets:Exploring opportunities to expand their geographic reach and serve a wider customer base.

- Investing in Technology:Continuing to invest in technology to enhance their online platform and provide a more seamless customer experience.

- Building Strategic Partnerships:Forging partnerships with real estate agents, builders, and other industry professionals to generate new leads and expand their network.

- Focus on Customer Satisfaction:Maintaining a strong focus on providing exceptional customer service and building lasting relationships.

Ultimate Conclusion

Keller Mortgage’s success in 2024 and beyond hinges on its ability to adapt to evolving market conditions and customer needs. By leveraging its strong foundation, diverse product offerings, and commitment to customer satisfaction, Keller Mortgage is well-positioned to navigate the challenges and capitalize on the opportunities that lie ahead.

The company’s strategic focus on innovation, technology, and customer-centricity will be instrumental in achieving its future growth objectives.

FAQ Resource

What are the current interest rates for mortgages?

Mortgage interest rates fluctuate daily. It’s best to contact Keller Mortgage directly for the most up-to-date information.

What are the eligibility requirements for an FHA loan?

Your credit score plays a significant role in determining your mortgage interest rate. Knowing the credit score needed to buy a house in 2024 can help you strategize your financial planning.

FHA loan eligibility requirements include credit score, income, and debt-to-income ratio. Keller Mortgage can provide specific details and guidance.

For military members and veterans, USAA home loans can be a great option. They offer competitive rates and specialized programs tailored to the needs of those who serve our country.

How long does the mortgage approval process take?

Before you start house hunting, it’s a good idea to prequalify for a home loan. This gives you a clear picture of how much you can afford to borrow and helps streamline the home buying process.

The mortgage approval process can vary depending on factors such as loan type, documentation, and market conditions. Keller Mortgage strives to provide efficient and timely service.

If you’re planning to invest in rental properties, understanding investment property interest rates is crucial for making sound financial decisions.

Navigating the world of mortgage loans in 2024 can be complex. It’s important to research different loan options and choose the one that best suits your financial situation.