Jackson Variable Annuity 2024 offers a unique approach to retirement planning, combining the security of an annuity with the potential for growth through market-linked investments. This guide delves into the intricacies of Jackson Variable Annuities, exploring their features, investment options, fees, benefits, and tax implications.

Whether you’re seeking to secure your future income or simply want to understand the nuances of this complex financial product, this comprehensive overview provides valuable insights.

Jackson Variable Annuities stand out as a hybrid financial product that blends the guaranteed income stream of traditional annuities with the growth potential of market-based investments. This combination caters to individuals seeking a balance between security and potential returns, allowing them to tailor their investment strategy based on their risk tolerance and financial goals.

There are many different types of annuities available, and some may be more suitable for your needs than others. If you’re looking for information about 4 annuity , you should research the various options and consult with a financial professional.

Introduction to Jackson Variable Annuities

Jackson variable annuities are a type of insurance product that combines the benefits of an annuity with the potential for investment growth. They offer a guaranteed lifetime income stream, along with the opportunity to invest your money in a variety of mutual funds and other investment options.

The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees. If you’re looking to calculate your TSP annuity , you can use the TSP website or consult with a financial advisor to determine your potential payouts.

Core Features of Jackson Variable Annuities

Jackson variable annuities are characterized by a number of key features, including:

- Guaranteed Lifetime Income:Jackson variable annuities typically offer a guaranteed lifetime income stream, which means that you will receive regular payments for as long as you live, regardless of how long you live or how your investments perform. This feature provides a sense of security and financial stability in retirement.

Variable annuities offer the potential for higher returns, but they also come with greater risk. You can find more information about variable annuity interest rates online, which can help you understand the potential rewards and risks of investing in this type of annuity.

- Investment Growth Potential:Unlike traditional fixed annuities, which offer a fixed rate of return, Jackson variable annuities allow you to invest your money in a variety of mutual funds and other investment options. This gives you the potential to earn higher returns than a fixed annuity, but it also exposes you to greater risk.

- Death Benefit:Jackson variable annuities typically include a death benefit, which provides a lump sum payment to your beneficiaries upon your death. This can be a valuable way to provide financial security for your loved ones.

- Tax Deferral:The earnings on your investments within a Jackson variable annuity are generally tax-deferred until you withdraw them. This can be a significant tax advantage, especially for individuals in higher tax brackets.

Key Differences Between Jackson Variable Annuities and Other Types of Annuities

Jackson variable annuities differ from other types of annuities in several ways:

- Investment Options:Unlike fixed annuities, which offer a fixed rate of return, Jackson variable annuities allow you to invest your money in a variety of mutual funds and other investment options. This gives you the potential to earn higher returns, but it also exposes you to greater risk.

The HP-12C is a popular financial calculator that can be used to calculate annuity payments. If you’re looking to calculate annuity using an HP-12C, you can find helpful tutorials online that explain the process.

- Guaranteed Lifetime Income:Jackson variable annuities typically offer a guaranteed lifetime income stream, while fixed annuities may not. This provides a sense of security and financial stability in retirement.

- Fees and Expenses:Jackson variable annuities typically have higher fees and expenses than fixed annuities. This is due to the complexity of managing the investment options within a variable annuity.

Target Audience for Jackson Variable Annuities

Jackson variable annuities are well-suited for individuals who:

- Are seeking investment growth potential:Jackson variable annuities offer the opportunity to invest your money in a variety of mutual funds and other investment options, which gives you the potential to earn higher returns than a fixed annuity.

- Want a guaranteed lifetime income stream:Jackson variable annuities typically offer a guaranteed lifetime income stream, which provides a sense of security and financial stability in retirement.

- Are comfortable with risk:Jackson variable annuities expose you to greater risk than fixed annuities, as the value of your investments can fluctuate.

- Are seeking tax advantages:The earnings on your investments within a Jackson variable annuity are generally tax-deferred until you withdraw them.

Investment Options within Jackson Variable Annuities

Jackson variable annuities offer a wide range of investment options, allowing you to tailor your portfolio to your individual risk tolerance and financial goals. These options typically include:

Mutual Funds

Mutual funds are a popular investment option within Jackson variable annuities. They allow you to diversify your portfolio by investing in a basket of stocks, bonds, or other assets. Mutual funds are managed by professional fund managers who strive to achieve specific investment objectives.

If you’re worried about your annuity being out of surrender, you’re not alone. There are many factors that can affect the surrender value of an annuity. If your annuity is out of surrender , it’s important to understand your options and what they mean for you.

- Stock Funds:These funds invest primarily in stocks, offering the potential for higher returns but also greater risk.

- Bond Funds:These funds invest primarily in bonds, providing a more conservative investment option with lower risk than stock funds.

- Balanced Funds:These funds invest in a mix of stocks and bonds, seeking to strike a balance between growth and stability.

Other Investment Options, Jackson Variable Annuity 2024

In addition to mutual funds, Jackson variable annuities may also offer other investment options, such as:

- Annuities:Some Jackson variable annuities allow you to invest in other annuities, such as fixed annuities or indexed annuities.

- Target-Date Funds:These funds automatically adjust their asset allocation over time, becoming more conservative as you approach retirement.

Risks and Potential Returns

The risks and potential returns associated with each investment option within a Jackson variable annuity vary depending on the specific investment.

- Stock Funds:Stock funds carry the highest risk but also offer the potential for the highest returns. The value of stocks can fluctuate significantly, and you could lose money on your investment.

- Bond Funds:Bond funds are generally considered less risky than stock funds, but they also offer lower potential returns. The value of bonds can also fluctuate, and you could lose money on your investment.

- Balanced Funds:Balanced funds seek to strike a balance between growth and stability, but they still carry some risk. The value of your investment can fluctuate depending on the performance of both the stock and bond markets.

Investment Strategies

There are a number of investment strategies that can be employed within Jackson variable annuities. Some common strategies include:

- Buy-and-Hold:This strategy involves investing in a diversified portfolio of assets and holding them for the long term, regardless of short-term market fluctuations.

- Dollar-Cost Averaging:This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. This helps to reduce the impact of market volatility on your investment returns.

- Rebalancing:This strategy involves periodically adjusting your portfolio to maintain your desired asset allocation. This can help to reduce risk and ensure that your portfolio remains aligned with your financial goals.

Fees and Expenses Associated with Jackson Variable Annuities

Jackson variable annuities come with a variety of fees and expenses that can impact your overall returns. It is important to understand these fees before investing in a Jackson variable annuity.

While annuities are generally designed for long-term retirement planning, there may be circumstances where a hardship withdrawal is allowed. If you’re considering an annuity hardship withdrawal , you should carefully review your contract and consult with a financial advisor to understand the potential consequences.

Types of Fees and Expenses

Common fees and expenses associated with Jackson variable annuities include:

- Mortality and Expense (M&E) Charges:These charges cover the cost of providing the guaranteed lifetime income stream and other insurance benefits. They are typically expressed as a percentage of your account value.

- Administrative Fees:These fees cover the cost of managing the annuity contract and providing administrative services. They are typically expressed as a fixed dollar amount or a percentage of your account value.

- Investment Fees:These fees are charged by the mutual funds or other investment options that you choose. They typically include management fees, expense ratios, and transaction fees.

- Surrender Charges:These charges may apply if you withdraw your money from the annuity before a certain period of time. They are typically expressed as a percentage of your account value.

Comparison to Other Annuity Products

Jackson variable annuities typically have higher fees and expenses than fixed annuities. This is due to the complexity of managing the investment options within a variable annuity. However, the potential for higher returns may offset these higher fees.

The decision between an annuity and a drawdown strategy depends on your individual circumstances. You might want to consider whether an annuity is better than drawdown by carefully weighing the potential benefits and risks of each.

Impact on Overall Return

Fees and expenses can significantly impact the overall return of a Jackson variable annuity. It is important to carefully consider the fees and expenses associated with a particular annuity contract before investing. High fees and expenses can erode your returns over time.

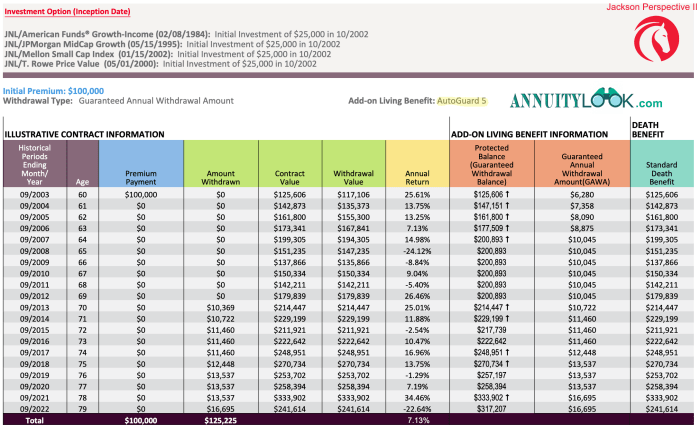

Death Benefit and Living Benefit Options

Jackson variable annuities offer a variety of death benefit and living benefit options, allowing you to tailor your annuity contract to your specific financial needs and goals.

Calculating an annuity can be complex, but there are resources available to help you. If you’re trying to calculate the annuity , you can find helpful calculators and guides online.

Death Benefit Options

Death benefit options provide a lump sum payment to your beneficiaries upon your death. Common death benefit options include:

- Guaranteed Death Benefit:This option guarantees that your beneficiaries will receive a minimum death benefit, regardless of how your investments perform. This can provide a sense of security and financial stability for your loved ones.

- Enhanced Death Benefit:This option offers a death benefit that is tied to the performance of your investments. This can provide the potential for a higher death benefit, but it also exposes you to greater risk.

- Joint and Survivor Benefit:This option provides a death benefit to your spouse or other designated beneficiary if you die. This can help to ensure that your spouse or other beneficiary has a continuing income stream after your death.

Living Benefit Options

Living benefit options provide additional income or protection during your lifetime. Common living benefit options include:

- Guaranteed Minimum Income Benefit (GMIB):This option guarantees a minimum level of income for a specified period of time, even if your investments perform poorly. This can provide a safety net in retirement and help to ensure that you have a steady income stream.

Annuity calculators can be incredibly helpful when planning for retirement. You can use a financial calculator annuity to estimate your potential payouts based on your current savings and expected interest rates.

- Guaranteed Lifetime Withdrawal Benefit (GLWB):This option allows you to withdraw a certain percentage of your account value each year, regardless of market conditions. This can provide a sense of security and financial stability in retirement.

- Death Benefit Rider:This option provides a death benefit that is tied to the performance of your investments. This can provide the potential for a higher death benefit, but it also exposes you to greater risk.

Examples of Using Death Benefits and Living Benefits

Death benefits and living benefits can be used to meet a variety of financial goals, such as:

- Providing for your loved ones:A death benefit can help to provide financial security for your spouse, children, or other beneficiaries after your death.

- Ensuring a steady income stream in retirement:A living benefit can help to ensure that you have a steady income stream in retirement, even if your investments perform poorly.

- Protecting your assets from market downturns:A living benefit can help to protect your assets from market downturns, ensuring that you have a guaranteed income stream even if your investments lose value.

Tax Implications of Jackson Variable Annuities

Understanding the tax implications of owning a Jackson variable annuity is crucial for making informed financial decisions. Here’s a breakdown of key tax aspects:

Tax Treatment of Distributions

Distributions from a Jackson variable annuity are generally taxed as ordinary income. This means that you will pay taxes on the earnings portion of your distributions at your ordinary income tax rate.

An annuity is a financial product that provides a stream of regular payments over a specified period. If you’re looking for information about annuities , you can find detailed explanations online that explain the various types of annuities and how they work.

- Earnings:The earnings portion of your distributions is taxed as ordinary income. This includes any capital gains or interest earned on your investments within the annuity.

- Principal:The principal portion of your distributions is generally tax-free. This represents the original amount of money that you invested in the annuity.

Tax-Advantaged Features

Jackson variable annuities offer some tax-advantaged features:

- Tax Deferral:The earnings on your investments within a Jackson variable annuity are generally tax-deferred until you withdraw them. This can be a significant tax advantage, especially for individuals in higher tax brackets.

- Death Benefit:The death benefit from a Jackson variable annuity is generally not subject to income tax. This can be a valuable way to pass on wealth to your beneficiaries tax-free.

Tax Planning Considerations

When planning for taxes with a Jackson variable annuity, consider:

- Withdrawal Strategy:Carefully plan your withdrawal strategy to minimize your tax liability. You may want to withdraw only the principal portion of your distributions to avoid paying taxes on the earnings.

- Tax Bracket:Consider your current and projected tax bracket when making withdrawal decisions. You may want to withdraw funds during years when your tax bracket is lower.

- Consult a Tax Professional:It is always advisable to consult with a tax professional to discuss the tax implications of your specific situation.

Considerations for Choosing a Jackson Variable Annuity: Jackson Variable Annuity 2024

Before deciding if a Jackson variable annuity is right for you, carefully consider these factors:

Key Factors to Consider

When choosing a Jackson variable annuity, consider these factors:

- Fees and Expenses:Compare the fees and expenses of different annuity contracts to find the most cost-effective option. Higher fees can significantly impact your overall returns.

- Investment Options:Choose an annuity contract that offers a wide range of investment options that align with your risk tolerance and financial goals.

- Death Benefit and Living Benefit Options:Select an annuity contract that offers the death benefit and living benefit options that best meet your needs and goals.

- Financial Situation:Consider your current financial situation, including your income, expenses, and investment goals, to determine if a Jackson variable annuity is right for you.

- Risk Tolerance:Understand your risk tolerance and choose an annuity contract that offers investment options that align with your comfort level.

Comparison to Other Financial Products

Compare Jackson variable annuities to other financial products, such as:

- Fixed Annuities:Fixed annuities offer a guaranteed rate of return, but they typically have lower growth potential than variable annuities.

- Mutual Funds:Mutual funds offer investment growth potential but do not provide a guaranteed lifetime income stream or other insurance benefits.

- Individual Retirement Accounts (IRAs):IRAs offer tax advantages for retirement savings, but they do not provide a guaranteed lifetime income stream or other insurance benefits.

Determining If a Jackson Variable Annuity Is Right for You

A Jackson variable annuity may be right for you if you:

- Are seeking investment growth potential:Jackson variable annuities offer the opportunity to invest your money in a variety of mutual funds and other investment options, which gives you the potential to earn higher returns than a fixed annuity.

- Want a guaranteed lifetime income stream:Jackson variable annuities typically offer a guaranteed lifetime income stream, which provides a sense of security and financial stability in retirement.

- Are comfortable with risk:Jackson variable annuities expose you to greater risk than fixed annuities, as the value of your investments can fluctuate.

- Are seeking tax advantages:The earnings on your investments within a Jackson variable annuity are generally tax-deferred until you withdraw them.

Jackson Variable Annuity in 2024

In 2024, the landscape for Jackson variable annuities is shaped by a combination of market conditions, recent changes in the industry, and potential future trends.

Current Market Conditions

The current market environment is characterized by [Describe current market conditions – e.g., rising interest rates, inflation, volatility, etc.]. These factors can impact the performance of investments within Jackson variable annuities.

Annuities can be a valuable tool for retirement planning. If you’re wondering whether an annuity is right for you, you should talk to a financial advisor to discuss your specific needs and goals.

- Rising Interest Rates:Rising interest rates can impact the value of bonds, which are a key component of many investment portfolios. This could lead to lower returns for investors in bond funds.

- Inflation:Inflation can erode the purchasing power of your investments. It is important to consider how inflation will impact your retirement planning.

- Market Volatility:Market volatility can make it difficult to predict the performance of your investments. It is important to have a long-term investment strategy and to avoid making emotional decisions.

Recent Changes and Updates

The insurance industry has been undergoing changes in recent years, including [Describe recent changes and updates – e.g., new regulations, product innovations, etc.]. These changes can impact the availability and features of Jackson variable annuities.

- New Regulations:The insurance industry is subject to a variety of regulations, which can impact the features and availability of Jackson variable annuities.

- Product Innovations:Insurance companies are constantly developing new products and features. This can lead to new investment options and benefits for investors in Jackson variable annuities.

Potential Future Trends

Looking ahead, the future of Jackson variable annuities is likely to be shaped by [Describe potential future trends – e.g., demographic shifts, technological advancements, etc.]. These trends can impact the demand for annuities and the features that they offer.

A free look period is a valuable opportunity to review your annuity contract and make sure it’s right for you. You can usually take advantage of a 30-day free look on most annuities, which gives you time to decide whether to keep or cancel your policy.

- Aging Population:As the population ages, the demand for retirement income products, such as annuities, is likely to increase.

- Technological Advancements:Technological advancements are likely to continue to impact the insurance industry, leading to new products and services.

Epilogue

In conclusion, Jackson Variable Annuities offer a compelling approach to retirement planning, providing a blend of security and growth potential. Understanding the nuances of investment options, fees, benefits, and tax implications is crucial to making informed decisions. As market conditions evolve, staying informed about the latest developments in Jackson Variable Annuity products is essential.

If you’re looking to compare different annuity options, an annuity calculator USA can help you analyze the pros and cons of each option.

This guide serves as a valuable resource for navigating the complexities of this financial instrument and making well-informed choices that align with your individual needs and aspirations.

With an annuity of $750,000, you can potentially receive a significant stream of income. If you’re thinking about an annuity of $750,000 , you’ll need to understand the different types of annuities and how they might work for you.

Common Queries

What are the minimum investment requirements for a Jackson Variable Annuity?

The term “annuity” has seven letters, which can be a helpful reminder when you’re trying to find information about it. If you’re looking for a resource on annuity , make sure to check out the website for more details.

The minimum investment requirements vary depending on the specific Jackson Variable Annuity product. It’s best to consult with a financial advisor or review the product prospectus for detailed information.

Can I withdraw funds from my Jackson Variable Annuity before retirement?

Yes, you can typically withdraw funds from a Jackson Variable Annuity before retirement. However, early withdrawals may be subject to penalties or fees. Consult the product prospectus for specific withdrawal rules and potential penalties.

Are there any surrender charges associated with Jackson Variable Annuities?

Yes, most Jackson Variable Annuities have surrender charges, which are fees imposed if you withdraw funds before a certain period. These charges are designed to discourage early withdrawals and can vary depending on the product and the time of withdrawal.

It’s important to review the surrender charge schedule in the product prospectus.