Is Annuity Life Insurance 2024 a good option for you? Annuities, a type of insurance product, offer a guaranteed stream of income, making them a popular choice for retirement planning. But with a variety of types and complexities, understanding the ins and outs of annuities is crucial before making a decision.

This guide explores the current state of the annuity market, its advantages and disadvantages, and how it can fit into your overall financial strategy.

From fixed annuities with guaranteed interest rates to variable annuities that offer investment growth potential, the world of annuities can seem daunting. This guide delves into the various types, their features, and the factors to consider when choosing the right annuity for your individual needs and financial goals.

What is an Annuity?

An annuity is a financial product that provides a stream of regular payments over a specified period of time, often used for retirement planning. It’s a contract between an individual and an insurance company where the individual makes a lump-sum payment or a series of payments in exchange for guaranteed future income.

Types of Annuities

There are several types of annuities, each with its own features and benefits. Here’s a breakdown:

- Fixed Annuities:These provide a fixed interest rate and guaranteed income payments. The rate is set at the time of purchase and doesn’t fluctuate with market changes. Fixed annuities offer predictable income and are suitable for those seeking stability and security.

- Variable Annuities:These offer the potential for higher returns, but they also come with investment risk. The income payments are tied to the performance of underlying investments, such as mutual funds or stocks. Variable annuities are more suitable for individuals with a higher risk tolerance and longer investment horizon.

- Indexed Annuities:These link their returns to the performance of a specific market index, such as the S&P 500. Indexed annuities offer potential growth with some protection from market downturns. They provide a minimum guaranteed return, but the actual income payments can fluctuate based on the index’s performance.

Key Features and Benefits of Annuities

Annuities offer various features and benefits, making them attractive financial tools:

- Guaranteed Income:Annuities provide a stream of guaranteed income payments for a set period or for life, offering financial security and peace of mind.

- Tax Deferral:The growth of your annuity’s value is generally tax-deferred, meaning you don’t have to pay taxes on the earnings until you start receiving income payments. This can help you accumulate wealth more efficiently.

- Longevity Protection:Annuities can help you outlive your savings by providing a lifetime income stream, ensuring you have financial support even if you live longer than expected.

How Annuities Work in 2024

The annuity market in 2024 is influenced by several factors, including interest rates, market volatility, and regulatory changes.

Market Trends and Influencing Factors

Current trends in the annuity market include:

- Rising Interest Rates:Increasing interest rates can lead to higher annuity payouts, making them more attractive to individuals seeking guaranteed income.

- Market Volatility:Fluctuations in the stock market can make annuities more appealing as a source of stable income, especially for individuals seeking to protect their savings.

- Inflation:Rising inflation can erode the purchasing power of fixed income products, leading some investors to seek annuities that offer inflation protection.

Regulations and Changes Affecting Annuities

Regulatory changes can impact annuity products and their availability. For example, in 2024, the SECURE 2.0 Act introduced new provisions related to retirement savings, which could affect annuity options.

Potential Risks and Considerations

While annuities offer benefits, it’s important to be aware of potential risks:

- Surrender Charges:Some annuities have surrender charges that can apply if you withdraw funds before a certain period. These charges can be substantial and reduce your overall return.

- Investment Risk:Variable annuities and indexed annuities carry investment risk, meaning the value of your investment can fluctuate and you could lose money.

- Limited Liquidity:Annuities generally have limited liquidity, making it difficult to access your funds quickly in case of an emergency.

Advantages of Annuity Life Insurance

Annuities can be a valuable addition to a life insurance strategy, offering several advantages:

Financial Goals and Benefits

Annuities can help individuals achieve various financial goals:

- Retirement Planning:Annuities can provide a steady stream of income during retirement, supplementing other retirement savings and ensuring financial security.

- Income Security:Annuities offer guaranteed income payments, providing peace of mind and protection against unexpected expenses or market downturns.

- Legacy Planning:Some annuities offer death benefits that can be passed on to beneficiaries, helping to preserve wealth and provide financial support for loved ones.

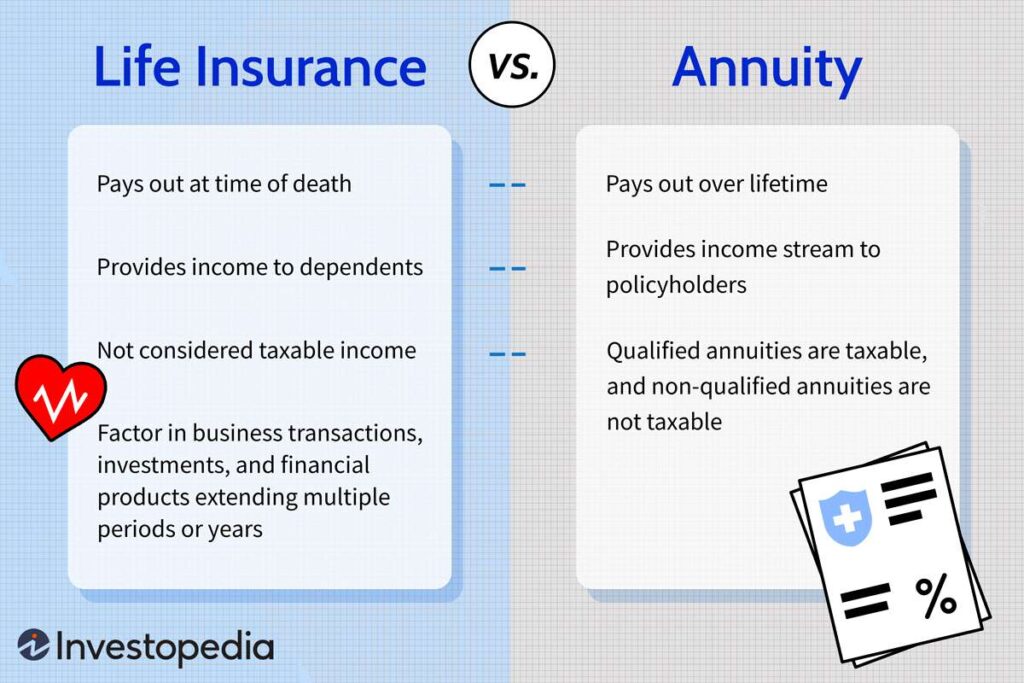

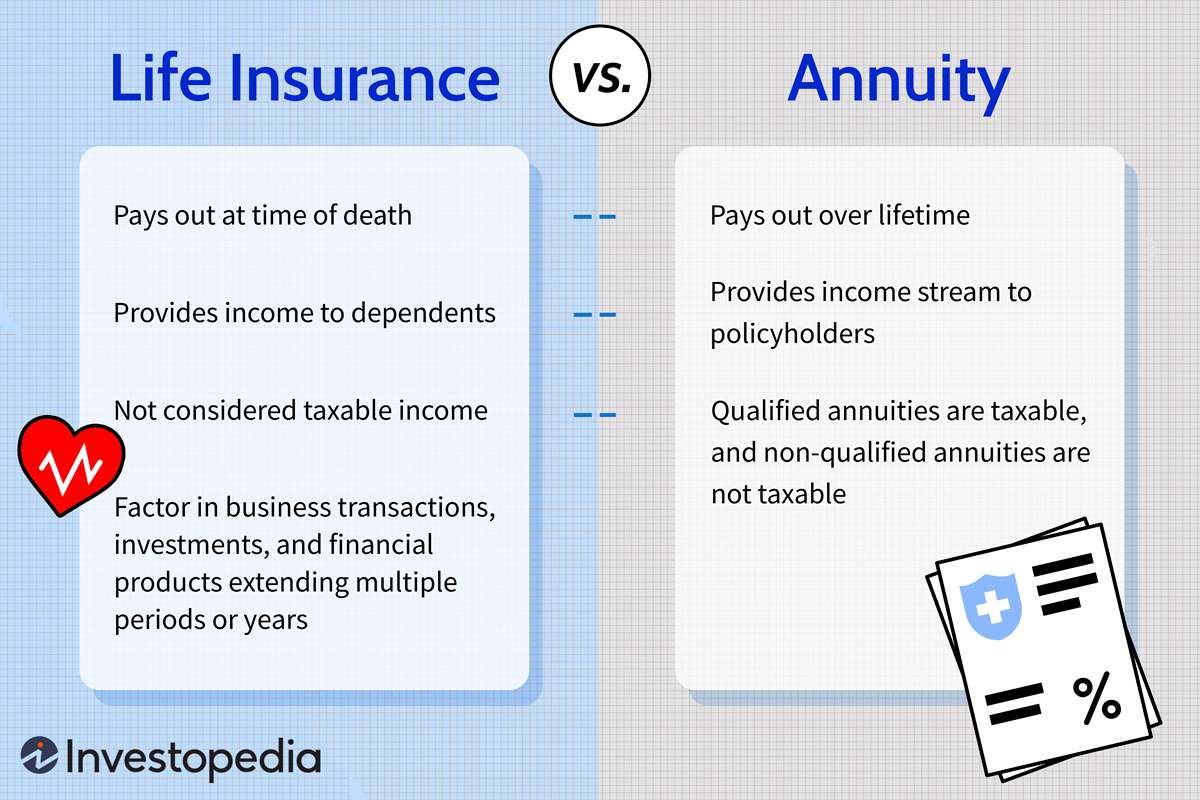

Comparison with Other Life Insurance Products, Is Annuity Life Insurance 2024

Compared to other life insurance products, annuities offer distinct advantages:

- Term Life Insurance:Term life insurance provides coverage for a specific period, typically 10-30 years. Annuities offer a guaranteed income stream for life, providing longevity protection and income security.

- Whole Life Insurance:Whole life insurance offers lifetime coverage and builds cash value, but premiums can be higher than term life insurance. Annuities provide a guaranteed income stream and can be more affordable for income generation.

Disadvantages of Annuity Life Insurance

While annuities offer benefits, it’s crucial to understand their potential drawbacks:

Potential Drawbacks and Downsides

Different types of annuities have their own potential downsides:

- Surrender Charges:As mentioned earlier, some annuities have surrender charges that can reduce your overall return if you withdraw funds early.

- Investment Risk:Variable annuities and indexed annuities carry investment risk, and you could lose money if the underlying investments perform poorly.

- Limited Flexibility:Annuities typically have limited flexibility in terms of withdrawing funds or changing investment options.

Costs and Fees

Annuities involve various costs and fees, which can impact your overall return:

- Administrative Fees:These fees cover the insurance company’s administrative expenses for managing the annuity contract.

- Mortality and Expense Charges:These charges are typically included in variable annuities and reflect the insurance company’s costs for providing death benefits and covering administrative expenses.

- Surrender Charges:As mentioned earlier, these charges apply if you withdraw funds before a certain period and can significantly reduce your return.

Choosing the Right Annuity for Your Needs

Selecting the right annuity product requires careful consideration of your individual circumstances and financial goals.

Guide to Choosing the Right Annuity

Here’s a comprehensive guide to help you choose the right annuity:

- Age:Younger individuals may benefit from variable annuities with a longer investment horizon, while older individuals may prefer fixed annuities for guaranteed income.

- Income:Your income level will influence the amount you can afford to invest in an annuity and the income payments you can expect to receive.

- Risk Tolerance:Your risk tolerance will determine whether you are comfortable with the potential for investment losses or prefer the stability of a fixed annuity.

- Investment Horizon:The length of time you plan to invest in the annuity will influence your choice of product. Longer investment horizons allow for greater potential growth, while shorter horizons may favor fixed annuities.

Checklist for Evaluating Annuity Options

Use this checklist when evaluating annuity options:

- Guaranteed Income Payments:Consider the amount and duration of guaranteed income payments offered.

- Investment Options:If you choose a variable or indexed annuity, review the available investment options and their performance history.

- Fees and Charges:Carefully analyze all fees and charges associated with the annuity, including surrender charges, administrative fees, and mortality and expense charges.

- Tax Implications:Understand the tax implications of annuity income and growth.

- Liquidity:Consider the annuity’s liquidity and your ability to access funds if needed.

- Death Benefits:If applicable, evaluate the death benefits offered and how they benefit your beneficiaries.

Comparing Different Annuity Products

Here’s a table comparing different annuity products based on key features:

| Feature | Fixed Annuity | Variable Annuity | Indexed Annuity |

|---|---|---|---|

| Income Payments | Guaranteed and fixed | Variable based on investment performance | Linked to a market index with a minimum guaranteed return |

| Investment Risk | Low | High | Moderate |

| Growth Potential | Limited | High | Moderate |

| Fees and Charges | Lower | Higher | Moderate |

| Liquidity | Limited | Limited | Limited |

Annuity Life Insurance and Retirement Planning: Is Annuity Life Insurance 2024

Annuities can play a crucial role in retirement planning by providing income security and supplementing other retirement savings.

Income Security During Retirement

Annuities can provide a steady stream of income during retirement, helping you cover essential expenses and maintain your lifestyle.

- Guaranteed Lifetime Income Payments:Some annuities offer guaranteed lifetime income payments, ensuring you have financial support for the rest of your life, regardless of how long you live.

- Income Riders:These riders can be added to an annuity contract to provide additional income benefits, such as inflation protection or a guaranteed minimum income level.

Supplementing Retirement Income

Annuities can supplement other retirement income sources, such as Social Security, pensions, and savings.

- Bridge Income:Annuities can provide bridge income during the transition from working to retirement, covering expenses until other income sources become available.

- Expense Coverage:Annuities can help cover essential expenses during retirement, such as housing, healthcare, and travel.

Incorporating Annuities into a Retirement Planning Strategy

Here’s a step-by-step guide for incorporating annuities into your retirement planning strategy:

- Determine Your Retirement Income Needs:Calculate your estimated expenses during retirement to determine how much income you’ll need.

- Evaluate Your Existing Retirement Savings:Assess your current retirement savings and how much additional income you’ll need.

- Consider Annuities as a Supplement:Explore annuity options to supplement your existing retirement savings and provide guaranteed income.

- Choose the Right Annuity Product:Select an annuity product that aligns with your risk tolerance, investment horizon, and financial goals.

- Monitor and Adjust Your Strategy:Regularly review your retirement plan and make adjustments as needed to ensure your annuity strategy remains aligned with your goals.

Annuity Life Insurance and Estate Planning

Annuities can be used as a tool for estate planning and legacy preservation, offering tax advantages and providing financial support for beneficiaries.

Legacy Preservation and Tax Implications

Annuities can help you minimize estate taxes and preserve wealth for your beneficiaries:

- Tax-Deferred Growth:The growth of your annuity’s value is generally tax-deferred, reducing your overall tax liability and maximizing the amount passed on to your beneficiaries.

- Death Benefits:Some annuities offer death benefits that can be passed on to your beneficiaries, providing financial support and ensuring your legacy continues.

Strategies for Using Annuities in Estate Planning

Here are strategies for using annuities in estate planning:

- Funding Trusts:Annuities can be used to fund trusts, providing a steady stream of income for beneficiaries and minimizing estate taxes.

- Providing for Special Needs Beneficiaries:Annuities can be structured to provide financial support for beneficiaries with special needs, ensuring their well-being and financial security.

- Charitable Giving:Annuities can be used to make charitable donations, providing tax benefits and supporting your favorite causes.

Alternatives to Annuity Life Insurance

While annuities offer benefits, there are alternative financial products that provide similar features and benefits:

Alternative Financial Products

Here are some alternatives to annuities:

- Deferred Compensation Plans:These plans allow employees to defer receiving a portion of their salary until retirement, offering tax advantages and potential for growth.

- Individual Retirement Accounts (IRAs):IRAs are tax-advantaged retirement savings accounts that offer various investment options and tax benefits.

- 401(k) Plans:These employer-sponsored retirement savings plans offer tax advantages and matching contributions from employers.

- Fixed Indexed Annuities (FIAs):FIAs offer a minimum guaranteed return linked to a market index, providing potential growth with some protection from market downturns.

Comparison of Features, Benefits, and Risks

Here’s a comparison of the features, benefits, and risks of these alternatives:

| Feature | Deferred Compensation Plans | IRAs | 401(k) Plans | FIAs |

|---|---|---|---|---|

| Guaranteed Income | No | No | No | No |

| Investment Risk | High | High | High | Moderate |

| Tax Advantages | Yes | Yes | Yes | Yes |

| Liquidity | Limited | Limited | Limited | Limited |

| Fees and Charges | Variable | Variable | Variable | Variable |

Advantages and Disadvantages of Alternatives

Each alternative product has its own advantages and disadvantages:

- Deferred Compensation Plans:Offer tax advantages and potential for growth, but limited liquidity and subject to employer risk.

- IRAs:Provide tax benefits and flexibility, but limited contribution limits and subject to market risk.

- 401(k) Plans:Offer tax advantages and employer matching, but limited investment options and subject to employer risk.

- FIAs:Offer potential growth with some protection from market downturns, but limited liquidity and subject to market risk.

Ultimate Conclusion

Ultimately, the decision of whether or not to invest in annuity life insurance is a personal one. Carefully weighing the advantages and disadvantages, understanding the risks involved, and considering your specific financial goals and risk tolerance is crucial. With the right research and guidance, you can make an informed decision that aligns with your financial future.

Expert Answers

How do annuities work?

Annuities are contracts where you make a lump sum payment or a series of payments, and in return, receive regular payments for a specified period, often for life. The payments can be fixed or variable, depending on the type of annuity.

What are the different types of annuities?

Common types include fixed annuities, variable annuities, and indexed annuities. Each type offers different features, risks, and potential returns.

Are annuities safe?

While annuities offer some level of security, they are not risk-free. Variable annuities, for instance, carry investment risks. It’s important to understand the potential risks and downsides associated with different types of annuities.