IRA contribution limits for 2024 for those over 50 offer a unique opportunity to boost your retirement savings. As you approach retirement, maximizing your contributions becomes even more crucial, and the catch-up contribution limit allows you to accelerate your savings journey.

Let’s explore how these limits can work for you.

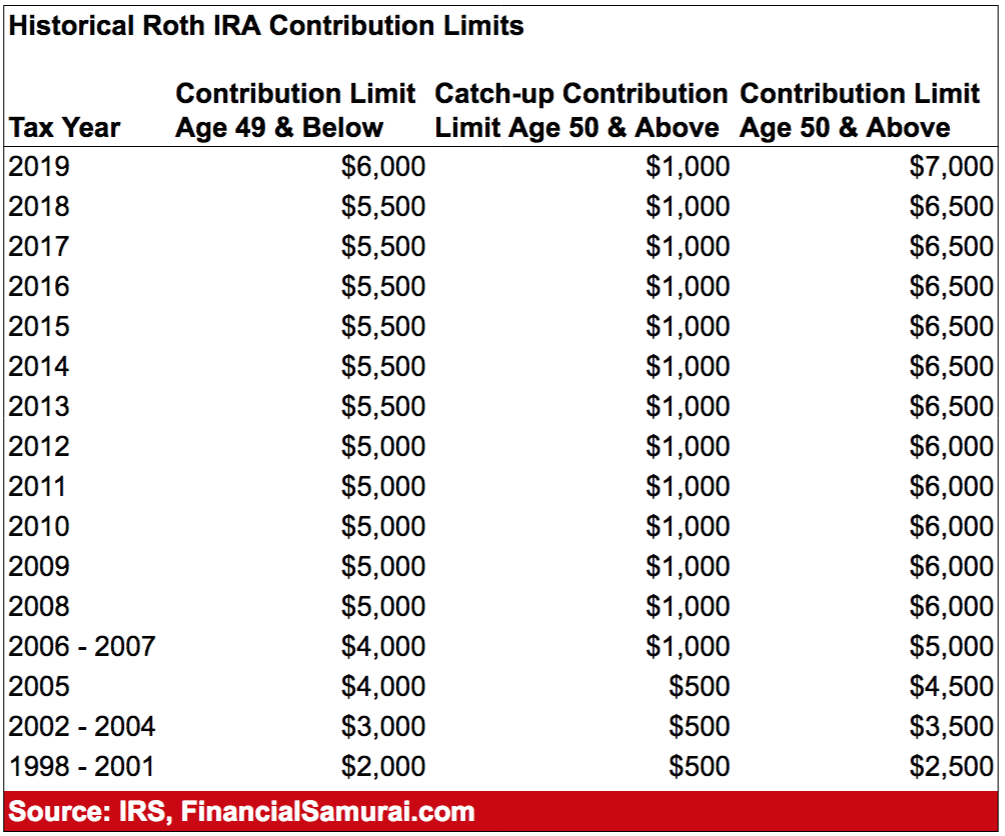

In 2024, individuals aged 50 and over can contribute an additional $1,000 to their traditional or Roth IRAs, on top of the standard contribution limit. This “catch-up” contribution is designed to help older individuals make up for lost time in their savings journey.

This means you can contribute a total of $7,500 to your IRA in 2024, compared to the standard limit of $6,500 for those under 50.

IRA Contribution Limits for 2024: IRA Contribution Limits For 2024 For Those Over 50

The maximum amount you can contribute to an IRA in 2024 is determined by your age and whether you’re contributing to a traditional IRA or a Roth IRA.

The IRS has a wealth of resources to help you prepare for the October 2024 tax deadline. This link will take you to a page with information on filing your taxes, deadlines, and available assistance programs.

Standard IRA Contribution Limit

The standard IRA contribution limit for 2024 is $6,500. This is the maximum amount you can contribute to your IRA regardless of your age.

Catch-Up Contribution Limit for Individuals Aged 50 and Over

If you are 50 or older in 2024, you can make an additional catch-up contribution to your IRA. The catch-up contribution limit for 2024 is $1,000. This means that if you are 50 or older, you can contribute a total of $7,500 to your IRA in 2024.

Comparison of Standard and Catch-Up Contribution Limits

The following table compares the standard and catch-up contribution limits for 2024:

| Contribution Limit | Age | Maximum Contribution |

|---|---|---|

| Standard | All ages | $6,500 |

| Catch-up | 50 and older | $7,500 |

Types of IRAs

There are two main types of IRAs: traditional IRAs and Roth IRAs. Both types of IRAs allow you to save for retirement, but they differ in their tax implications.

Traditional IRAs and Roth IRAs offer different tax advantages, and understanding these differences can help you choose the best option for your situation.

It’s always good to know how your IRA contribution limits have changed from year to year. This comparison will show you the differences between 2023 and 2024 limits.

Traditional IRAs

Traditional IRA contributions are tax-deductible, meaning you can deduct them from your taxable income in the year you make the contribution. This can reduce your current tax liability. However, you’ll pay taxes on your withdrawals in retirement.

Knowing your tax bracket is crucial for budgeting and financial planning. This resource provides a breakdown of the 2024 tax brackets in the United States.

Traditional IRAs are often a good choice for people who expect to be in a lower tax bracket in retirement than they are now.

Filling out a W9 Form can seem daunting, but it’s a straightforward process. This guide provides step-by-step instructions for completing the form.

Roth IRAs

Roth IRA contributions are made with after-tax dollars, so you don’t receive a tax deduction for your contributions. However, qualified withdrawals in retirement are tax-free.

Self-employed individuals have specific IRA contribution limits. Check out the limits for 2024 and start planning your retirement savings.

Roth IRAs are often a good choice for people who expect to be in a higher tax bracket in retirement than they are now.

Non-profit organizations also need to fill out W9 Forms for payments they receive. This page offers information on the specific requirements for non-profits.

Tax Implications of Traditional and Roth IRAs, IRA contribution limits for 2024 for those over 50

Here’s a table summarizing the tax implications of traditional and Roth IRAs:

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contribution Deduction | Tax-deductible | Not tax-deductible |

| Withdrawals in Retirement | Taxable | Tax-free |

Eligibility Requirements for Traditional and Roth IRAs

There are some eligibility requirements for both types of IRAs.

- Traditional IRAs:You can contribute to a traditional IRA regardless of your income level. However, if you’re covered by a retirement plan at work and your income is above certain limits, your deduction for traditional IRA contributions may be reduced or eliminated.

For 2024, the income limits for the traditional IRA deduction are $153,000 for single filers and $228,000 for married couples filing jointly.

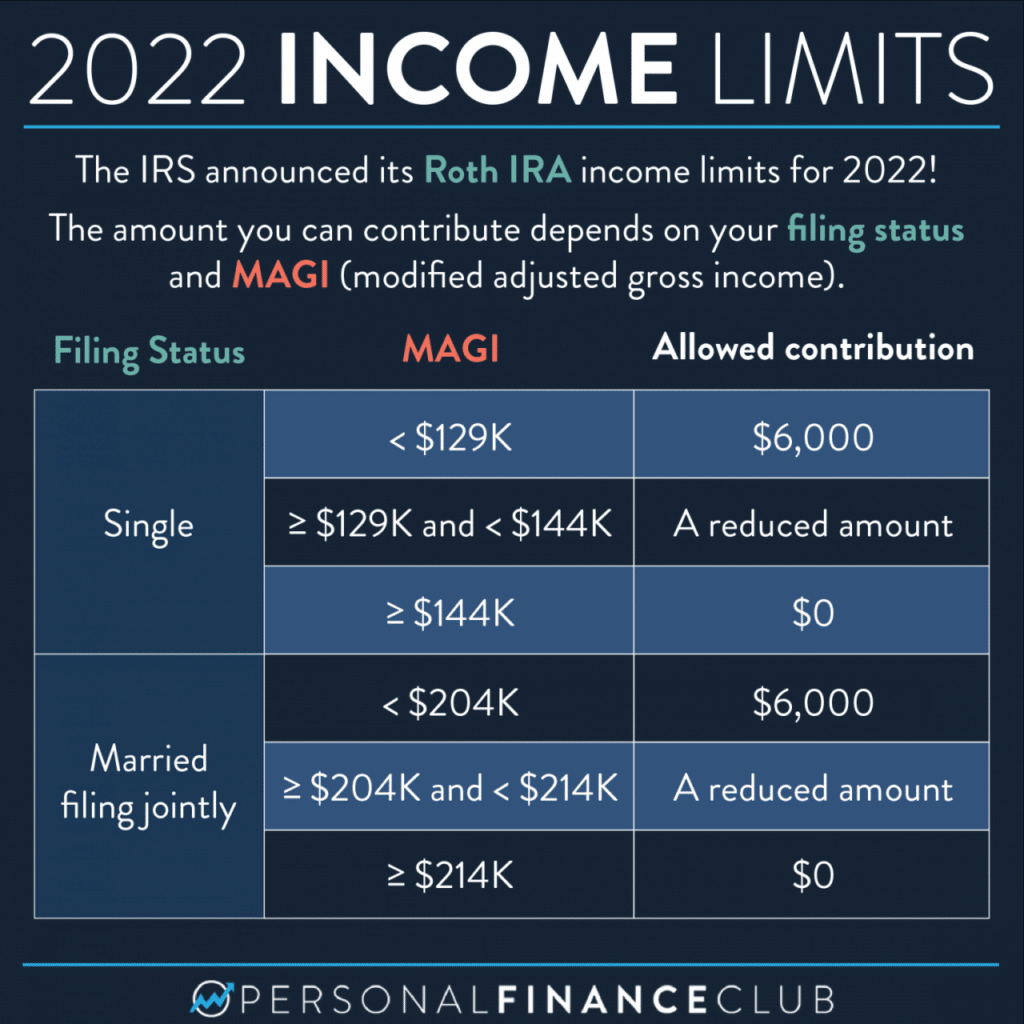

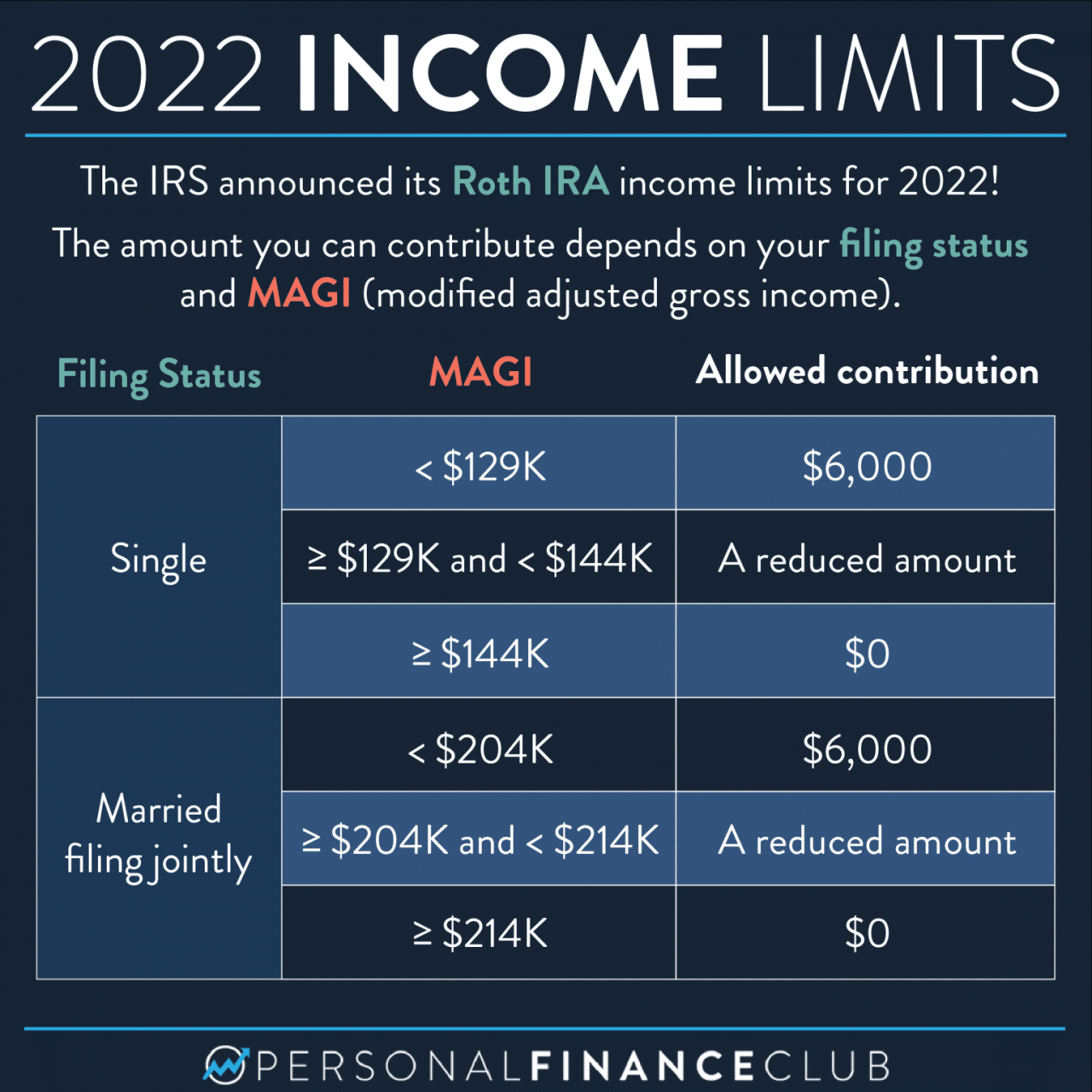

- Roth IRAs:You can contribute to a Roth IRA if your modified adjusted gross income (MAGI) is below certain limits. For 2024, the income limits for Roth IRA contributions are $153,000 for single filers and $228,000 for married couples filing jointly. If your MAGI exceeds these limits, you may not be able to contribute to a Roth IRA, or your contribution may be partially or fully limited.

Contribution Strategies

Maximizing your IRA contributions can significantly impact your retirement savings. Understanding the various contribution strategies can help you make informed decisions about your retirement planning.

Maximizing IRA Contributions

The benefits of making the maximum IRA contribution include:

- Tax Advantages:Traditional IRA contributions are tax-deductible, which can lower your taxable income and reduce your current tax liability. Roth IRA contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. Both types of IRAs offer significant tax benefits for retirement savings.

If you’re over 50, you might be eligible for a higher 401k contribution limit. Find out what the 2024 limits are and make sure you’re maximizing your retirement savings.

- Compounding Growth:By contributing the maximum amount, you allow your investments to grow more quickly through the power of compounding. The earlier you start saving, the more time your money has to grow exponentially.

- Retirement Security:Contributing the maximum amount helps you build a larger retirement nest egg, providing greater financial security in your later years. This can help you maintain your desired lifestyle and avoid financial strain during retirement.

Catch-Up Contributions for Those Aged 50 and Over

Individuals aged 50 and over can contribute an additional amount to their IRA on top of the regular contribution limit. This catch-up contribution allows older individuals to accelerate their retirement savings and make up for any lost time.

A tax bracket calculator can be a helpful tool for estimating your tax liability. Use this calculator to get a personalized estimate for 2024.

- Increased Contribution Limit:The catch-up contribution limit for 2024 is $1,000, which means those aged 50 and over can contribute up to $7,500 to a traditional or Roth IRA. This significantly increases the amount you can save each year.

- Faster Retirement Savings:Catch-up contributions allow you to accumulate a larger retirement nest egg faster, providing you with more financial security in retirement. This can be especially beneficial if you started saving later in life.

- Tax Benefits:Catch-up contributions are subject to the same tax benefits as regular IRA contributions, providing tax advantages for retirement savings. This can help you maximize your after-tax retirement income.

Strategies for Maximizing IRA Contributions Within Income Limitations

Income limitations can restrict your ability to contribute to a Roth IRA. However, there are strategies to maximize your IRA contributions even if you face these limitations:

- Consider a Traditional IRA:If you exceed the income limits for Roth IRA contributions, you can still contribute to a traditional IRA. While withdrawals in retirement are taxable, you can deduct your contributions from your taxable income, lowering your current tax liability.

- Convert to a Roth IRA:If you have a traditional IRA, you can convert it to a Roth IRA. While you will need to pay taxes on the conversion amount, future withdrawals will be tax-free. This strategy can be beneficial if you anticipate being in a lower tax bracket in retirement.

Tax laws are constantly changing, so it’s essential to stay informed. This article highlights some key changes that might impact the October 2024 tax deadline.

- Backdoor Roth IRA:This strategy involves contributing to a traditional IRA and then immediately converting it to a Roth IRA. This allows you to circumvent the income limitations for Roth IRA contributions, although you may need to pay taxes on the conversion amount.

Qualifying widow(er)s have specific tax brackets that may be more advantageous than the standard brackets. Find out more about the tax brackets for qualifying widow(er)s in 2024.

Tax-Free Withdrawals

One of the significant advantages of contributing to a Roth IRA is the potential for tax-free withdrawals in retirement. Unlike traditional IRAs, where you pay taxes on withdrawals in retirement, Roth IRA withdrawals are tax-free if certain conditions are met.

This can significantly reduce your tax burden in retirement and increase your overall retirement savings.

Eligibility Requirements for Tax-Free Withdrawals

To be eligible for tax-free withdrawals from a Roth IRA, you must meet certain requirements:

- The withdrawal must be made after the account has been open for at least five years.

- The withdrawal must be made after you reach age 59 1/2.

- The withdrawal must be for qualified purposes, such as retirement, disability, or paying for a first-time home purchase.

If you withdraw funds from your Roth IRA before meeting these requirements, you may have to pay taxes and a 10% penalty on the earnings portion of the withdrawal.

If you use your vehicle for business purposes, you can deduct mileage expenses. The IRS mileage rate for October 2024 is available on this page.

Tax Implications of Roth IRA Withdrawals vs. Traditional IRA Withdrawals

Here’s a comparison of the tax implications of withdrawing funds from a Roth IRA versus a traditional IRA:

| Type of IRA | Tax Treatment of Contributions | Tax Treatment of Withdrawals |

|---|---|---|

| Roth IRA | After-tax contributions | Tax-free withdrawals (if eligible) |

| Traditional IRA | Pre-tax contributions | Taxable withdrawals |

As you can see, Roth IRA contributions are made with after-tax dollars, while traditional IRA contributions are made with pre-tax dollars. This means that Roth IRA withdrawals are tax-free if you meet the eligibility requirements, while traditional IRA withdrawals are taxable.For example, if you contribute $6,500 to a Roth IRA in 2024 and withdraw $10,000 in retirement, you would not have to pay taxes on the $10,000 withdrawal.

Tax preparation can be stressful, but it doesn’t have to be. These tips will help you streamline the process and avoid common mistakes.

However, if you contribute $6,500 to a traditional IRA in 2024 and withdraw $10,000 in retirement, you would have to pay taxes on the $10,000 withdrawal.

The tax implications of withdrawing funds from a Roth IRA versus a traditional IRA can have a significant impact on your overall retirement savings.

Retirement Planning Considerations

Retirement planning involves making crucial decisions about how to save and invest for your future. One important aspect is choosing the right retirement savings vehicle. Traditional and Roth IRAs are popular options, each with its own advantages and disadvantages.

Knowing the IRA contribution limits for both 2024 and 2025 can help you plan ahead. This resource provides a breakdown of the limits for both years.

Comparing Traditional and Roth IRAs

Choosing between a traditional and Roth IRA involves considering your current financial situation, your tax bracket, and your expectations for future income. Here’s a comparison of the key features:

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contribution Deductibility | Contributions are tax-deductible in the year you make them, reducing your taxable income. | Contributions are not tax-deductible, but withdrawals in retirement are tax-free. |

| Tax Treatment of Withdrawals | Withdrawals in retirement are taxed as ordinary income. | Withdrawals in retirement are tax-free, as long as you meet certain requirements. |

| Income Limits | There are income limits for making contributions to a traditional IRA. | There are income limits for making contributions to a Roth IRA. |

| Tax Bracket | If you expect to be in a lower tax bracket in retirement, a traditional IRA may be more beneficial. | If you expect to be in a higher tax bracket in retirement, a Roth IRA may be more beneficial. |

Factors to Consider When Choosing Between a Traditional and Roth IRA

Several factors influence your decision between a traditional and Roth IRA.

IRA contribution limits can vary based on your age. This resource provides a breakdown of the limits for different age groups in 2024.

- Current Tax Bracket:If you are currently in a lower tax bracket, a traditional IRA may be advantageous, as your contributions will be tax-deductible, reducing your immediate tax liability. However, if you anticipate being in a higher tax bracket in retirement, a Roth IRA may be more beneficial, as your withdrawals will be tax-free.

- Future Income Expectations:Consider your projected income in retirement. If you anticipate being in a lower tax bracket, a traditional IRA may be more favorable, as your withdrawals will be taxed at a lower rate. Conversely, if you expect to be in a higher tax bracket, a Roth IRA may be more beneficial, as your withdrawals will be tax-free.

As an independent contractor, you’ll need to fill out a W9 Form for any payments you receive. This guide will help you navigate the process and ensure you’re providing the correct information.

- Investment Time Horizon:Your investment time horizon is also crucial. If you have a longer investment time horizon, a traditional IRA may be more advantageous, as your contributions are tax-deductible, allowing your investment to grow tax-deferred. However, if you have a shorter time horizon, a Roth IRA may be more beneficial, as your withdrawals will be tax-free.

- Financial Stability:Your current financial stability is another factor to consider. If you are in a stable financial position, a Roth IRA may be more advantageous, as you can benefit from tax-free withdrawals in retirement. However, if you are experiencing financial challenges, a traditional IRA may be more beneficial, as your contributions will be tax-deductible, reducing your immediate tax liability.

Tips for Maximizing Retirement Savings Through IRA Contributions

Maximizing your retirement savings through IRA contributions is essential.

- Contribute the Maximum Allowed:Maximize your contributions to your IRA each year, taking advantage of the full contribution limit. The earlier you start contributing, the more time your savings have to grow.

- Make Catch-Up Contributions:If you are over 50, you can contribute an additional amount to your IRA each year, known as a catch-up contribution. This can significantly boost your retirement savings.

- Invest Wisely:Diversify your IRA investments across different asset classes, such as stocks, bonds, and real estate. This helps to reduce risk and maximize returns over the long term.

- Consider Automatic Contributions:Set up automatic contributions to your IRA from your paycheck. This helps ensure that you are consistently saving for retirement.

Outcome Summary

Understanding IRA contribution limits and catch-up contributions is essential for maximizing your retirement savings. By strategically utilizing these tools, you can set yourself up for a comfortable and secure retirement. Remember to consider your individual financial circumstances and consult with a financial advisor to create a retirement plan that meets your specific needs.

Quick FAQs

What happens if I contribute more than the IRA limit?

If you contribute more than the annual IRA limit, you may face a penalty. The IRS considers excess contributions as a taxable event, and you may also be subject to a 6% penalty.

Can I contribute to both a traditional and Roth IRA in the same year?

Yes, you can contribute to both a traditional and Roth IRA in the same year, but the total amount you contribute cannot exceed the annual limit.

Can I withdraw my contributions from an IRA before retirement?

You can withdraw your contributions from an IRA before retirement without penalty, but you may have to pay taxes on the withdrawals. However, early withdrawals for certain reasons, such as first-time home purchases or medical expenses, may be exempt from penalties.

What are the income limits for contributing to a Roth IRA?

There are income limits for contributing to a Roth IRA. In 2024, if your modified adjusted gross income (MAGI) is above a certain threshold, you may not be able to contribute to a Roth IRA or you may be limited in the amount you can contribute.

The exact limits vary based on filing status.