IRA contribution limits for 2024 for single filers offer a valuable opportunity to bolster retirement savings. Understanding these limits, the distinctions between traditional and Roth IRAs, and the eligibility requirements is crucial for maximizing your retirement nest egg.

This guide delves into the specifics of IRA contributions for single filers in 2024, covering contribution limits, income limitations, tax advantages, and strategies for maximizing your savings. Whether you’re new to retirement planning or seeking to refine your current approach, this information can help you make informed decisions about your IRA contributions.

Eligibility Requirements

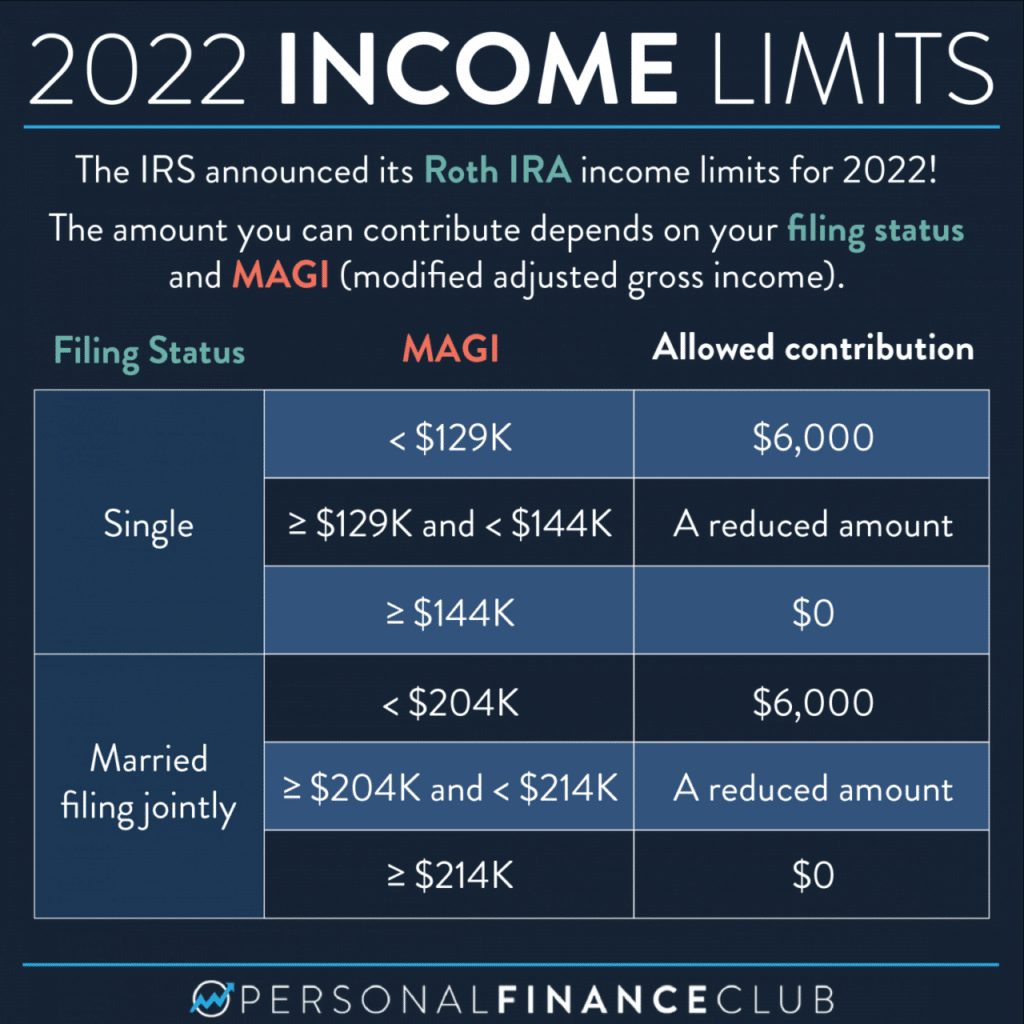

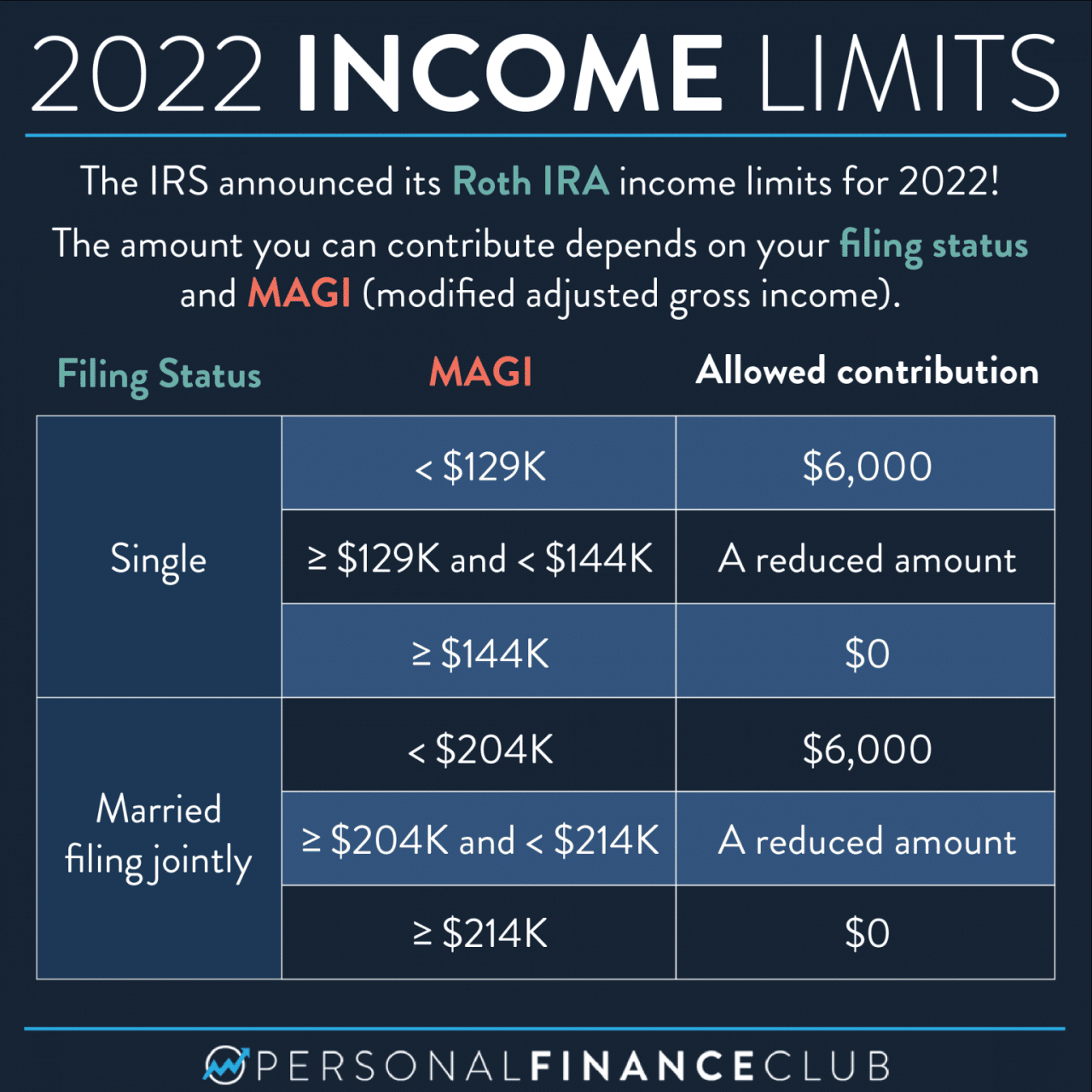

Not everyone is eligible to contribute to a traditional IRA. Income limitations exist for traditional IRA contributions. The amount you can contribute depends on your filing status and your modified adjusted gross income (MAGI).

For employees looking to save for retirement, it’s essential to know the 2024 401k contribution limits for employees to make informed decisions.

Income Limitations for Traditional IRA Contributions

The IRS sets income limits for those who can contribute to a traditional IRA. These limits are based on your filing status and your MAGI. If your MAGI is above the limit, you may not be able to contribute to a traditional IRA, or your contribution may be limited.

Completing a W9 Form can seem daunting, but our guide on how to fill out W9 Form for October 2024 makes the process easy.

Income Phase-Out Ranges for Single Filers

For single filers in 2024, the income phase-out range for traditional IRA contributions is between $73,000 and $83,000. This means that if your MAGI is between $73,000 and $83,000, your contribution amount will be reduced. If your MAGI is above $83,000, you will not be able to contribute to a traditional IRA.

Are you over 50 and looking to maximize your retirement contributions? The Ira contribution limits for people over 50 in 2024 provide valuable insights.

The phase-out range is not a hard limit. Instead, it is a gradual reduction of the contribution amount as your MAGI increases.

Navigating the tax system can be confusing, but understanding tax brackets for 2024 is crucial for accurate tax preparation.

Modified Adjusted Gross Income (MAGI)

MAGI is a measure of your income used to determine your eligibility for certain tax benefits, including traditional IRA contributions. To calculate your MAGI, start with your adjusted gross income (AGI) and add back certain deductions. For example, if you are claiming the student loan interest deduction, you would add back this deduction to your AGI to calculate your MAGI.

Freelancers need to understand the specifics of the W9 Form October 2024 for freelancers to ensure accurate reporting and tax compliance.

The formula for calculating MAGI is: AGI + Certain Deductions = MAGI.

High earners have specific contribution limits to consider, so understanding the 401k contribution limits for 2024 for high earners is important for maximizing retirement savings.

For 2024, the following deductions are added back to your AGI to calculate your MAGI:

- Student loan interest deduction

- Tuition and fees deduction

- Domestic production activities deduction

- Moving expenses deduction

- One-half of self-employment taxes

- Deduction for certain retirement contributions

The IRS provides detailed instructions on how to calculate your MAGI on its website. You can also use tax software or consult with a tax professional to determine your MAGI.

Need to know the latest requirements for filling out a W9 Form for your business? The W9 Form October 2024 requirements for businesses article provides comprehensive guidance on the updated rules and regulations.

Considerations for Single Filers

As a single filer, you have the option of contributing to either a traditional or Roth IRA, each offering distinct advantages and disadvantages. Understanding these differences is crucial for making informed decisions about your retirement savings strategy.

If you’re filing taxes as a married couple filing separately, you’ll want to understand the tax brackets for married filing separately in 2024 to determine your tax liability.

Traditional vs. Roth IRA

Choosing between a traditional and Roth IRA depends on your current income, tax bracket, and expected tax bracket in retirement.

Planning a business trip and need to calculate your mileage expenses? The mileage rate for October 2024 is essential for accurate tax deductions.

- Traditional IRA:Contributions are tax-deductible in the current year, reducing your taxable income. However, withdrawals in retirement are taxed as ordinary income. This option may be beneficial if you expect to be in a lower tax bracket in retirement than you are now.

Looking to maximize your retirement savings? Find out the maximum 401k contribution for 2024 and start planning your financial future.

- Roth IRA:Contributions are not tax-deductible, but withdrawals in retirement are tax-free. This option is advantageous if you expect to be in a higher tax bracket in retirement than you are now.

Choosing the Right IRA Type

To determine the most suitable IRA type for you, consider the following factors:

- Current Income:If you have a lower income, a traditional IRA may be more beneficial as the tax deduction can provide immediate savings.

- Expected Future Income:If you anticipate a higher income in retirement, a Roth IRA may be more advantageous due to tax-free withdrawals.

- Tax Bracket:If you are currently in a higher tax bracket, a traditional IRA might be preferable. Conversely, if you anticipate a lower tax bracket in retirement, a Roth IRA might be more advantageous.

- Investment Goals:Consider your investment goals and risk tolerance. Both traditional and Roth IRAs offer flexibility in investment options, allowing you to diversify your portfolio.

Maximizing Retirement Savings, IRA contribution limits for 2024 for single filers

You can maximize your retirement savings through various strategies:

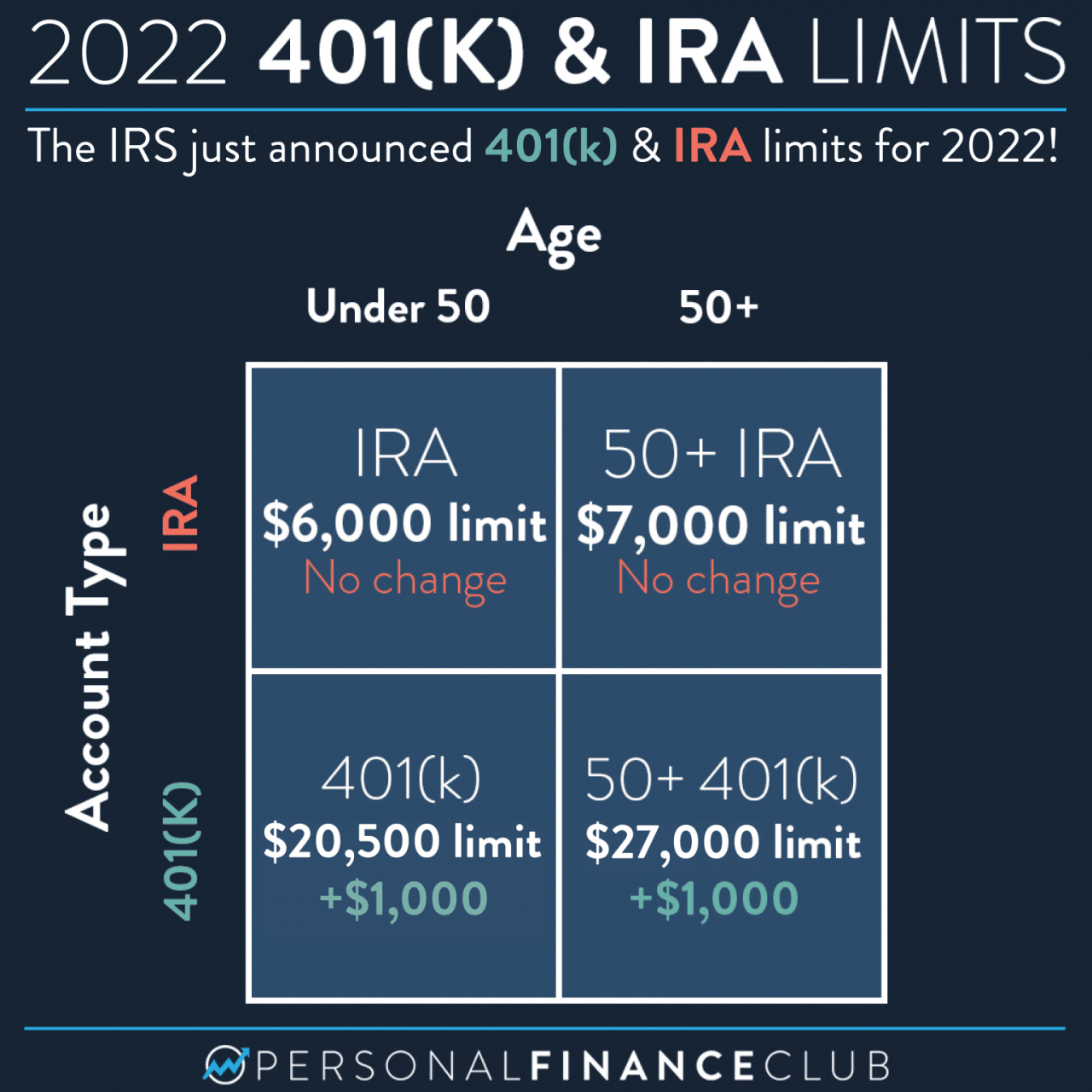

- Contribute the Maximum Amount:For 2024, the maximum contribution limit for single filers is $7,500. Contributing the full amount allows you to take advantage of the tax benefits and compound growth over time.

- Consider a “Catch-Up” Contribution:If you are 50 or older, you can make an additional “catch-up” contribution of $1,500, increasing your total contribution limit to $9,000.

- Automate Contributions:Set up automatic contributions from your paycheck to your IRA account. This helps ensure regular and consistent savings.

- Invest Wisely:Diversify your investments across different asset classes, such as stocks, bonds, and real estate. This helps mitigate risk and potentially generate higher returns.

Closure: IRA Contribution Limits For 2024 For Single Filers

Navigating the world of IRA contributions can be complex, but by understanding the limits, eligibility criteria, and tax implications, single filers can confidently make informed decisions about their retirement savings. Whether you opt for a traditional or Roth IRA, maximizing your contributions within the allowable limits can significantly impact your financial future.

By taking advantage of these valuable retirement savings tools, you can build a solid foundation for a comfortable and secure retirement.

FAQ Overview

What is the difference between a traditional IRA and a Roth IRA?

A traditional IRA allows you to deduct your contributions from your taxable income, leading to tax savings in the present. However, withdrawals in retirement are taxed as ordinary income. A Roth IRA, on the other hand, doesn’t provide immediate tax benefits, but withdrawals in retirement are tax-free.

The best choice depends on your individual financial situation and tax bracket.

Can I contribute to both a traditional and Roth IRA in the same year?

Yes, you can contribute to both a traditional and a Roth IRA in the same year, but there are income limitations for contributing to a traditional IRA. The combined contributions to both types of IRAs cannot exceed the annual limit for the year.

What happens if I exceed the IRA contribution limit?

If you exceed the IRA contribution limit, you will be subject to a 6% penalty on the excess contribution. It’s important to carefully track your contributions to avoid exceeding the limit.

Knowing the differences between Ira contribution limits for 2024 vs 2023 helps you make informed financial decisions for the year ahead.

Need to know the current mileage rate for your tax deductions? Find out where can I find the mileage rate for October 2024 for accurate expense reporting.

Looking ahead to your retirement savings? Understanding the Ira contribution limits for 2024 and beyond helps you plan for the future.

Trusts have specific requirements when it comes to W9 Forms, so make sure you’re familiar with the W9 Form October 2024 for trusts guidelines.

Stay up-to-date on the latest Ira limits for October 2024 to ensure you’re maximizing your retirement savings.