Inflation Expectations and the November 2024 CPI: Gauging Consumer Sentiment, the relationship between these two factors is crucial for understanding the economic landscape. Consumer confidence, a key driver of spending, is directly influenced by inflation expectations. As we approach November 2024, the Consumer Price Index (CPI) will provide a critical snapshot of inflation’s impact on the economy.

This analysis delves into the intricate interplay between inflation expectations, consumer sentiment, and the November 2024 CPI, offering insights into the future trajectory of economic growth.

Understanding how consumers anticipate inflation and how their confidence levels react to these expectations is essential for policymakers and businesses alike. This analysis will explore the various methods used to gauge consumer sentiment, examining the key factors that influence their outlook.

By analyzing the historical impact of inflation expectations on the CPI, we can gain valuable insights into the potential impact of the November 2024 CPI on consumer spending and overall economic health.

You also can investigate more thoroughly about CPI and Unionization in November 2024: The Role of Unions in Wage Negotiations to enhance your awareness in the field of CPI and Unionization in November 2024: The Role of Unions in Wage Negotiations.

Inflation Expectations: A Foundation for Understanding Consumer Sentiment

Inflation expectations play a crucial role in shaping consumer behavior and influencing the overall health of the economy. When consumers anticipate rising prices, they tend to spend more in the present, fearing that goods and services will become more expensive in the future.

This phenomenon, known as the “inflationary spiral,” can lead to increased demand and further fuel inflation. Conversely, if consumers expect prices to remain stable or decline, they may postpone purchases, leading to decreased demand and potentially deflationary pressures.

Relationship Between Inflation Expectations and Consumer Spending

Consumer spending is a major driver of economic growth, accounting for a significant portion of GDP in most developed economies. When inflation expectations are high, consumers tend to increase their spending, anticipating that prices will rise in the future. This can lead to a surge in demand, which can further fuel inflation.

Conversely, when inflation expectations are low, consumers may delay purchases, anticipating that prices will fall in the future. This can lead to a decrease in demand, which can put downward pressure on prices.

Impact of Inflation Expectations on Consumer Confidence

Consumer confidence is a measure of how optimistic consumers are about the economy. It is often used as a leading indicator of future economic activity. When inflation expectations are high, consumers tend to be less confident about the economy, as they fear that their purchasing power will erode.

This can lead to a decline in consumer spending, which can have a negative impact on economic growth. Conversely, when inflation expectations are low, consumers tend to be more confident about the economy, as they believe that their purchasing power will be preserved.

Understand how the union of The Affordability Crisis and the November 2024 CPI can improve efficiency and productivity.

This can lead to an increase in consumer spending, which can boost economic growth.

Historical Impact of Inflation Expectations on the November 2024 CPI

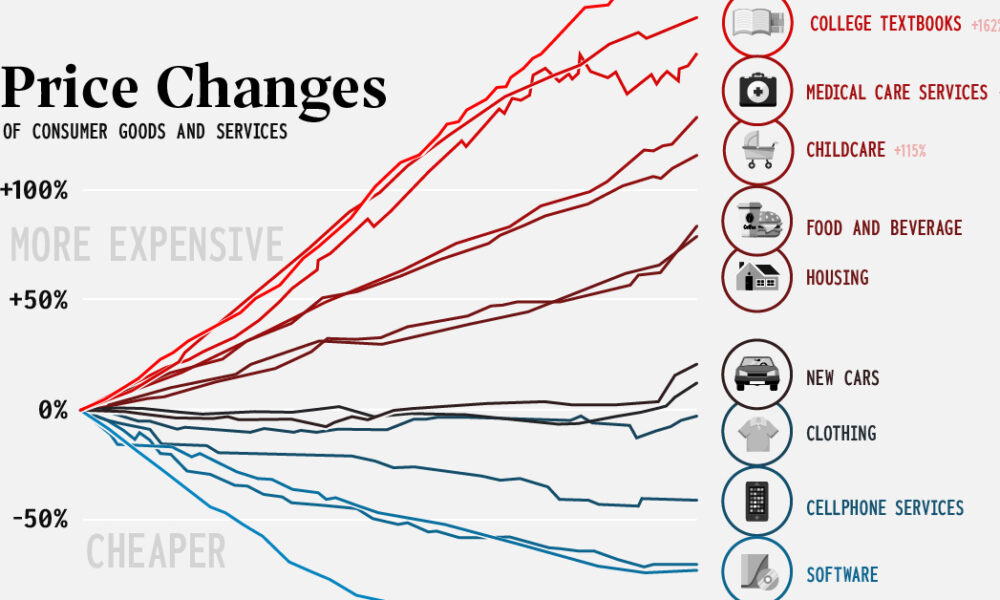

Inflation expectations have historically played a significant role in influencing the Consumer Price Index (CPI). For example, in the 1970s, when inflation expectations were high, the CPI rose sharply. Conversely, in the 1990s, when inflation expectations were low, the CPI remained relatively stable.

Discover how CPI and Technological Advancements Leading to November 2024 has transformed methods in this topic.

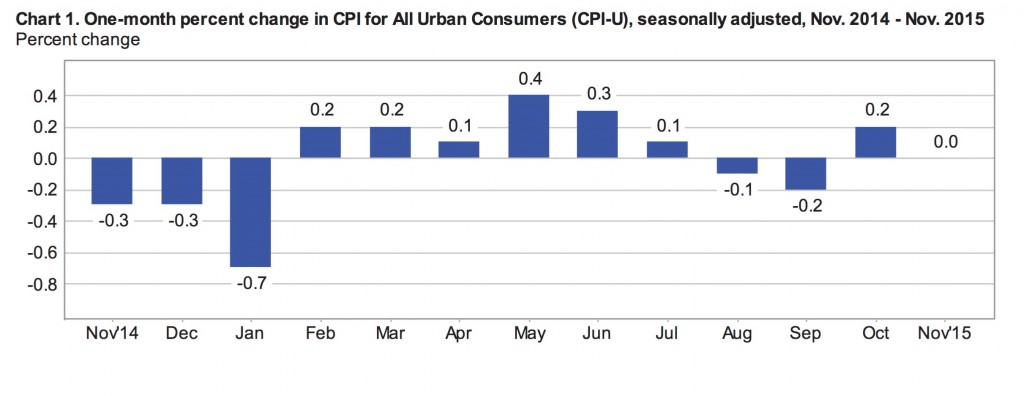

The November 2024 CPI is expected to be influenced by a number of factors, including the current level of inflation, the Federal Reserve’s monetary policy stance, and global economic conditions. Inflation expectations are likely to play a significant role in shaping the November 2024 CPI, as consumers will be looking to see whether prices are rising or falling in line with their expectations.

November 2024 CPI: A Key Indicator of Economic Health

The Consumer Price Index (CPI) is a widely used measure of inflation. It tracks the changes in prices paid by urban consumers for a basket of goods and services. The November 2024 CPI will be a key indicator of the health of the US economy, providing insights into the current inflation rate and its impact on consumers.

Key Economic Indicators Influencing the November 2024 CPI

Several key economic indicators are likely to influence the November 2024 CPI. These include:

- Energy prices:Fluctuations in oil and gas prices can significantly impact the overall CPI, particularly for transportation and energy-related goods.

- Food prices:Rising food prices, driven by factors such as supply chain disruptions, weather events, and increased demand, can contribute to higher inflation.

- Housing costs:Rent and mortgage interest rates play a significant role in the CPI, as housing is a major expense for most consumers.

- Wage growth:Rising wages can put upward pressure on prices, as businesses may pass on higher labor costs to consumers.

- Supply chain disruptions:Ongoing supply chain disruptions, caused by factors such as the COVID-19 pandemic and geopolitical tensions, can lead to higher prices for goods and services.

Potential Impact of the November 2024 CPI on Inflation Expectations

The November 2024 CPI will provide valuable information about the current inflation rate and its direction. If the CPI shows a significant increase, it could reinforce inflation expectations and lead to further price increases. Conversely, if the CPI shows a decline or remains stable, it could dampen inflation expectations and potentially lead to lower prices.

Gauging Consumer Sentiment: Methods and Insights: Inflation Expectations And The November 2024 CPI: Gauging Consumer Sentiment

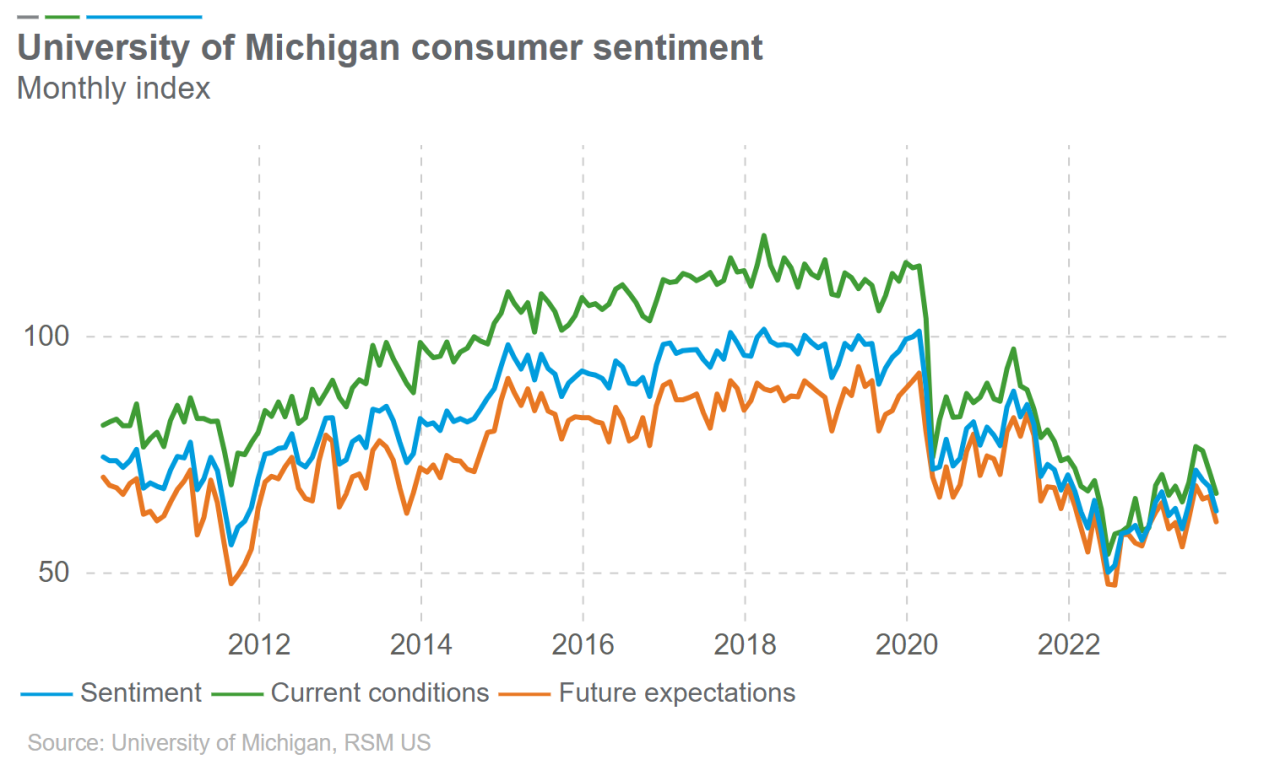

Consumer sentiment is a crucial indicator of economic health, providing insights into consumer confidence and spending patterns. It is often used as a leading indicator of future economic activity.

Examine how CPI and Transportation Costs in November 2024: Getting Around can boost performance in your area.

Methods Used to Gauge Consumer Sentiment

There are several methods used to gauge consumer sentiment, including:

- Surveys:Surveys are a common method used to gauge consumer sentiment. These surveys typically ask consumers about their perceptions of the economy, their personal finances, and their willingness to spend.

- Economic indicators:Several economic indicators can be used to gauge consumer sentiment. These indicators include:

- Retail sales:Retail sales data provide insights into consumer spending patterns.

- Consumer confidence index:The Consumer Confidence Index (CCI) is a widely followed indicator of consumer sentiment.

- Housing starts:Housing starts data provide insights into consumer demand for new homes.

Relationship Between Consumer Sentiment and the November 2024 CPI

Consumer sentiment is closely linked to inflation expectations and can influence the November 2024 CPI. When consumers are confident about the economy, they tend to spend more, which can lead to higher demand and potentially higher prices. Conversely, when consumers are pessimistic about the economy, they tend to spend less, which can lead to lower demand and potentially lower prices.

Implications of Consumer Sentiment for the Overall Economy

Consumer sentiment has a significant impact on the overall economy. When consumers are confident about the economy, they tend to spend more, which boosts economic growth. Conversely, when consumers are pessimistic about the economy, they tend to spend less, which can slow economic growth.

Notice The Phillips Curve and the November 2024 CPI: Examining the Relationship for recommendations and other broad suggestions.

Factors Influencing Consumer Sentiment

Consumer sentiment is influenced by a variety of factors, including:

- Employment:Job security and employment prospects are major factors influencing consumer sentiment. When unemployment is low and job security is high, consumers tend to be more confident about the economy.

- Wages:Wage growth is another key factor influencing consumer sentiment. When wages are rising, consumers tend to be more confident about their ability to afford goods and services.

- Interest rates:Interest rates can impact consumer sentiment by influencing borrowing costs and the cost of saving. When interest rates are low, consumers tend to be more confident about borrowing money, which can boost spending.

- Inflation:Inflation can erode consumer purchasing power, leading to a decline in consumer confidence.

- Government policies:Government policies, such as tax cuts or spending increases, can impact consumer sentiment by influencing disposable income and economic growth prospects.

- Political stability:Political stability is also a factor that can influence consumer sentiment. When there is political uncertainty, consumers tend to be less confident about the economy.

Impact of Factors on the November 2024 CPI

The factors influencing consumer sentiment can also impact the November 2024 CPI. For example, if employment is strong and wages are rising, consumers may be more willing to spend, leading to higher demand and potentially higher prices. Conversely, if unemployment is high and wages are stagnant, consumers may be more cautious about spending, leading to lower demand and potentially lower prices.

Obtain access to CPI and the Global Interest Rate Environment in November 2024 to private resources that are additional.

Relationship Between Consumer Sentiment and Inflation Expectations, Inflation Expectations and the November 2024 CPI: Gauging Consumer Sentiment

Consumer sentiment and inflation expectations are closely intertwined. When consumers are confident about the economy, they tend to expect higher inflation, as they anticipate that businesses will pass on higher costs to consumers. Conversely, when consumers are pessimistic about the economy, they tend to expect lower inflation, as they anticipate that businesses will be reluctant to raise prices.

Check what professionals state about CPI and PCE in a Changing Economy in November 2024 and its benefits for the industry.

Implications for Policymakers

Consumer sentiment is a crucial indicator for policymakers, providing insights into the health of the economy and consumer confidence. Policymakers use consumer sentiment data to inform their monetary and fiscal policy decisions.

Implications of Consumer Sentiment for Policymakers

Policymakers use consumer sentiment data to inform their monetary and fiscal policy decisions. For example, if consumer sentiment is low, policymakers may consider implementing measures to boost economic growth, such as lowering interest rates or increasing government spending. Conversely, if consumer sentiment is high, policymakers may consider measures to cool the economy, such as raising interest rates or reducing government spending.

Impact of Policy Decisions on Inflation Expectations and the November 2024 CPI

Policy decisions can have a significant impact on inflation expectations and the November 2024 CPI. For example, if policymakers raise interest rates, it can make borrowing more expensive, which can slow economic growth and potentially lower inflation. Conversely, if policymakers lower interest rates, it can make borrowing less expensive, which can stimulate economic growth and potentially lead to higher inflation.

Using Consumer Sentiment Data to Guide Economic Policy

Policymakers can use consumer sentiment data to guide economic policy by:

- Monitoring consumer confidence:Tracking consumer sentiment data allows policymakers to assess the health of the economy and identify potential risks.

- Predicting future economic activity:Consumer sentiment can be a leading indicator of future economic activity, allowing policymakers to anticipate changes in consumer spending and adjust policy accordingly.

- Evaluating the effectiveness of policy decisions:Consumer sentiment data can be used to evaluate the effectiveness of policy decisions, such as changes in interest rates or government spending.

Outcome Summary

In conclusion, consumer sentiment and the November 2024 CPI are inextricably linked, influencing each other in a complex dance. By understanding the interplay between these factors, policymakers can make informed decisions regarding monetary and fiscal policy. Businesses can leverage these insights to adapt their strategies and navigate the evolving economic landscape.

Discover more by delving into CPI and Healthcare Costs: A Long-Term View Leading to November 2024 further.

As we move towards November 2024, the November CPI will serve as a pivotal indicator of inflation’s impact on consumer confidence and the overall economy. The insights gained from this analysis will provide a valuable framework for understanding the future direction of economic growth and consumer behavior.

For descriptions on additional topics like CPI and Entertainment Costs in November 2024: Having Fun Affordably, please visit the available CPI and Entertainment Costs in November 2024: Having Fun Affordably.

Frequently Asked Questions

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a basket of consumer goods and services.

How does inflation affect consumer sentiment?

Discover more by delving into CPI and the Stock Market: A Historical Link Leading to November 2024 further.

High inflation erodes purchasing power, leading to concerns about affordability and future financial stability. This can negatively impact consumer confidence and spending.

What are some key economic indicators that influence the CPI?

Factors such as energy prices, food prices, housing costs, and wages all play a role in determining the CPI.

What are the implications of consumer sentiment for policymakers?

Policymakers use consumer sentiment data to assess the health of the economy and guide their decisions on interest rates, government spending, and other economic policies.