Income tax rates for October 2024 are a critical aspect of financial planning for individuals and businesses. Understanding the intricacies of the tax system is crucial for maximizing deductions, minimizing tax liability, and ensuring compliance with regulations. This guide delves into the essential aspects of income tax rates, providing a clear and comprehensive overview of the key factors that influence your tax burden.

From the different income tax brackets and their corresponding rates to the deductions available to individuals and businesses, we cover the essential components of the tax system. We also discuss the impact of potential changes in tax policies, ensuring you stay informed about any significant updates or revisions announced for October 2024.

Understanding Income Tax Rates

Income tax rates in October 2024 are a crucial aspect of personal financial planning. Understanding these rates helps individuals determine their tax liability and plan their financial strategies accordingly. This section delves into the different income tax brackets for October 2024, highlighting the impact of potential changes in tax policies and providing any significant updates or revisions to the income tax rates announced for October 2024.

Income Tax Brackets in October 2024

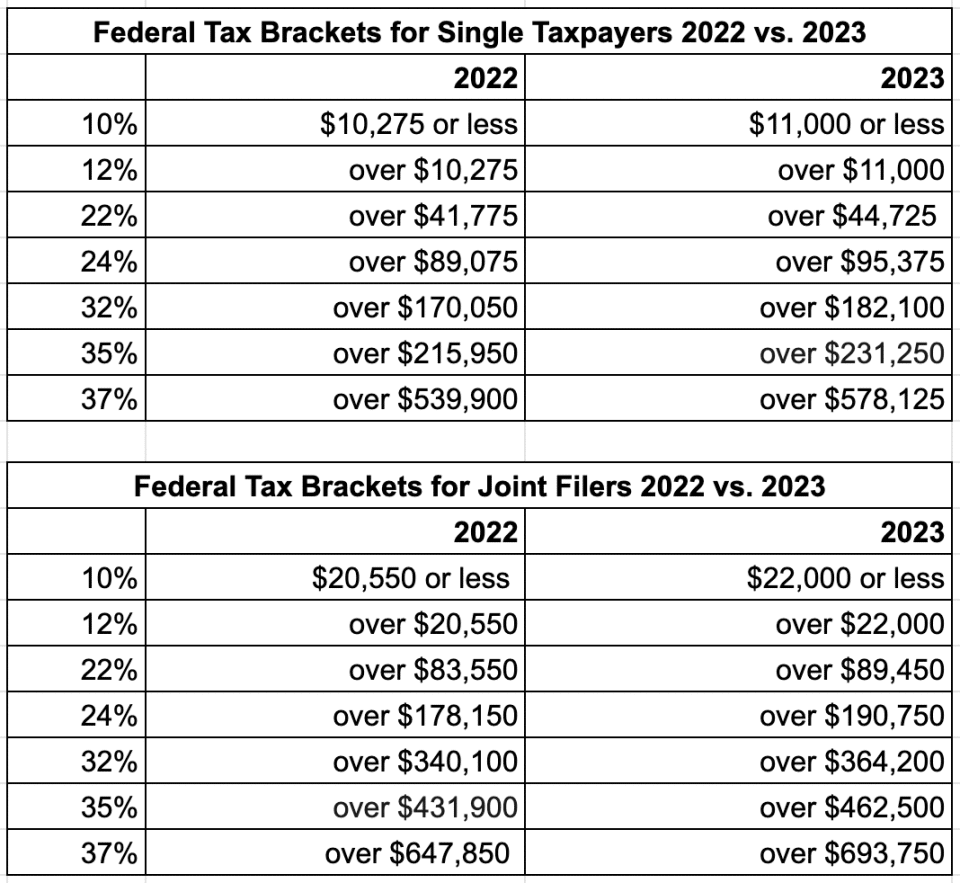

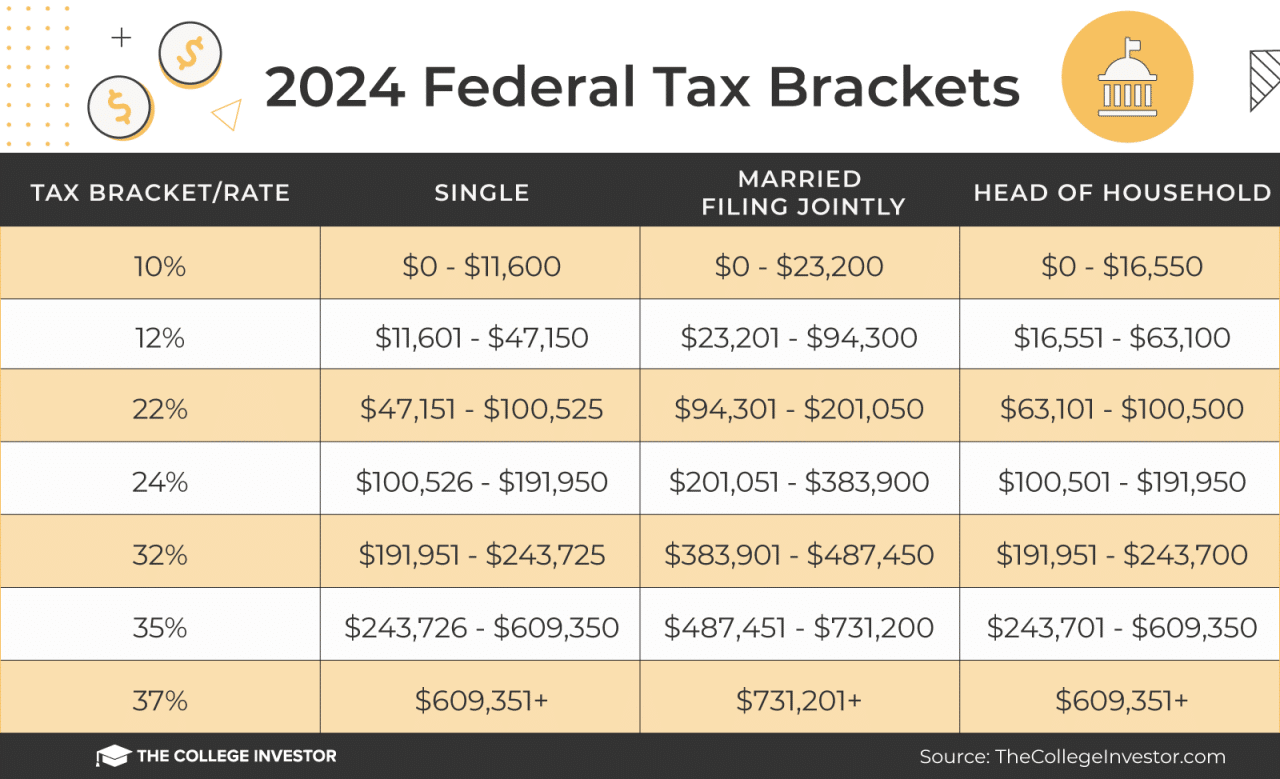

The income tax brackets for October 2024 are designed to determine the tax rate applied to different income levels. The higher the income, the higher the tax rate. This progressive tax system aims to ensure that individuals with higher incomes contribute a larger share of their income to the government.

- Bracket 1:This bracket applies to income up to a certain threshold. The tax rate for this bracket is the lowest. For example, in October 2024, income up to $10,000 might be taxed at a rate of 10%.

- Bracket 2:This bracket applies to income exceeding the threshold of the first bracket. The tax rate for this bracket is higher than the first bracket. For example, income between $10,001 and $40,000 might be taxed at a rate of 15%.

- Bracket 3:This bracket applies to income exceeding the threshold of the second bracket. The tax rate for this bracket is higher than the second bracket. For example, income between $40,001 and $80,000 might be taxed at a rate of 20%.

- Bracket 4:This bracket applies to income exceeding the threshold of the third bracket. The tax rate for this bracket is the highest. For example, income exceeding $80,000 might be taxed at a rate of 25%.

Impact of Potential Changes in Tax Policies

Changes in tax policies can significantly impact income tax rates. For example, a decrease in the standard deduction could result in individuals paying higher taxes. Conversely, an increase in the personal exemption could lead to lower tax liabilities.

Potential changes in tax policies could include adjustments to the tax brackets, standard deductions, personal exemptions, and tax credits. These changes could impact the overall tax burden on individuals and businesses.

If you’re over 50, you can contribute more to your 401(k) than younger individuals. This is known as a “catch-up contribution,” which allows you to make additional contributions to help you reach your retirement goals. To learn how much you can contribute to your 401(k) in 2024 with catch-up contributions, visit How much can I contribute to my 401k in 2024 with catch-up contributions.

Significant Updates or Revisions to Income Tax Rates

The income tax rates for October 2024 are subject to change based on government decisions and economic conditions. It is essential to stay informed about any significant updates or revisions to the income tax rates.

For instance, if the government decides to stimulate economic growth, it might consider lowering income tax rates for certain income brackets. On the other hand, if the government aims to increase revenue, it might consider raising income tax rates or introducing new taxes.

Freelancers and independent contractors often have a tax extension deadline of October 15th. This allows them more time to gather their financial information and file their taxes. For information on the tax extension deadline for freelancers in October 2024, visit Tax extension deadline October 2024 for freelancers.

Taxable Income and Deductions

Taxable income is the portion of your income that is subject to taxation. It is calculated by subtracting deductions from your gross income. Understanding the different types of income and deductions is crucial for accurately determining your tax liability.

Taxable Income, Income tax rates for October 2024

Taxable income encompasses various sources of revenue, including:

- Salaries and wages:This includes your regular paycheck, bonuses, commissions, and other forms of compensation received from your employer.

- Self-employment income:If you operate your own business, your earnings from that business are considered taxable income.

- Investment income:This includes dividends, interest earned on savings accounts, and capital gains from selling investments.

- Rental income:If you own rental properties, the income generated from those properties is taxable.

- Other income:This category includes various sources of income not covered above, such as alimony, unemployment benefits, and lottery winnings.

Deductions

Deductions are expenses that can be subtracted from your gross income to reduce your taxable income and, consequently, your tax liability.

- Standard deduction:This is a fixed amount that can be claimed instead of itemizing your deductions. The standard deduction amount varies based on your filing status.

- Itemized deductions:This allows you to deduct specific expenses, such as:

- Medical expenses:You can deduct medical expenses exceeding a certain percentage of your adjusted gross income.

- State and local taxes:Certain limitations apply to the deductibility of state and local taxes.

- Home mortgage interest:You can deduct interest paid on a qualified home mortgage.

- Charitable contributions:You can deduct donations to qualified charitable organizations.

- Above-the-line deductions:These deductions are subtracted from your gross income before calculating your adjusted gross income. Examples include:

- Student loan interest:You can deduct up to $2,500 in interest paid on student loans.

- Contributions to traditional IRAs:Individuals can deduct contributions to traditional IRAs, subject to certain income limitations.

Impact of Deductions

Deductions play a significant role in reducing your tax liability. By strategically claiming eligible deductions, you can lower your taxable income, leading to lower tax payments. For instance, if you have substantial medical expenses or charitable contributions, itemizing your deductions might be more advantageous than claiming the standard deduction.

Tax Filing and Payment Procedures

Filing your income tax return and paying your taxes are crucial steps in fulfilling your tax obligations. Understanding the procedures involved ensures timely compliance and avoids potential penalties.

Tax credits can help reduce your tax liability, making it easier to manage your finances. These credits can be claimed for various reasons, such as education, child care, or energy efficiency. To learn more about tax credits available for the October 2024 deadline, visit Tax credits for the October 2024 deadline.

Filing Income Tax Returns

The process of filing your income tax return involves gathering your financial information, completing the necessary forms, and submitting them to the relevant tax authority. The steps involved in filing your income tax return in October 2024 are as follows:

- Gather your tax information:This includes your income statements (such as Form W-2 or 1099), receipts for deductions and credits, and any other relevant documentation that supports your income and expenses.

- Choose a filing method:You can file your taxes electronically through tax preparation software or online services, or you can file by mail using paper forms. Electronic filing is generally faster and more convenient, but you can also choose to file by mail if you prefer.

If you’re self-employed, you can contribute to a solo 401(k), which allows you to contribute as both an employee and an employer. To learn about the contribution limits for 2024, check out this article on 401k contribution limits for 2024 for self-employed.

- Complete the necessary tax forms:The specific forms you need to complete will depend on your individual circumstances. You can access the necessary forms from the official website of the Internal Revenue Service (IRS) or from tax preparation software.

- Review and sign your tax return:Carefully review your tax return before signing it to ensure accuracy. Make sure all the information is correct and that you have claimed all the deductions and credits you are entitled to.

- File your tax return by the deadline:The deadline for filing your income tax return is typically April 15th of each year. However, if April 15th falls on a weekend or holiday, the deadline is extended to the next business day. In October 2024, the deadline for filing your income tax return will be October 15th.

Paying Income Taxes

Paying your income taxes on time is crucial to avoid penalties and maintain a good tax standing. The following steps will guide you through the process of paying your income taxes:

- Determine your tax liability:Calculate your tax liability based on your income, deductions, and credits. You can use tax preparation software or online services to assist you with this calculation.

- Choose a payment method:You can pay your taxes online, by mail, or through a tax preparation service. Online payment is generally the most convenient option, while payment by mail involves sending a check or money order to the IRS.

- Make your payment by the deadline:The deadline for paying your income taxes is typically April 15th of each year. However, if you owe taxes, you may be able to make payments in installments. In October 2024, the deadline for paying your income taxes will be October 15th.

Consequences of Late Filing or Non-Payment

Failing to file your income tax return or pay your taxes on time can result in penalties and interest charges. The consequences of late filing or non-payment can be significant and vary depending on the specific circumstances.

Late filing penalties are typically calculated as a percentage of the unpaid tax liability, while late payment penalties are usually a percentage of the unpaid tax amount. Interest may also be charged on the unpaid tax liability and penalties.

Tax Credits and Rebates

Tax credits and rebates are valuable tools that can help individuals and families reduce their tax liability. These incentives are designed to encourage certain behaviors or provide financial assistance to those who qualify. Understanding the different types of tax credits and rebates available can help you maximize your tax savings.

Types of Tax Credits and Rebates

Tax credits and rebates are offered by the government to encourage specific behaviors or to provide financial assistance to certain groups of people. Tax credits are direct reductions in your tax liability, while rebates are payments you receive from the government.

The 401(k) contribution limit for 2024 is a significant factor in retirement planning. It determines how much you can contribute to your 401(k) plan each year. For detailed information on the 401(k) contribution limit for 2024, visit What is the 401k contribution limit for 2024.

Here are some common types of tax credits and rebates:

- Earned Income Tax Credit (EITC):This is a refundable tax credit for low-to-moderate-income working individuals and families. The amount of the credit depends on your income, filing status, and number of qualifying children. For example, a single filer with two qualifying children and an adjusted gross income of $20,000 in 2024 could be eligible for a tax credit of up to $7,430.

- Child Tax Credit:This credit is available to taxpayers who have qualifying children under the age of 17. The credit amount is $2,000 per child, and it is partially refundable. This means that you can receive a portion of the credit even if you owe no taxes.

Similar to self-employed individuals, small business owners can also contribute to a 401(k) plan. These plans often have higher contribution limits, allowing you to save more for retirement. Find out more about the contribution limits for small business owners in 2024 by reading 401k contribution limits for 2024 for small business owners.

For example, a family with two qualifying children could receive a tax credit of up to $4,000.

- American Opportunity Tax Credit (AOTC):This credit is available for the first four years of post-secondary education. The credit is worth up to $2,500 per student and is phased out for higher income taxpayers. For example, a student attending a four-year college could receive a tax credit of up to $10,000 over four years.

There might be situations where you can contribute more than the standard 401(k) limit. This could include catch-up contributions or special circumstances. To find out if you can contribute more to your 401(k) in 2024, read Can I contribute more to my 401k in 2024.

- Premium Tax Credit:This credit helps individuals and families afford health insurance through the Affordable Care Act marketplace. The credit amount depends on your income and the cost of your health insurance plan. For example, a family with an income of $60,000 in 2024 could receive a tax credit of up to $5,000 to help cover the cost of their health insurance premiums.

Self-employed individuals have access to traditional and Roth IRAs, which can help them save for retirement. The contribution limits for these accounts may differ from those for traditional employees. For information on IRA contribution limits for self-employed individuals in 2024, visit Ira contribution limits for self-employed in 2024.

- Residential Renewable Energy Tax Credit:This credit is available for homeowners who install solar panels, wind turbines, or other renewable energy systems on their homes. The credit amount is 30% of the cost of the system, up to a maximum of $6,000. For example, a homeowner who installs $20,000 worth of solar panels could receive a tax credit of $6,000.

Eligibility Criteria for Tax Credits and Rebates

The eligibility criteria for tax credits and rebates vary depending on the specific program. In general, most tax credits and rebates are based on factors such as income, filing status, and the number of qualifying dependents. For example, the Earned Income Tax Credit has income limits that vary based on filing status and the number of qualifying children.

The October 2024 tax deadline is approaching, and it’s important to file your taxes on time to avoid penalties. Whether you’re filing electronically or by mail, there are steps you can take to ensure your taxes are filed correctly.

For helpful tips on how to file taxes by the October 2024 deadline, read How to file taxes by the October 2024 deadline.

The Child Tax Credit is also subject to income limits, but it is generally available to a broader range of taxpayers than the EITC.

Impact of Tax Credits and Rebates on Income

Tax credits and rebates can have a significant impact on individual and household income. Tax credits directly reduce your tax liability, effectively increasing your disposable income. For example, if you receive a $2,000 tax credit, your tax bill is reduced by $2,000, and you have $2,000 more in your pocket.

Rebates are payments you receive from the government, which also increase your disposable income. For example, if you receive a $1,000 rebate, you have $1,000 more to spend.

If you’re under 50, you can contribute a certain amount to your 401(k) plan each year. This contribution limit can help you build a strong retirement nest egg. For information on the 401(k) contribution limit for 2024 for people under 50, check out 401k contribution limit 2024 for people under 50.

Examples of Tax Credits and Rebates in Action

Here are some examples of how tax credits and rebates can benefit individuals and families:

- A single parent with an income of $25,000 and two qualifying children could receive an Earned Income Tax Credit of up to $6,935. This credit could help the parent afford basic necessities such as food, housing, and healthcare.

- A family with an income of $80,000 and two children could receive a Child Tax Credit of $4,000. This credit could help the family pay for childcare expenses or save for their children’s future education.

- A student attending college could receive an American Opportunity Tax Credit of up to $2,500 per year. This credit could help the student pay for tuition, books, and other educational expenses.

Key Takeaways

Tax credits and rebates can be valuable tools for reducing your tax liability and increasing your disposable income. It is important to understand the eligibility criteria for different tax credits and rebates and to claim all the credits you are entitled to.

By taking advantage of these incentives, you can maximize your tax savings and improve your financial well-being.

State and Local Income Taxes: Income Tax Rates For October 2024

In addition to federal income tax, many states and local jurisdictions also impose their own income taxes. These taxes can significantly impact your overall tax liability, and understanding their nuances is crucial for accurate tax planning.

Businesses generally have a longer tax deadline than individuals, typically falling on October 15th. This deadline can vary based on the type of business and its filing status. To get a better understanding of the October 2024 tax deadline for businesses, check out October 2024 tax deadline for businesses.

State Income Tax Rates and Regulations

State income tax rates and regulations vary significantly across the United States. Some states, like Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming, have no state income tax. Other states, like California, Hawaii, and Oregon, have progressive income tax systems, with higher earners paying a larger percentage of their income in taxes.Here’s a glimpse into the potential differences in state and local income tax policies:

- Tax Rates:States have different tax brackets and rates, with some states having flat tax rates and others having progressive rates. For example, in 2024, California has a top marginal income tax rate of 13.3%, while Colorado’s top marginal income tax rate is 4.55%.

- Deductions and Credits:States offer various deductions and credits to reduce taxable income, such as deductions for charitable contributions, mortgage interest, and property taxes. These deductions and credits can vary significantly from state to state.

- Exemptions:Some states offer exemptions for certain types of income, such as retirement income or military pensions.

- Tax Filing Requirements:Each state has its own filing requirements, including deadlines and specific forms to be used.

Impact on Overall Tax Liability

State and local income taxes can significantly impact your overall tax liability. For example, a high-income earner living in a state with a high income tax rate and a high cost of living might face a much higher overall tax burden than someone living in a state with no income tax and a lower cost of living.

Example:A resident of California earning $200,000 annually could face a state income tax liability of around $26,600, while a resident of Texas earning the same amount would pay no state income tax.

Local Income Taxes

In addition to state income taxes, some cities and counties also impose their own income taxes. These local taxes can further increase your overall tax burden. For example, cities like New York City and Philadelphia have local income taxes that can add a significant percentage to your overall tax liability.

Impact on Different Income Levels

The income tax rates in October 2024 will have a significant impact on individuals and households at different income levels. Understanding how these rates affect different income brackets is crucial for financial planning and decision-making.

Tax Burden on Various Income Brackets

The following table illustrates the estimated tax burden for various income brackets in October 2024, assuming a standard deduction and no other deductions or credits:

| Income Bracket | Tax Rate | Taxable Income | Tax Liability |

|---|---|---|---|

$0

|

10% | $10,000 | $1,000 |

$10,001

|

15% | $30,000 | $4,500 |

| $40,001

Estates may need to file a W9 form to provide their tax identification number to businesses or organizations they work with. If you’re an estate that needs to file a W9 form in October 2024, visit W9 Form October 2024 for estates.

|

20% | $40,000 | $8,000 |

| $80,001

Travel rewards credit cards can help you earn points or miles that you can redeem for flights, hotels, or other travel expenses. If you’re looking for the best travel rewards credit cards available in October 2024, check out Best credit cards for travel rewards in October 2024.

|

25% | $80,000 | $20,000 |

| $160,001+ | 30% | $100,000 | $30,000 |

This table shows that individuals in higher income brackets will pay a larger proportion of their income in taxes. For example, an individual earning $10,000 will pay $1,000 in taxes, representing 10% of their income, while an individual earning $160,001 or more will pay $30,000 in taxes, representing 18.75% of their income.

Impact on Household Budgets and Financial Planning

The income tax rates can significantly impact household budgets and financial planning. Individuals in lower income brackets may find it difficult to save for retirement or other financial goals due to the higher proportion of their income going towards taxes.

Understanding IRA contribution limits is essential for planning your retirement savings. These limits can change over time, so it’s crucial to stay informed. To learn about IRA contribution limits for 2024 and beyond, visit Ira contribution limits for 2024 and beyond.

Conversely, individuals in higher income brackets may have more disposable income but may also face a higher tax burden.Understanding the impact of income tax rates on different income levels is essential for individuals and households to make informed financial decisions.

When filing taxes as “married filing separately,” you’ll have a different standard deduction than if you were filing jointly. This can affect your tax liability, so it’s important to understand the standard deduction amount. Learn more about the standard deduction for married filing separately in 2024 by checking out Standard deduction for married filing separately in 2024.

This includes budgeting, saving, investing, and planning for retirement. For example, individuals in lower income brackets may need to prioritize budgeting and saving to ensure they have enough money for essential expenses and to build a financial safety net. Individuals in higher income brackets may need to consider tax-advantaged investment strategies to minimize their tax liability and maximize their after-tax returns.

Historical Trends in Income Tax Rates

Understanding the historical trends in income tax rates is crucial for comprehending the evolution of tax policy and its impact on individuals and the economy. By examining the changes in tax rates over time, we can gain insights into the motivations behind these adjustments and their potential consequences.

Changes in Income Tax Rates Over Time

Income tax rates have fluctuated significantly throughout history, reflecting various economic and political factors. For instance, during times of war or economic crisis, governments often raise tax rates to finance increased spending or stimulate economic activity. Conversely, during periods of economic prosperity, tax rates may be lowered to encourage investment and consumer spending.

- The Early Years:In the early 20th century, income tax rates were relatively low, with the top marginal rate reaching around 7% in the United States. However, the introduction of the federal income tax in 1913 marked a turning point, with rates gradually increasing during World War I and the Great Depression.

- The Post-War Era:Following World War II, income tax rates surged to fund reconstruction and social programs. The top marginal rate in the United States reached 91% in 1952. These high rates were intended to reduce income inequality and promote social welfare. However, they also discouraged economic growth and led to widespread tax avoidance.

- The Reagan Era:The 1980s saw a significant shift in tax policy under President Ronald Reagan, who advocated for lower tax rates to stimulate economic growth. The Economic Recovery Tax Act of 1981 reduced the top marginal rate from 70% to 50%, and subsequent legislation further lowered rates.

This era witnessed a surge in economic growth, although some critics argued that the tax cuts disproportionately benefited the wealthy.

- The Clinton Era:President Bill Clinton raised the top marginal rate to 39.6% in 1993, arguing that it was necessary to reduce the federal budget deficit. However, the economy continued to grow during this period, suggesting that the tax increase did not significantly hinder economic activity.

- The Bush Era:President George W. Bush enacted significant tax cuts in 2001 and 2003, lowering income tax rates for all brackets and eliminating the estate tax. These cuts were intended to stimulate economic growth following the 9/11 attacks and the dot-com bubble burst.

The economy did experience a period of growth, but the tax cuts also contributed to a widening budget deficit.

- The Obama Era:President Barack Obama signed the American Recovery and Reinvestment Act of 2009, which included tax cuts and spending measures to stimulate the economy during the Great Recession. The Affordable Care Act of 2010 also introduced new taxes on high-income earners and health insurance companies.

- The Trump Era:President Donald Trump signed the Tax Cuts and Jobs Act of 2017, which reduced income tax rates for all brackets, lowered the corporate tax rate, and expanded the standard deduction. The law was intended to stimulate economic growth, but its long-term effects are still being debated.

Ultimate Conclusion

Navigating the complexities of income tax rates can be daunting, but with the right information and guidance, it can be a manageable process. By understanding the intricacies of the tax system, you can optimize your financial strategies, minimize your tax liability, and ensure compliance with the relevant regulations.

This guide serves as a comprehensive resource, providing the knowledge you need to navigate the tax landscape with confidence.

Questions Often Asked

What are the key changes in income tax rates for October 2024?

This guide will provide the latest updates on any changes in income tax rates for October 2024. Please refer to the relevant sections for specific details.

How do I calculate my income tax liability?

The calculation of income tax liability involves subtracting deductions from your taxable income and applying the corresponding tax rates to each bracket. This guide will provide a detailed breakdown of the calculation process.

What are the penalties for late filing or non-payment of income taxes?

Late filing or non-payment of income taxes can result in penalties, including interest charges and fines. The specific penalties vary depending on the circumstances and the severity of the violation. This guide will provide information on the potential consequences.

Where can I find additional resources on income tax rates?

The Internal Revenue Service (IRS) website is a valuable resource for information on income tax rates, regulations, and filing procedures. You can also consult with a qualified tax professional for personalized advice and guidance.