The Impact of Dependents on Stimulus Check Payment Amounts in Illinois takes center stage, offering a compelling look at how the presence of children and other dependents influences the financial support provided by the government. This exploration delves into the specific eligibility criteria for stimulus checks, the payment amounts associated with different numbers of dependents, and the potential impact these payments have on Illinois families.

Understanding how dependents factor into stimulus check eligibility and payment amounts is crucial for many Illinois residents. The information presented here provides a clear picture of the financial benefits available to families with dependents and sheds light on the potential economic impact of these payments on household budgets and overall well-being.

Stimulus Check Eligibility in Illinois

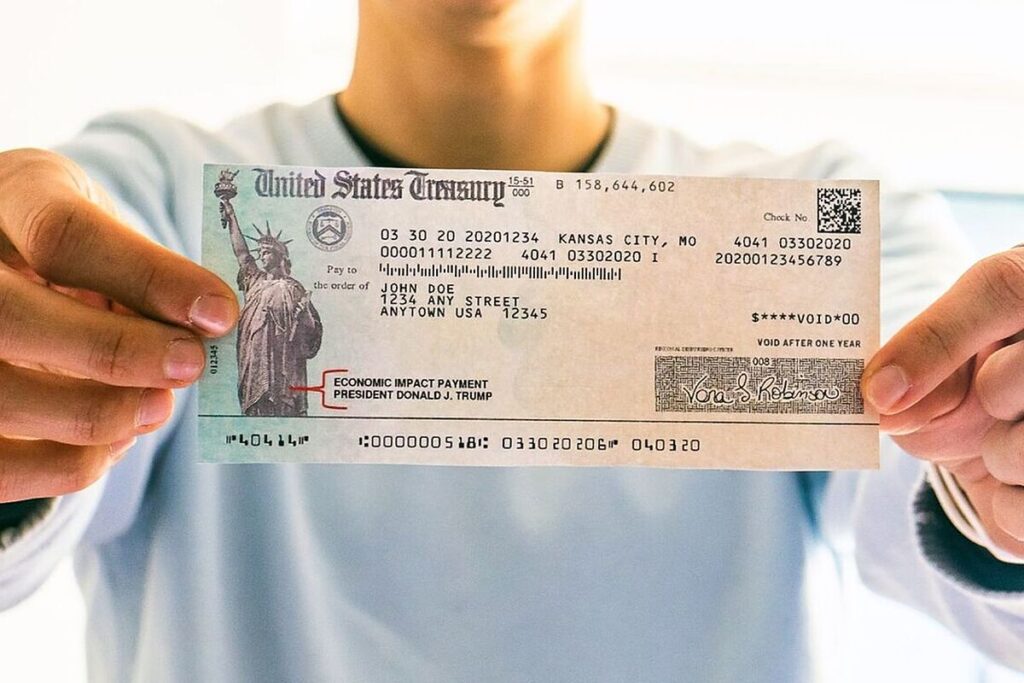

The Economic Impact Payments, commonly known as stimulus checks, were a crucial part of the federal government’s response to the COVID-19 pandemic. In Illinois, as in other states, these payments were designed to provide financial relief to individuals and families impacted by the economic downturn.

To be eligible for stimulus checks in Illinois, residents had to meet specific criteria, including requirements related to dependents.

Understand how the union of Stimulus Checks Payment Amounts in Illinois can improve efficiency and productivity.

General Eligibility Criteria

To qualify for a stimulus check in Illinois, individuals needed to meet the following general criteria:

- Be a U.S. citizen or a lawful permanent resident.

- Have a valid Social Security number.

- Not be claimed as a dependent on someone else’s tax return.

- Have a gross adjusted gross income (AGI) below certain thresholds.

Dependent Eligibility

The presence of dependents significantly impacted stimulus check eligibility and payment amounts. Here are the specific requirements related to dependents:

- Age:Dependents must have been under 17 years old at the end of the tax year.

- Relationship:Dependents must have been qualifying children or qualifying relatives, as defined by the Internal Revenue Service (IRS).

- Residency:Dependents must have lived with the taxpayer for more than half the year.

Exceptions and Special Cases, Impact of Dependents on Stimulus Check Payment Amounts in Illinois

While the general eligibility criteria applied to most individuals and families, there were some exceptions and special cases regarding dependents:

- Students:Full-time students over the age of 17 were generally not eligible to be claimed as dependents.

- Disabled Individuals:Individuals with disabilities, regardless of age, could be claimed as dependents if they met certain criteria.

- Foster Children:Foster children could be claimed as dependents if they lived with the taxpayer for more than half the year.

Stimulus Check Payment Amounts Based on Dependents

The amount of the stimulus check received was directly tied to the number of dependents claimed on the taxpayer’s tax return. The payments were structured to provide additional financial support for families with children.

Payment Amounts for Different Dependent Categories

Here is a breakdown of stimulus check payment amounts based on the number of dependents:

| Number of Dependents | Payment Amount |

|---|---|

| 0 | $1,200 |

| 1 | $1,900 |

| 2 | $2,600 |

| 3 or more | $3,300 |

It’s important to note that these amounts were for the first round of stimulus checks. Subsequent rounds of payments may have had different amounts.

Obtain a comprehensive document about the application of Required Documents for Florida Stimulus Check Application that is effective.

Comparison with Other States

The payment amounts for stimulus checks in Illinois were consistent with those in other states. The federal government established the general eligibility criteria and payment amounts, ensuring uniformity across the nation.

Impact of Dependents on Stimulus Check Payment Timing

The presence of dependents could potentially affect the processing time for stimulus checks. While there was no direct correlation between dependents and delays, certain factors related to dependents could contribute to processing complexities.

Potential Delays and Complications

Here are some potential reasons why stimulus checks for families with dependents might experience delays:

- Verification Processes:The IRS may need to verify the eligibility of dependents, particularly in cases involving complex family structures or unusual circumstances.

- Changes in Family Circumstances:If there were significant changes in family circumstances, such as a recent adoption or the birth of a child, it could lead to delays in processing.

Early Payments for Families with Dependents

In some cases, families with dependents might receive their stimulus checks earlier than individuals without dependents. This could be due to factors such as the IRS prioritizing payments to families with children or because the dependents were already listed on the taxpayer’s tax return.

Impact of Stimulus Checks on Illinois Families

The stimulus checks had a significant impact on Illinois families, particularly those with dependents. These payments provided much-needed financial relief during a time of economic hardship.

Economic Benefits for Families with Dependents

Stimulus checks provided families with dependents with a variety of economic benefits, including:

- Coverage of Essential Expenses:The payments helped families cover essential expenses such as food, housing, utilities, and healthcare.

- Reduced Financial Stress:Stimulus checks alleviated financial stress, allowing families to focus on their well-being and the needs of their children.

- Increased Spending Power:The additional funds provided families with increased spending power, which could boost local economies.

Potential Impact on Child Poverty Rates

Stimulus checks had the potential to reduce child poverty rates in Illinois. By providing direct financial assistance to families, the payments helped alleviate economic hardship and ensure that children had access to basic necessities.

Remember to click Getting Help with Your Stimulus Check Application in Your Florida Community to understand more comprehensive aspects of the Getting Help with Your Stimulus Check Application in Your Florida Community topic.

Policy Considerations for Stimulus Check Payments and Dependents: Impact Of Dependents On Stimulus Check Payment Amounts In Illinois

The stimulus check program highlighted the importance of considering the needs of families with dependents in policy design. There are several policy recommendations that could improve the system for future economic relief efforts.

Improving Eligibility Criteria and Payment Amounts

Here are some potential changes to eligibility criteria and payment amounts that could better support families with dependents:

- Increase Payment Amounts for Dependents:Consider increasing the payment amounts for each dependent to provide greater financial support to families with children.

- Simplify Eligibility Requirements:Streamline the eligibility criteria for dependents to make it easier for families to access relief.

- Expand Eligibility to Include Older Dependents:Consider expanding eligibility to include older dependents, such as those with disabilities or those who are financially dependent on the taxpayer.

Long-Term Implications of Stimulus Check Payments

The long-term implications of stimulus check payments on dependents remain to be seen. However, it is clear that these payments have a significant impact on the financial well-being of families. Future policies should continue to address the needs of families with dependents, ensuring that they have the resources they need to thrive.

Epilogue

Navigating the complex landscape of stimulus checks and dependent eligibility can be challenging, but understanding the key factors involved is essential for families seeking financial assistance. By providing a comprehensive overview of the rules and regulations surrounding stimulus checks in Illinois, this guide empowers residents to make informed decisions and access the financial support they deserve.

Find out further about the benefits of Tips for a Smooth Stimulus Check Application Process in Florida that can provide significant benefits.

FAQ Resource

What if I have dependents who don’t live with me?

Further details about Troubleshooting Common Stimulus Check Application Issues in Florida is accessible to provide you additional insights.

Generally, dependents must live with you to be considered for stimulus check payments. However, specific exceptions may apply in certain circumstances, such as if you have custody of a child who lives with a different parent.

How do I know if I’m eligible for a stimulus check?

Understand how the union of How to Apply for a Stimulus Check in Florida can improve efficiency and productivity.

You can check your eligibility for stimulus checks through the IRS website or by contacting the Illinois Department of Revenue. They will be able to provide you with the necessary information and guidance.

Are there any deadlines for claiming stimulus check payments?

Yes, there are often deadlines for claiming stimulus checks. It’s essential to stay informed about these deadlines to ensure you don’t miss out on any eligible payments.

What if I didn’t receive a stimulus check even though I was eligible?

If you believe you were eligible for a stimulus check but didn’t receive one, you can file an amended tax return with the IRS to claim the payment. There may be specific procedures for doing so, so it’s advisable to consult with a tax professional for assistance.