Immediate Term Annuity – Immediate Term Annuities provide a structured way to convert a lump sum into a guaranteed stream of income for a specific duration. This financial product can be particularly appealing to retirees or individuals seeking a reliable income source for a defined period, offering peace of mind and financial security.

An annuity is a financial product that provides a stream of income for a set period of time. An Annuity Is A Series Of 2024 equal periodic payments, and they can be a valuable tool for retirement planning.

An immediate term annuity works by allowing you to exchange a lump sum for regular payments, often monthly, over a predetermined term. The annuity provider guarantees these payments, regardless of market fluctuations or your own longevity. This structure provides a level of certainty and predictability that can be particularly attractive in retirement planning or for managing specific financial goals.

An annuity is a financial product that provides a stream of income for a set period of time. Annuity How It Works 2024 is by converting a lump sum of money into a series of regular payments.

Immediate Term Annuities: A Comprehensive Guide

Immediate term annuities, also known as fixed immediate annuities, are financial products that provide a stream of guaranteed income payments for a specified period. These annuities are often used by individuals seeking a secure and predictable income stream during retirement or other life stages.

An annuity is a financial product that provides a stream of income for a set period of time. An Annuity Is A Series Of Equal Periodic Payments 2024 , and they can be a valuable tool for retirement planning.

What are Immediate Term Annuities?, Immediate Term Annuity

An immediate term annuity is a type of annuity contract where you make a lump-sum payment to an insurance company in exchange for regular, fixed payments that begin immediately. The payments can continue for a set period, such as a specific number of years, or for the rest of your life.

Variable annuities are subject to market fluctuations, so it’s important to understand the Variable Annuity Minimum Return 2024. This minimum return is the guaranteed rate of return that you will receive on your annuity, regardless of how the market performs.

Examples of When an Immediate Term Annuity Might Be Suitable

- Retirement Income:Immediate term annuities can provide a reliable source of income during retirement, supplementing other retirement savings or replacing a traditional pension.

- Bridge Financing:They can serve as a temporary source of income during a transition period, such as between jobs or while waiting for other investments to mature.

- Estate Planning:Immediate term annuities can be used to create a guaranteed income stream for beneficiaries after your death.

- Long-Term Care Planning:Immediate term annuities can provide a steady income stream to cover the costs of long-term care.

Key Features of Immediate Term Annuities

- Guaranteed Payments:Immediate term annuities offer guaranteed payments for the specified term, regardless of market fluctuations.

- Fixed Payment Amounts:The payment amount is fixed and does not change throughout the annuity term, providing predictable income.

- Choice of Payment Options:You can choose from various payment options, such as monthly, quarterly, or annually.

- Death Benefit:Some immediate term annuities include a death benefit, which pays out a lump sum to your beneficiaries if you die before the annuity term ends.

How Immediate Term Annuities Work

Purchasing an immediate term annuity involves the following steps:

- Choose an Annuity Provider:Select a reputable insurance company that offers immediate term annuities.

- Determine the Annuity Amount:Decide on the lump-sum amount you want to invest in the annuity.

- Select Payment Options:Choose the frequency and duration of the annuity payments.

- Finalize the Contract:Review and sign the annuity contract, which Artikels the terms and conditions of the agreement.

- Receive Annuity Payments:Once the contract is finalized, you will start receiving regular income payments.

Payment Structure of Immediate Term Annuities

Immediate term annuities typically have a guaranteed period, which is the minimum number of years you will receive payments. You can also choose a payout option, which determines how long the payments will continue. Common payout options include:

- Fixed Period:Payments continue for a specific number of years, regardless of your lifespan.

- Life Annuity:Payments continue for as long as you live.

- Joint Life Annuity:Payments continue for as long as you or your spouse live.

- Period Certain Annuity:Payments continue for a minimum period, and then for the rest of your life.

Factors Influencing Annuity Payouts

- Interest Rates:Higher interest rates generally result in higher annuity payouts.

- Annuity Amount:The larger the lump-sum amount you invest, the higher your annuity payments will be.

- Payout Option:The payout option you choose will impact the payment amount and duration.

- Age and Health:Your age and health can influence the annuity payout, as these factors affect your life expectancy.

Advantages of Immediate Term Annuities

Immediate term annuities offer several advantages, including:

- Guaranteed Income:They provide a secure and predictable income stream, regardless of market conditions.

- Financial Security:Annuities can help reduce the risk of outliving your savings, providing peace of mind during retirement.

- Protection from Inflation:Some annuities offer inflation protection, which adjusts payments to keep pace with rising costs.

- Tax Advantages:Annuity payments are typically taxed as ordinary income, but there may be tax advantages depending on your circumstances.

Disadvantages of Immediate Term Annuities

While immediate term annuities offer advantages, they also have some drawbacks:

- Limited Liquidity:The lump-sum investment is not readily accessible, and withdrawals before the annuity term ends may be subject to penalties.

- Risk of Outliving the Annuity Term:If you choose a fixed-term annuity and live longer than the term, you will stop receiving payments.

- Impact of Inflation:Fixed payments may not keep pace with inflation, reducing the purchasing power of your income over time.

- Potential for Low Returns:Annuities may not offer the same growth potential as other investments, such as stocks or mutual funds.

Factors to Consider When Choosing an Immediate Term Annuity

When selecting an immediate term annuity, it is crucial to consider several factors, including:

- Annuity Provider:Choose a reputable and financially sound insurance company with a strong track record.

- Annuity Terms:Compare the terms and conditions of different annuities, including the payout options, interest rates, and death benefits.

- Fees and Expenses:Review the fees associated with the annuity, such as administrative fees, surrender charges, and mortality and expense charges.

- Your Financial Goals:Consider your financial goals, risk tolerance, and time horizon when making your decision.

Immediate Term Annuities vs. Other Income Products

Immediate term annuities can be compared to other income products, such as:

- Traditional Pensions:Pensions provide guaranteed income payments for life, but they are becoming less common. Annuities can offer a similar income stream.

- Fixed-Income Investments:Bonds and CDs offer predictable income, but their returns are not guaranteed. Annuities offer guaranteed payments.

- Reverse Mortgages:Reverse mortgages allow homeowners to access equity in their homes, but they come with risks and costs. Annuities offer a more predictable income stream.

Tax Implications of Immediate Term Annuities

The income from an immediate term annuity is typically taxed as ordinary income. The tax treatment can vary depending on the type of annuity and your individual circumstances. It is essential to consult with a tax advisor to understand the tax implications of annuity payments.

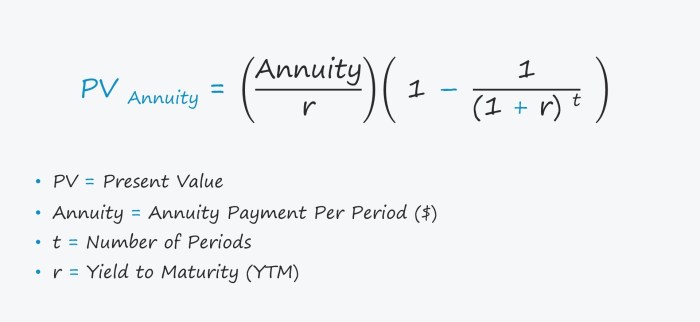

An annuity is a financial product that provides a stream of income for a set period of time. The How To Calculate Annuity Formula 2024 is a complex mathematical equation, but it can be helpful to understand the basics.

Case Studies and Examples

| Case Study | Annuity Amount | Payout Period | Potential Benefits |

|---|---|---|---|

| John, a 65-year-old retiree, invests $100,000 in an immediate term annuity to provide a guaranteed income stream during retirement. He chooses a life annuity with monthly payments. | $100,000 | Life annuity | John receives a predictable monthly income for the rest of his life, reducing the risk of outliving his savings. |

| Mary, a 70-year-old widow, purchases a $50,000 immediate term annuity with a 10-year fixed period. She wants to ensure a reliable income stream for the next decade. | $50,000 | 10 years | Mary receives guaranteed monthly payments for 10 years, providing financial security during a specific period. |

Final Conclusion: Immediate Term Annuity

Immediate Term Annuities offer a unique blend of financial security and income predictability. While they may not be suitable for everyone, they can be a valuable tool for individuals seeking guaranteed income streams for a defined period. By carefully considering your financial goals, risk tolerance, and the specific features of the annuity, you can determine if this product aligns with your overall financial strategy.

The Annuity Calculator Sbi 2024 is a useful tool for planning your retirement income. It can help you estimate how much money you can withdraw from your annuity each year and still have enough money to last throughout your retirement.

User Queries

What is the difference between an immediate term annuity and a traditional annuity?

An immediate annuity is a type of annuity that begins paying out immediately. Immediate Annuity Required Minimum Distribution is based on your age and the amount of money you’ve invested in the annuity.

A traditional annuity typically provides payments for life, while an immediate term annuity offers payments for a fixed period. The duration of the term can be chosen by the buyer.

Annuity withdrawal calculators are a useful tool for planning your retirement income. By using a Annuity Withdrawal Calculator 2024 , you can estimate how much money you can withdraw from your annuity each year and still have enough money to last throughout your retirement.

How does inflation impact the value of an immediate term annuity?

If you’re a federal employee, you may be eligible for a Thrift Savings Plan (TSP) annuity. The Calculating Tsp Annuity 2024 can be complex, but it’s important to understand how it works so that you can make informed decisions about your retirement savings.

Inflation can erode the purchasing power of annuity payments over time. However, some annuities offer inflation protection features, which adjust payments to account for rising prices.

What are the tax implications of receiving payments from an immediate term annuity?

The Variable Annuity Distribution Taxation 2024 can be complicated, so it’s important to consult with a tax advisor to ensure that you’re maximizing your tax benefits. You may be able to withdraw your contributions tax-free, but the earnings will be taxed as ordinary income.

Annuity payments are generally taxed as ordinary income. The specific tax treatment may vary depending on the type of annuity and the individual’s tax situation.

Variable annuities are a popular retirement savings option, but they can be complex. If you’re considering investing in a variable annuity, it’s important to understand the Variable Annuity Blocks 2024. These blocks are the minimum amount of money that you can withdraw from your annuity each year without incurring a penalty.

How can I find a reputable immediate term annuity provider?

It’s crucial to research and compare providers based on their financial strength, reputation, and annuity terms. Consider seeking advice from a financial advisor to help you make an informed decision.

A group immediate annuity is a type of annuity that is purchased by a group of people, such as a company or an organization. Group Immediate Annuity Is Also Known As a “group immediate annuity contract” or a “group immediate annuity policy.”

Annuity contracts can be complex, but they can also be a valuable tool for retirement planning. 4 Annuity 2024 are common types of annuities: fixed annuities, variable annuities, immediate annuities, and deferred annuities.

Calculating your retirement annuity payments can be a complex process, but it’s an important step in planning for your retirement. Calculating Retirement Annuity Payments 2024 will depend on several factors, including your age, your savings, and your chosen annuity contract.

Understanding the future value of an annuity can be important for financial planning. Problem 6-24 Calculating Annuity Future Values 2024 involves using a formula to calculate the future value of a series of equal payments over a specified period of time.