The Immediate Needs Annuity Calculator is a powerful tool that can help you plan for your retirement by providing a guaranteed stream of income. This calculator allows you to explore various annuity options, understand their features, and estimate your potential payouts based on your specific needs and circumstances.

Choosing between an annuity and a pension can be a tough decision. This resource provides a clear comparison of both options, outlining the pros and cons of each to help you make the right choice for your retirement planning.

An immediate needs annuity is a type of annuity that provides you with regular payments immediately after you purchase it. These annuities are designed to provide a steady source of income for retirement, and they can be particularly helpful for individuals who are concerned about outliving their savings.

Annuity is a life insurance product that provides a steady stream of income. This article explains the ins and outs of annuities and how they can benefit your retirement planning.

What is an Immediate Needs Annuity?

An immediate needs annuity is a type of annuity that provides a stream of income payments starting immediately after you purchase it. Unlike other annuities, which may have a delay period before payments begin, immediate needs annuities offer immediate financial support, making them particularly attractive for those seeking quick access to guaranteed income.

Purpose of an Immediate Needs Annuity

The primary purpose of an immediate needs annuity is to provide a steady source of income for retirement or other financial needs. It can be a valuable tool for individuals who require a predictable cash flow and want to eliminate the risk of outliving their savings.

Curious about Class B variable annuities in 2024? This article delves into the characteristics and potential benefits of this type of annuity, helping you understand its nuances and how it might fit into your financial plan.

Key Features of an Immediate Needs Annuity

Immediate needs annuities are characterized by several key features that differentiate them from other types of annuities:

- Immediate Payments:The most prominent feature is the immediate commencement of payments. You start receiving income as soon as you purchase the annuity.

- Guaranteed Income:Immediate needs annuities provide a guaranteed stream of income for a specified period or for life. This ensures a predictable cash flow regardless of market fluctuations.

- Lump Sum Payment:You typically make a lump sum payment to purchase an immediate needs annuity. This payment is then used to fund the annuity’s payouts.

Examples of Suitable Situations

Immediate needs annuities can be suitable solutions in various situations, including:

- Retirement Planning:For individuals seeking a reliable source of income during retirement, an immediate needs annuity can provide financial security.

- Bridge Financing:When facing a temporary financial shortfall, an immediate needs annuity can provide a bridge loan until other income sources become available.

- Estate Planning:An immediate needs annuity can be incorporated into estate planning strategies to provide income for beneficiaries.

How Immediate Needs Annuities Work

Purchasing an immediate needs annuity involves a straightforward process:

- Determine Your Needs:Assess your income requirements and desired payment duration.

- Contact an Annuity Provider:Shop around and compare annuity products from different providers.

- Provide Information:You’ll need to provide personal information, including age, gender, and health status.

- Choose Payment Options:Select your preferred payment frequency (e.g., monthly, quarterly, annually) and whether you want a lump sum or a combination of payments.

- Make the Purchase:Once you’ve finalized the terms, you’ll make a lump sum payment to purchase the annuity.

Factors Determining Payout Amount

The payout amount from an immediate needs annuity is determined by several factors:

- Age and Gender:Younger individuals generally receive higher payouts than older individuals due to their longer life expectancy. Women typically receive slightly lower payouts than men, reflecting their longer life expectancy.

- Interest Rates:Higher interest rates generally result in larger payouts. Annuity providers base their payout calculations on prevailing interest rates.

- Payment Frequency:The frequency of payments (monthly, quarterly, annually) can affect the payout amount. More frequent payments typically result in slightly smaller individual payments.

- Annuity Type:Different types of immediate needs annuities, such as fixed or variable annuities, may offer varying payout structures.

Payment Options

Immediate needs annuities offer flexibility in payment options:

- Lump Sum:You can choose to receive a single lump sum payment, which can be advantageous for specific financial needs.

- Monthly Payments:Regular monthly payments provide a consistent stream of income, ideal for ongoing expenses.

- Combination:You can opt for a combination of lump sum and monthly payments, allowing you to access a portion of your funds upfront while receiving ongoing income.

Benefits of Immediate Needs Annuities

Immediate needs annuities offer several advantages for retirement planning:

Guaranteed Income for Life

One of the most significant benefits of immediate needs annuities is the guarantee of income for life. This eliminates the uncertainty of outliving your savings and ensures a steady stream of income throughout your retirement years.

Is Annuity Gator a legitimate company? Find out about the reputation and legitimacy of this provider to ensure you’re making a safe and informed investment decision.

Protection Against Inflation and Market Volatility

Immediate needs annuities provide a hedge against inflation and market volatility. The guaranteed income payments are not affected by market fluctuations, ensuring a consistent income stream regardless of economic conditions.

The question of whether an annuity is a loan in 2024 can be confusing. This article clarifies the difference between an annuity and a loan, helping you understand the nature of this financial product.

Tax Advantages

The tax treatment of immediate needs annuities can be advantageous. The interest earned on an immediate needs annuity is generally taxed as ordinary income, but the principal amount is not taxed until it is withdrawn.

Should you choose an annuity or a lump sum in 2024? This guide helps you weigh the pros and cons of both options, enabling you to make the best decision for your specific financial situation.

Risks and Considerations

While immediate needs annuities offer benefits, it’s crucial to consider potential downsides:

Lack of Flexibility, Immediate Needs Annuity Calculator

Immediate needs annuities typically lack flexibility compared to other investments. Once you purchase an annuity, you cannot easily access your funds without penalties.

Potential for Lower Returns

The returns from immediate needs annuities may be lower than other investments, such as stocks or mutual funds. This is because the guaranteed income payments are based on a fixed interest rate.

Thinking about withdrawing from your variable annuity before age 59 1/2 in 2024? This article explains the potential tax penalties and other considerations involved in early withdrawals.

Important Considerations

Before purchasing an immediate needs annuity, it’s essential to:

- Assess Your Financial Goals:Determine if an immediate needs annuity aligns with your retirement planning objectives.

- Consider Your Risk Tolerance:Evaluate your comfort level with the lack of flexibility and potential for lower returns.

- Explore Alternatives:Compare immediate needs annuities with other retirement planning strategies, such as traditional IRAs, 401(k)s, or Roth IRAs.

Using an Immediate Needs Annuity Calculator

An immediate needs annuity calculator is a helpful tool for estimating payouts and understanding the potential income you could receive from an annuity.

Purpose of an Annuity Calculator

The calculator allows you to input your personal information, such as age, gender, and the amount you wish to invest, to estimate the monthly or annual payments you could receive.

Want to know if variable annuities are taxable in 2024? This article provides insights into the tax implications of variable annuities, helping you understand how they impact your overall financial picture.

Step-by-Step Guide

To use an immediate needs annuity calculator, follow these steps:

- Enter Your Information:Provide your age, gender, and the amount you plan to invest in the annuity.

- Select Payment Options:Choose your preferred payment frequency (monthly, quarterly, annually) and whether you want a lump sum or a combination of payments.

- Review the Results:The calculator will provide an estimate of the monthly or annual payments you could receive based on your input.

Limitations of Calculators

It’s important to note that annuity calculators provide estimates only. The actual payouts you receive may vary based on factors such as interest rates, annuity provider, and other terms of the contract.

Are variable annuities suitable for young investors in 2024? This article explores the pros and cons of variable annuities for younger investors, helping them make informed decisions about their financial future.

Consulting a Financial Advisor

While annuity calculators can be useful, it’s always advisable to consult with a financial advisor before making any investment decisions. An advisor can provide personalized guidance based on your specific financial situation and goals.

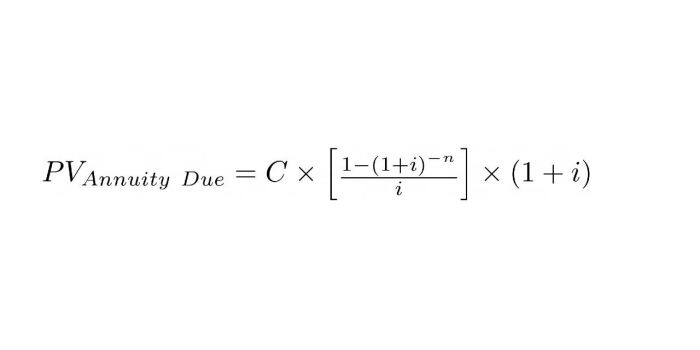

The annuity method can be a complex topic. This article breaks down the different methods used to calculate annuity payments, providing clarity and insights into this financial tool.

Comparing Immediate Needs Annuities: Immediate Needs Annuity Calculator

When comparing different immediate needs annuity products, consider the following factors:

Payout Options

Compare the payment options offered by different providers, including payment frequencies, lump sum options, and combinations.

Looking for information on the top 5 annuities in 2024? This article highlights some of the best annuity options available, helping you narrow down your choices and find the right fit for your needs.

Interest Rates

The interest rate offered by the annuity provider will directly impact the payout amount. Look for providers offering competitive interest rates.

Calculating an annuity from your pension can be tricky. This resource provides a step-by-step guide to help you determine the annuity payment you can expect based on your pension benefits.

Fees

Annuity providers may charge various fees, such as administrative fees, surrender charges, or mortality and expense charges. Compare fee structures to find the most affordable option.

Wondering if the annuity from LIC is taxable in 2024? Find out here if your annuity payments are subject to taxation and how it impacts your financial planning.

Table Comparing Annuity Providers

| Provider | Interest Rate | Monthly Payout | Fees |

|---|---|---|---|

| Provider A | 3.5% | $1,500 | $50/year |

| Provider B | 3.75% | $1,600 | $75/year |

| Provider C | 3.25% | $1,400 | $25/year |

Finding the Right Immediate Needs Annuity

Selecting the right immediate needs annuity involves careful research and comparison:

Research and Compare

Thoroughly research different annuity providers and compare their products based on interest rates, fees, payment options, and other key features.

If you’re in India and wondering if your annuity is taxable in 2024, this article can provide you with the necessary information about tax implications and how to manage your tax liabilities.

Reputable Annuity Provider

Choose a reputable and financially sound annuity provider with a strong track record and positive customer reviews.

Want to understand the current trends in variable annuity rates? This link provides an overview of variable annuity rates from 2021 to 2024, helping you make informed decisions about your investment strategy.

Meet Your Needs

Ensure that the chosen annuity product meets your specific financial needs and objectives, including income requirements, payment frequency, and desired duration.

Negotiate Terms

Don’t hesitate to negotiate the terms of the annuity contract, particularly regarding interest rates, fees, and payment options.

Ultimate Conclusion

Understanding the intricacies of immediate needs annuities can be a complex endeavor, but utilizing a calculator empowers you to make informed decisions. It allows you to assess potential payouts, compare different annuity options, and ultimately, navigate the world of retirement planning with confidence.

Answers to Common Questions

What are the tax implications of an immediate needs annuity?

The payments you receive from an immediate needs annuity are typically taxed as ordinary income. However, the specific tax treatment may vary depending on the type of annuity and your individual circumstances. It’s always best to consult with a tax professional for personalized advice.

Can I withdraw my principal amount from an immediate needs annuity?

Immediate needs annuities are designed to provide a guaranteed stream of income, and typically, you cannot withdraw the principal amount. However, there may be some exceptions depending on the specific terms of the annuity contract. It’s important to carefully review the terms and conditions before purchasing an annuity.