Immediate Annuity With Return Of Purchase Price offers a unique approach to retirement planning, providing guaranteed income for life and a potential return of the initial investment to beneficiaries. This type of annuity can be a valuable tool for individuals seeking to secure a steady income stream during retirement, ensuring financial stability and peace of mind.

O-shares are a type of variable annuity, and they often have a surrender period before you can withdraw your funds without penalties. You can find information about surrender periods for O-share variable annuities on O Share Variable Annuity Surrender Period 2024.

It allows individuals to convert a lump sum of money into a stream of guaranteed payments, providing a predictable and reliable source of income that can help cover essential expenses and enhance their retirement lifestyle.

Financial calculators can be helpful for planning your retirement and understanding annuity options. You can find a variety of financial calculators designed specifically for annuities on Financial Calculator Annuity 2024.

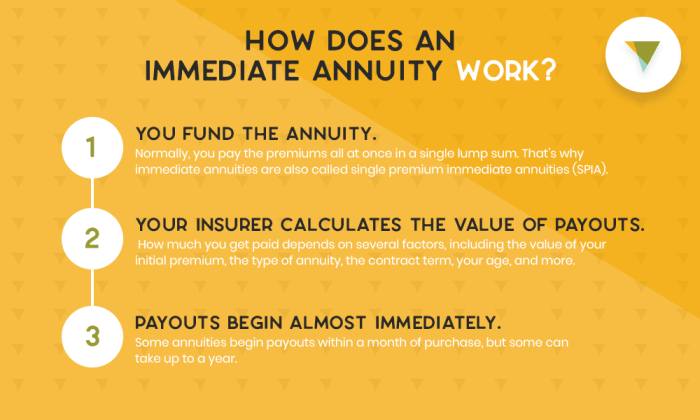

Immediate annuities, also known as single-premium immediate annuities (SPIAs), differ from other types of annuities by offering immediate payments upon purchase. The “return of purchase price” feature adds an extra layer of security, guaranteeing that at least the original investment will be returned to the beneficiary upon the annuitant’s death.

If you’re in Nigeria and considering an annuity, you can use an annuity calculator to estimate your potential payments. You can find a Nigeria-specific calculator on Annuity Calculator Nigeria 2024.

This feature can be particularly beneficial for individuals who want to ensure that their loved ones will receive a financial benefit from their annuity purchase.

Groww offers an annuity calculator that can help you estimate your potential payments. You can find this calculator on Annuity Calculator Groww 2024.

Immediate Annuities: A Comprehensive Overview

Immediate annuities, often referred to as single-premium immediate annuities (SPIAs), are financial products that provide a guaranteed stream of income payments starting immediately after the purchase. They are a popular choice for individuals seeking to convert a lump sum of money into a steady and predictable income stream, particularly during retirement.

Unlike other types of annuities, immediate annuities offer immediate income payments, making them a unique and valuable tool for retirement planning.

Some variable annuities offer long-term care riders, which can help cover the costs of long-term care services. You can learn more about these riders on Variable Annuity With Long Term Care Rider 2024.

Key Features of Immediate Annuities, Immediate Annuity With Return Of Purchase Price

Immediate annuities are characterized by several key features that set them apart from other financial instruments. These features include:

- Immediate Income Payments:The primary advantage of immediate annuities is the ability to receive income payments immediately after the purchase. This contrasts with deferred annuities, which provide payments at a future date.

- Guaranteed Income Stream:Immediate annuities provide a guaranteed stream of income for a specified period, either for life or for a fixed term. This guarantees a consistent income flow, regardless of market fluctuations or changes in interest rates.

- Return of Purchase Price:Some immediate annuities offer a “return of purchase price” feature. This means that if the annuitant dies before receiving back the full purchase price of the annuity, the remaining balance is paid out to their beneficiaries. This feature can provide additional financial protection for loved ones.

Variable annuity payments can fluctuate based on the performance of the underlying investments. You can find more details about how these payments are calculated on Variable Annuity Payments 2024.

Advantages and Disadvantages of Immediate Annuities

Immediate annuities, like any financial product, come with both advantages and disadvantages. It is crucial to weigh these carefully before making a decision.

Advantages

- Guaranteed Income:The primary advantage of immediate annuities is the guaranteed income stream, providing financial security and peace of mind. This is particularly appealing for individuals seeking a reliable source of income during retirement.

- Longevity Protection:Immediate annuities can provide protection against outliving one’s savings. They offer a lifelong income stream, ensuring that individuals will have financial support even if they live longer than expected.

- Simplicity:Immediate annuities are relatively simple to understand and manage. Once the purchase is made, the income stream is guaranteed, eliminating the need for ongoing investment management decisions.

- Tax Benefits:The income payments from immediate annuities are typically taxed as ordinary income. However, the return of purchase price portion is often tax-free.

Disadvantages

- Limited Flexibility:Once an immediate annuity is purchased, it is difficult to change the payment schedule or withdraw funds. This lack of flexibility can be a disadvantage if unforeseen circumstances arise.

- Potential for Lower Returns:Immediate annuities typically offer lower returns compared to other investments, such as stocks or bonds. This is because they provide a guaranteed income stream, which comes at the cost of potential growth.

- Risk of Inflation:The fixed income payments from immediate annuities may not keep pace with inflation. This means that the purchasing power of the income stream could erode over time.

The “Return of Purchase Price” Feature

The “return of purchase price” feature in immediate annuities is a valuable benefit that provides financial protection for beneficiaries. It ensures that if the annuitant dies before receiving back the full purchase price of the annuity, the remaining balance is paid out to their designated beneficiaries.

How the Feature Works

The return of purchase price feature is typically included in the annuity contract. The contract Artikels the specific terms, such as the amount of the return of purchase price, the conditions for payment, and the beneficiaries who will receive the funds.

An annuity can be a valuable retirement planning tool, but understanding its meaning is key. A clear explanation and examples are available on Annuity Meaning With Example 2024 to help you make sense of this financial instrument.

The return of purchase price is usually calculated as a percentage of the original purchase price, and it is paid out to the beneficiaries upon the annuitant’s death. For example, an annuity contract may state that the return of purchase price is 100% of the original purchase price.

Before committing to an immediate annuity, you’ll want to consider the associated fees. You can find a breakdown of these fees on Immediate Annuity Fees , helping you make a well-informed decision.

This means that if the annuitant dies before receiving back the full purchase price, the remaining balance will be paid out to their beneficiaries in full.

An annuity can be a single sum payment, but it’s important to understand the different options available. You can learn more about this concept on Annuity Is A Single Sum 2024.

Comparison with Other Death Benefit Options

The return of purchase price feature is just one of several death benefit options available in annuities. Other options include:

- Death Benefit Option:This option typically pays out a lump sum to the beneficiaries upon the annuitant’s death. The amount of the death benefit may be a fixed amount, a multiple of the monthly annuity payment, or a percentage of the original purchase price.

- Joint and Survivor Annuity:This type of annuity provides payments to two individuals, usually a couple. The payments continue until the death of the last surviving annuitant. This option offers longevity protection for both individuals.

The best death benefit option for an individual depends on their specific needs and circumstances. If the annuitant wants to ensure that their beneficiaries receive a specific amount of money, a death benefit option may be more suitable. However, if the annuitant wants to provide ongoing income for their beneficiaries, a return of purchase price feature may be a better choice.

Annuity home loans are a type of mortgage that uses an annuity to provide regular payments. You can learn more about these loans on Annuity Home Loan 2024.

Factors Influencing Immediate Annuity Decisions

Several factors should be considered when deciding whether an immediate annuity is suitable for an individual’s financial goals. These factors can influence the decision to purchase an immediate annuity and the specific type of annuity that is most appropriate.

Key Factors to Consider

- Age:Individuals closer to retirement or already retired may find immediate annuities more attractive, as they offer immediate income payments. Younger individuals with a longer time horizon may prefer other investment options with potential for growth.

- Health:An individual’s health can influence the decision to purchase an immediate annuity. If an individual has a longer life expectancy, an immediate annuity can provide a guaranteed income stream for a longer period. However, if an individual has a shorter life expectancy, they may be better off with other investment options that offer potential for growth.

- Investment Horizon:The time horizon for which the individual needs the income is a crucial factor. Immediate annuities are ideal for those seeking guaranteed income for a specific period, such as retirement. However, if the need for income is short-term, other investment options may be more suitable.

- Risk Tolerance:Immediate annuities offer a guaranteed income stream, but they typically have lower returns than other investment options. Individuals with a high risk tolerance may prefer other investment options that offer potential for higher returns, even though they come with more risk.

Table Comparing Different Types of Immediate Annuities

| Type of Annuity | Interest Rates | Guaranteed Income | Return of Purchase Price |

|---|---|---|---|

| Fixed Annuity | Fixed interest rate | Guaranteed income for life or a fixed term | May or may not offer return of purchase price |

| Variable Annuity | Interest rate fluctuates based on market performance | Guaranteed income for life or a fixed term | May or may not offer return of purchase price |

| Indexed Annuity | Interest rate is linked to a specific index, such as the S&P 500 | Guaranteed income for life or a fixed term | May or may not offer return of purchase price |

The Role of Immediate Annuities in Retirement Planning

Immediate annuities can play a crucial role in retirement planning, helping individuals create a secure and sustainable income stream. They can be used to supplement other retirement income sources, such as Social Security and pensions, and can help address specific retirement planning needs.

New York Life offers a variety of variable annuities. To learn more about the specific features and benefits of their variable annuity offerings, you can visit Variable Annuity New York Life 2024.

Creating a Secure Retirement Income Stream

Immediate annuities provide a guaranteed income stream, which can be essential for individuals seeking financial security during retirement. This guaranteed income can help cover essential expenses, such as housing, healthcare, and food, providing peace of mind and reducing the risk of outliving one’s savings.

Variable annuities may include 12b-1 fees, which are used to cover marketing and distribution expenses. To understand how these fees work and their impact on your investment, check out 12b-1 Fees Variable Annuity 2024.

Supplementing Other Retirement Income Sources

Immediate annuities can be used to supplement other retirement income sources, such as Social Security and pensions. By providing a guaranteed income stream, immediate annuities can help bridge the gap between an individual’s retirement income needs and their other income sources.

Addressing Specific Retirement Planning Needs

Immediate annuities can be used to address specific retirement planning needs, such as:

- Covering Essential Expenses:Immediate annuities can provide a guaranteed income stream to cover essential expenses, such as housing, healthcare, and food.

- Funding Long-Term Care:Immediate annuities can provide a steady stream of income to help cover the costs of long-term care, which can be a significant expense in retirement.

- Protecting Against Outliving Savings:Immediate annuities can provide longevity protection, ensuring that individuals have a guaranteed income stream even if they live longer than expected.

Tax Implications of Immediate Annuities

The tax treatment of immediate annuity payments and the return of purchase price can vary depending on the specific type of annuity contract and individual circumstances. It is essential to understand the tax implications before purchasing an immediate annuity.

The HMRC annuity calculator can help you estimate your potential annuity payments. You can find this useful tool on Annuity Calculator Hmrc 2024.

Tax Treatment of Payments

Income payments from immediate annuities are typically taxed as ordinary income. This means that the payments are subject to federal and state income taxes, just like wages or salary. The portion of the payment that represents a return of the original purchase price is usually tax-free.

This is because the return of purchase price is considered a return of capital. For example, if an individual purchases an immediate annuity for $100,000 and receives annual payments of $10,000, the first $10,000 payment will be taxed as ordinary income.

Understanding how variable annuities are taxed in 2024 can be tricky, but you can find helpful information on Variable Annuity Taxation 2024. It’s important to be aware of the potential tax implications before investing in a variable annuity.

However, the remaining $90,000 of the purchase price will be tax-free when it is eventually returned to the annuitant or their beneficiaries.

Minimizing Tax Burden

To minimize the tax burden associated with immediate annuities, individuals should consider the following:

- Choosing a Tax-Advantaged Annuity:Some annuities offer tax advantages, such as tax-deferred growth or tax-free income payments. These annuities can help reduce the overall tax burden associated with annuity payments.

- Timing of Withdrawals:Individuals can time their withdrawals to minimize their tax liability. For example, they may choose to withdraw funds during years when they have lower income, resulting in a lower tax rate.

- Consult with a Tax Advisor:It is always advisable to consult with a qualified tax advisor to understand the tax implications of immediate annuities and to develop a tax planning strategy that meets their individual needs.

Choosing the Right Immediate Annuity Provider

Selecting a reputable and reliable annuity provider is crucial to ensure that individuals receive the guaranteed income stream and benefits they expect. There are several factors to consider when choosing an annuity provider.

Inheriting an annuity can come with its own set of considerations. To understand how an inherited annuity works, you can check out What Happens When I Inherit An Annuity 2024.

Factors to Consider

- Financial Strength:It is essential to choose an annuity provider with a strong financial track record. This ensures that the provider will be able to meet its financial obligations and provide the guaranteed income stream promised.

- Customer Service:A reputable annuity provider will have excellent customer service, making it easy for individuals to get the information and support they need.

- Contract Terms:Individuals should carefully review the contract terms before purchasing an annuity. This includes the interest rate, guaranteed income stream, return of purchase price features, and any fees or charges.

Table Comparing Different Annuity Providers

| Annuity Provider | Interest Rates | Fees | Return of Purchase Price |

|---|---|---|---|

| Provider A | [Interest rate information] | [Fee information] | [Return of purchase price information] |

| Provider B | [Interest rate information] | [Fee information] | [Return of purchase price information] |

| Provider C | [Interest rate information] | [Fee information] | [Return of purchase price information] |

Ultimate Conclusion: Immediate Annuity With Return Of Purchase Price

Immediate annuities with return of purchase price offer a compelling solution for individuals seeking guaranteed income and peace of mind during retirement. By converting a lump sum into a steady stream of payments, these annuities provide a predictable and reliable source of income that can help cover essential expenses and enhance retirement lifestyle.

The return of purchase price feature provides an added layer of security, ensuring that at least the original investment will be returned to the beneficiary upon the annuitant’s death. As you explore your retirement planning options, consider the potential benefits of incorporating an immediate annuity with return of purchase price into your financial strategy.

FAQ Explained

How do I choose the right immediate annuity provider?

Selecting a reputable and reliable annuity provider is crucial. Consider factors such as financial strength, customer service, and contract terms. Research providers, compare their offerings, and seek advice from a financial advisor.

What are the tax implications of immediate annuities?

The tax treatment of immediate annuity payments and the return of purchase price can vary depending on the type of annuity contract and individual circumstances. Consult with a tax advisor to understand the specific tax implications for your situation.

Are there any penalties for withdrawing funds from an immediate annuity?

Immediate annuities are designed for long-term income generation, and withdrawing funds before a certain age or period can result in penalties. Consult with your annuity provider to understand the specific withdrawal rules and potential penalties.

How does the return of purchase price feature work in different annuity contracts?

The specific implementation of the return of purchase price feature can vary among annuity contracts. Some contracts may return the full purchase price, while others may have a limited return based on factors like the annuitant’s age or the length of the annuity period.

Review the contract terms carefully to understand the specifics of the return of purchase price feature.