Immediate Annuity Wiki is your comprehensive guide to understanding immediate annuities, a financial product that provides guaranteed income for life. An immediate annuity allows you to convert a lump sum of money into a stream of regular payments, offering financial security and peace of mind in retirement.

Whether you’re seeking to supplement your retirement income, protect your savings from market volatility, or simply ensure a steady flow of funds, this wiki will explore the ins and outs of immediate annuities, providing you with the knowledge to make informed decisions.

It can be helpful to understand how much annuity you can receive for a specific amount of money, such as $100,000. Factors like your age and the current interest rates will play a role in determining the annuity payment.

You can explore the details on this topic by visiting How Much Annuity For 100 000 2024.

We’ll delve into the intricacies of how immediate annuities work, from the purchase process to the factors that influence your annuity payment amount. We’ll also examine the benefits of guaranteed income, the potential risks and drawbacks, and explore alternative income-generating options to help you determine if an immediate annuity aligns with your financial goals and risk tolerance.

What is an Immediate Annuity?

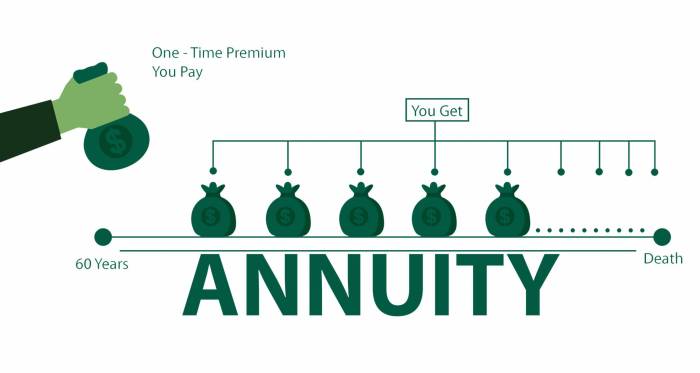

An immediate annuity is a type of insurance contract that provides a guaranteed stream of income payments for life. These annuities are designed to provide a steady income stream for retirees, especially those who want to ensure a reliable source of income during their golden years.

Immediate annuities are a type of annuity that begins paying out benefits immediately after the purchase is made. You can use an immediate annuity income calculator to estimate how much income you can expect to receive from an annuity.

To find out more about immediate annuity income calculators, you can visit Immediate Annuity Income Calculator.

Defining an Immediate Annuity

An immediate annuity is a contract where you give a lump sum of money to an insurance company in exchange for regular payments that start immediately. These payments can be made monthly, quarterly, or annually, and they continue for as long as you live.

How Immediate Annuities Work

The insurance company invests the lump sum you provide and uses the investment returns to pay you the guaranteed income stream. This income stream is typically calculated based on factors like your age, gender, and the interest rate environment.

A variable annuity is a type of insurance product that combines features of both an annuity and a mutual fund. They offer the potential for growth, but also carry some risk. If you’re interested in learning more about variable annuities, you can visit What Is A Variable Annuity 2024.

Types of Immediate Annuities

There are different types of immediate annuities, each with its own features and benefits.

- Single Premium Immediate Annuity (SPIA):This is the most common type of immediate annuity. You make a single, lump-sum payment to the insurance company, and they start making payments immediately.

- Fixed Annuity:With a fixed annuity, the payment amount is fixed for the life of the contract. This provides a predictable income stream, but the payments may not keep up with inflation.

- Variable Annuity:In a variable annuity, the payment amount is tied to the performance of a specific investment portfolio. This means the payments can fluctuate, but they have the potential to grow over time.

- Indexed Annuity:Indexed annuities offer a guaranteed minimum return, but the payments can also increase based on the performance of a specific index, like the S&P 500.

Advantages of Immediate Annuities

Immediate annuities offer several benefits, making them an attractive option for retirees.

- Guaranteed Income for Life:One of the biggest advantages of immediate annuities is that they provide a guaranteed income stream for life, regardless of how long you live. This eliminates the risk of outliving your savings.

- Protection Against Inflation and Market Volatility:Immediate annuities can provide some protection against inflation, especially if you choose a fixed annuity or an indexed annuity. They also offer protection against market volatility, as the payments are guaranteed regardless of how the stock market performs.

- Estate Planning:Immediate annuities can be used for estate planning purposes. You can use them to create a legacy for your loved ones or to provide for their financial needs after your death.

- Supplementing Retirement Income:Immediate annuities can be a valuable tool for supplementing your retirement income. They can provide a reliable source of income to cover your essential expenses, allowing you to use your other savings for discretionary spending.

Disadvantages of Immediate Annuities

While immediate annuities offer several benefits, they also have some potential drawbacks.

An annuity is a financial product that can provide a stream of income for life. It’s a contract that provides regular payments for a certain period of time. To learn more about the meaning of an annuity, you can check out Annuity Meaning In English 2024.

- Limited Liquidity:Once you purchase an immediate annuity, you generally cannot access the lump sum you invested. This can be a drawback if you need to access your money for an emergency.

- Potential for Lower Returns:The returns on immediate annuities are typically lower than the returns you could potentially earn in the stock market. However, they offer guaranteed income and protection against market risk.

- Limited Flexibility:Once you purchase an immediate annuity, you typically cannot change the payment amount or frequency. This can be a drawback if your financial needs change over time.

How Immediate Annuities Work

Purchasing an immediate annuity involves a simple process, but it’s important to understand the factors that determine your annuity payments.

Purchasing an Immediate Annuity

To purchase an immediate annuity, you’ll need to contact an insurance company and provide them with information about your age, gender, and the amount of money you want to invest. The insurance company will then calculate your annuity payments based on these factors, as well as the current interest rate environment.

Immediate annuities are a type of annuity that begins paying out benefits immediately after the purchase is made. Some immediate annuities offer a return of purchase price, which means that if you die before receiving back the amount you invested, your beneficiaries will receive the remaining principal.

To learn more about immediate annuities with a return of purchase price, you can visit Immediate Annuity With Return Of Purchase Price.

Factors Determining Annuity Payment Amount

Several factors influence the amount of your annuity payments.

- Age:Younger individuals typically receive lower annuity payments than older individuals because they have a longer life expectancy.

- Gender:Women generally receive higher annuity payments than men because they tend to live longer.

- Interest Rates:Higher interest rates generally lead to higher annuity payments. This is because the insurance company can earn more on its investments.

- Lump Sum Investment:The larger the lump sum you invest, the higher your annuity payments will be.

- Annuity Type:The type of annuity you choose will also affect your payments. For example, a fixed annuity will typically have a lower payment than a variable annuity.

Role of Interest Rates and Life Expectancy

Interest rates and life expectancy are two of the most important factors that determine your annuity payments.

- Interest Rates:The insurance company uses the interest rate environment to calculate the returns it can earn on your investment. Higher interest rates mean the company can earn more, leading to higher annuity payments.

- Life Expectancy:The insurance company uses life expectancy tables to estimate how long you will live. The longer your life expectancy, the lower your annuity payments will be because the insurance company has to pay you for a longer period.

Example of an Immediate Annuity Calculation, Immediate Annuity Wiki

Let’s assume you are a 65-year-old woman who wants to purchase a single premium immediate annuity with a lump sum of $100, The current interest rate environment is 3%, and your life expectancy is 20 years. The insurance company might calculate your monthly annuity payment as follows:

$100,000 x 0.03 / 12 = $250 per month

An annuity is a financial product that can provide a stream of income for life. They can be a valuable tool for retirement planning, as they can help to provide a steady source of income during your golden years.

If you’re interested in learning more about annuities with a $600,000 investment, you can check out Annuity 600 000 2024.

This is just a simplified example, and the actual payment amount will vary depending on the specific terms of the annuity contract.

Benefits of Immediate Annuities

Immediate annuities offer several benefits that make them a popular choice for retirees.

Immediate annuities are a type of annuity that begins paying out benefits immediately after the purchase is made. If you’re considering purchasing an immediate annuity, it’s important to compare quotes from different insurance companies to find the best rate.

You can learn more about immediate annuity quotes by visiting Immediate Annuity Quotes.

Guaranteed Income for Life

Immediate annuities provide a guaranteed income stream for life, regardless of how long you live. This eliminates the risk of outliving your savings and ensures a reliable source of income during your retirement years.

Protection Against Inflation and Market Volatility

Immediate annuities can provide some protection against inflation, especially if you choose a fixed annuity or an indexed annuity. Fixed annuities offer a guaranteed payment amount that does not change, while indexed annuities provide a minimum guaranteed return and the potential for growth based on the performance of a specific index.

Variable annuities have an accumulation phase, where your investment grows tax-deferred. This means that you won’t have to pay taxes on the earnings until you withdraw them in retirement. If you’re interested in learning more about the accumulation phase of variable annuities, you can visit Variable Annuity Accumulation Phase 2024.

This can help to preserve your purchasing power over time.

Estate Planning

Immediate annuities can be used for estate planning purposes. You can use them to create a legacy for your loved ones or to provide for their financial needs after your death. For example, you could purchase an immediate annuity with a death benefit that would pass on to your beneficiaries upon your death.

Immediate annuities are a type of annuity that begins paying out benefits immediately after the purchase is made. The return on an immediate annuity can vary depending on a number of factors, including the interest rates at the time of purchase.

If you’re interested in learning more about immediate annuity returns, you can visit Immediate Annuity Returns.

Supplementing Retirement Income

Immediate annuities can be a valuable tool for supplementing your retirement income. They can provide a reliable source of income to cover your essential expenses, allowing you to use your other savings for discretionary spending. This can help to reduce your financial stress and give you more peace of mind in retirement.

Immediate care annuities are a type of annuity that provides a stream of income that can be used to cover long-term care expenses. These annuities can be a valuable tool for individuals who are concerned about the cost of long-term care.

If you’d like to learn more about immediate care annuities, check out Immediate Care Annuity Just.

Considerations for Purchasing an Immediate Annuity

Before purchasing an immediate annuity, it’s essential to consider your financial goals, risk tolerance, and the potential drawbacks.

Immediate annuities are a type of annuity that begins paying out benefits immediately after the purchase is made. These annuities are often used by retirees who want to convert a lump sum of money into a guaranteed stream of income.

If you’re interested in learning more about the immediate annuity rate, you can visit Immediate Annuity Rate.

Understanding Your Financial Goals and Risk Tolerance

It’s important to have a clear understanding of your financial goals and risk tolerance before purchasing an immediate annuity. If you are seeking a guaranteed income stream for life, an immediate annuity may be a good option. However, if you are comfortable taking on more risk in hopes of higher returns, you may want to consider other investment options.

An annuity is a financial product that can provide a stream of income for life. An annuity with growth refers to an annuity that includes a component that grows over time. If you’re interested in learning more about annuities with growth, you can check out Fv Annuity With Growth 2024.

Comparing Annuity Options from Different Providers

It’s essential to compare annuity options from different providers before making a decision. Annuity contracts can vary significantly in terms of their features, benefits, and fees. By comparing options, you can ensure you are getting the best possible deal.

Variable annuities are a type of annuity that can be used in a 401(k) retirement plan. These annuities offer the potential for growth, but also carry some risk. If you’re interested in learning more about variable annuities in a 401(k) plan, you can visit 401k Variable Annuity 2024.

Potential Risks and Drawbacks

While immediate annuities offer several benefits, they also have some potential risks and drawbacks.

Variable annuities are a type of insurance product that can provide a stream of income for life. They are often used in retirement planning, as they can help to provide a steady source of income during your golden years.

If you’re looking for information on variable annuity riders in 2024, you can find more details at Variable Annuity Riders 2024.

- Limited Liquidity:Once you purchase an immediate annuity, you generally cannot access the lump sum you invested. This can be a drawback if you need to access your money for an emergency.

- Potential for Lower Returns:The returns on immediate annuities are typically lower than the returns you could potentially earn in the stock market. However, they offer guaranteed income and protection against market risk.

- Limited Flexibility:Once you purchase an immediate annuity, you typically cannot change the payment amount or frequency. This can be a drawback if your financial needs change over time.

Questions to Ask Before Purchasing an Immediate Annuity

Before purchasing an immediate annuity, you should ask yourself the following questions:

- What are my financial goals for retirement?

- What is my risk tolerance?

- How long do I expect to live?

- What are my current income and expenses?

- What are my other investment options?

- What are the fees associated with the annuity?

- What are the guarantees and protections offered by the annuity?

- What happens if I die before I receive all of my payments?

Alternatives to Immediate Annuities

While immediate annuities offer a guaranteed income stream, there are other options available for retirees seeking income generation.

Other Income-Generating Options for Retirees

Retirees have several options for generating income, including:

- Traditional and Roth IRAs:These retirement accounts offer tax advantages for saving and investing for retirement.

- 401(k) Plans:Employer-sponsored retirement plans that allow employees to contribute pre-tax income to a retirement account.

- Annuities:Annuities can provide a guaranteed income stream or the potential for growth, depending on the type of annuity you choose.

- Rental Properties:Investing in rental properties can provide a steady stream of rental income.

- Part-Time Work:Many retirees continue to work part-time to supplement their income.

Comparing Immediate Annuities with Other Investment Strategies

Immediate annuities are just one option for generating income in retirement. Other investment strategies include:

- Investing in the Stock Market:Investing in the stock market can offer the potential for higher returns than immediate annuities, but it also comes with more risk.

- Investing in Bonds:Bonds offer a more conservative investment option than stocks, but they typically have lower returns.

- Real Estate:Investing in real estate can provide a steady stream of income from rent, but it also requires a significant upfront investment and ongoing maintenance costs.

Pros and Cons of Each Alternative Investment Approach

Each investment approach has its own pros and cons:

| Investment Approach | Pros | Cons |

|---|---|---|

| Immediate Annuities | Guaranteed income for life, protection against inflation and market volatility, estate planning benefits | Limited liquidity, potential for lower returns, limited flexibility |

| Stock Market | Potential for high returns | High risk, volatility, potential for losses |

| Bonds | Lower risk than stocks, provide income | Lower returns than stocks, interest rate risk |

| Real Estate | Potential for rental income, appreciation | High upfront investment, maintenance costs, illiquidity |

Ultimate Conclusion

Immediate annuities can be a valuable tool for individuals seeking a secure and predictable source of income in retirement. By understanding the intricacies of immediate annuities, you can make informed decisions that align with your financial goals and risk tolerance.

Variable annuities are a type of annuity that offers the potential for growth, but also carries some risk. The investment options within a variable annuity can fluctuate in value, so the amount of income you receive may vary. To learn more about variable annuity products in 2024, you can check out Variable Annuity Products 2024.

Whether you choose to invest in an immediate annuity or explore alternative options, the knowledge gained from this wiki will empower you to navigate the world of retirement income with confidence.

Question Bank: Immediate Annuity Wiki

What are the tax implications of immediate annuities?

The tax implications of immediate annuities vary depending on the type of annuity and the individual’s tax situation. It’s crucial to consult with a financial advisor or tax professional to understand the specific tax consequences of your annuity.

Are there any fees associated with immediate annuities?

Yes, there are often fees associated with immediate annuities, including administrative fees, surrender charges, and mortality and expense charges. These fees can vary significantly depending on the provider and the type of annuity. It’s essential to carefully review the fee structure before purchasing an annuity.

Can I withdraw my principal from an immediate annuity?

Generally, you cannot withdraw your principal from an immediate annuity once it’s purchased. However, some annuities may offer partial withdrawal options, which may be subject to fees and penalties.