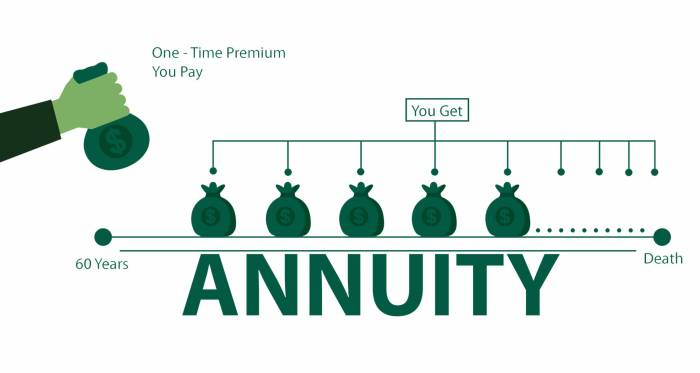

Immediate Annuity UK offers a way to secure a guaranteed income stream for life, providing peace of mind in retirement. This type of annuity involves a single lump-sum payment in exchange for regular, predictable payments, making it a popular choice for individuals seeking financial security.

Variable annuities can offer potential growth, but it’s important to consider the management and expense fees associated with them. You might also want to compare variable annuities to fixed annuities to see which option best suits your needs and risk tolerance.

Don’t forget to factor in the potential impact of variable annuity sales trends on your investment decisions.

Understanding how immediate annuities work in the UK is crucial for those considering this option. It’s important to weigh the advantages, such as guaranteed income and tax benefits, against potential drawbacks like limited flexibility and the risk of inflation eroding purchasing power.

Choosing the right type of immediate annuity, whether fixed, variable, or index-linked, depends on individual circumstances and financial goals.

Annuity options for 2024 are quite diverse, with choices ranging from annuities of 600,000 to smaller options like annuities of 60,000. Understanding the different types of annuities is crucial, especially when considering the potential for early withdrawal penalties as seen with variable annuities.

What is an Immediate Annuity?

An immediate annuity is a financial product that provides a guaranteed stream of income for life. It’s essentially a contract where you make a lump-sum payment to an insurance company, and in return, they agree to pay you regular payments for the rest of your life.

This provides a secure and predictable income source, especially during retirement.

Key Features of Immediate Annuities

- Single Lump-Sum Payment:You make a one-time payment to purchase the annuity.

- Regular Income Stream:You receive regular payments, usually monthly, for as long as you live.

When Immediate Annuities Can Be Beneficial

- Retirement Planning:Provides a reliable income stream to supplement other retirement savings.

- Income Security:Offers peace of mind by guaranteeing a consistent income, regardless of market fluctuations.

- Estate Planning:Can be used to provide a legacy for beneficiaries after your death.

How Immediate Annuities Work in the UK

In the UK, purchasing an immediate annuity typically involves these steps:

- Choose an Annuity Provider:Compare different providers and their annuity options.

- Determine the Purchase Price:The amount you pay for the annuity will depend on factors like your age, gender, health status, and the type of annuity you choose.

- Select the Payment Frequency:You can choose to receive payments monthly, quarterly, or annually.

- Choose the Payment Option:You can opt for a fixed or variable annuity, with different payout structures and risk profiles.

- Complete the Application Process:Provide necessary information and documentation to the annuity provider.

Types of Immediate Annuities in the UK

- Fixed Annuities:Provide a guaranteed fixed income for life, regardless of market fluctuations.

- Variable Annuities:Offer a potential for higher returns, but the income payments can fluctuate based on the performance of the underlying investments.

- Index-Linked Annuities:The income payments are linked to the performance of a specific index, such as the FTSE 100.

Factors Influencing Income Payout

- Purchase Price:The higher the purchase price, the higher the income payments.

- Age:Younger individuals generally receive lower income payments than older individuals.

- Gender:Women generally receive lower income payments than men due to longer life expectancies.

- Health Status:Individuals in good health typically receive higher income payments than those with health issues.

Advantages of Immediate Annuities in the UK

Immediate annuities offer several benefits for individuals seeking guaranteed income in retirement:

Guaranteed Income for Life

Immediate annuities eliminate the risk of outliving your savings, ensuring a steady income stream for as long as you live.

Peace of Mind

By providing a predictable income, immediate annuities reduce financial stress and offer peace of mind during retirement.

Investment Risk Elimination

Annuities eliminate the risk associated with market fluctuations, providing a secure and reliable income stream.

When deciding on an annuity, it’s wise to explore all your options, including the potential benefits of variable annuities. To get a clearer picture of how different annuities might perform, you can use an annuity calculator. Keep in mind that the minimum return on a variable annuity is not guaranteed.

Tax Advantages

In the UK, annuity payments are generally tax-free, as the tax is already paid on the lump-sum purchase price.

Disadvantages of Immediate Annuities in the UK

While immediate annuities offer advantages, it’s essential to consider potential drawbacks:

Lack of Flexibility

Once you purchase an annuity, you generally cannot access the lump-sum payment or change the payment structure.

Potential for Lower Returns

Immediate annuities may offer lower returns compared to other investments, especially if market conditions are favorable.

Inflation Risk

Inflation can erode the purchasing power of your annuity income over time.

Importance of Careful Consideration

It’s crucial to carefully consider your individual financial circumstances and long-term goals before purchasing an immediate annuity.

Choosing the Right Immediate Annuity in the UK

The best immediate annuity for you will depend on your specific needs and circumstances. Here’s a comparison of different types:

Types of Immediate Annuities, Immediate Annuity Uk

| Type | Key Features | Benefits |

|---|---|---|

| Fixed Annuities | Guaranteed fixed income for life | Predictable income, no risk of market fluctuations |

| Variable Annuities | Income payments fluctuate based on underlying investments | Potential for higher returns |

| Index-Linked Annuities | Income payments linked to a specific index | Potential for higher returns linked to market performance |

Choosing an Immediate Annuity

- Assess Your Needs:Determine your income requirements and risk tolerance.

- Compare Providers:Research different annuity providers and their offerings.

- Seek Professional Advice:Consult with a financial advisor to get personalized guidance.

- Consider Tax Implications:Understand the tax implications of different annuity options.

- Review the Contract:Carefully read the annuity contract before making a decision.

Resources and Tools

Several resources are available to help you compare and research annuity providers in the UK:

- MoneySavingExpert:Provides independent reviews and comparisons of annuity providers.

- Which?:Offers unbiased reviews and ratings of financial products, including annuities.

- The Money Advice Service:Provides free and impartial financial advice.

Case Studies: Immediate Annuities in Action

Here are some examples of how immediate annuities can address specific financial needs in retirement:

Case Study 1: Providing a Regular Income Stream

John, a retired teacher, wanted a reliable income stream to cover his living expenses. He purchased a fixed immediate annuity with a lump sum of £100,000, guaranteeing him a monthly income of £1,000 for life. This provided him with a secure and predictable income, eliminating the need to worry about market fluctuations.

Case Study 2: Protecting Against Longevity Risk

Mary, a retired nurse, was concerned about outliving her savings. She purchased a variable immediate annuity with a lump sum of £50,000, hoping to increase her income over time. While the income payments could fluctuate based on market performance, it offered her the potential for higher returns, helping her protect against longevity risk.

Case Study 3: Supplementing Other Retirement Income Sources

David, a retired businessman, had a substantial pension but wanted to supplement his income with a guaranteed stream. He purchased an index-linked immediate annuity with a lump sum of £25,000, linking his income payments to the FTSE 100. This provided him with additional income, potentially growing alongside the market.

Last Recap: Immediate Annuity Uk

Immediate annuities in the UK can be a valuable tool for retirement planning, providing a reliable income stream and mitigating longevity risk. However, careful consideration is essential, weighing the benefits against potential drawbacks and seeking professional financial advice to ensure the right choice for individual needs.

If you’re looking for a guaranteed income stream, an immediate annuity might be a good fit. These annuities provide a fixed stream of payments for life, but it’s essential to understand the settlement options available to you. You can also use an immediate lifetime annuity calculator to estimate your potential payouts.

By understanding the intricacies of immediate annuities and exploring the options available, individuals can make informed decisions about their financial future.

Variable annuities offer the potential for growth, but also carry certain risks. It’s important to understand how subaccounts work and how they can affect your returns. You might also want to explore the possibility of taking out a loan against your variable annuity , though remember this could come with its own set of fees and conditions.

FAQ Resource

What are the tax implications of immediate annuities in the UK?

The income received from an immediate annuity is typically taxed as ordinary income. However, the initial lump-sum payment used to purchase the annuity is not subject to income tax. It’s important to consult with a tax advisor for specific guidance on your situation.

Can I withdraw my lump sum payment from an immediate annuity?

Once you purchase an immediate annuity, you typically cannot withdraw the lump sum payment. This is because the annuity contract guarantees a specific income stream for life. However, there may be limited exceptions depending on the specific terms of the annuity contract.

How do I find a reputable immediate annuity provider in the UK?

You can start by researching reputable financial institutions and annuity providers in the UK. Consider factors like their financial stability, track record, and customer service. It’s also helpful to seek recommendations from trusted financial advisors.