Immediate Annuity Types offer a unique path to secure retirement income, providing a steady stream of payments starting immediately. This guide delves into the different types of immediate annuities, their features, advantages, and disadvantages, helping you understand how they can fit into your financial plan.

Whether you’re seeking guaranteed income, longevity protection, or a way to supplement your existing retirement savings, immediate annuities can be a valuable tool. By understanding the various types available and the factors to consider when choosing one, you can make informed decisions that align with your individual needs and goals.

If you’re looking for information on the current rates for immediate annuities in 2024, check out this article: Immediate Annuity Rates 2024. This article will provide you with an overview of the current market and how rates are being affected by various economic factors.

What are Immediate Annuities?

Immediate annuities are financial products that provide a stream of guaranteed income payments starting immediately after you purchase the annuity. They are often used by retirees to supplement their savings and ensure a steady income stream throughout their retirement years.

Calculator.net is a popular online resource for financial calculations, including annuities. This article: Calculator.Net Annuity 2024 explains how to use Calculator.net’s annuity calculator and how it can help you make informed financial decisions.

Benefits of Immediate Annuities

Immediate annuities offer several benefits for individuals seeking guaranteed income during retirement:

- Guaranteed Income:Immediate annuities provide a guaranteed stream of payments for life, regardless of market fluctuations or longevity.

- Longevity Protection:They offer protection against outliving your savings, ensuring you have a consistent income source even if you live longer than expected.

- Tax Benefits:Annuity payments are typically taxed as ordinary income, but the growth of the principal is tax-deferred until payments begin.

- Simplicity and Convenience:Immediate annuities simplify retirement planning by providing a predictable income stream without the need for ongoing investment management.

Comparing Immediate Annuities with Other Retirement Income Options

Immediate annuities are a valuable retirement income option, but they are not without alternatives. Here’s a comparison with other common retirement income sources:

- Traditional IRAs and 401(k)s:These accounts offer tax-deferred growth but require you to manage your investments and withdraw funds in retirement. Immediate annuities provide guaranteed income, eliminating the need for investment management and ensuring longevity protection.

- Annuities:While immediate annuities provide immediate income, other types of annuities, such as deferred annuities, allow for tax-deferred growth before income payments begin. The choice depends on your time horizon and income needs.

- Social Security:Social Security provides a guaranteed income stream, but it is often insufficient to cover all retirement expenses. Immediate annuities can supplement Social Security benefits and provide a more comprehensive income plan.

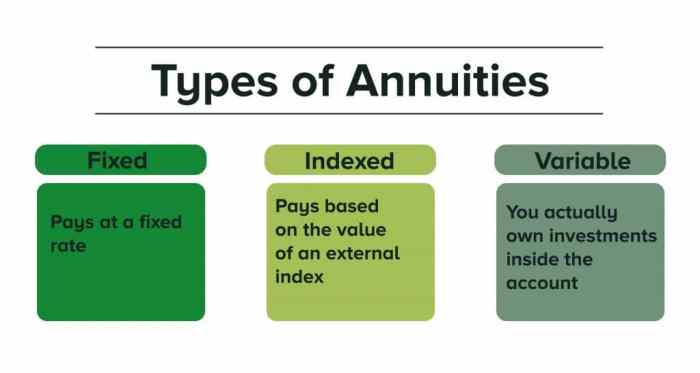

Types of Immediate Annuities

Immediate annuities are categorized based on how the payments are structured and how the investment is managed. The most common types include:

Fixed Immediate Annuities

Fixed immediate annuities provide a guaranteed fixed payment amount for life. The payment amount is determined at the time of purchase and remains unchanged throughout the annuity’s duration. These annuities offer predictability and stability, but they are generally less sensitive to market fluctuations than variable or indexed annuities.

A variable life annuity with a 10-year period certain offers a unique combination of growth potential and guaranteed income. This article: Variable Life Annuity With 10-Year Period Certain 2024 provides insights into the features and benefits of this type of annuity.

Variable Immediate Annuities, Immediate Annuity Types

Variable immediate annuities offer payments that fluctuate based on the performance of the underlying investment portfolio. These annuities allow for the potential for higher returns but also carry the risk of lower payments if the investments underperform. The payment amount is not guaranteed and can vary over time.

An annuity is a financial tool primarily used to provide a steady stream of income. This article: An Annuity Is Primarily Used To Provide 2024 explains how annuities work and how they can be a valuable part of your retirement planning.

Indexed Immediate Annuities

Indexed immediate annuities offer a guaranteed minimum payment amount and the potential for higher returns based on the performance of a specific index, such as the S&P 500. These annuities provide some protection against market downturns while still allowing for growth potential.

The payment amount is typically tied to the index’s performance, with a cap on the maximum return.

A group immediate annuity is a type of annuity offered to groups of individuals, often through an employer or organization. This article: Group Immediate Annuity provides an overview of this type of annuity and its benefits.

Other Types of Immediate Annuities

In addition to the three primary types, other variations of immediate annuities exist, including:

- Joint and Survivor Annuities:These annuities provide payments to two individuals, typically a couple, with the survivor receiving payments after the first individual passes away.

- Period Certain Annuities:These annuities guarantee payments for a specific period, regardless of whether the annuitant is alive or not. After the period expires, payments may continue for life or cease.

- Deferred Income Annuities:These annuities offer payments that begin at a later date, allowing for tax-deferred growth during the deferral period.

Features of Immediate Annuities

Immediate annuities typically offer a variety of features, including:

Payout Options

Immediate annuities provide different payout options to suit individual needs and preferences. These options include:

- Fixed Payments:Receive a guaranteed fixed payment amount for life.

- Variable Payments:Payments fluctuate based on the performance of the underlying investment portfolio.

- Indexed Payments:Payments are tied to the performance of a specific index, such as the S&P 500, with a guaranteed minimum payment amount.

- Lump Sum Payments:Receive a single lump sum payment instead of regular payments.

Death Benefits

Many immediate annuities offer death benefits, which provide a lump sum payment to a designated beneficiary upon the annuitant’s death. The death benefit amount may be based on the original purchase price, the accumulated value, or a combination of both.

If you’re in New Zealand and looking for an annuity calculator, this article: Annuity Calculator Nz 2024 provides a comprehensive guide to finding the right calculator for your needs.

Surrender Charges

Immediate annuities may include surrender charges, which are fees imposed if you withdraw your principal before a specified period. Surrender charges typically decline over time and may be waived under certain circumstances.

If you’re using a TI-84 calculator and want to learn how to calculate an annuity, this article: Calculate Annuity On Ti 84 2024 provides a step-by-step guide to using your calculator for annuity calculations.

Factors to Consider When Choosing an Immediate Annuity

Selecting the right immediate annuity requires careful consideration of various factors:

Age and Health

Your age and health status play a significant role in determining the annuity’s payout amount and the overall cost. Younger individuals with good health may receive higher payments than older individuals with health concerns.

One common question people have about annuities is whether the interest earned is taxable. This article: Is Annuity Interest Taxable 2024 provides a clear explanation of the tax implications associated with annuities.

Financial Goals

Your financial goals, such as income needs, longevity protection, and legacy planning, will influence your choice of annuity type and payout options.

Understanding the difference between an immediate annuity and an annuity due is crucial for making informed financial decisions. This article: Immediate Annuity And Annuity Due explains the key distinctions between these two types of annuities.

Risk Tolerance

Your risk tolerance will determine whether you prefer a fixed annuity with guaranteed payments or a variable annuity with the potential for higher returns but also greater risk.

Interested in the trends of variable annuity sales? This article: Variable Annuity Sales 2019 2024 provides data and insights into the sales performance of variable annuities in recent years.

Consulting with a Financial Advisor

It’s essential to consult with a financial advisor to determine the most suitable annuity type for your specific circumstances. A financial advisor can help you assess your needs, understand the different options, and make an informed decision.

If you have questions about annuities, you’re not alone. This article: Annuity Questions And Answers 2024 addresses some of the most common questions people have about annuities, helping you gain a better understanding of this financial product.

Questions to Ask

When evaluating different immediate annuity options, ask these questions:

- What are the guaranteed payments and how are they calculated?

- What are the investment options and how are they managed?

- What are the death benefits and how are they calculated?

- What are the surrender charges and how long do they apply?

- What are the fees and expenses associated with the annuity?

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer several advantages but also have some potential drawbacks:

Advantages

- Guaranteed Income:Provides a guaranteed stream of payments for life, regardless of market fluctuations or longevity.

- Longevity Protection:Protects against outliving your savings, ensuring a consistent income source even if you live longer than expected.

- Tax Benefits:Annuity payments are typically taxed as ordinary income, but the growth of the principal is tax-deferred until payments begin.

- Simplicity and Convenience:Simplifies retirement planning by providing a predictable income stream without the need for ongoing investment management.

Disadvantages

- Limited Flexibility:Once you purchase an immediate annuity, you typically cannot withdraw your principal or change the payment options without incurring surrender charges.

- Potential for Lower Returns:Fixed immediate annuities offer guaranteed payments but may provide lower returns than investments with higher risk potential.

- Surrender Charges:Surrender charges can significantly reduce your principal if you withdraw your money before a specified period.

Comparing Pros and Cons with Other Retirement Income Options

Immediate annuities offer a balance of advantages and disadvantages compared to other retirement income options. They provide guaranteed income and longevity protection, but they also lack flexibility and may have lower returns than other investment options.

Real-World Examples of Immediate Annuities: Immediate Annuity Types

| Insurance Company | Annuity Type | Features | Benefits | Drawbacks |

|---|---|---|---|---|

| [Insurance Company 1] | Fixed Immediate Annuity | Guaranteed fixed payments for life, no surrender charges | Predictable income stream, no risk of losing principal | May offer lower returns than variable or indexed annuities |

| [Insurance Company 2] | Variable Immediate Annuity | Payments fluctuate based on the performance of the underlying investment portfolio, potential for higher returns | Potential for higher returns, flexibility in investment options | Risk of lower payments if investments underperform, no guaranteed minimum payment |

| [Insurance Company 3] | Indexed Immediate Annuity | Guaranteed minimum payment amount, payments tied to the performance of a specific index, such as the S&P 500 | Potential for higher returns, some protection against market downturns | Returns may be capped, may have higher fees than fixed annuities |

These examples illustrate the variety of immediate annuities available, each with its unique features, benefits, and drawbacks. The suitability of each annuity type depends on individual circumstances, such as age, health, financial goals, and risk tolerance.

Want to know more about the potential returns you can expect from an annuity in 2024? This article: 7 Annuity Return 2024 delves into the factors influencing annuity returns and provides insights into what you can potentially gain.

Final Wrap-Up

Immediate annuities offer a compelling solution for those seeking a reliable income stream in retirement. While they may not be the right fit for everyone, their potential benefits, including guaranteed payments and tax advantages, make them a worthy consideration. By carefully weighing the pros and cons and consulting with a financial advisor, you can determine if an immediate annuity can play a role in your retirement planning strategy.

If you’re approaching your 70 1/2 birthday in 2024, you might be considering an annuity. This article: Annuity 70 1/2 2024 discusses the benefits and considerations of annuities for those nearing retirement age.

User Queries

What are the tax implications of immediate annuities?

Are you considering a variable annuity loan in 2024? This article: Variable Annuity Loan 2024 explores the nuances of this financial tool, helping you understand the potential benefits and drawbacks.

The tax treatment of immediate annuities depends on the type of annuity. Generally, the payments received from an immediate annuity are taxed as ordinary income, while the principal amount is not taxed until it is withdrawn.

Inherited a variable annuity in 2024? You’re not alone. This article: I Inherited A Variable Annuity 2024 can guide you through the process of understanding and managing this type of inherited asset.

How do I choose the right immediate annuity for my needs?

Choosing the right immediate annuity requires careful consideration of your age, health, financial goals, and risk tolerance. It’s essential to consult with a financial advisor who can help you assess your options and make informed decisions.

What are the risks associated with immediate annuities?

While immediate annuities offer guaranteed income, they also carry some risks, such as potential for lower returns than other investments, limited flexibility, and surrender charges. It’s crucial to understand these risks before making a decision.