Immediate Annuity Singapore offers a unique way to secure a guaranteed income stream throughout retirement. These annuities provide a steady stream of payments for life, offering peace of mind and financial stability during your golden years. Whether you’re looking to supplement your existing retirement savings or create a reliable income source, immediate annuities can be a valuable tool for achieving your financial goals.

The tax implications of variable annuities can be complex, especially when it comes to distributions. Variable Annuity Distribution Taxation 2024 explains how taxes are applied to different types of annuity withdrawals, which can help you plan for future income and minimize your tax burden.

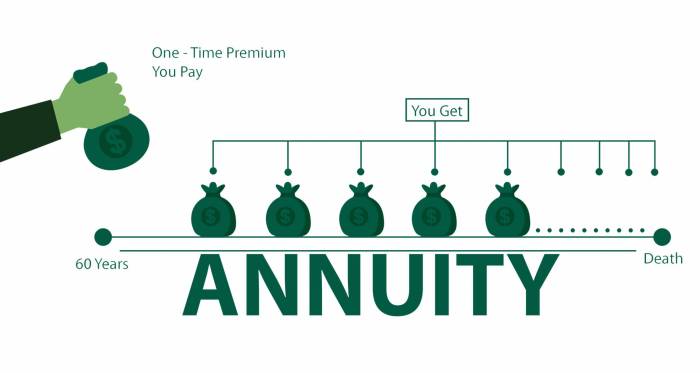

Immediate annuities function by converting a lump sum of money into a regular income stream. This income can be fixed or variable, depending on the type of annuity you choose. With a fixed annuity, you receive a guaranteed payment amount for life, while a variable annuity offers the potential for higher returns but also carries a greater risk.

Staying informed about the latest annuity developments is essential. Annuity News 2024 offers up-to-date news and insights on the annuity market, helping you make informed decisions about your financial future.

Indexed annuities offer a blend of both, with a minimum guaranteed return tied to the performance of a specific index, such as the S&P 500.

Variable annuities can be a complex investment, but understanding their workings is crucial. Understanding Variable Annuities 2024 provides a comprehensive guide to these annuities, explaining their features, risks, and potential benefits.

Introduction to Immediate Annuities in Singapore

Immediate annuities are a type of financial product that provides a guaranteed stream of income for life. In Singapore, immediate annuities are becoming increasingly popular as individuals look for ways to secure their retirement income. This article will provide a comprehensive overview of immediate annuities in Singapore, covering their features, benefits, risks, and how to choose the right provider.

While annuities and life insurance share similarities, they serve different purposes. Is Annuity The Same As Life Insurance 2024 breaks down the key differences between these financial products, helping you understand which option is right for you.

What are Immediate Annuities?

An immediate annuity is a contract between an individual and an insurance company. The individual makes a lump-sum payment to the insurance company in exchange for a guaranteed stream of income payments that begin immediately. The amount of the income payments is determined by factors such as the size of the lump-sum payment, the individual’s age, and the chosen payout option.

To understand the potential benefits of an annuity, it’s helpful to see how it works in practice. Calculate Annuity Example 2024 provides a clear illustration of how annuity payments are calculated, showing you the potential income you could receive.

These annuities are particularly beneficial for those seeking guaranteed income streams and longevity protection, as they provide a consistent income stream for life, regardless of how long the individual lives.

If you need a guaranteed stream of income immediately, an immediate care annuity may be a good option. Immediate Care Annuity Just provides details on how these annuities work and the benefits they can offer, such as a fixed monthly payment for life.

Key Features and Benefits of Immediate Annuities

- Guaranteed Income Stream:Immediate annuities provide a guaranteed stream of income for life, regardless of market fluctuations or investment performance. This offers peace of mind and financial security, especially during retirement.

- Longevity Protection:Immediate annuities protect individuals against outliving their assets. Even if they live longer than expected, they will continue to receive income payments for the rest of their lives.

- Potential Tax Advantages:In Singapore, immediate annuity payments may be taxed differently than other types of income. This can result in tax savings for individuals who choose this type of retirement income solution.

Real-Life Scenarios

Immediate annuities can be beneficial in various real-life scenarios. For instance, an individual retiring with a lump-sum savings could choose to purchase an immediate annuity to secure a stable income stream. Alternatively, someone with a large inheritance could use a portion of the inheritance to purchase an immediate annuity to supplement their existing retirement savings.

Annuity and perpetuity are both financial concepts, but they differ in their payment structure. Annuity Vs Perpetuity 2024 provides a clear explanation of the differences between these two concepts, helping you understand their respective benefits and drawbacks.

Types of Immediate Annuities in Singapore

There are several types of immediate annuities available in Singapore, each with its own features, risks, and potential returns. Understanding the different types is crucial for choosing the right annuity for your individual needs and risk tolerance.

While annuities are often associated with retirement, they can be beneficial at any age. Annuity 9 2024 explores how annuities can work for individuals even in their early 20s, providing a way to save for future goals.

Types of Immediate Annuities

| Annuity Type | Features | Risks | Potential Returns |

|---|---|---|---|

| Fixed Annuities | Guaranteed fixed income payments for life. | Low potential for growth. | Stable, predictable income stream. |

| Variable Annuities | Income payments fluctuate based on the performance of underlying investments. | Higher risk of losing principal. | Potential for higher returns. |

| Indexed Annuities | Income payments linked to the performance of a specific index, such as the S&P 500. | Limited upside potential. | Potential for growth with downside protection. |

Factors to Consider When Choosing an Immediate Annuity

Choosing the right immediate annuity requires careful consideration of several factors, including your age, health, financial goals, and risk tolerance. It’s also crucial to understand the terms and conditions of the annuity contract, including the payout options, surrender charges, and death benefits.

The 59.5 rule applies to early withdrawals from certain retirement accounts, including annuities. Annuity 59.5 Rule 2024 explains the details of this rule and the potential tax penalties associated with early withdrawals, helping you avoid costly mistakes.

Key Considerations

- Age and Health:Your age and health status can significantly impact the amount of income you receive from an immediate annuity. Younger and healthier individuals typically receive higher payments.

- Financial Goals:Determine your retirement income needs and how an immediate annuity can help you achieve those goals. Consider factors like your desired lifestyle, living expenses, and any other financial obligations.

- Risk Tolerance:Assess your risk tolerance before choosing an annuity type. Fixed annuities offer guaranteed income but limited growth potential, while variable annuities offer higher potential returns but also carry higher risk.

Understanding the Annuity Contract

- Payout Options:Different payout options are available, such as a fixed monthly payment, a single lump-sum payment, or a combination of both. Choose the option that best suits your needs.

- Surrender Charges:Some annuity contracts include surrender charges, which are penalties imposed if you withdraw your funds before a certain period. Carefully review the surrender charge structure before purchasing an annuity.

- Death Benefits:Consider the death benefit provisions of the annuity contract. Some annuities provide a death benefit to your beneficiaries if you pass away before the annuity payments have been fully received.

Questions to Ask Annuity Providers

- What are the fees associated with the annuity?

- What are the payout options available?

- What are the surrender charges and how long do they apply?

- What is the death benefit provision?

- What is the financial strength of the annuity provider?

Benefits of Immediate Annuities in Singapore

Immediate annuities offer several benefits for individuals in Singapore, particularly those seeking guaranteed income for life, protection against inflation, and potential tax advantages. They can be a valuable tool for achieving retirement planning goals and ensuring financial security in later years.

Specific Benefits

- Guaranteed Income for Life:Immediate annuities provide a guaranteed stream of income for life, regardless of market fluctuations or investment performance. This provides peace of mind and financial security, especially during retirement.

- Protection Against Inflation:Some immediate annuities offer inflation protection, which helps to ensure that your income keeps pace with rising prices over time. This is particularly important for individuals who are concerned about the long-term impact of inflation on their purchasing power.

- Potential Tax Advantages:In Singapore, immediate annuity payments may be taxed differently than other types of income. This can result in tax savings for individuals who choose this type of retirement income solution.

Retirement Planning Goals

- Ensuring a Stable Income Stream:Immediate annuities can provide a stable and predictable income stream, which can be essential for covering essential expenses during retirement.

- Supplementing Existing Retirement Savings:Immediate annuities can supplement existing retirement savings, providing additional income to help individuals maintain their desired lifestyle.

- Protecting Against Outliving Assets:Immediate annuities protect individuals against outliving their assets. Even if they live longer than expected, they will continue to receive income payments for the rest of their lives.

Hypothetical Case Study, Immediate Annuity Singapore

Imagine a Singaporean individual, Mr. Tan, who is retiring with a lump-sum savings of S$500,000. Mr. Tan wants to ensure a stable income stream for his retirement and protect himself against outliving his assets. He decides to purchase an immediate annuity with a portion of his savings, which provides him with a guaranteed monthly income of S$3,000 for life.

Knowing how to calculate your monthly annuity payments can help you make informed financial decisions. Calculating Monthly Annuity 2024 outlines the factors involved in calculating your monthly income, giving you a better understanding of your future financial security.

This income stream allows Mr. Tan to cover his essential expenses and enjoy a comfortable retirement, without worrying about running out of money.

Risks Associated with Immediate Annuities

While immediate annuities offer several benefits, it’s essential to be aware of the potential risks associated with them. These risks should be carefully considered before making a decision about purchasing an annuity.

Variable annuities offer the potential for growth, but they also come with risks. Variable Annuities Have 2024 explores the key risks associated with these annuities, including market volatility and the potential for loss of principal.

Potential Risks

- Lower Returns Compared to Other Investment Options:Immediate annuities typically offer lower returns compared to other investment options, such as stocks or mutual funds. This is because the income payments are guaranteed, limiting the potential for growth.

- Risk of Outliving the Annuity Payout:If you live longer than expected, you may outlive the annuity payout. This means that you may run out of income before you die, especially if you have chosen a shorter payout period.

- Impact of Interest Rate Changes:Interest rate changes can affect the value of an annuity. If interest rates rise, the value of your annuity may decrease, potentially reducing the amount of income you receive.

Finding the Right Immediate Annuity Provider in Singapore: Immediate Annuity Singapore

Choosing the right immediate annuity provider is crucial for ensuring that you receive the best possible value and service. It’s essential to compare different providers and their offerings based on factors such as fees, payout options, and customer service.

Nationwide is a well-known provider of annuities, offering a variety of options to suit different needs. Nationwide Immediate Annuity Quote provides information on how to get a personalized quote from Nationwide, allowing you to compare their rates and find the best option for you.

Finding Reputable Providers

- Research and Compare:Research different annuity providers in Singapore and compare their offerings, fees, and payout options. Look for providers with a strong track record of financial stability and customer satisfaction.

- Seek Professional Advice:Consult with a qualified financial advisor to discuss your specific needs and get personalized recommendations for immediate annuity providers.

- Check for Ratings and Reviews:Check for independent ratings and reviews of annuity providers to get insights into their performance and reputation.

Resources and Tools

- Financial Industry Regulatory Authority (FINRA):FINRA provides information and resources for investors, including information about annuity products and providers.

- MoneySmart:MoneySmart is a Singapore-based financial comparison website that provides information and tools for comparing annuity products from different providers.

Final Conclusion

Choosing the right immediate annuity can significantly impact your retirement planning. It’s crucial to carefully consider your financial situation, risk tolerance, and long-term goals. Consulting with a qualified financial advisor can provide valuable insights and help you navigate the complexities of annuity selection.

Variable annuities can offer a way to grow your retirement savings, but it’s important to understand the potential risks and benefits before investing. Variable Annuity Pros And Cons 2024 provides a good overview of the advantages and disadvantages to help you decide if this type of investment is right for you.

By understanding the benefits, risks, and different types of immediate annuities available in Singapore, you can make an informed decision that aligns with your retirement aspirations and secures a comfortable future.

General Inquiries

What are the tax implications of immediate annuities in Singapore?

Immediate annuities are generally not subject to income tax in Singapore. However, it’s important to consult with a tax advisor to ensure you understand the specific tax implications of your chosen annuity product.

Annuity options can vary depending on your age and financial goals. Annuity 65 2024 delves into the specific features and considerations for individuals turning 65, helping you find the best annuity solution for your needs.

How do I find a reputable immediate annuity provider in Singapore?

Start by researching reputable financial institutions and insurance companies that offer immediate annuities. You can also seek recommendations from trusted financial advisors or consult with the Monetary Authority of Singapore (MAS) for guidance.

What are the surrender charges associated with immediate annuities?

Surrender charges are fees you may have to pay if you withdraw from your annuity before a certain period. These charges can vary depending on the annuity provider and the terms of your contract. Make sure to carefully review the terms and conditions before making a decision.

What happens to my annuity payments if I pass away?

Most immediate annuities offer a death benefit, which means a lump sum payment will be made to your beneficiary upon your death. The specific amount of the death benefit may vary depending on the type of annuity and the terms of your contract.