Immediate Annuity Settlement Options offer a powerful way to secure your retirement income, providing a steady stream of payments for life. This article delves into the various options available, allowing you to choose the best fit for your unique circumstances and financial goals.

Retirement planning often involves understanding RMDs, or Required Minimum Distributions. Variable annuities are subject to RMDs, which can impact your tax liability in retirement. For information on RMDs and variable annuities in 2024, visit Rmd Variable Annuity 2024.

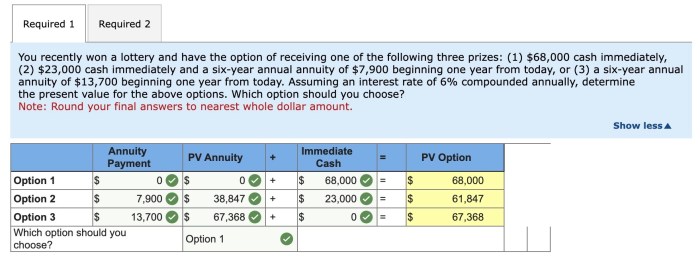

Whether you prefer a lump sum payout, fixed monthly payments, or a lifetime income stream, understanding your options is crucial for making informed decisions about your retirement funds.

An immediate needs annuity can provide a guaranteed stream of income to meet essential expenses, particularly during a time of financial uncertainty. This type of annuity is often used to cover immediate needs like housing, food, and medical bills. For more information, visit An Immediate Needs Annuity.

We’ll explore the benefits and drawbacks of each settlement option, including the impact of factors like age, health, and investment goals. By carefully considering these factors, you can choose the settlement option that aligns with your retirement plans and provides the financial security you desire.

Immediate annuities can play a role in estate planning, as they can provide a guaranteed income stream for beneficiaries after your passing. This can be a valuable strategy for ensuring financial security for loved ones. For more information, visit Immediate Annuity Estate.

Immediate Annuities

An immediate annuity is a type of insurance contract that provides a guaranteed stream of income payments, starting immediately after the purchase. This type of annuity is often used by retirees or individuals seeking a reliable source of income. Immediate annuities are known for their predictable cash flows and the potential to provide financial security in retirement.

Federal employees have unique options for retirement planning, including immediate annuities. These annuities can provide a guaranteed income stream for life, offering financial security after leaving government service. Discover more about immediate annuities for federal employees at Immediate Annuity Federal Employee.

What is an Immediate Annuity?

An immediate annuity is a type of insurance contract that provides a guaranteed stream of income payments, starting immediately after the purchase. The payments can be made for a fixed period, for the life of the annuitant, or for a combination of both.

Variable annuities are subject to market volatility, which can impact their value. Hedging strategies can help mitigate potential losses. For information on hedging strategies for variable annuities in 2024, visit Variable Annuity Hedging 2024.

Immediate annuities are often used by retirees or individuals seeking a reliable source of income. They are also popular with those who want to protect their principal from market risk. This is because the payments are guaranteed by the insurance company, regardless of how the market performs.

While annuities offer tax-deferred growth, the income generated from them is typically taxable in retirement. However, certain types of annuities may offer tax-exempt features. For a comprehensive understanding of annuity taxation, visit Is Annuity Exempt From Tax 2024.

Key Characteristics of Immediate Annuities

- Guaranteed Income Payments:Immediate annuities provide a guaranteed stream of income payments, regardless of how the market performs.

- Immediate Payment Commencement:Payments begin immediately after the purchase of the annuity.

- Variety of Payment Options:Immediate annuities offer a range of payment options, such as lump sum, fixed payments, life income, and more.

- Potential for Tax Advantages:Some immediate annuities offer tax advantages, such as tax-deferred growth or tax-free income.

Difference Between Immediate and Deferred Annuities

The key difference between immediate and deferred annuities lies in the timing of the income payments. While immediate annuities start paying out immediately after purchase, deferred annuities have a delay before payments begin.

Edward Jones, a well-known financial services firm, offers annuity calculators to help you estimate potential payouts and explore different annuity options. These calculators can be valuable tools for planning your retirement in 2024. For more information, visit Annuity Calculator Edward Jones 2024.

Deferred annuities are often used by individuals who are still working and want to save for retirement. They allow individuals to accumulate funds over time and then begin receiving income payments later in life.

Medicaid eligibility can be impacted by assets, including annuities. Understanding how immediate annuities might affect your Medicaid eligibility is crucial for long-term care planning. For more information on immediate annuities and Medicaid, visit Immediate Annuity Medicaid.

Benefits of Choosing an Immediate Annuity

- Guaranteed Income:Provides a reliable source of income, eliminating the risk of outliving your savings.

- Protection from Market Risk:The payments are guaranteed by the insurance company, regardless of market fluctuations.

- Financial Security:Offers peace of mind knowing that you have a steady income stream.

- Flexibility:Provides various payment options to suit individual needs and financial goals.

- Potential Tax Advantages:Some annuities may offer tax benefits, such as tax-deferred growth or tax-free income.

Settlement Options for Immediate Annuities

Immediate annuities offer a variety of settlement options, allowing you to choose how you want to receive your payments. The settlement option you choose will impact the amount of your payments and the duration of the income stream.

Immediate annuities can provide regular income payments, and some offer the flexibility of quarterly payments. This can be beneficial for managing cash flow and budgeting expenses. Learn more about immediate annuities with quarterly payments at Immediate Annuity With Quarterly Payments.

Comparing Settlement Options

| Settlement Option | Description | Payment Amount | Duration |

|---|---|---|---|

| Lump Sum | Receive the entire annuity value in a single payment. | Full annuity value. | One-time payment. |

| Fixed Payments | Receive regular payments for a fixed period. | Predetermined amount. | Specific number of years or months. |

| Life Income | Receive payments for the rest of your life. | Based on your age, health, and other factors. | Until your death. |

| Joint Life | Receive payments for the lifetime of two individuals. | Based on the ages and health of both individuals. | Until the last surviving individual dies. |

| Period Certain | Receive payments for a minimum period, even if you die before the period ends. | Based on the chosen period. | Minimum guaranteed period, followed by lifetime payments if you live longer. |

Factors to Consider When Choosing a Settlement Option

Choosing the right settlement option for your immediate annuity is crucial. Here are some factors to consider:

- Age and Health:If you are younger and in good health, you might prefer a life income settlement to maximize your lifetime payments.

- Investment Goals:If you need a lump sum for a specific investment, choosing a lump sum settlement might be suitable.

- Risk Tolerance:Those with a higher risk tolerance might prefer a lump sum settlement, while those who prefer a guaranteed income stream might choose a fixed payment or life income option.

- Financial Needs:Your financial needs and lifestyle will influence your decision. Consider factors like housing expenses, healthcare costs, and other financial obligations.

Lump Sum Settlement

A lump sum settlement allows you to receive the entire annuity value in a single payment. This option offers flexibility and control over how you use the funds.

Understanding how annuities are taxed is essential for making informed financial decisions in 2024. The tax implications of annuities can vary depending on the type of annuity and your individual circumstances. To learn more about annuity taxation, check out How Annuity Is Taxed 2024.

Advantages of a Lump Sum Settlement

- Flexibility:You have complete control over how you use the funds.

- Investment Opportunities:You can invest the lump sum in various assets to potentially grow your wealth.

- Tax Advantages:In some cases, a lump sum settlement may offer tax advantages.

Disadvantages of a Lump Sum Settlement

- Risk of Outliving Your Savings:You could run out of money if you don’t manage the lump sum wisely.

- Investment Risk:If you invest the lump sum and the market performs poorly, you could lose a portion of your savings.

- Lack of Guaranteed Income:You are responsible for managing the lump sum and generating your own income stream.

Examples of How a Lump Sum Settlement Can Be Used

- Pay off Debt:Use the lump sum to eliminate high-interest debt, such as credit card debt or a mortgage.

- Invest in Real Estate:Purchase a rental property or invest in a real estate investment trust (REIT).

- Start a Business:Use the funds to launch a new business venture or expand an existing one.

Fixed Payment Settlement

A fixed payment settlement provides you with regular payments for a predetermined period. The payment amount is fixed and does not fluctuate with market conditions.

Features of a Fixed Payment Settlement

- Guaranteed Payments:The payment amount is fixed and guaranteed for the chosen period.

- Predictability:You know exactly how much income you will receive each month.

- Financial Stability:Provides a predictable income stream, offering peace of mind.

How the Payment Amount is Determined

The payment amount for a fixed payment settlement is determined based on factors like the annuity value, the chosen period, and the interest rate.

Understanding the annuity formula is crucial for anyone pursuing the Jaiib certification in 2024. The formula helps calculate the present value of future payments, essential for evaluating annuity investments. For a detailed explanation of the annuity formula, check out Annuity Formula Jaiib 2024.

Benefits of Choosing Fixed Payments

- Predictable Income:Provides a reliable source of income for a specific period.

- Financial Planning:Makes it easier to budget and plan for future expenses.

- Protection from Market Volatility:The payment amount is not affected by market fluctuations.

Drawbacks of Choosing Fixed Payments

- Limited Growth Potential:The payments are fixed, so you won’t benefit from potential market gains.

- Inflation Risk:The purchasing power of your payments may decline over time due to inflation.

- Limited Flexibility:You cannot adjust the payment amount or period once you choose a fixed payment settlement.

Life Income Settlement

A life income settlement provides you with payments for the rest of your life. The payment amount is based on factors like your age, health, and the chosen payment option.

Variable annuities can be incorporated into pension plans, providing additional investment options for retirement savings. This can be particularly relevant in 2024, as individuals seek to maximize their retirement income potential. For more details on variable annuities and pension plans, visit Variable Annuity Pension Plan 2024.

Different Variations of Life Income Settlements, Immediate Annuity Settlement Options

- Straight Life:Payments continue for the rest of your life, with no guaranteed minimum period.

- Joint Life:Payments continue for the lifetime of two individuals, typically a couple.

- Period Certain:Payments are guaranteed for a minimum period, even if you die before the period ends. If you live longer than the guaranteed period, payments continue for the rest of your life.

How the Payment Amount is Calculated

The payment amount for a life income settlement is calculated based on actuarial tables that consider factors like your age, health, and the chosen payment option.

An annuity is essentially a series of equal periodic payments, often used for retirement income. This structured payment system offers predictability and financial stability, making it a popular choice for long-term planning. To learn more about annuities and their structure, visit An Annuity Is A Series Of Equal Periodic Payments 2024.

Advantages of Choosing Life Income

- Lifetime Income:Provides a guaranteed income stream for the rest of your life.

- Protection from Outliving Your Savings:You will receive payments as long as you live.

- Potential for Higher Payments:You may receive higher payments compared to fixed payment options.

Disadvantages of Choosing Life Income

- No Lump Sum:You do not receive a lump sum, so you cannot invest the funds or use them for other purposes.

- Potential for Lower Payments:If you die early, you may not receive the full value of the annuity.

- Limited Flexibility:You cannot change the payment amount or option once you choose a life income settlement.

Risks and Considerations

While immediate annuities offer several benefits, it’s essential to understand the potential risks associated with them.

Potential Risks

- Interest Rate Risk:If interest rates rise after you purchase an annuity, the value of your annuity may decline.

- Inflation Risk:The purchasing power of your payments may decline over time due to inflation.

- Company Risk:If the insurance company issuing your annuity becomes insolvent, you may not receive your payments.

Importance of Understanding the Annuity Contract

Before purchasing an immediate annuity, carefully review the terms and conditions of the annuity contract. Pay attention to factors like the interest rate, the payment options, and any fees or charges.

A 1035 exchange can allow you to transfer funds from one annuity to another without triggering a tax liability. This can be a useful strategy for variable annuities, especially in 2024. For a deeper understanding of 1035 exchanges, visit Variable Annuity 1035 Exchange 2024.

Seeking Professional Guidance

It’s always advisable to seek professional financial advice before making a decision about purchasing an immediate annuity. A financial advisor can help you understand the various settlement options, assess your risk tolerance, and choose the best option for your individual circumstances.

Inflation is a significant concern for anyone considering a variable annuity, especially in 2024. Variable annuities offer potential for growth but are susceptible to inflation’s eroding effect on returns. Learn more about how inflation impacts variable annuities in 2024 by visiting Variable Annuity Inflation 2024.

End of Discussion: Immediate Annuity Settlement Options

Choosing the right immediate annuity settlement option is a significant decision that can impact your financial well-being for years to come. It’s essential to weigh your individual needs, risk tolerance, and financial goals when making this choice. Seeking professional advice from a financial advisor can provide valuable insights and help you make the most informed decision for your retirement security.

FAQ Explained

What are the tax implications of receiving an immediate annuity?

The tax treatment of annuity payments depends on the type of annuity and how it was purchased. In general, a portion of each payment is considered a return of principal (tax-free) and a portion is considered interest or earnings (taxable).

It’s crucial to consult with a tax advisor to understand the specific tax implications of your annuity.

How do I choose the right annuity provider?

Selecting an annuity provider involves careful research and comparison. Consider factors like financial strength, reputation, customer service, and the range of annuity products offered. It’s essential to work with a reputable provider that offers competitive rates and flexible options.

What are the risks associated with immediate annuities?

Immediate annuities, like any financial product, come with certain risks. These include the risk of outliving your annuity payments, the risk of inflation eroding the purchasing power of your payments, and the risk of the annuity provider failing to meet its obligations.

It’s important to understand these risks before making a decision.