Immediate Annuity Required Minimum Distributions (RMDs) are a crucial aspect of retirement planning, particularly for those seeking guaranteed income streams through immediate annuities. Understanding the rules and regulations surrounding RMDs is essential for maximizing retirement income while fulfilling tax obligations.

Want to know how much income you can expect from an annuity? “How Much Will An Annuity Pay Calculator 2024” provides a helpful tool for estimating your potential annuity payments. How Much Will An Annuity Pay Calculator 2024.

Immediate annuities offer a way to convert a lump sum of savings into a steady stream of income, but RMDs impose minimum withdrawal requirements that can impact your overall retirement strategy. This article delves into the intricacies of immediate annuity RMDs, exploring their calculation, potential tax implications, and effective planning strategies to ensure a smooth and financially secure retirement.

Immediate Annuities

Immediate annuities are a type of insurance product that provides a stream of guaranteed income payments for life, starting immediately after the purchase. Unlike deferred annuities, which allow for investment growth before payouts begin, immediate annuities offer a fixed, guaranteed income stream that can help provide financial security in retirement.

If you’re looking to make a charitable contribution and receive regular payments in return, an Immediate Gift Annuity might be a good option for you.

Types of Immediate Annuities

Immediate annuities come in various forms, each offering different features and payout options. Understanding these variations can help you choose the annuity that best aligns with your retirement income goals and risk tolerance.

An “ordinary annuity” is a common type of annuity where payments are made at the end of each period. “Annuity Is Ordinary 2024” provides insights into the characteristics and calculations associated with this type of annuity. Annuity Is Ordinary 2024.

- Fixed Annuities:These annuities provide a fixed, guaranteed payment amount for life, regardless of market fluctuations. This option offers predictable income, making it suitable for individuals seeking stability and peace of mind.

- Variable Annuities:Unlike fixed annuities, variable annuities offer the potential for growth but also carry investment risk. Payments are tied to the performance of underlying investments, which can fluctuate over time. This option is suitable for individuals seeking the potential for higher returns but willing to accept greater risk.

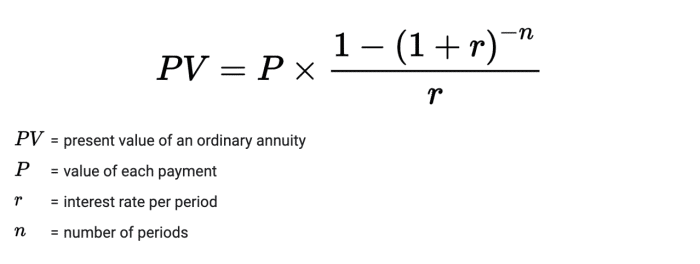

Understanding the formula behind immediate annuities is essential for accurate calculations. “Formula Of Immediate Annuity” provides a detailed breakdown of this important formula. Formula Of Immediate Annuity.

- Indexed Annuities:These annuities offer a combination of fixed and variable features. They provide a guaranteed minimum return linked to a specific index, such as the S&P 500, while also allowing for potential growth based on the index’s performance. This option offers a balance between stability and potential growth, making it attractive to risk-averse individuals who want some exposure to market gains.

Immediate annuities can be a valuable financial tool for individuals who are seeking guaranteed income. “Immediate Annuity And Medicaid” explores how these annuities can be used in conjunction with Medicaid programs. Immediate Annuity And Medicaid.

Advantages of Immediate Annuities

Immediate annuities offer several advantages for retirement income planning:

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, eliminating the risk of outliving your savings.

- Longevity Protection:Immediate annuities offer protection against the risk of living longer than expected, ensuring a consistent income stream throughout retirement.

- Simplified Retirement Planning:Immediate annuities simplify retirement planning by providing a predictable income stream, reducing the need for complex investment management.

- Tax-Deferred Growth:While the initial investment may be subject to taxes, future annuity payments are typically taxed as ordinary income, offering tax-deferred growth potential.

Disadvantages of Immediate Annuities

Despite their benefits, immediate annuities also have some drawbacks:

- Limited Flexibility:Once you purchase an immediate annuity, you generally cannot withdraw the principal or change the payment structure, limiting flexibility.

- Lower Returns:Immediate annuities typically offer lower returns compared to other investment options, especially during periods of market growth.

- Potential for Inflation Risk:Fixed annuity payments are not adjusted for inflation, meaning the purchasing power of your income can decline over time.

Required Minimum Distributions (RMDs): Immediate Annuity Required Minimum Distribution

Required Minimum Distributions (RMDs) are mandatory withdrawals from retirement accounts that must be taken annually starting at age 72. These rules apply to traditional IRAs, 401(k)s, and other qualified retirement plans, including immediate annuities.

Northwestern Mutual is a well-known provider of financial products, including annuities. You can learn more about their variable annuity offerings in “Variable Annuity Northwestern Mutual 2024.” Variable Annuity Northwestern Mutual 2024.

RMDs and Immediate Annuities

RMDs for immediate annuities are calculated based on the annuity’s payout schedule and the annuitant’s age. The amount of the RMD is typically a percentage of the annuity’s value, determined by IRS tables. The RMD for an immediate annuity is typically based on the annuitant’s life expectancy and the annuity’s payout structure.

The RMD for an immediate annuity is typically based on the annuitant’s life expectancy and the annuity’s payout structure. For example, if the annuitant is 75 years old and the annuity’s payout structure is a straight life annuity, the RMD might be calculated based on a life expectancy of 18.6 years, according to the IRS’s Uniform Lifetime Table.

Calculating the present value of an annuity due is a common financial calculation. “Calculate Annuity Due Present Value 2024” offers guidance on how to perform this calculation. Calculate Annuity Due Present Value 2024.

The RMD would be a percentage of the annuity’s value, calculated using the life expectancy factor. The RMD amount will vary based on the individual’s age and the type of annuity purchased. It’s important to note that RMDs are subject to income tax, and failure to withdraw the required amount can result in penalties.

The word “annuity” is a seven-letter word. “Annuity 7 Letters 2024” explores the etymology and history of this financial term. Annuity 7 Letters 2024.

Annuity payments are often viewed as a stream of future income. Understanding the relationship between annuities and future value is essential for informed financial planning. “Annuity Is Future Value 2024” explores this connection in detail. Annuity Is Future Value 2024.

Tax Implications of RMDs, Immediate Annuity Required Minimum Distribution

RMDs from immediate annuities are generally taxed as ordinary income. The tax implications can vary depending on the specific type of annuity and the annuitant’s overall tax situation. It’s crucial to consider the tax implications of RMDs when developing a retirement income strategy.

Are immediate annuities a good investment? “Immediate Annuity Good Or Bad” provides a balanced perspective on the pros and cons of this type of annuity. Immediate Annuity Good Or Bad.

Immediate Annuity RMDs

Calculating RMDs for immediate annuities involves considering factors such as the annuitant’s age, the annuity’s payout structure, and the annuity’s value. The IRS provides tables that Artikel life expectancies based on age, which are used to determine the RMD percentage.

Variable annuities can offer additional income protection through income riders. “Variable Annuity With Income Rider 2024” delves into the benefits and considerations of this type of annuity. Variable Annuity With Income Rider 2024.

The RMD for an immediate annuity is typically based on the annuitant’s life expectancy and the annuity’s payout structure. The RMD for an immediate annuity is typically based on the annuitant’s life expectancy and the annuity’s payout structure. For example, if the annuitant is 75 years old and the annuity’s payout structure is a straight life annuity, the RMD might be calculated based on a life expectancy of 18.6 years, according to the IRS’s Uniform Lifetime Table.

A variable annuity can be either qualified or non-qualified. “Variable Annuity Non Qualified 2024” explains the differences between these two types of annuities. Variable Annuity Non Qualified 2024.

The RMD would be a percentage of the annuity’s value, calculated using the life expectancy factor. The RMD amount will vary based on the individual’s age and the type of annuity purchased. It’s important to note that RMDs are subject to income tax, and failure to withdraw the required amount can result in penalties.

Consequences of Failing to Meet RMD Requirements

Failure to meet RMD requirements for immediate annuities can result in significant penalties. The penalty for failing to withdraw the required amount is 50% of the difference between the required distribution and the amount actually withdrawn. This penalty can be substantial, especially for large annuity values.

Wondering what exactly an annuity is? You can find the answer in this comprehensive guide, “Annuity Is Defined As Mcq 2024”, which provides a clear and concise explanation. Annuity Is Defined As Mcq 2024.

In addition to the penalty, the unpaid RMD is also subject to income tax. It’s crucial to understand and comply with RMD requirements to avoid these penalties.

A 5 Year Variable Annuity 2024 is a type of annuity that offers a guaranteed return for a set period of time. It’s a popular option for investors seeking stability and predictable income.

Final Summary

Navigating the complexities of immediate annuity RMDs requires careful planning and a thorough understanding of the relevant regulations. By taking proactive steps to calculate your RMDs, explore various withdrawal strategies, and consider your individual circumstances, you can maximize your retirement income while ensuring compliance with tax requirements.

Consulting with a financial advisor can provide valuable guidance and support in making informed decisions about your retirement income planning.

Essential Questionnaire

What is the difference between an immediate annuity and a deferred annuity?

An immediate annuity provides income payments immediately upon purchase, while a deferred annuity delays payments until a future date.

Excel is a powerful tool for financial calculations, including annuity calculations. “Calculating An Annuity In Excel 2024” offers a step-by-step guide to help you get started. Calculating An Annuity In Excel 2024.

How do I calculate my RMD for an immediate annuity?

The RMD for an immediate annuity is calculated based on your age and the annuity’s value. The IRS provides tables and formulas to determine the exact amount.

Are there penalties for failing to meet my RMD requirements?

Yes, failure to withdraw the required minimum amount can result in a 50% penalty on the under-distributed amount.

Can I withdraw more than my RMD from an immediate annuity?

Yes, you can withdraw more than your RMD, but doing so may have tax implications. It’s best to consult with a financial advisor to determine the most advantageous withdrawal strategy.

How do I manage RMDs from an immediate annuity in a tax-efficient manner?

Strategies for managing RMDs include withdrawing in low-income years, timing withdrawals to coincide with other income sources, and exploring tax-efficient withdrawal options such as Roth conversions.