Immediate Annuity Rates 2021: Navigating the landscape of immediate annuities can seem daunting, especially considering the ever-changing economic climate. This guide delves into the intricacies of immediate annuities, offering valuable insights for individuals seeking to secure a reliable stream of income during retirement.

If you’re considering a variable annuity, you’ll want to understand the different tax implications. Variable annuity non-qualified stretch is a tax strategy that allows you to defer taxes on your annuity payments. This can be a good option for people who are in a lower tax bracket during retirement.

We’ll explore the factors influencing rates in 2021, the different types of annuities available, and the pros and cons to help you make informed decisions.

There are a number of annuity calculators available online that can help you estimate your potential annuity payments. An annuity calculator with steps can walk you through the process of entering your information and provide you with an estimate of your payments.

This can be a helpful tool for comparing different annuity options.

Understanding the fundamentals of immediate annuities is crucial for anyone planning for retirement. These financial instruments provide a guaranteed stream of income, offering peace of mind in uncertain times. This guide provides a comprehensive overview of the topic, addressing common questions and concerns.

Variable annuities are a type of annuity that offers the potential for growth, but they also come with some risks. Life Incl Variable Annuity (0214) is a specific type of variable annuity that offers a guaranteed death benefit. This means that if you die before your annuity payments run out, your beneficiaries will receive a lump sum payment equal to the guaranteed death benefit.

Immediate Annuities: A Comprehensive Guide

Immediate annuities are a popular financial product that provides a steady stream of income for life. They are often used by retirees to supplement their retirement savings and ensure a secure financial future. In this article, we will explore the key aspects of immediate annuities, including their purpose, types, benefits, and considerations when choosing one.

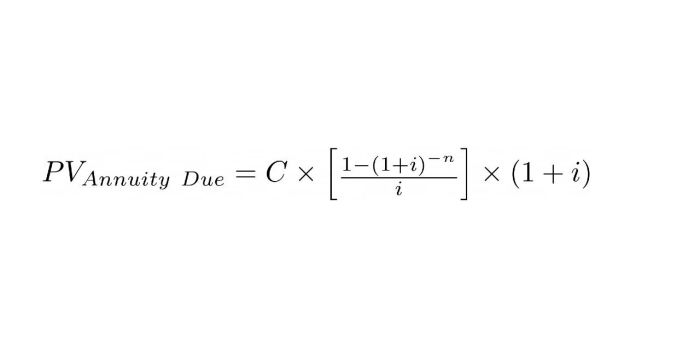

Understanding how annuities work is important before making a decision about whether to purchase one. The annuity formula is a helpful tool for understanding how the different variables affect your annuity payments. The formula takes into account the principal amount, the interest rate, and the number of periods.

Introduction to Immediate Annuities

An immediate annuity is a contract that provides a guaranteed stream of income payments for life, starting immediately upon purchase. These payments can be fixed, variable, or indexed, depending on the type of annuity chosen. The purpose of an immediate annuity is to provide a reliable source of income that is not subject to market fluctuations.

Jackson National Life Insurance Company is a well-known provider of annuities. Jackson Immediate Annuity is a type of immediate annuity that offers a guaranteed stream of income for life. This can be a good option for retirees who are looking for a secure source of income.

Immediate annuities are different from deferred annuities, which provide income payments at a future date. With a deferred annuity, you make contributions over time, and the payments begin at a later date, typically during retirement. Immediate annuities, on the other hand, are purchased with a lump sum, and the payments start immediately.

If you’re considering a variable annuity, you’ll want to understand the pros and cons. Is a variable annuity a good investment? It depends on your individual financial situation and goals. You should also consider your risk tolerance and time horizon before making a decision.

Immediate annuities offer several key features that make them attractive to retirees:

- Guaranteed payments:Immediate annuities provide a guaranteed stream of income for life, regardless of how long you live. This can provide peace of mind and financial security in retirement.

- Potential tax advantages:Annuity payments may be taxed differently than other retirement income, depending on the type of annuity and the individual’s tax situation.

Factors Influencing Immediate Annuity Rates in 2021

The rates offered on immediate annuities are influenced by several factors, including interest rates, inflation, market volatility, and mortality rates. These factors can impact the amount of income you receive from an annuity.

- Interest rates:When interest rates rise, annuity rates tend to increase. This is because insurance companies can earn higher returns on their investments, which allows them to offer higher payouts to annuity holders.

- Inflation:Inflation erodes the purchasing power of money over time. As inflation rises, annuity rates may need to increase to compensate for the loss of purchasing power.

- Market volatility:When the stock market is volatile, annuity rates may be lower. This is because insurance companies are more cautious about investing in the market when it is uncertain.

- Mortality rates:Annuities are based on actuarial tables that predict how long people will live. If mortality rates improve, meaning people are living longer, annuity rates may decline. This is because insurance companies have to pay out benefits for a longer period of time.

Types of Immediate Annuities

There are several different types of immediate annuities available, each with its own features, benefits, and risks. The most common types include:

- Fixed annuities:Fixed annuities provide a guaranteed rate of return for the life of the contract. This means that you will receive a fixed amount of income each month, regardless of how the market performs. Fixed annuities are generally considered to be less risky than variable annuities.

If you’re looking for a more hands-on approach to annuity calculations, you can use an Excel spreadsheet. An annuity calculator XLS can help you understand how the different variables affect your annuity payments. You can also use the spreadsheet to track your annuity payments and see how your investment is performing over time.

- Variable annuities:Variable annuities invest your money in a portfolio of stocks, bonds, or other assets. The amount of income you receive each month will vary depending on the performance of the underlying investments. Variable annuities have the potential for higher returns than fixed annuities, but they also carry more risk.

Annuity calculations can be complex, but there are tools available to help you understand the basics. The PV annuity of 1 table can be used to calculate the present value of an annuity, which is the amount of money you would need to invest today to receive a certain stream of payments in the future.

- Indexed annuities:Indexed annuities offer a guaranteed minimum rate of return, but they also have the potential to earn higher returns based on the performance of a specific index, such as the S&P 500. Indexed annuities provide a balance between the security of a fixed annuity and the potential growth of a variable annuity.

If you’re familiar with Microsoft Excel, you can use it to calculate annuity payments. Annuity in Excel is a useful tool for understanding the different variables that can affect your annuity payments. You can also use Excel to track your annuity payments and see how your investment is performing over time.

Considerations When Choosing an Immediate Annuity

When choosing an immediate annuity, there are several factors to consider, including your age, health, and financial goals. You should also carefully review the terms and conditions of the annuity contract.

If you’re looking for an annuity that can provide you with a guaranteed stream of income, you may want to consider an immediate annuity. The best immediate annuity for you will depend on your individual financial situation and goals. You should compare different annuity providers and their rates before making a decision.

- Age and health:Your age and health can affect the amount of income you receive from an annuity. Younger and healthier individuals typically receive lower annuity payments than older and less healthy individuals, as they are expected to live longer.

- Financial goals:Your financial goals will determine the amount of income you need from an annuity. If you are looking for a guaranteed income stream to cover your basic living expenses, you may choose a fixed annuity. If you are seeking a higher potential return, you may consider a variable or indexed annuity.

Microsoft Excel can be a powerful tool for calculating annuity payments. Calculating an annuity in Excel allows you to see how the different variables affect your annuity payments. You can also use Excel to track your annuity payments and see how your investment is performing over time.

- Annuity payment amount and duration:You need to decide how much income you want to receive each month and for how long. You can choose a lump-sum payment or a series of payments over a specific period. The amount of income you receive will depend on the amount of money you invest and the type of annuity you choose.

Variable annuities are a type of annuity that offers the potential for growth, but they also come with some risks. Variable annuity insurance can provide you with a guaranteed death benefit, which means that if you die before your annuity payments run out, your beneficiaries will receive a lump sum payment.

- Annuity contract terms and conditions:It is essential to carefully review the terms and conditions of the annuity contract before you purchase it. Pay attention to factors such as the guarantee period, the surrender charges, and the death benefit provisions.

Pros and Cons of Immediate Annuities

Immediate annuities offer both potential advantages and disadvantages. It is important to weigh these factors carefully before deciding if an immediate annuity is right for you.

An immediate annuity is a type of annuity that begins paying out immediately after you purchase it. The formula for an immediate annuity takes into account the principal amount, the interest rate, and the number of periods. It’s important to note that the interest rate on an immediate annuity is typically lower than the interest rate on a deferred annuity.

- Pros:

- Guaranteed income for life

- Protection from market fluctuations

- Potential tax advantages

- Simplicity and ease of management

- Cons:

- Limited flexibility

- Potential for lower returns compared to other investments

- Surrender charges if you withdraw your money early

- Inflation risk for fixed annuities

Finding and Comparing Immediate Annuity Rates, Immediate Annuity Rates 2021

Finding and comparing immediate annuity rates from different providers can be a time-consuming process. However, there are several resources available to help you find the best options.

Annuity payments are typically guaranteed for life, but the amount of the payment can vary depending on the type of annuity you choose. Whose life expectancy is used when an annuity is written? It depends on the annuity contract. Some annuities are based on the life expectancy of the annuitant, while others are based on the joint life expectancy of the annuitant and their spouse.

- Online annuity calculators:Many websites offer online annuity calculators that allow you to compare rates from different providers. These calculators typically require you to enter information about your age, health, and desired income amount.

- Annuity comparison websites:There are also websites that specialize in comparing annuity rates from multiple providers. These websites can save you time and effort by providing a comprehensive overview of available options.

- Financial advisor:It is also recommended to seek professional advice from a financial advisor. A financial advisor can help you understand the different types of annuities available and recommend the best option for your individual needs and circumstances.

Closing Notes

As you navigate the world of immediate annuities, remember that each individual’s circumstances are unique. Consulting with a financial advisor can help you tailor your retirement planning strategy to meet your specific needs. By understanding the factors that influence annuity rates, the different types available, and the potential benefits and drawbacks, you can make informed decisions that contribute to a secure and comfortable retirement.

FAQ Section: Immediate Annuity Rates 2021

What are the tax implications of immediate annuities?

Variable annuities are a type of investment that can provide you with a stream of income in retirement. Administrative fees are one of the charges you’ll need to consider when deciding if a variable annuity is right for you. These fees can vary depending on the annuity provider, so it’s important to shop around and compare different options.

The tax implications of immediate annuities can vary depending on the type of annuity and the individual’s tax situation. It’s important to consult with a tax professional to understand the specific tax treatment of your annuity.

How do I find a reputable annuity provider?

When selecting an annuity provider, it’s crucial to research their reputation, financial stability, and track record. You can also seek recommendations from trusted financial advisors.

What are the risks associated with immediate annuities?

While immediate annuities offer guaranteed income, they also come with certain risks. For example, the rate of return may be lower than other investments, and you may have limited flexibility in accessing your funds.