Immediate Annuity Plan India 2020 presents a compelling opportunity for individuals seeking a secure and reliable income stream during retirement. This plan offers a guaranteed stream of income, providing peace of mind and financial stability in later years. Immediate annuities have gained popularity in India as a crucial tool for retirement planning, offering a unique blend of financial security and longevity risk mitigation.

This comprehensive guide delves into the intricacies of immediate annuity plans in India, exploring their various types, benefits, and considerations. We’ll examine the regulatory framework, tax implications, and compare immediate annuities with other popular retirement investment options. By understanding the nuances of this financial instrument, individuals can make informed decisions about incorporating immediate annuities into their retirement planning strategies.

Understanding where an annuity fits into your overall financial picture is crucial. Annuity Is Which Account 2024 explores the different types of accounts and how annuities can be a valuable addition to your portfolio.

Introduction to Immediate Annuity Plans in India

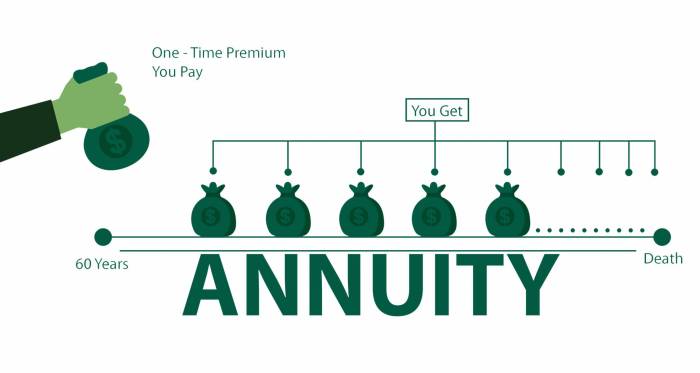

An immediate annuity plan is a type of insurance product that provides a guaranteed stream of income for life, starting immediately after the purchase of the plan. This plan is a popular choice for individuals who are looking to secure their retirement income and protect themselves against the risk of outliving their savings.

Choosing the right annuity issuer is essential for a successful retirement plan. Annuity Issuer 2024 provides insights into key factors to consider when selecting an issuer for your annuity.

In India, immediate annuities have gained traction as a retirement planning tool, offering a reliable source of income during the golden years.

Understanding the Immediate Annuity Factor is crucial when considering an immediate annuity. It’s a key factor that determines the amount of income you’ll receive. This factor is influenced by various factors such as your age, gender, and the interest rate environment.

Concept and Purpose

Immediate annuities are designed to convert a lump-sum amount into a regular income stream. This income stream can be used to cover essential expenses, such as housing, healthcare, and daily living costs, during retirement. The purpose of an immediate annuity is to provide financial security and peace of mind by ensuring a steady source of income throughout retirement, regardless of how long you live.

Annuity payments are a vital part of retirement income. K Is An Annuitant Currently Receiving Payments 2024 sheds light on the experience of annuitants receiving payments and how they navigate their retirement finances.

Key Features and Characteristics

Immediate annuity plans in India come with several key features and characteristics, making them attractive to retirees:

- Guaranteed Income Stream:Immediate annuities offer a guaranteed income stream for life, ensuring a steady flow of income regardless of market fluctuations or personal circumstances.

- Lump-Sum Investment:You make a one-time lump-sum investment to purchase the annuity, and the insurance company then provides a guaranteed income stream for life.

- Flexible Payment Options:Annuity plans offer various payment options, such as monthly, quarterly, or annually, depending on your preferences.

- Tax Benefits:In India, immediate annuity premiums may be eligible for tax deductions under specific provisions, offering potential tax savings.

- Death Benefits:Some plans offer death benefits to your beneficiaries if you pass away before receiving the full value of your annuity. This can provide financial support to your loved ones.

Historical Overview

Immediate annuity plans have been available in the Indian market for several decades. The Life Insurance Corporation of India (LIC), the largest life insurance company in the country, has offered annuity plans since its inception. Over the years, other private insurance companies have entered the market, providing a wider range of annuity options to Indian consumers.

Variable annuities can offer tax advantages, but understanding the Variable Annuity Exclusion Ratio 2024 is crucial. This ratio determines the portion of your annuity payments that is tax-free, allowing you to maximize your after-tax income.

Types of Immediate Annuity Plans

Immediate annuity plans in India are categorized based on the payment structure and features they offer. Here’s a breakdown of the most common types:

Types of Immediate Annuity Plans

| Plan Type | Key Features | Benefits |

|---|---|---|

| Single Premium Immediate Annuity (SPIA) | A single lump-sum payment is made to purchase the annuity, providing a guaranteed income stream for life. | Provides a guaranteed income stream for life, offers a fixed rate of return, and may be eligible for tax deductions. |

| Deferred Annuity | Payments begin at a later date, allowing for a period of accumulation before income payments start. | Provides a higher income stream compared to immediate annuities, offers flexibility in starting the income stream, and may be suitable for those with a longer investment horizon. |

| Variable Annuity | Income payments are linked to the performance of a specific investment portfolio, providing potential for higher returns. | Offers the potential for higher returns, but also carries higher risk due to market fluctuations. |

| Indexed Annuity | Income payments are linked to the performance of a specific index, such as the Sensex or Nifty. | Provides protection against inflation and potential for growth, but returns are capped at a certain percentage. |

Comparing Immediate Annuity Plans

The choice of immediate annuity plan depends on individual circumstances, risk tolerance, and financial goals.

For those seeking to plan for future income, Deferred Variable Annuities 2024 offer a way to build a nest egg. These annuities allow you to accumulate funds over time, which you can then access later in retirement.

- SPIA:Suitable for individuals seeking a guaranteed income stream with a fixed rate of return.

- Deferred Annuity:Ideal for individuals who want to accumulate wealth before starting income payments.

- Variable Annuity:Attractive to individuals with a higher risk appetite seeking potential for higher returns.

- Indexed Annuity:A good option for those seeking inflation protection and potential growth with limited risk.

Benefits of Immediate Annuities

Immediate annuity plans offer several advantages for individuals seeking retirement income security. Here are some of the key benefits:

Guaranteed Income Stream

Immediate annuities provide a guaranteed income stream for life, ensuring a reliable source of income during retirement. This eliminates the uncertainty of market fluctuations and provides peace of mind. The guaranteed income stream helps retirees plan their expenses and maintain their lifestyle during retirement.

If you’re trying to figure out the right annuity for you, a calculator can be a helpful tool. How To Calculate Annuity On Casio Calculator 2024 guides you through the steps of calculating annuity payments using a Casio calculator.

Protection Against Inflation

Some immediate annuity plans offer inflation protection, which helps to preserve the purchasing power of your income stream over time. This is particularly important in a country like India, where inflation can erode the value of savings over time.

An immediate term annuity is a type of annuity that provides a fixed stream of income for a specific period. Immediate Term Annuity explains the features and benefits of this type of annuity, helping you determine if it’s the right choice for your needs.

Longevity Risk Mitigation

Immediate annuities help mitigate longevity risk, which is the risk of outliving your savings. With an annuity, you receive a guaranteed income stream for life, ensuring that you have a source of income even if you live longer than expected.

Tax Benefits

In India, the premiums paid for immediate annuity plans may be eligible for tax deductions under specific provisions, offering potential tax savings. This can help to reduce your overall tax liability and increase your retirement income.

Factors to Consider Before Investing

Before investing in an immediate annuity plan, it’s crucial to carefully consider several factors to ensure that it aligns with your retirement goals and financial situation.

Essential Considerations

- Age and Health Status:Your age and health status play a significant role in determining the annuity payout. If you are in good health and have a longer life expectancy, you may receive a higher income stream.

- Retirement Goals and Income Needs:Define your retirement goals and calculate your expected income needs. This will help you determine the amount of annuity income you require to meet your expenses.

- Investment Horizon and Risk Tolerance:Consider your investment horizon and risk tolerance. Immediate annuities are generally considered low-risk investments, but they may not provide the same potential for growth as other investment options.

- Financial Situation and Other Assets:Evaluate your overall financial situation and other assets, such as savings, investments, and property. This will help you determine how much you can allocate to an immediate annuity.

- Terms and Conditions:Carefully review the terms and conditions of the annuity contract, including the payment structure, interest rates, and any fees or charges.

- Provider Reputation:Choose a reputable insurance provider with a strong track record of financial stability and customer service.

Choosing the Right Immediate Annuity Plan

Selecting the right immediate annuity plan is crucial to meet your retirement income needs. Here are some tips for evaluating and comparing different annuity plans:

Guidance on Selection

- Compare Rates and Features:Request quotes from multiple insurance providers and compare the rates, payment options, and features offered.

- Consider Inflation Protection:If you are concerned about inflation, choose a plan that offers inflation protection to preserve the purchasing power of your income stream.

- Review Death Benefits:Evaluate the death benefit options offered by different plans. Some plans may offer a lump-sum payment to your beneficiaries if you pass away before receiving the full value of your annuity.

- Seek Professional Advice:Consult with a financial advisor who specializes in retirement planning to discuss your specific circumstances and receive personalized recommendations.

Risks and Considerations

While immediate annuity plans offer several benefits, it’s important to understand the potential risks and limitations associated with them.

Annuitization and Investment Flexibility

Annuitization, the process of converting a lump-sum amount into a guaranteed income stream, can reduce your future investment flexibility. Once you purchase an annuity, you generally cannot access the principal amount, and your income stream is fixed.

USAA offers a range of financial products, including annuities. If you’re a USAA member and considering an immediate annuity, Immediate Annuity Usaa might be a good option to explore. They often offer competitive rates and benefits.

Understanding Terms and Conditions

It’s crucial to carefully read and understand the terms and conditions of the annuity contract before making a purchase. This includes the payment structure, interest rates, fees, and any other restrictions.

To effectively manage your annuity, understanding how to calculate withdrawals is essential. Annuity Withdrawal Calculator 2024 offers insights into using calculators to determine your withdrawal strategy and ensure your annuity income lasts throughout retirement.

Market Volatility

Although immediate annuities provide a guaranteed income stream, they may not offer the same potential for growth as other investment options, such as stocks or mutual funds. If market conditions are favorable, you may miss out on potential gains.

Federal employees have access to a variety of retirement benefits, including annuities. Immediate Annuity Federal Employee delves into the specifics of immediate annuities for federal employees, exploring their advantages and considerations.

Regulatory Framework and Taxation

Immediate annuity plans in India are regulated by the Insurance Regulatory and Development Authority of India (IRDAI). The IRDAI sets guidelines for the operations of insurance companies, including the issuance of annuity plans.

Annuity due is a type of annuity where payments are made at the beginning of each period. Calculating Annuity Due 2024 provides guidance on how to calculate the present and future values of an annuity due, helping you understand its financial implications.

Tax Implications

The tax implications of immediate annuity plans in India vary depending on the specific plan and the tax laws in effect. Here are some general points to consider:

- Premium Deductions:Premiums paid for immediate annuity plans may be eligible for tax deductions under specific provisions of the Income Tax Act.

- Income Taxability:The income received from an immediate annuity is generally taxable as per the applicable income tax slab rates.

Comparison with Other Retirement Products

Immediate annuity plans are just one of many retirement investment options available in India. Here’s a comparison with some popular alternatives:

Comparing Retirement Products, Immediate Annuity Plan India 2020

- Fixed Deposits:Fixed deposits offer a guaranteed return with a fixed maturity period. However, they may not provide adequate protection against inflation and may offer lower returns than other investment options.

- Mutual Funds:Mutual funds offer the potential for higher returns than fixed deposits but carry a higher risk. They may not provide a guaranteed income stream during retirement.

- National Pension Scheme (NPS):NPS is a government-sponsored pension scheme that provides a regular income stream during retirement. It offers tax benefits and a long-term investment horizon.

Case Studies and Examples

Here are some real-life examples of how immediate annuities can be incorporated into retirement planning strategies:

Illustrative Examples

- Scenario 1:A retired teacher, aged 60, has a lump-sum amount of ₹50 lakh. They want to secure a guaranteed income stream to cover their living expenses. An immediate annuity plan could provide them with a monthly income of ₹30,000 for life, ensuring financial security during retirement.

Planning for retirement often involves considering different options. Annuity 400k 2024 explores how an annuity can provide a steady stream of income during retirement, potentially supplementing other sources of income.

- Scenario 2:A retired businessman, aged 65, has a substantial retirement corpus but is concerned about longevity risk. An immediate annuity plan could provide them with a guaranteed income stream, ensuring that they have a source of income even if they live longer than expected.

Variable annuities can offer different investment options, including L shares. Understanding Variable Annuity L Share Cdsc 2024 can help you make informed decisions about your investment strategy.

Future Trends and Developments: Immediate Annuity Plan India 2020

The immediate annuity market in India is expected to continue growing in the coming years. Here are some potential future trends and developments:

Evolving Trends

- Increasing Demand:As India’s population ages and individuals become more aware of retirement planning, the demand for immediate annuities is likely to increase.

- Product Innovation:Insurance companies are expected to introduce new and innovative annuity products to cater to the evolving needs of retirees.

- Technological Advancements:Technology is expected to play a significant role in the annuity market, enabling online distribution, personalized recommendations, and improved customer service.

Ending Remarks

Immediate annuity plans in India offer a valuable tool for individuals seeking to secure their retirement income. By carefully considering their financial goals, risk tolerance, and the specific features of available plans, individuals can make informed decisions to maximize their retirement income and financial well-being.

As the Indian retirement landscape continues to evolve, understanding the benefits and intricacies of immediate annuities is essential for achieving a comfortable and secure retirement.

Quick FAQs

What are the minimum and maximum age limits for purchasing an immediate annuity plan in India?

The minimum and maximum age limits for purchasing an immediate annuity plan may vary depending on the insurance provider. However, typically, the minimum age is 45 years old, and there is no maximum age limit.

Can I withdraw my principal amount invested in an immediate annuity plan?

Once you purchase an immediate annuity plan, you cannot withdraw your principal amount. The plan provides a guaranteed stream of income for life, and the principal amount is used to generate those payments.

If you’re looking for a variable annuity option, the Rava 5 Variable Annuity 2024 might be worth exploring. It’s a popular choice for investors who want to participate in potential market growth while seeking some protection against downside risk.

Are there any tax benefits associated with immediate annuity plans in India?

Yes, immediate annuity plans offer certain tax benefits in India. The premiums paid towards an immediate annuity plan are eligible for tax deductions under Section 80CCC of the Income Tax Act, 1961. However, the income received from an immediate annuity plan is taxable as per your income tax slab.