Immediate Annuity Ka Hindi, a term that often sparks curiosity among individuals seeking secure retirement income, unveils a unique approach to financial planning. This concept, rooted in the idea of guaranteed payments for life, offers a compelling alternative to traditional investments, especially for those seeking predictable and reliable income during their golden years.

Want to simplify your annuity calculations? Annuity Calculator Excel Template 2024 provides a helpful Excel template that can streamline the process. This template can help you estimate future annuity payments and make informed decisions.

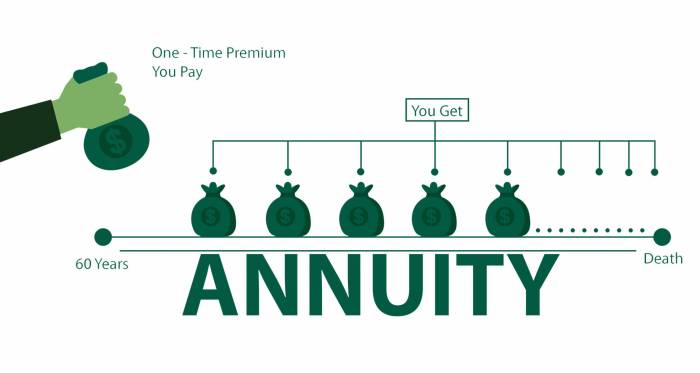

The essence of immediate annuities lies in their ability to transform a lump sum of savings into a steady stream of payments. This can provide peace of mind, knowing that you have a guaranteed income stream, regardless of market fluctuations.

Want to know how to calculate the right annuity for your needs? How To Calculate Annuity Formula 2024 breaks down the formulas used in annuity calculations. It provides step-by-step instructions to help you understand the process.

Whether you’re considering retirement planning, seeking protection against longevity risk, or simply desiring a secure financial foundation, immediate annuities can play a significant role in your overall strategy.

If you’re in the UK and considering an annuity, Calculate Annuity Uk 2024 is a great resource. It offers information on how to calculate annuity payments and understand the UK’s annuity market.

What is an Immediate Annuity?

An immediate annuity is a type of insurance contract that provides a guaranteed stream of income for life, starting immediately after you purchase it. It’s like a retirement savings plan in reverse: you pay a lump sum upfront, and the insurance company promises to pay you a fixed amount of money every month for the rest of your life.

Deciding between a variable annuity and a 401k can be tricky. You can learn more about the differences between these two retirement savings options by checking out Variable Annuity Vs 401k 2024. It offers insights to help you make the best decision for your financial future.

Key Features of an Immediate Annuity

- Guaranteed Income:The most significant feature of an immediate annuity is that it provides guaranteed income for life. You can be sure that you will receive regular payments, regardless of how long you live.

- Fixed Payments:The amount of your monthly payments is determined at the time you purchase the annuity and will not change, unless you choose to change your payment schedule.

- Life Expectancy:The amount of your annuity payments is calculated based on your life expectancy. This means that the longer you live, the more you will receive in total payments.

Examples of How Immediate Annuities Can Be Used in Retirement Planning

- Supplementing Retirement Income:An immediate annuity can provide a reliable source of income to supplement your existing retirement savings, such as your 401(k) or IRA.

- Creating a Guaranteed Income Stream:If you are concerned about running out of money in retirement, an immediate annuity can provide a guaranteed income stream that you can rely on.

- Protecting Against Market Volatility:Immediate annuities offer protection against market volatility. Your annuity payments are guaranteed, regardless of what happens to the stock market.

Immediate Annuity in Hindi

The Hindi translation for “Immediate Annuity” is “तत्काल वार्षिकी” (Tatkal Vaarshiki). It is commonly used in the context of retirement planning and financial security.

Not all variable annuities are created equal. Variable Annuity Non Qualified 2024 explains the specifics of non-qualified variable annuities, including their tax implications and potential benefits.

Key Concepts and Terminology in Hindi

- वार्षिकी (Vaarshiki):This refers to the concept of annuity in general.

- तत्काल (Tatkal):This means “immediate” or “instantaneous.”

- निश्चित भुगतान (Nischit Bhugaatan):This refers to the fixed payments that are guaranteed by the annuity.

- जीवन भर (Jeevan Bhar):This means “for life” and indicates that the payments will continue until the annuitant’s death.

Common Phrases and Expressions in Hindi, Immediate Annuity Ka Hindi

- वार्षिकी खरीदना (Vaarshiki Kharidna):To purchase an annuity.

- वार्षिकी भुगतान (Vaarshiki Bhugaatan):Annuity payments.

- वार्षिकी योजना (Vaarshiki Yojana):Annuity plan.

Benefits of Immediate Annuities

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, eliminating the risk of outliving your savings.

- Tax Benefits:Depending on the type of annuity, some of the payments may be tax-free. This can help to reduce your overall tax burden in retirement.

- Protection Against Market Volatility:Immediate annuities offer protection against market fluctuations, ensuring that your income is not affected by the ups and downs of the stock market.

Potential Drawbacks of Immediate Annuities

- Lack of Flexibility:Once you purchase an immediate annuity, you typically cannot access your principal or change the payment schedule. This can limit your flexibility in retirement.

- Potential for Lower Returns:Immediate annuities may provide lower returns than other investments, such as stocks or bonds. However, they also offer greater security and predictability.

Comparing Immediate Annuities with Other Retirement Income Options

- Traditional Pensions:Traditional pensions provide a guaranteed income stream for life, but they are becoming less common. Immediate annuities can offer a similar level of security and predictability.

- 401(k)s and Roth IRAs:These retirement savings plans offer tax advantages, but they do not provide guaranteed income. Immediate annuities can supplement these accounts by providing a guaranteed income stream.

Types of Immediate Annuities: Immediate Annuity Ka Hindi

- Fixed Annuities:Fixed annuities offer guaranteed payments for life, with a fixed interest rate that is set at the time of purchase. They provide predictable income but may not keep up with inflation.

- Variable Annuities:Variable annuities offer payments that are tied to the performance of a sub-account of investments. They offer the potential for higher returns but also carry more risk.

- Indexed Annuities:Indexed annuities offer payments that are linked to the performance of a specific index, such as the S&P 500. They offer the potential for growth while providing some protection against market downturns.

How to Purchase an Immediate Annuity

- Find a Reputable Insurance Company:Look for a company with a strong financial rating and a good reputation for customer service.

- Compare Quotes:Get quotes from several insurance companies to compare interest rates, payment options, and fees.

- Understand the Terms and Conditions:Carefully review the annuity contract to understand the terms and conditions, including the interest rate, payment options, and death benefit.

Seeking Professional Financial Advice

It is essential to seek professional financial advice before purchasing an immediate annuity. A financial advisor can help you determine if an annuity is right for you and can help you choose the right type of annuity for your needs.

Wondering how a variable annuity can fit into your 401k plan? Variable Annuity 401k 2024 discusses the integration of variable annuities into 401k plans, providing insights into potential benefits and drawbacks.

Factors to Consider When Evaluating an Immediate Annuity

- Interest Rate:The interest rate will determine the amount of your annuity payments.

- Payment Options:Choose a payment option that meets your needs, such as monthly, quarterly, or annually.

- Death Benefit:Some annuities offer a death benefit that will be paid to your beneficiary if you die before receiving all of your payments.

Immediate Annuity in India

Immediate annuities are available in India, but they are not as popular as other retirement income options, such as traditional pensions and mutual funds.

Looking to learn about how a substantial annuity can be structured? Annuity 300 000 2024 delves into the specifics of setting up a large annuity. It covers factors like payment schedules and investment options.

Regulatory Framework and Tax Implications

- Regulatory Framework:Immediate annuities in India are regulated by the Insurance Regulatory and Development Authority of India (IRDAI).

- Tax Implications:The income from an immediate annuity is generally taxable in India. However, there may be tax deductions available for certain types of annuities.

Insurance Companies Offering Immediate Annuities in India

- Life Insurance Corporation of India (LIC):LIC offers a variety of annuity products, including immediate annuities.

- HDFC Life:HDFC Life offers immediate annuities with a variety of payment options.

- ICICI Prudential Life:ICICI Prudential Life offers immediate annuities with guaranteed income for life.

Immediate Annuity: A Case Study

Let’s imagine that a 65-year-old individual, Mr. Sharma, is considering purchasing an immediate annuity to supplement his retirement income. He has a lump sum of ₹10,000,000 that he wants to invest.

Annuity loans can be a useful financial tool, but it’s important to understand the risks involved. Variable Annuity Loan 2024 explains the specifics of variable annuity loans, including interest rates and repayment terms.

Calculating the Annuity Payment

Assuming an interest rate of 6% per annum, Mr. Sharma can expect to receive an annuity payment of approximately ₹60,000 per month for life. This calculation is based on his life expectancy and the interest rate offered by the insurance company.

Sometimes, retirement income is better secured through group arrangements. Group Immediate Annuity Is Also Known As explains the concept of group immediate annuities and how they can provide a reliable income stream for a group of individuals.

Analyzing the Potential Benefits and Risks

- Benefits:Mr. Sharma can be sure of a guaranteed income stream for life, providing him with financial security in retirement. The annuity payments will not be affected by market fluctuations.

- Risks:The interest rate offered by the annuity may be lower than the returns he could potentially earn from other investments. He also loses access to the principal amount, which could limit his flexibility in retirement.

Implications of Different Payment Options

Mr. Sharma can choose from various payment options, such as monthly, quarterly, or annually. He should select an option that best suits his needs and spending habits.

Understanding present value is essential for making informed financial decisions. Pv Annuity Of 1 Table 2024 explains the concept of present value and provides a table to help you calculate it for annuities.

Impact of Inflation on the Annuity Income

Inflation can erode the purchasing power of his annuity payments over time. He should consider choosing an annuity that offers some protection against inflation, such as an indexed annuity.

Understanding how annuity bonds work is essential for making informed financial decisions. Calculate Annuity Bond 2024 offers valuable information about these bonds, including their potential returns and risks.

Concluding Remarks

In conclusion, immediate annuities offer a compelling option for individuals seeking guaranteed income and financial stability during retirement. While they may not be suitable for everyone, they can be a valuable tool for those prioritizing predictability and peace of mind.

If you’re a federal employee looking for retirement income, Immediate Annuity Federal Employee provides details about immediate annuities. These annuities can offer a guaranteed stream of income upon retirement.

By carefully considering your individual circumstances, financial goals, and risk tolerance, you can determine if an immediate annuity is the right choice for your retirement journey.

Question Bank

What are the tax implications of immediate annuities in India?

Curious about what a variable annuity is and how it works? What’s Variable Annuity 2024 gives you a clear and concise explanation. It’s a valuable resource for understanding the basics of this type of retirement savings.

The tax implications of immediate annuities in India vary depending on the type of annuity and the individual’s tax bracket. It’s important to consult with a financial advisor to understand the specific tax implications for your situation.

If you’re looking to ensure your loved ones are taken care of after you’re gone, understanding Variable Annuity Beneficiary 2024 is crucial. This aspect of variable annuities allows you to name a beneficiary who will receive the remaining funds upon your passing.

How can I find a reputable insurance company offering immediate annuities in India?

You can research and compare different insurance companies that offer immediate annuities in India by looking at their websites, reading customer reviews, and seeking recommendations from financial advisors.

What are the risks associated with immediate annuities?

One of the main risks associated with immediate annuities is that the interest rate may be lower than other investment options. Additionally, you may not have access to your principal amount once you purchase an immediate annuity.

Understanding the features of a variable annuity is key to making an informed investment decision. Variable Annuity Features 2024 offers a comprehensive overview of these features, including investment options, death benefits, and withdrawal provisions.