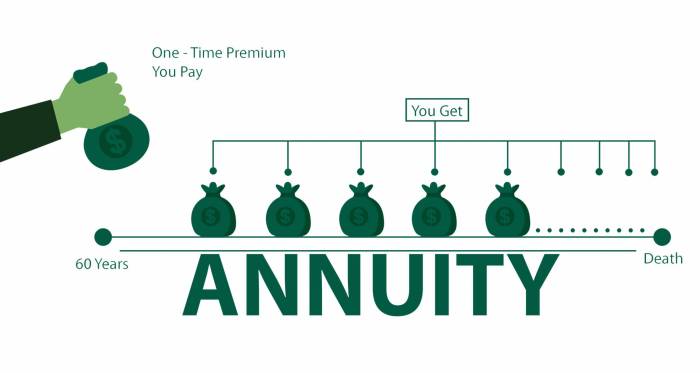

Immediate Annuity Is Also Known As a powerful tool for retirement planning, providing a guaranteed stream of income. This type of annuity, often called a “single premium immediate annuity” or “SPIA,” is purchased with a lump sum payment, and it begins making regular payments to the annuitant immediately.

These payments can be structured to last for a specific period, such as a certain number of years, or for the lifetime of the annuitant.

If you’re using Excel to calculate annuity values, there’s a function called PV that can help you determine the present value of an annuity. You can find more information on Pv Annuity Excel 2024. If you’re looking for a guaranteed monthly income, an annuity that pays out $2,000 per month might be a good option for you.

Check out Annuity 2000 Per Month 2024 to learn more about this type of annuity.

Immediate annuities offer a unique way to convert a lump sum of money into a steady stream of income. This can be especially beneficial for retirees who want to eliminate the risk of outliving their savings. However, it’s important to understand the potential drawbacks, such as the lack of flexibility and the impact of interest rate changes.

Immediate annuities provide guaranteed income payments right away. They are a popular option for retirees who want to ensure a steady stream of income. You can find more information on Immediate Annuity. Annuity is a seven-letter word that describes a financial product designed to provide regular income payments.

You can learn more about Annuity 7 Letters 2024 to see if it’s right for you.

By carefully considering the pros and cons, individuals can determine if an immediate annuity is the right fit for their retirement planning needs.

Immediate Annuity: A Guaranteed Income Stream

An immediate annuity, also known as a single-premium immediate annuity (SPIA), is a financial product that provides a guaranteed stream of income for life. This type of annuity is purchased with a lump sum payment, and payments begin immediately after the purchase is completed.

Unlike other types of annuities, such as deferred annuities, immediate annuities don’t have an accumulation period. This means that you don’t have to wait for your money to grow before receiving payments.

Definition of Immediate Annuity

An immediate annuity is a contract between you and an insurance company where you exchange a lump sum of money for a series of regular payments that begin immediately. These payments are guaranteed for life, meaning you’ll receive them regardless of how long you live.

The payments can be structured in various ways, such as monthly, quarterly, or annually, and can be adjusted for inflation.

Other Names for Immediate Annuities

Immediate annuities are often referred to by other names, including:

- Single-premium immediate annuity (SPIA)

- Fixed immediate annuity

- Guaranteed lifetime income annuity

- Life annuity

These terms are used interchangeably with “immediate annuity” because they all describe the same type of product: a contract that provides a guaranteed income stream for life in exchange for a lump sum payment. The term “SPIA” is commonly used because it highlights the fact that the annuity is purchased with a single premium payment.

How Immediate Annuities Work

Purchasing an immediate annuity is a straightforward process. You simply provide the insurance company with a lump sum payment, and they will begin making payments to you according to the terms of the contract. The amount of each payment is determined by several factors, including:

- The size of the lump sum payment

- Your age and gender

- The type of annuity you choose (fixed, variable, or indexed)

- The payment frequency (monthly, quarterly, annually)

- The payment option (life only, joint life, or period certain)

The insurance company uses actuarial tables to calculate the payment amount, taking into account factors such as life expectancy and interest rates. The higher the lump sum payment, the higher the annuity payments will be. Similarly, the younger you are, the longer you are expected to live, and therefore, the lower your payments will be.

Benefits of Immediate Annuities

Immediate annuities offer several benefits, making them an attractive option for retirement planning and income security.

There are many different types of annuities available, and each has its own unique features. For example, a T-C annuity is a type of fixed annuity that offers a guaranteed rate of return. Learn more about T-C Annuity 2024 to see if it’s right for you.

You can also use an annuity value calculator to estimate how much your annuity will be worth in the future. Check out Annuity Value Calculator 2024 to see what your options are.

- Guaranteed income stream:Immediate annuities provide a guaranteed stream of income for life, regardless of market fluctuations or investment performance. This can provide peace of mind and financial security in retirement.

- Protection against longevity risk:Immediate annuities help protect against longevity risk, the risk of outliving your savings. Since payments are guaranteed for life, you won’t run out of money even if you live longer than expected.

- Simplicity and ease of management:Immediate annuities are relatively simple to understand and manage. Once you purchase an annuity, you don’t have to worry about investing or managing your money. The insurance company takes care of everything.

- Tax advantages:Depending on the type of annuity and your tax situation, annuity payments may be taxed differently than other forms of income. Consult with a financial advisor to understand the tax implications of immediate annuities.

Risks and Considerations of Immediate Annuities

While immediate annuities offer many benefits, there are also some risks and considerations to keep in mind.

- Interest rate risk:If interest rates rise after you purchase an annuity, the value of your annuity may decrease. This is because the insurance company may be able to invest your money at a higher rate, reducing the amount they need to pay you in annuity payments.

When choosing a variable annuity, it’s important to consider your investment goals and risk tolerance. There are many different variable annuities available, so it’s important to do your research to find one that meets your needs. Check out What Is The Best Variable Annuity 2024 to learn more about the options available.

- Inflation risk:Annuity payments are typically fixed, meaning they don’t increase with inflation. If inflation is high, your annuity payments may not keep pace with the rising cost of living.

- Lack of flexibility:Once you purchase an immediate annuity, you generally can’t access your money without incurring penalties. This can be a disadvantage if you need to withdraw funds for an emergency or other unexpected expenses.

- Risk of insurer insolvency:Although rare, there is a risk that the insurance company issuing your annuity could become insolvent. This could result in the loss of your annuity payments.

To mitigate these risks, it’s important to choose an annuity from a financially sound insurance company and consider investing in a variable or indexed annuity, which may offer some protection against inflation and interest rate risk.

Types of Immediate Annuities

Immediate annuities come in various types, each with its own features and benefits. The most common types include:

- Fixed immediate annuities:These annuities provide a fixed payment amount for life. The payment amount is determined at the time of purchase and doesn’t change, regardless of market fluctuations.

- Variable immediate annuities:These annuities offer a variable payment amount that is tied to the performance of a specific investment portfolio. The payment amount can fluctuate based on the performance of the underlying investments. This type of annuity offers the potential for higher returns, but also carries a higher risk of losing money.

- Indexed immediate annuities:These annuities offer a guaranteed minimum payment amount and the potential for higher payments based on the performance of a specific index, such as the S&P 500. The payment amount is typically adjusted annually based on the index’s performance, but it’s capped at a certain percentage.

This type of annuity offers a balance between guaranteed income and potential growth.

The best type of immediate annuity for you will depend on your individual needs and risk tolerance. If you are looking for guaranteed income and don’t want to take on any risk, a fixed immediate annuity may be the best option.

An annuity is a financial product that provides a stream of income for a specific period of time. Learn more about Annuity Is Meaning 2024 to understand the basics. Immediate annuities offer guaranteed income payments, but there are some potential drawbacks to consider.

For example, you may not be able to access your principal if you need it. Learn more about Immediate Annuity Disadvantages to see if this type of annuity is right for you.

If you are willing to take on more risk for the potential of higher returns, a variable or indexed immediate annuity may be a better choice.

Annuity payouts can vary depending on a number of factors. For example, if you have a $2 million annuity, your monthly payout will be significantly higher than someone with a $1 million annuity. Find out more about How Much Does A 2 Million Annuity Pay 2024 to get a better idea of your potential income.

Variable annuities have a benefit base that is used to calculate your payments. You can find more information on Variable Annuity Benefit Base 2024.

Immediate Annuities vs. Other Retirement Income Options

Immediate annuities are just one of many retirement income options available. Other options include:

- Pensions:Pensions are guaranteed income streams provided by employers. They are typically based on a formula that takes into account your salary and years of service.

- 401(k)s:401(k)s are employer-sponsored retirement savings plans that allow you to contribute pre-tax dollars to an account that grows tax-deferred. You can withdraw your money after you retire, but you will be subject to taxes on your withdrawals.

- Social Security:Social Security is a government-run retirement program that provides monthly payments to eligible retirees. The amount of your Social Security payments is based on your earnings history.

| Feature | Immediate Annuity | Pension | 401(k) | Social Security |

|---|---|---|---|---|

| Guaranteed income | Yes | Yes | No | Yes |

| Flexibility | Limited | Limited | High | Limited |

| Risk | Low | Low | High | Low |

| Taxation | Taxed as ordinary income | Taxed as ordinary income | Taxed as ordinary income | Taxed as ordinary income |

The best retirement income option for you will depend on your individual circumstances and goals. If you are looking for a guaranteed income stream and don’t want to take on any risk, an immediate annuity or a pension may be a good option.

If you are willing to take on more risk for the potential of higher returns, a 401(k) may be a better choice. Social Security provides a basic level of income for most retirees, but it is not typically enough to live on alone.

Real-World Examples of Immediate Annuities, Immediate Annuity Is Also Known As

Immediate annuities are used in a variety of real-world situations. For example, a retired couple might use an immediate annuity to provide a guaranteed stream of income to cover their living expenses. A single individual might use an immediate annuity to supplement their Social Security payments.

An individual with a large inheritance might use an immediate annuity to create a guaranteed income stream for themselves and their heirs.

It’s important to note that immediate annuities are not a one-size-fits-all solution. The best way to determine if an immediate annuity is right for you is to consult with a financial advisor who can help you understand the risks and benefits of this type of product and determine if it fits into your overall financial plan.

Ultimate Conclusion

Immediate annuities can be a valuable tool for retirement planning, providing a guaranteed income stream that can help individuals and families achieve financial security. While there are risks to consider, such as the potential for lower returns compared to other investments, the benefits of a predictable and reliable income source can be significant.

By carefully evaluating the pros and cons, individuals can make informed decisions about whether an immediate annuity is the right choice for their specific circumstances.

When you purchase an immediate annuity, you receive regular payments right away. The amount of your payout will depend on factors like your age, the amount of your investment, and current interest rates. You can find more information on Immediate Annuity Payout.

If you’re thinking about an annuity in the UK, you’ll want to know if your income will be taxed. Check out Is Annuity Income Taxable In Uk 2024 to learn more.

Expert Answers: Immediate Annuity Is Also Known As

What is the difference between an immediate annuity and a deferred annuity?

An immediate annuity starts making payments immediately after the lump sum is paid, while a deferred annuity delays payments until a later date, often after a specific period or at a certain age.

Variable annuities are a popular retirement savings option, as they offer tax-deferred growth and the potential for higher returns. If you’re considering this option, it’s important to understand the basics, like Variable Annuity Tax Deferred 2024. Variable annuities are not life insurance policies, although they may offer some death benefit features.

To learn more about this, check out Is Annuity A Life Insurance Policy 2024.

How do I choose the right type of immediate annuity?

The best type of immediate annuity depends on your individual needs and circumstances. Consider factors like your risk tolerance, desired payment frequency, and longevity expectations.

Are there any tax implications associated with immediate annuities?

Yes, annuity payments are generally taxed as ordinary income. However, there are some tax-advantaged options available, such as qualified longevity annuity contracts (QLACs).