Immediate Annuity India offers a unique financial solution for individuals seeking guaranteed income during retirement. This type of annuity provides a steady stream of payments starting immediately after purchase, ensuring a reliable source of income for the future. Immediate annuities are particularly appealing to those seeking financial security and peace of mind, as they eliminate the uncertainties associated with market fluctuations and investment risks.

Annuities are often discussed in financial planning, and you might encounter the term “Chapter 9 Annuities”. You can learn more about Chapter 9 Annuities in 2024 and how they work.

In India, immediate annuities are offered by a range of insurance companies and financial institutions, each with its own set of features and benefits. These plans can be tailored to individual needs and preferences, allowing individuals to choose the payment frequency, duration, and amount that best suits their financial goals.

Financial guru Dave Ramsey often shares his views on various financial products, including variable annuities. You can explore Dave Ramsey’s stance on variable annuities in 2024 and see if it aligns with your financial goals.

Whether you are nearing retirement or looking to secure a future income stream for a loved one, understanding the nuances of immediate annuities in India is crucial to making informed financial decisions.

Visual aids can be helpful when understanding financial concepts like annuities. You can find PV annuity charts in 2024 that provide a visual representation of present value calculations.

Immediate Annuities in India

Immediate annuities, also known as fixed annuities, are a type of financial product that provides a guaranteed stream of income for life. They are popular among individuals seeking a reliable source of income during retirement or other life stages. In India, immediate annuities have gained traction as a retirement planning tool and a way to secure a steady income stream.

The BA II Plus calculator is a popular tool for financial calculations, including annuities. If you’re interested in learning how to calculate an annuity using the BA II Plus in 2024 , you can find resources and tutorials online.

This article will delve into the intricacies of immediate annuities in India, covering their workings, advantages, disadvantages, and essential factors to consider before investing.

When considering annuities, it’s essential to factor in your life expectancy. You can explore tools that help you calculate an annuity based on your life expectancy in 2024 and make informed decisions.

What is an Immediate Annuity in India?

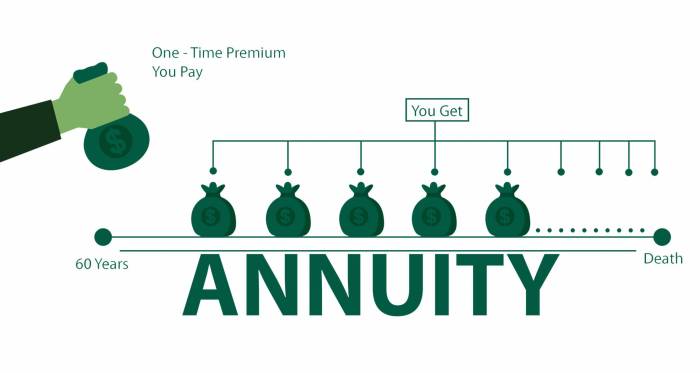

An immediate annuity is a financial product that provides a guaranteed stream of income for life. In simple terms, you make a lump-sum payment to an insurance company or financial institution, and in return, you receive regular payments for the rest of your life.

With the abundance of financial products available, it’s natural to question the legitimacy of specific companies. If you’re considering using Annuity Gator, you might be wondering if Annuity Gator is a legitimate company in 2024.

The amount of the annuity payments is determined by the principal amount you invest, the prevailing interest rates, and the chosen payment frequency. Immediate annuities differ from other investment options in several ways:

- Guaranteed Income:Unlike other investments, immediate annuities offer a guaranteed income stream for life, regardless of market fluctuations.

- Principal Protection:The principal amount invested in an immediate annuity is not subject to market risk, providing a degree of protection against capital loss.

- Longevity Protection:Immediate annuities provide income for the rest of your life, ensuring financial security even if you live longer than expected.

Immediate annuities in India come in various forms, each with its unique features and benefits. Here are some common types:

- Single Premium Immediate Annuity (SPIA):This is the most basic type of immediate annuity, where you make a single lump-sum payment and receive regular payments for life.

- Joint Life Annuity:This type of annuity provides income for two individuals, typically a couple. The payments continue as long as at least one of the annuitants is alive.

- Variable Annuity:Unlike fixed annuities, variable annuities offer the potential for higher returns but also carry a higher level of risk. The annuity payments are linked to the performance of underlying investments.

- Deferred Annuity:In a deferred annuity, payments begin at a later date, allowing you to accumulate a larger sum before starting to receive income.

Immediate annuities offer several advantages, making them an attractive investment option for certain individuals. However, they also come with certain disadvantages. Here’s a balanced perspective:

Advantages

- Guaranteed Income:The most significant advantage is the guaranteed income stream for life, providing financial stability and peace of mind.

- Principal Protection:Immediate annuities protect your principal from market risk, unlike stocks or other investments.

- Longevity Protection:Immediate annuities provide income for the rest of your life, ensuring financial security even if you live longer than expected.

- Tax Benefits:In India, annuity payments are taxed at a lower rate than other income sources, offering tax advantages.

Disadvantages

- Limited Flexibility:Once you purchase an immediate annuity, you cannot access the principal amount. You are locked into the annuity payments for life.

- Lower Returns:Compared to other investment options, immediate annuities generally offer lower returns. However, they provide a guaranteed income stream.

- Inflation Risk:The value of annuity payments may be eroded by inflation over time. However, some annuities offer inflation protection.

How Immediate Annuities Work in India, Immediate Annuity India

Purchasing an immediate annuity in India involves a straightforward process:

- Choose an Annuity Provider:Select a reputable insurance company or financial institution offering immediate annuities.

- Determine Your Annuity Needs:Decide on the type of annuity, the payment frequency, and the desired income amount.

- Provide Necessary Documentation:You will need to provide personal information, medical history, and financial documents.

- Make the Lump-Sum Payment:You will make a lump-sum payment to the annuity provider.

- Receive Annuity Payments:Once the annuity is activated, you will receive regular payments according to the chosen payment frequency.

Annuity payments are calculated based on several factors:

- Principal Amount:The larger the principal amount you invest, the higher the annuity payments.

- Interest Rates:Prevailing interest rates play a significant role in determining annuity payments.

- Payment Frequency:The chosen payment frequency, such as monthly, quarterly, or annually, affects the amount of each payment.

- Annuitant’s Age:Generally, younger annuitants receive lower annuity payments than older annuitants.

- Annuitant’s Gender:In some cases, annuity payments may vary slightly based on gender.

Immediate annuities offer various payment options to suit different needs:

- Lump Sum:You can receive a single lump-sum payment at the start of the annuity period.

- Monthly Installments:You can receive regular monthly payments for life.

- Quarterly or Annual Payments:You can opt for payments at a less frequent interval.

- Increasing Payments:Some annuities offer increasing payments to help keep pace with inflation.

Factors to Consider Before Purchasing an Immediate Annuity

Before making a decision about investing in an immediate annuity, it’s essential to consider several factors:

| Factor | Description |

|---|---|

| Age | Your age plays a significant role in determining the annuity payment amount. Younger annuitants receive lower payments than older annuitants. |

| Health | Your health status can impact the annuity payments. Some annuities offer guarantees for specific health conditions. |

| Financial Goals | Immediate annuities are suitable for individuals seeking a guaranteed income stream for retirement or other life stages. |

| Risk Tolerance | Immediate annuities offer a guaranteed income stream but generally provide lower returns than other investment options. |

Immediate annuities can be a suitable investment option for individuals seeking a guaranteed income stream during retirement or other life stages. However, they may not be appropriate for everyone. Here are some scenarios:

Suitable Scenarios

- Individuals with a high risk aversion who prioritize guaranteed income over potential high returns.

- Individuals seeking to protect their principal from market fluctuations.

- Individuals who want to ensure a steady income stream for the rest of their lives.

Unsuitable Scenarios

- Individuals with a high risk tolerance who are comfortable with market volatility.

- Individuals who need access to their principal amount in the future.

- Individuals seeking a high return on their investment.

It’s crucial to seek professional financial advice before making a decision about investing in an immediate annuity. A financial advisor can help you assess your individual circumstances, understand the risks and benefits of immediate annuities, and determine if they are the right investment for you.

Annuities can be integrated with retirement savings plans like 401(k)s. If you’re curious about annuities within 401(k) plans in 2024 , you can explore the details and potential benefits.

Popular Immediate Annuity Providers in India

Several leading insurance companies and financial institutions offer immediate annuities in India. Here are some prominent providers:

- Life Insurance Corporation of India (LIC):LIC is the largest life insurance company in India and offers a range of annuity plans, including immediate annuities.

- SBI Life Insurance:SBI Life is a joint venture between State Bank of India and BNP Paribas Cardif. They offer various annuity plans, including immediate annuities with different features.

- HDFC Life Insurance:HDFC Life is a leading private life insurance company in India. They offer immediate annuities with flexible payment options and other benefits.

- ICICI Prudential Life Insurance:ICICI Prudential is a joint venture between ICICI Bank and Prudential plc. They provide a range of annuity plans, including immediate annuities with different payout options.

Each provider offers different annuity plans with varying features, benefits, and potential drawbacks. It’s important to compare the different plans available from various providers before making a decision. Consider factors like the interest rate, payment frequency, minimum investment amount, and other terms and conditions.

It’s important to understand the tax implications of annuities, especially when it comes to death benefits. You can explore the question of whether annuity death benefits are taxable in 2024 and how it might affect your financial planning.

When choosing an annuity provider, consider factors like their reputation, track record, customer satisfaction, financial stability, and regulatory compliance. Research the provider’s history, read customer reviews, and ensure they are regulated by the Insurance Regulatory and Development Authority of India (IRDAI).

Wondering about the first payment you’ll receive from an immediate annuity? You can find more information about immediate annuity first payments and how they work.

Tax Implications of Immediate Annuities in India

The tax treatment of immediate annuities in India can be complex. Here’s a summary of the key tax implications:

- Taxability of Annuity Payments:Annuity payments are generally taxed as income in India. The tax rate applicable to annuity payments depends on your overall income bracket.

- Tax Deductions:Certain tax deductions may be available for immediate annuities, depending on the specific plan and your individual circumstances. Consult with a tax advisor for personalized guidance.

- Impact on Overall Return:Tax regulations can affect the overall return on investment for immediate annuities. The tax implications should be factored into your investment decision.

To minimize tax liability related to immediate annuities, consider the following tips:

- Choose a Tax-Efficient Annuity Plan:Explore different annuity plans and select one that offers tax advantages.

- Consult with a Tax Advisor:Seek professional advice from a tax advisor to understand the tax implications of your annuity investment.

- Utilize Available Tax Deductions:Take advantage of any tax deductions available for your annuity investment.

Ending Remarks

Immediate annuities in India provide a valuable tool for individuals seeking a guaranteed income stream during retirement. While they offer several advantages, it is essential to carefully consider the factors Artikeld in this guide before making a decision. By understanding the nuances of immediate annuities, their benefits, and potential drawbacks, individuals can make informed choices that align with their financial goals and risk tolerance.

Consulting with a qualified financial advisor is highly recommended to ensure the best possible outcome for your retirement planning.

Immediate annuities are known for their straightforward structure, but you might be curious about surrender periods. If you’re wondering whether an immediate annuity has a surrender period , you can find the answer here.

Essential Questionnaire: Immediate Annuity India

What is the minimum amount required to purchase an immediate annuity in India?

Variable annuities can sometimes involve surrender charges. If you’re thinking about surrendering a variable annuity in 2024 , it’s wise to understand the potential implications.

The minimum amount required to purchase an immediate annuity in India varies depending on the insurance company and plan chosen. It is generally advisable to consult with an insurance provider to determine the specific minimum investment amount for their plans.

For those who want to delve into the calculations, there are resources available to help you understand how to calculate an annuity using the HP12c calculator in 2024.

How does the interest rate affect the annuity payments?

The interest rate plays a significant role in determining the annuity payments. A higher interest rate generally leads to higher annuity payments. However, it is essential to remember that interest rates can fluctuate over time, potentially impacting the overall return on investment.

Are there any tax benefits associated with immediate annuities in India?

Yes, there are tax benefits associated with immediate annuities in India. Annuity payments are generally taxed as per the individual’s income tax slab. However, the premium paid towards the annuity is eligible for tax deductions under specific provisions of the Income Tax Act.

The concept of present value is fundamental to annuities. You can learn more about how annuities relate to present value in 2024 and how it affects your financial decisions.

When considering annuity payments, you might wonder about the potential income you could receive. If you’re curious about receiving an annuity payment of $1,000 per month in 2024 , you can explore how to achieve that goal.

Variable annuities can offer various investment options, including “O Shares”. If you’re interested in O Share variable annuities in 2024 , you can learn about their features and potential benefits.