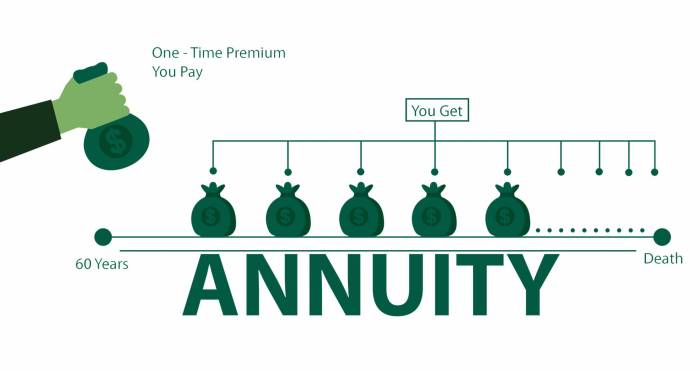

Immediate Annuity Guaranteed, a financial product offering a stream of guaranteed income for life, provides a unique solution for retirement planning. This type of annuity, often purchased with a lump sum, offers a level of security that can alleviate concerns about outliving your savings.

Annuities and IRAs are both popular retirement savings options, but they differ in their features and benefits. To learn more about the key differences between annuities and IRAs, visit Annuity V Ira 2024. This article compares the advantages and disadvantages of annuities and IRAs, helping you choose the retirement savings strategy that best aligns with your financial goals.

By converting a lump sum into a steady stream of income, immediate annuities can offer peace of mind and a predictable financial future.

Calculating annuity payments can be a bit tricky, but there are helpful tools available to simplify the process. To learn how to calculate annuity payments using a calculator, visit How To Calculate Annuity Calculator 2024. This guide provides step-by-step instructions on using an annuity calculator, making it easier to estimate your future income stream.

The decision to purchase an immediate annuity is a significant one, requiring careful consideration of your individual financial circumstances and goals. It’s essential to understand the different types of immediate annuities, their potential advantages and disadvantages, and the role they can play in your overall financial strategy.

The annuity industry offers various job opportunities for professionals with expertise in finance, insurance, and customer service. If you’re considering a career in this field, Annuity Jobs 2024 provides a comprehensive overview of available positions. This resource explores the different roles within the annuity industry, outlining the skills and qualifications needed for success.

What is an Immediate Annuity?

An immediate annuity is a financial product that provides a guaranteed stream of income for life. It’s like a retirement plan where you exchange a lump sum of money for a regular, predictable income stream. Think of it as a way to turn your savings into a reliable paycheck for the rest of your life.

Variable annuities and indexed annuities are two popular types of annuities, each with its own set of advantages and disadvantages. To learn more about the key differences between these two options, check out Variable Annuity Vs Indexed Annuity 2024.

This article compares the features, risks, and potential returns of variable and indexed annuities, helping you make an informed decision based on your individual needs.

How Immediate Annuities Work

Here’s how an immediate annuity works:

- You purchase an immediate annuity with a lump sum of money.

- The insurance company that issued the annuity guarantees you a certain amount of income for life.

- This income can be paid out monthly, quarterly, or annually, depending on your preference.

Types of Immediate Annuities

There are different types of immediate annuities, each with its own features and benefits:

- Single Premium Immediate Annuity (SPIA):This is the most common type of immediate annuity. You make a single lump-sum payment, and the insurance company starts paying you income immediately.

- Fixed Immediate Annuity:This type of annuity provides a guaranteed, fixed income for life. The payments you receive will not change, regardless of market fluctuations.

- Variable Immediate Annuity:This annuity’s payments are linked to the performance of an underlying investment portfolio. The amount of income you receive can fluctuate based on the investment’s performance. This option could potentially provide higher returns, but it also carries greater risk.

Key Features of Immediate Annuities

Immediate annuities offer a range of features, but two stand out:

Guaranteed Income

The most significant advantage of immediate annuities is the guaranteed income for life. This means that regardless of how long you live, you’ll receive a consistent stream of income. It provides peace of mind knowing you’ll have a reliable source of income to cover your living expenses.

Variable annuities often include income riders that can provide additional income guarantees. If you’re interested in learning more about variable annuity income riders, visit Variable Annuity Income Rider 2024. This article explains the different types of income riders available, outlining their features and potential benefits.

Fixed vs. Variable Annuities

Immediate annuities come in two primary flavors: fixed and variable.

Annuity rates can fluctuate over time, impacting the amount of income you receive. To stay informed about current annuity rates, check out Annuity Rates 2021 2024. This resource provides insights into recent annuity rate trends, helping you compare rates from different providers and make informed decisions.

- Fixed Annuities:These annuities provide a guaranteed, fixed income stream for life. The amount of income you receive will not change, regardless of market fluctuations. This offers stability and predictability.

- Variable Annuities:These annuities offer the potential for higher returns but also come with more risk. The payments you receive are linked to the performance of an underlying investment portfolio. If the market performs well, your income may increase. However, if the market declines, your income could decrease.

Annuities are a complex financial product, and there are certain uncertainties associated with them. If you’re concerned about the potential risks of annuities, Annuity Uncertain 2024 offers a balanced perspective. This article addresses the potential downsides of annuities, highlighting the factors that could impact your returns and overall financial security.

Advantages of Immediate Annuities

Immediate annuities offer several advantages, making them an attractive option for retirement planning:

Guaranteed Income for Life

The most significant benefit of immediate annuities is the guaranteed income for life. This eliminates the risk of outliving your savings and ensures a consistent income stream for the rest of your life. It provides peace of mind and financial security, especially for those who want to avoid the volatility of the stock market.

Annuities and perpetuities are both financial products that provide a stream of payments, but they differ in their duration. To learn more about the key differences between annuities and perpetuities, explore Annuity Vs Perpetuity 2024. This article compares the features, benefits, and risks of annuities and perpetuities, helping you understand the nuances of each financial product.

Potential Tax Advantages

The income you receive from an immediate annuity is typically taxed as ordinary income. However, some annuities may offer tax advantages, such as tax-deferred growth or tax-free withdrawals. It’s essential to consult with a financial advisor to understand the tax implications of a specific annuity.

Calculating annuity payments involves several factors, including the principal amount, interest rate, and payment frequency. If you’re looking for a guide on how to calculate annuity payments, visit How Calculate Annuity 2024. This article provides a step-by-step explanation of the calculation process, helping you estimate your future income stream from an annuity.

Peace of Mind

Knowing you have a guaranteed income stream for life can provide peace of mind and reduce financial stress during retirement. It allows you to focus on enjoying your golden years without worrying about running out of money.

Variable annuities are a type of investment that offers growth potential along with income guarantees. If you’re curious about their characteristics, you can find a comprehensive overview at Variable Annuity Has Which Of The Following Characteristics 2024. This article breaks down the key features of variable annuities, helping you understand how they work and whether they’re right for your financial goals.

Disadvantages of Immediate Annuities

While immediate annuities offer significant advantages, they also have potential drawbacks to consider:

Potential Risks, Immediate Annuity Guaranteed

Immediate annuities are generally considered low-risk investments. However, they are not without risks:

- Inflation Risk:Fixed annuities do not protect against inflation. The purchasing power of your income could decline over time if inflation outpaces the fixed payments you receive.

- Interest Rate Risk:If interest rates rise after you purchase an annuity, you may receive a lower return on your investment than you would have if you had waited to buy.

- Company Risk:There’s a risk that the insurance company issuing the annuity could become insolvent. It’s crucial to choose a financially sound company with a strong track record.

Lower Returns

Immediate annuities typically offer lower returns than other investments, such as stocks or bonds. This is because they provide a guaranteed income stream, which comes at a cost. However, this trade-off is often worth it for individuals who prioritize security and predictability over potential growth.

Understanding the tax implications of variable annuities is essential for making informed financial decisions. To learn more about the taxability of variable annuities, explore Variable Annuity Taxable 2024. This article provides a clear explanation of how variable annuity income is taxed, helping you plan for potential tax liabilities.

Annuity Mortality

Annuity mortality refers to the impact of life expectancy on the returns of an annuity. Insurance companies factor in the average lifespan of their policyholders when setting annuity rates. If you live longer than average, you may receive a higher return on your investment.

Immediate annuities can be a valuable tool for individuals seeking to secure a guaranteed income stream. If you’re considering using an immediate annuity to qualify for Medicaid, Immediate Annuity And Medicaid provides valuable insights. This article explores the relationship between immediate annuities and Medicaid eligibility, helping you understand how these financial products can impact your healthcare coverage.

However, if you die sooner than average, you may not receive the full value of your annuity.

An annuity is a financial product that provides a stream of regular payments, often for life. If you’re looking for a more in-depth explanation of annuities, An Annuity Is Quizlet 2024 offers a concise and informative resource. This guide delves into the basics of annuities, covering their purpose, types, and how they can be used in retirement planning.

Considerations for Choosing an Immediate Annuity

Before purchasing an immediate annuity, it’s essential to consider several factors:

Comparing Annuity Providers

Here’s a table comparing key features of different annuity providers:

| Provider | Guaranteed Income Rate | Minimum Investment | Fees | Other Features |

|---|---|---|---|---|

| Provider A | [Insert Rate] | [Insert Amount] | [Insert Fees] | [Insert Features] |

| Provider B | [Insert Rate] | [Insert Amount] | [Insert Fees] | [Insert Features] |

| Provider C | [Insert Rate] | [Insert Amount] | [Insert Fees] | [Insert Features] |

Checklist for Choosing an Immediate Annuity

Here’s a checklist to consider before purchasing an immediate annuity:

- Your Financial Goals:What are your financial goals for retirement? Are you looking for guaranteed income, growth potential, or a combination of both?

- Risk Tolerance:How much risk are you willing to take with your investments? Fixed annuities are considered low-risk, while variable annuities carry more risk.

- Time Horizon:How long do you plan to live off your retirement savings? This will help determine the appropriate type of annuity for your needs.

- Tax Implications:Understand the tax implications of the annuity and how it will affect your overall tax situation.

- Fees and Charges:Compare fees and charges among different annuity providers to ensure you’re getting the best value for your money.

- Company Financial Strength:Choose an insurance company with a strong financial track record and a high credit rating to minimize the risk of insolvency.

Seeking Professional Financial Advice

It’s essential to seek professional financial advice before purchasing an immediate annuity. A financial advisor can help you:

- Assess your financial situation and goals.

- Compare different annuity options and providers.

- Determine the appropriate type of annuity for your needs.

- Understand the tax implications of an annuity.

Real-World Examples and Scenarios: Immediate Annuity Guaranteed

Immediate annuities can be a valuable tool for retirement planning and estate planning. Here are some real-world examples and scenarios:

Case Studies

- John and Mary:John and Mary are a retired couple who want to ensure a steady income stream for life. They purchase a fixed immediate annuity with a lump sum of their savings, providing them with a guaranteed monthly income. This eliminates their worry about outliving their savings and allows them to enjoy their retirement without financial stress.

An immediate annuity is a type of annuity that starts paying out benefits immediately after you purchase it. If you’re interested in learning more about the definition of immediate annuities, check out Immediate Annuity Def. This resource provides a concise explanation of immediate annuities, highlighting their key features and benefits.

- Sarah:Sarah is a single woman who wants to leave a legacy for her children. She purchases a variable immediate annuity with a portion of her savings, hoping to generate higher returns. The income she receives from the annuity is used to cover her living expenses, and any growth in the annuity is passed on to her children upon her death.

Retirement Planning

Immediate annuities can be incorporated into retirement planning strategies to:

- Generate Guaranteed Income:Immediate annuities provide a reliable source of income for life, ensuring you have funds to cover essential living expenses.

- Reduce Investment Risk:By converting a portion of your savings into a guaranteed income stream, you can reduce the risk associated with market volatility.

- Supplement Other Retirement Income:Annuities can supplement other sources of retirement income, such as Social Security or pensions.

Estate Planning

Immediate annuities can be used in estate planning to:

- Provide for Loved Ones:You can name a beneficiary to receive the remaining value of the annuity after your death, providing financial support for your family.

- Reduce Estate Taxes:Some annuities may offer tax advantages that can reduce your estate taxes.

- Create a Legacy:You can use an annuity to create a lasting legacy for your loved ones, ensuring their financial security even after you’re gone.

Epilogue

Immediate annuities can be a valuable tool for individuals seeking a guaranteed income stream in retirement. By converting a lump sum into a steady stream of income, these annuities can offer peace of mind and financial security. However, it’s crucial to carefully evaluate the risks and potential limitations of immediate annuities, ensuring they align with your individual financial goals and risk tolerance.

Getting a variable annuity quote can be a crucial step in exploring this investment option. If you’re interested in obtaining a quote, Variable Annuity Quote 2024 provides valuable insights. This resource offers guidance on finding quotes from reputable providers and understanding the factors that influence the cost of variable annuities.

Consulting with a qualified financial advisor can help you determine if an immediate annuity is the right choice for you.

Essential FAQs

How do immediate annuities differ from other types of annuities?

Immediate annuities differ from other types of annuities in their payout schedule. With immediate annuities, payments begin immediately after the purchase, while other types of annuities may have a deferral period before payments start. This makes immediate annuities ideal for those seeking an immediate income stream.

Are there tax implications for immediate annuities?

Yes, there are tax implications for immediate annuities. The payments you receive are typically taxed as ordinary income. However, there may be some tax advantages depending on the specific type of annuity and your individual tax situation. It’s important to consult with a tax advisor to understand the tax implications of immediate annuities.

What are some factors to consider when choosing an immediate annuity provider?

When choosing an immediate annuity provider, consider factors such as the provider’s financial stability, the interest rates offered, the flexibility of the annuity contract, and the provider’s reputation. It’s essential to compare different providers and their offerings to find the best option for your needs.

Can I withdraw funds from an immediate annuity?

Typically, you cannot withdraw funds from an immediate annuity once it’s purchased. The purpose of an immediate annuity is to provide a guaranteed income stream for life. However, some annuities may offer limited withdrawal options, which you should carefully review before purchasing.