Immediate Annuity Factor, a crucial concept in financial planning, determines the amount of income you receive from an annuity. It acts as a bridge between your initial investment and the stream of regular payments you’ll enjoy over time. This factor is influenced by various elements, including interest rates, time periods, and the type of annuity you choose.

If you’re looking for a quick and easy way to calculate annuity payments, you can use an Annuity Calculator Soup 2024. This online calculator allows you to input your information and receive an immediate estimate of your payments.

Understanding the immediate annuity factor allows you to make informed decisions about your retirement savings, ensuring a comfortable and secure future.

Most annuities are considered ordinary annuities. An Annuity Is Ordinary 2024 means that payments are made at the end of each period. This is the most common type of annuity, but it’s important to understand the different types to make an informed decision.

Imagine you’ve accumulated a substantial sum for retirement. You’re now ready to convert this lump sum into a steady stream of income. The immediate annuity factor comes into play here, helping you determine how much you’ll receive each year. It’s like a financial calculator, factoring in interest rates, your chosen annuity type, and the time period over which you’ll receive payments.

If you’re considering a Jackson variable annuity, you may need to request a partial withdrawal or surrender. A Jackson Variable Annuity Partial Withdrawal/Surrender Request 2024 will involve specific steps and procedures, so make sure you understand the process before making any requests.

Immediate Annuity Factor

An immediate annuity factor is a crucial concept in financial planning, particularly when dealing with annuities. It essentially acts as a bridge between the present value of a lump sum and the stream of future payments you receive from an annuity.

Variable annuities offer a variety of features that can be appealing to investors. An Variable Annuity Features 2024 may include things like death benefits, living benefits, and the ability to adjust your investment portfolio over time.

In simple terms, it tells you how much you’ll receive each year for a given amount of money you invest in an immediate annuity.

While they sound similar, there are key differences between variable life insurance and variable annuities. An Difference Between Variable Life And Variable Annuity 2024 highlights that variable life insurance provides a death benefit, while variable annuities provide income payments.

Understanding these differences can help you choose the right product for your needs.

Definition of Immediate Annuity Factor

The immediate annuity factor is a numerical representation of the present value of a stream of future payments from an annuity. It essentially converts a lump sum into a series of regular payments. This factor is influenced by several factors, including interest rates and the length of the annuity period.

It’s important to be aware of the disclosures required for variable annuities. An Variable Annuity Disclosure Is Required To Contain 2024 should include information about the risks involved, as well as the potential for growth and loss. Make sure you understand these disclosures before making any investment decisions.

The immediate annuity factor plays a vital role in financial planning. It helps individuals determine the amount of income they can expect from an annuity based on their initial investment. It also assists in comparing different annuity options and choosing the most suitable one based on their financial goals and risk tolerance.

Annuities offer a variety of options to suit different needs and goals. An Annuity Options 2024 may include fixed, variable, or indexed annuities, each with its own features and risks. It’s important to research the different options available to find the best fit for your situation.

For instance, imagine you have $100,000 and want to purchase an immediate annuity that pays out annually for 20 years. The immediate annuity factor, based on the current interest rates, would determine the amount of annual payment you would receive.

The variable annuity market has seen fluctuations in recent years. Variable Annuity Sales 2019 2024 data can provide insights into the overall trends and performance of this type of investment.

A higher immediate annuity factor would translate to larger annual payments, while a lower factor would result in smaller payments.

Calculation of Immediate Annuity Factor

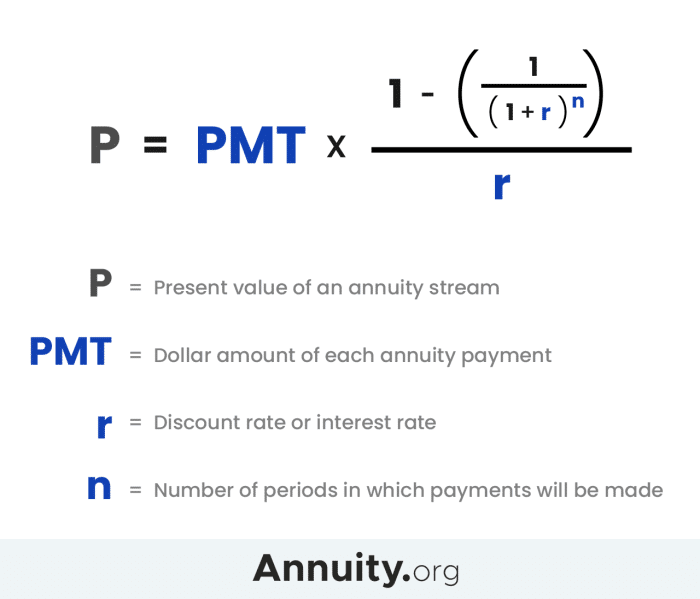

The immediate annuity factor is calculated using a specific formula that takes into account the interest rate and the number of periods for which the annuity will pay out. The formula is:

Immediate Annuity Factor = (1

An Immediate Annuity Consists Of A single lump sum payment that is used to purchase a stream of income payments that begin immediately. This type of annuity can be a good option for retirees who need a guaranteed income stream.

(1 + i)^-n) / i

When it comes to annuities, there are two main types: immediate and deferred. An Immediate Annuity Vs Deferred Annuity is one that starts making payments right away, while a deferred annuity starts making payments at a later date. The choice between the two depends on your individual needs and circumstances.

Where:

- i is the interest rate per period

- n is the number of periods

The higher the interest rate, the higher the immediate annuity factor, resulting in larger annual payments. Conversely, a lower interest rate leads to a lower immediate annuity factor and smaller annual payments. Similarly, a longer annuity period (higher n) generally results in a lower immediate annuity factor, as the payments are spread out over a longer duration.

If you’re trying to figure out how much interest you’ll earn on your annuity, you can use a calculator to help you. Calculating Annuity Interest 2024 can be done by inputting the principal amount, interest rate, and length of the annuity.

The calculator will then show you the total amount of interest you’ll earn over the life of the annuity.

Application of Immediate Annuity Factor

The immediate annuity factor is primarily used in calculating payments for immediate annuities. These annuities provide regular payments that begin immediately after the purchase. The immediate annuity factor is applied to the principal amount to determine the amount of each payment.

When it comes to retirement planning, you may wonder if an annuity is a better option than a drawdown. An Is Annuity Better Than Drawdown 2024 article can help you compare the pros and cons of each approach to determine which is right for you.

The immediate annuity factor is used in various types of annuities, including:

- Fixed annuities: These provide a fixed payment amount for the duration of the annuity. The immediate annuity factor is used to calculate the fixed payment based on the principal amount and the chosen payout period.

- Variable annuities: These offer payments that fluctuate based on the performance of underlying investments. The immediate annuity factor is used to determine the initial payment amount, which can change over time based on market conditions.

- Indexed annuities: These offer payments linked to the performance of a specific index, such as the S&P 500. The immediate annuity factor is used to calculate the initial payment amount, which is adjusted based on the index’s performance.

Here’s a table illustrating how different immediate annuity factors can impact annuity payments:

| Immediate Annuity Factor | Annuity Payment (Annual) |

|---|---|

| 10.00 | $10,000 |

| 12.50 | $12,500 |

| 15.00 | $15,000 |

As you can see, a higher immediate annuity factor results in larger annual payments. This demonstrates the direct impact of the immediate annuity factor on the income stream generated by an annuity.

Understanding how annuities work can be a bit tricky. To help clarify, you can check out Annuity Calculation Questions And Answers 2024. This resource provides answers to common questions about annuity calculations, making it easier to grasp the concepts.

Factors Influencing Immediate Annuity Factor

Several factors can influence the immediate annuity factor, directly impacting the amount of annuity payments received. Here are some key factors:

- Interest rates: Higher interest rates generally lead to a higher immediate annuity factor. This is because the annuity provider can earn more interest on the principal, allowing them to pay out larger annual payments.

- Time period: The length of the annuity period also influences the immediate annuity factor. A longer annuity period typically results in a lower immediate annuity factor. This is because the payments are spread out over a longer duration, leading to smaller annual payments.

Keeping up with the latest news and developments in the variable annuity market is essential. Variable Annuity News 2024 can provide valuable information about changes in regulations, product offerings, and market performance.

- Type of annuity: The specific type of annuity can also impact the immediate annuity factor. For instance, fixed annuities often have a lower immediate annuity factor compared to variable annuities, as the payments are guaranteed and less risky for the provider.

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer several advantages, but it’s essential to consider the potential disadvantages as well. Here’s a breakdown:

- Advantages:

- Guaranteed income stream: Immediate annuities provide a steady stream of income that is guaranteed for the duration of the annuity period. This can be particularly beneficial for retirees seeking financial security.

- Protection against inflation: Some immediate annuities offer inflation protection, ensuring that payments keep pace with rising prices. This helps preserve the purchasing power of your income over time.

- Simplicity: Immediate annuities are relatively simple to understand and manage. Once you purchase an annuity, you receive regular payments without needing to actively manage investments.

- Disadvantages:

- Limited liquidity: Once you purchase an immediate annuity, your principal is generally not accessible. This can be a drawback if you need access to your funds for unexpected expenses.

- Interest rate risk: If interest rates rise after you purchase an immediate annuity, you may receive a lower return on your investment compared to other investment options.

- Potential for lower returns: Immediate annuities may offer lower returns compared to other investments, particularly if interest rates are low.

Immediate annuities can be suitable for individuals who are seeking a guaranteed income stream, have a low risk tolerance, and don’t need immediate access to their funds. However, they may not be appropriate for individuals who require flexibility with their funds, are comfortable with higher risk, or need to access their principal in the future.

Concluding Remarks

By understanding the immediate annuity factor, you can effectively plan for your retirement, ensuring a steady stream of income to meet your financial needs. This factor acts as a vital tool, empowering you to make informed decisions about your savings and retirement planning.

Whether you’re looking to secure a comfortable retirement or supplement your existing income, the immediate annuity factor can play a significant role in achieving your financial goals.

If you’re looking for a way to calculate annuity payments, you can use an Annuity Calculator Excel Template 2024. This template will help you determine the amount of your monthly payments, as well as the total amount of interest you will pay over the life of the annuity.

Commonly Asked Questions: Immediate Annuity Factor

How does the immediate annuity factor differ for fixed and variable annuities?

The immediate annuity factor for fixed annuities is typically higher than for variable annuities. This is because fixed annuities offer a guaranteed rate of return, while variable annuities have a rate of return that fluctuates with the market.

What happens to the immediate annuity factor if interest rates rise?

If interest rates rise, the immediate annuity factor will generally decrease. This is because higher interest rates mean that insurance companies can offer lower payments for the same amount of investment.

What are the tax implications of immediate annuities?

The tax implications of immediate annuities vary depending on the type of annuity and the individual’s tax situation. It’s important to consult with a tax professional to understand the specific tax implications of your annuity.