Immediate Annuity Example Problems With Solutions delves into the intricacies of immediate annuities, providing practical examples and solutions to help you understand how these financial instruments work. Immediate annuities are a popular choice for retirees seeking a steady stream of income, but choosing the right type and understanding the factors that affect payout amounts can be complex.

Wondering if an annuity is a good investment in 2024? This article explores the pros and cons of annuities, helping you determine if they fit your financial goals.

This guide explores various scenarios, demonstrating the calculations involved and highlighting the advantages and disadvantages of different immediate annuity options.

Through detailed explanations, step-by-step calculations, and real-world examples, this guide aims to equip readers with the knowledge and tools needed to make informed decisions about immediate annuities. By examining the key features, types, and factors that influence payout amounts, this guide sheds light on the intricacies of immediate annuities, empowering readers to confidently navigate this important financial planning aspect.

Deciding between an annuity and a 401(k) can be a big decision. This article explores the pros and cons of each option to help you make the right choice for your retirement savings.

Introduction to Immediate Annuities

An immediate annuity is a financial product that provides a stream of regular payments, typically for life, starting immediately after the purchase. These annuities are designed to provide a guaranteed income stream for individuals who are seeking to convert a lump sum of money into a reliable source of retirement income.

While both annuities and life insurance offer financial protection, they serve different purposes. This article explains the key differences and helps you understand which option is right for you.

Key Features of Immediate Annuities

Immediate annuities are characterized by several key features that distinguish them from other retirement income products. These features include:

- Payout Structure:Immediate annuities provide a predetermined stream of payments, either in the form of a fixed amount or a variable amount that fluctuates based on the performance of an underlying investment portfolio.

- Annuitant:The individual who purchases the annuity is known as the annuitant. The annuitant receives the annuity payments for the duration of their lifetime, or for a specified period of time.

- Interest Rates:Interest rates play a significant role in determining the payout amount of an immediate annuity. Higher interest rates generally result in larger annuity payments, while lower interest rates lead to smaller payments.

Historical Overview of Immediate Annuities

Immediate annuities have been around for centuries, with their origins tracing back to the early days of life insurance. Over time, immediate annuities have evolved to meet the changing needs of retirees, with the introduction of new types of annuities and innovative payout options.

An immediate annuity, also known as a single premium immediate annuity (SPIA), provides guaranteed income payments right away. Learn more about this type of annuity and its potential benefits.

Types of Immediate Annuities

Immediate annuities can be categorized into several different types, each offering distinct features and payout options. The most common types of immediate annuities include:

Fixed Annuities

Fixed annuities provide a guaranteed stream of fixed payments for life or for a specific period of time. These annuities offer predictable income and protection against inflation risk, but the payout amount is typically lower than other types of annuities.

Choosing between an annuity and an IRA can be a tough decision. This comparison highlights the key differences and helps you determine which option best suits your needs.

Variable Annuities

Variable annuities offer a stream of payments that fluctuate based on the performance of an underlying investment portfolio. These annuities provide the potential for higher returns but also carry a higher level of risk. The payout amount is not guaranteed and can vary depending on the performance of the investment portfolio.

If you’re a 65-year-old male considering an annuity, this resource can provide valuable insights and help you make informed decisions about your retirement planning.

Indexed Annuities

Indexed annuities offer a guaranteed minimum payout, but the actual payout amount is linked to the performance of a specific market index, such as the S&P 500. These annuities provide the potential for growth while offering some protection against market downturns.

Example Problems for Immediate Annuities

To illustrate the concept of immediate annuities and their payout calculations, let’s consider a few example problems. These scenarios will demonstrate how different types of annuities and assumptions can affect the payout amount.

Variable annuity rates can fluctuate based on market performance. Stay up-to-date on the latest variable annuity rates and understand how they can impact your investment.

| Scenario | Annuity Type | Assumptions | Solution |

|---|---|---|---|

| Scenario 1: Fixed Annuity | Fixed Annuity | Annuitant age: 65, Initial investment: $100,000, Interest rate: 4% | The payout amount will be calculated based on the initial investment, interest rate, and the annuitant’s life expectancy. |

| Scenario 2: Variable Annuity | Variable Annuity | Annuitant age: 70, Initial investment: $200,000, Investment portfolio: S&P 500 Index | The payout amount will fluctuate based on the performance of the S&P 500 Index. |

| Scenario 3: Indexed Annuity | Indexed Annuity | Annuitant age: 68, Initial investment: $150,000, Index: S&P 500 Index, Minimum guaranteed payout: 3% | The payout amount will be linked to the performance of the S&P 500 Index, but the minimum guaranteed payout will ensure a minimum income stream. |

Solution Approaches and Calculations

Scenario 1: Fixed Annuity, Immediate Annuity Example Problems With Solutions

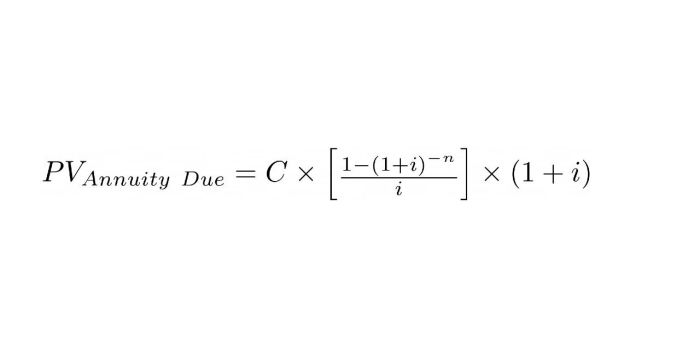

In Scenario 1, the annuitant is 65 years old and invests $100,000 in a fixed annuity with a 4% interest rate. To calculate the payout amount, we can use the following formula:

Payout Amount = Initial Investment x (Interest Rate / 100)

An annuity is essentially a series of equal payments made over a set period. This article explains the concept in more detail, including its uses in various financial scenarios.

Plugging in the values from Scenario 1, we get:

Payout Amount = $100,000 x (4 / 100) = $4,000 per year

Therefore, the annuitant will receive a guaranteed annual payout of $4,000 for life. This amount is fixed and does not fluctuate based on market conditions.

An annuity contract is a legally binding agreement outlining the terms of your annuity. Understanding the details of your contract is crucial for making informed decisions about your financial future.

Scenario 2: Variable Annuity

In Scenario 2, the annuitant is 70 years old and invests $200,000 in a variable annuity linked to the S&P 500 Index. The payout amount will vary depending on the performance of the index. If the index performs well, the payout amount will increase.

Conversely, if the index performs poorly, the payout amount will decrease.

To calculate the payout amount, we need to track the performance of the S&P 500 Index over time. The payout amount will be calculated based on the index’s growth rate and the initial investment. The specific formula used will vary depending on the annuity provider.

A group immediate annuity, also known as a group immediate fixed annuity, provides income payments to a group of individuals. Learn more about this type of annuity and its potential applications.

Scenario 3: Indexed Annuity

In Scenario 3, the annuitant is 68 years old and invests $150,000 in an indexed annuity linked to the S&P 500 Index. The payout amount will be linked to the index’s performance, but the minimum guaranteed payout of 3% ensures a minimum income stream.

Variable annuities can be complex, and HSBC offers its own unique options. Learn more about HSBC’s variable annuity offerings and what makes them stand out.

To calculate the payout amount, we need to track the performance of the S&P 500 Index over time. The payout amount will be calculated based on the index’s growth rate, the initial investment, and the minimum guaranteed payout. The specific formula used will vary depending on the annuity provider.

Factors Affecting Immediate Annuity Payments

The payout amount of an immediate annuity is influenced by several factors, including:

| Factor | Impact on Payout | Example |

|---|---|---|

| Interest Rates | Higher interest rates generally result in larger annuity payments. | If the interest rate on a fixed annuity increases from 4% to 5%, the payout amount will increase accordingly. |

| Mortality Rates | Annuity providers use mortality rates to estimate the average lifespan of annuitants. Lower mortality rates result in larger annuity payments. | If the mortality rate for a specific age group decreases, the annuity provider may offer larger payouts to reflect the increased life expectancy. |

| Annuitant’s Age and Health | Younger annuitants with good health typically receive smaller annuity payments, as they are expected to live longer and receive more payments. | A 60-year-old annuitant with excellent health may receive a smaller payout than a 70-year-old annuitant with health issues. |

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer several advantages, including:

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income, which can provide peace of mind during retirement.

- Longevity Protection:Immediate annuities can help protect against the risk of outliving your savings. The payments continue for life, regardless of how long you live.

- Tax Benefits:In some cases, the annuity payments may be tax-deferred or tax-free, depending on the type of annuity and the individual’s tax situation.

However, immediate annuities also have some potential disadvantages, such as:

- Limited Flexibility:Once you purchase an immediate annuity, you generally cannot withdraw the principal or change the payout amount.

- Potential for Inflation Risk:Fixed annuities do not provide protection against inflation, which can erode the purchasing power of your income over time.

- Impact of Interest Rate Changes:If interest rates rise after you purchase an immediate annuity, the payout amount you receive may be lower than if you had purchased the annuity at a later date.

Considerations for Choosing an Immediate Annuity

Before purchasing an immediate annuity, it’s important to carefully consider your individual circumstances and financial goals. Some key factors to consider include:

- Your Retirement Income Needs:How much income do you need to cover your expenses in retirement?

- Your Risk Tolerance:Are you comfortable with the risk of variable annuity payouts or do you prefer the guaranteed income of a fixed annuity?

- Your Life Expectancy:How long do you expect to live? This will affect the total amount of annuity payments you receive.

- Your Tax Situation:How will the annuity payments affect your tax liability?

It’s also important to shop around and compare different annuity products from multiple providers. Be sure to read the fine print carefully and understand the terms and conditions of the annuity before making a purchase.

Closing Notes: Immediate Annuity Example Problems With Solutions

Understanding immediate annuities is crucial for anyone seeking a secure retirement income stream. This guide has provided a comprehensive overview of the topic, covering the basics, different types, calculation methods, and factors that affect payout amounts. By exploring real-world examples and analyzing the advantages and disadvantages of immediate annuities, we aim to empower readers with the knowledge needed to make informed decisions about their retirement planning.

While annuities are often associated with retirement income, they can also be used as a loan. This article explains how annuities can be used for borrowing and the potential benefits and drawbacks.

Remember, consulting with a financial advisor is essential to tailor your retirement income strategy to your specific needs and circumstances.

Variable annuities often offer optional living benefits, which can provide additional financial security in retirement. Learn more about these benefits and how they can enhance your retirement plan.

Question Bank

What are the tax implications of immediate annuities?

Just like any financial product, variable annuities come with administrative fees. Understanding these fees is crucial to making informed decisions about your investments.

The tax treatment of immediate annuities depends on the specific type of annuity and the terms of the contract. In general, the income received from an immediate annuity is taxed as ordinary income, but there may be tax-deferred options available.

Calculating annuities in accounting can be a bit tricky, but it’s essential for accurate financial reporting. This guide provides a clear explanation and practical examples to help you understand the process.

Consult with a tax advisor to determine the specific tax implications for your situation.

How do I choose the right type of immediate annuity?

The best type of immediate annuity for you depends on your individual needs and risk tolerance. Consider factors such as your age, health, investment goals, and desired payout options. It’s recommended to consult with a financial advisor to determine the most suitable type of annuity for your circumstances.

What are the risks associated with immediate annuities?

Immediate annuities carry certain risks, such as inflation risk, interest rate risk, and the potential for the issuing company to become insolvent. It’s important to carefully consider these risks and understand the terms of the annuity contract before making a decision.