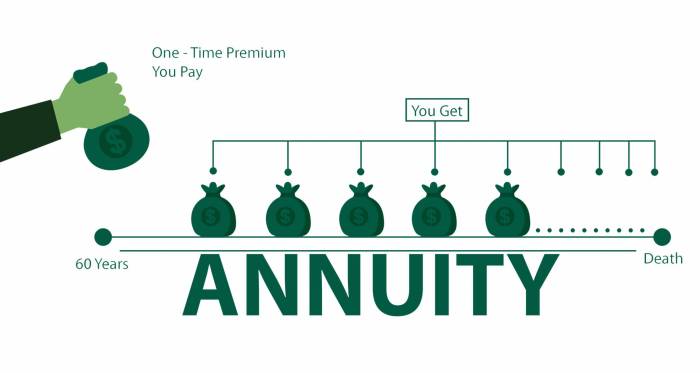

Immediate Annuity Def, a financial instrument that converts a lump sum into a guaranteed stream of income, offers a unique approach to retirement planning. This strategy provides a reliable and predictable source of income, often appealing to individuals seeking financial security and peace of mind.

When you purchase an annuity, you might be able to exclude some of the payments from your taxable income. The Calculate Annuity Exclusion Ratio 2024 page can help you understand how to calculate the exclusion ratio for your annuity.

Immediate annuities are structured to provide regular payments, either for a fixed period or for the lifetime of the annuitant. They can be purchased with a single lump sum or through a series of payments, and the payment amount is determined by factors such as the age of the annuitant, the amount of the initial investment, and the type of annuity chosen.

If you want to ensure that your annuity payments continue after your death, you might consider setting up joint ownership. The Annuity Joint Ownership 2024 page can provide you with more information about this option.

Immediate Annuities: Definition and Types

Immediate annuities are a popular retirement income strategy that provides a guaranteed stream of payments for life. They are a type of fixed-income investment that allows individuals to convert a lump sum of money into a regular income stream. This article will provide a comprehensive overview of immediate annuities, including their definition, types, features, and benefits.

Annuity plans are becoming increasingly popular as a way to secure your retirement income. You can learn more about the different types of annuities and how they work by visiting the Annuity Is Pension Plan 2024 page. Understanding annuities can help you make informed decisions about your financial future.

Definition of an Immediate Annuity

An immediate annuity is a contract between an individual and an insurance company that provides a guaranteed stream of payments for life, beginning immediately after the purchase. In exchange for a lump sum payment, the insurance company agrees to make regular payments to the annuitant for a specified period or for the rest of their life.

Variable annuities offer a way to potentially grow your investment, but they also come with some risks. You can learn more about how withdrawals work for variable annuities on the Variable Annuity Withdrawals 2024 page.

The payments can be made monthly, quarterly, semi-annually, or annually.

Annuity payments are typically made by a life insurance company. If you’re curious about how these payments are determined, you can find more information on the Annuity Is Given By 2024 page.

Types of Immediate Annuities

There are various types of immediate annuities, each with its unique features and benefits. Here are some of the most common types:

- Single Premium Immediate Annuity (SPIA):This is the most basic type of immediate annuity, where a single lump sum payment is made to purchase the annuity. The payments begin immediately and continue for the rest of the annuitant’s life.

- Fixed Annuity:A fixed annuity provides a guaranteed fixed payment amount for life. The payment amount is determined at the time of purchase and does not fluctuate with market conditions.

- Variable Annuity:A variable annuity offers payments that fluctuate based on the performance of an underlying investment portfolio. The payment amount can increase or decrease depending on the investment’s performance.

- Indexed Annuity:An indexed annuity provides payments that are linked to the performance of a specific index, such as the S&P 500. The payments can increase or decrease based on the index’s performance, but there is a minimum guaranteed payment amount.

- Deferred Annuity:A deferred annuity allows the annuitant to delay the start of payments until a later date. This option can be beneficial for individuals who want to accumulate more savings before starting to receive payments.

How Immediate Annuities Work, Immediate Annuity Def

Purchasing an immediate annuity involves a simple process. The individual chooses the type of annuity, the payment amount, and the payment frequency. The insurance company then calculates the lump sum payment required to purchase the annuity. Once the payment is made, the insurance company begins making regular payments to the annuitant.

Calculating the future value of an annuity can be a complex process, especially when it’s compounded monthly. The Calculating Annuity Future Value Compounded Monthly 2024 page provides resources and information to help you with this calculation.

Factors Influencing Annuity Payment Amount

Several factors influence the amount of annuity payments, including:

- Age of the Annuitant:The older the annuitant, the higher the payment amount, as they are expected to live for a shorter period.

- Gender:Women typically receive higher payments than men due to their longer life expectancy.

- Interest Rates:Higher interest rates generally result in higher annuity payments.

- Annuity Type:Different annuity types offer different payment structures and can affect the payment amount.

Payment Options

Immediate annuities offer various payment options, including:

- Lifetime Payments:Payments continue for the rest of the annuitant’s life.

- Period Certain Payments:Payments are guaranteed for a specified period, even if the annuitant dies before the period ends.

- Joint Life Payments:Payments continue as long as either of two annuitants is alive.

- Guaranteed Minimum Payments:The annuitant receives a minimum guaranteed payment amount, even if the market conditions are unfavorable.

Advantages of Immediate Annuities

Immediate annuities offer several advantages for retirees, including:

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, regardless of market conditions.

- Longevity Protection:Annuities protect against outliving your savings, ensuring a steady income stream for as long as you live.

- Tax Advantages:Annuity payments are generally taxed as ordinary income, but the tax treatment can vary depending on the type of annuity and the individual’s tax situation.

- Simplicity:Annuities are relatively simple to understand and manage, providing a straightforward way to generate retirement income.

Disadvantages of Immediate Annuities

While immediate annuities offer significant advantages, they also have some potential disadvantages:

- Illiquidity:Once you purchase an annuity, you generally cannot access the lump sum payment without incurring penalties.

- Interest Rate Risk:Fixed annuities can be affected by rising interest rates, which can lower the value of the annuity.

- Limited Growth Potential:Annuities generally do not offer significant growth potential, as the payment amount is fixed or limited to a specific index.

- Inflation Risk:Inflation can erode the purchasing power of annuity payments over time.

How Immediate Annuities Work in Retirement Planning

Immediate annuities can be a valuable tool for retirement planning, providing a steady stream of income that can supplement other retirement savings. Here are some examples of how immediate annuities are used in retirement planning:

- Generating Income:Immediate annuities can provide a guaranteed income stream for retirees, helping to cover essential expenses such as housing, healthcare, and food.

- Protecting Against Outliving Savings:Annuities can protect against the risk of outliving your savings, ensuring that you have a steady income stream for the rest of your life.

- Supplementing Other Retirement Income:Annuities can supplement other retirement income sources, such as Social Security or pensions, providing a more comprehensive retirement income plan.

Considerations for Choosing an Immediate Annuity

Choosing the right immediate annuity requires careful consideration of several factors, including:

- Annuity Type:Different annuity types offer different features and benefits, so it’s important to choose the one that best meets your needs and risk tolerance.

- Payment Amount and Frequency:Determine the payment amount and frequency that will meet your income needs.

- Annuity Provider:Choose a reputable and financially sound insurance company with a strong track record.

- Contract Terms and Conditions:Carefully review the terms and conditions of the annuity contract, including the payment structure, fees, and surrender charges.

- Tax Implications:Understand the tax treatment of annuity payments and how they may impact your overall tax situation.

Immediate Annuities and Tax Implications

The tax treatment of immediate annuity payments can vary depending on the type of annuity and the individual’s tax situation. Here are some key tax implications:

- Taxability of Payments:Annuity payments are generally taxed as ordinary income, but the tax treatment can vary depending on the type of annuity and the individual’s tax situation.

- Tax Advantages:Some annuities may offer tax advantages, such as tax-deferred growth or tax-free income streams.

- Tax Disadvantages:Other annuities may have tax disadvantages, such as higher tax rates or penalties for early withdrawals.

Real-World Examples and Case Studies

| Case Study | Situation | Annuity Type | Outcome |

|---|---|---|---|

| John, a retired teacher, purchased a single premium immediate annuity with a lump sum of $100,000 to provide a guaranteed income stream for life. | John wanted to ensure a steady income stream for his retirement and protect against outliving his savings. | Single Premium Immediate Annuity (SPIA) | John received monthly payments of $5,000 for life, providing him with a reliable income stream and peace of mind. |

| Mary, a retired nurse, purchased a fixed annuity with a lump sum of $200,000 to generate a guaranteed income stream for her and her husband. | Mary wanted to provide a guaranteed income stream for her and her husband during retirement, ensuring that they had a steady income stream even if one of them passed away. | Fixed Annuity | Mary and her husband received monthly payments of $10,000, providing them with a guaranteed income stream for life, even if one of them passed away. |

| David, a retired businessman, purchased a variable annuity with a lump sum of $500,000 to potentially generate higher income streams. | David wanted to potentially generate higher income streams during retirement, but he was willing to accept some risk. | Variable Annuity | David’s payments fluctuated based on the performance of the underlying investment portfolio. In some years, he received higher payments, while in other years, he received lower payments. |

| Sarah, a retired teacher, purchased an indexed annuity with a lump sum of $300,000 to provide a guaranteed income stream with potential for growth. | Sarah wanted to provide a guaranteed income stream for her retirement, but she also wanted the potential for growth. | Indexed Annuity | Sarah received monthly payments that were linked to the performance of the S&P 500 index. Her payments increased in years when the index performed well, but she received a minimum guaranteed payment amount in years when the index performed poorly. |

Concluding Remarks

Understanding the intricacies of immediate annuities is crucial for individuals seeking to secure their retirement income. By carefully considering the advantages and disadvantages, exploring different annuity types, and consulting with a financial advisor, retirees can make informed decisions that align with their financial goals and risk tolerance.

Common Queries: Immediate Annuity Def

What are the different types of immediate annuities?

There are several types of immediate annuities, including fixed annuities, variable annuities, and indexed annuities. Each type offers different features and risks, so it’s essential to understand the differences before making a decision.

How do I choose the right immediate annuity provider?

It’s crucial to choose a reputable and financially sound annuity provider. Consider factors like financial stability, customer service, and the provider’s track record. It’s also wise to compare rates and fees from multiple providers.

Are there any tax implications associated with immediate annuities?

If you’re considering an annuity, it’s important to understand the terms and conditions. One important aspect is the surrender period, which refers to the time during which you can withdraw your funds without penalty. You can find more information about this on the My Annuity Is Out Of Surrender 2024 page.

Yes, immediate annuity payments are typically taxed as ordinary income. However, there may be tax advantages associated with certain types of annuities. It’s essential to consult with a tax advisor to understand the tax implications specific to your situation.

If you’re looking for a tool to help you estimate your annuity payments, Schwab offers a useful calculator. You can find more information about this calculator on the Annuity Calculator Schwab 2024 page.

Annuity payments can vary depending on the amount of your initial investment. You can find more information about annuities with a specific investment amount, like $300,000, on the Annuity 300 000 2024 page.

There are many different types of annuities available. You can explore seven common types of annuities by visiting the 7 Annuities 2024 page.

If you’re looking for a way to receive guaranteed income payments immediately, you might consider purchasing an immediate annuity. The Buy A Immediate Annuity page can help you understand how these annuities work.

The T-C Annuity is a specific type of annuity that offers tax-deferred growth. You can learn more about this type of annuity on the T-C Annuity 2024 page.

Annuity payments can be structured in different ways, including as a single sum. You can find more information about annuities that are paid as a single sum on the Annuity Is A Single Sum 2024 page.

Variable annuities offer the potential for growth, but they also come with risks. If you’re considering a variable annuity, you might want to understand the surrender period, which refers to the time during which you can withdraw your funds without penalty.

You can find more information about this on the Variable Annuity Out Of Surrender 2024 page.

There are different methods used to calculate annuity payments. The Calculating Annuity Method 2024 page can help you understand the various methods used for these calculations.