Immediate Annuity Calculator Usaa – Immediate Annuity Calculator USA, offered by USAA, empowers individuals to visualize their retirement income potential. This user-friendly tool allows you to explore various annuity options and understand how they can contribute to your financial security. By inputting details such as age, desired income, and investment amount, you can generate personalized quotes tailored to your specific needs.

USAA’s immediate annuity products cater to diverse retirement goals. They offer fixed, variable, and indexed annuities, each with its own set of features, benefits, and risks. Understanding the nuances of these options is crucial for making informed decisions about your retirement savings.

Understanding Immediate Annuities

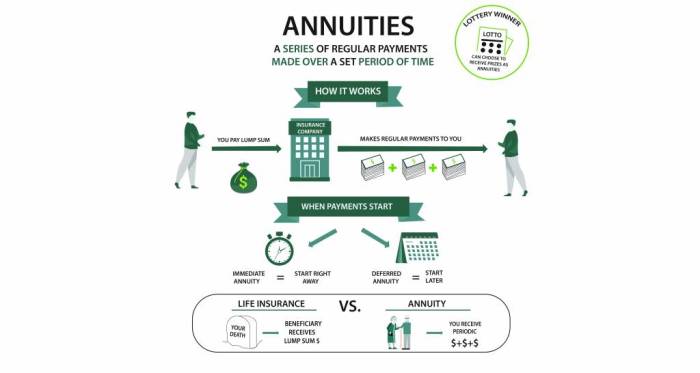

Immediate annuities are a type of insurance product that provides a guaranteed stream of income for life, starting immediately upon purchase. They are a popular option for retirees and individuals looking for a secure and predictable source of income.

Key Features of Immediate Annuities

Immediate annuities offer several key features that make them attractive to investors, including:

- Guaranteed Income Payments:Once you purchase an immediate annuity, you are guaranteed to receive regular income payments for life, regardless of how long you live.

- Payout Options:Immediate annuities offer various payout options, such as a fixed monthly payment, a lump sum payment, or a combination of both. You can choose the payout option that best suits your financial needs.

- Longevity Protection:Immediate annuities protect you from outliving your savings, as they provide a lifetime income stream. This is especially important for individuals who are concerned about their financial security in their later years.

Benefits of Immediate Annuities

Immediate annuities offer several benefits, including:

- Guaranteed Income Stream:Immediate annuities provide a steady and predictable source of income, which can be essential for covering essential expenses in retirement.

- Longevity Protection:Immediate annuities ensure that you will receive income for life, regardless of how long you live, protecting you from outliving your savings.

- Potential Tax Advantages:The income from an immediate annuity may be taxed differently than other forms of retirement income, potentially resulting in tax savings.

USAA Immediate Annuity Products

USAA offers a range of immediate annuity products to meet the diverse needs of its members. Their offerings include:

Types of USAA Immediate Annuities, Immediate Annuity Calculator Usaa

- Fixed Annuities:Fixed annuities provide a guaranteed rate of return, ensuring that you will receive a specific amount of income each month. These annuities are ideal for individuals seeking stability and predictability.

- Variable Annuities:Variable annuities offer the potential for higher returns but also carry more risk. The income payments from a variable annuity are tied to the performance of underlying investments, so the amount you receive can fluctuate. These annuities are suitable for individuals with a higher risk tolerance who are willing to accept some volatility in exchange for the potential for greater returns.

When considering the different types of annuities available, you might come across the term Annuity Contingent Is 2024. Understanding this concept can help you make informed decisions. Also, if you’re looking into variable annuities, be sure to learn about Variable Annuity Hardship Withdrawal 2024 to understand the potential implications.

- Indexed Annuities:Indexed annuities link their returns to the performance of a specific market index, such as the S&P 500. They offer the potential for growth while providing some downside protection. Indexed annuities are a good option for individuals seeking a balance between growth and security.

Annuity options are diverse. One type to consider is Annuity Is Reversionary 2024. Understanding the different types of annuities and their potential benefits can help you make the right choice for your individual needs.

Comparing USAA Immediate Annuities

When choosing a USAA immediate annuity, it’s crucial to compare the features, benefits, and risks of each type. Consider factors such as:

- Guaranteed Income Rate:The guaranteed income rate determines the amount of income you will receive each month. Higher rates generally result in larger payments but may also come with higher premiums.

- Investment Options:Variable and indexed annuities offer various investment options, allowing you to tailor your annuity to your risk tolerance and investment goals.

- Fees and Expenses:Annuities come with various fees and expenses, such as administrative fees, mortality charges, and surrender charges. Be sure to compare the fees associated with different annuity products to ensure you choose the most cost-effective option.

Using the USAA Immediate Annuity Calculator

USAA provides an online immediate annuity calculator that can help you estimate your potential income payments and compare different annuity options. The calculator is easy to use and provides personalized quotes based on your individual circumstances.

When thinking about annuities, you might want to explore Calculate Annuity Loan 2024 to understand how they can be used as part of a loan strategy. For those in the UK, Immediate Annuity Calculator Uk can provide valuable insights.

How to Use the USAA Immediate Annuity Calculator

- Enter your age:The calculator will use your age to determine your life expectancy and calculate your potential income payments.

- Enter your desired income:Specify the amount of income you want to receive each month. The calculator will then estimate the amount of money you need to invest to achieve that income level.

- Enter your investment amount:Input the amount of money you are willing to invest in an immediate annuity. The calculator will then calculate your potential monthly income payments.

- Select an annuity type:Choose the type of immediate annuity that best suits your needs, such as a fixed, variable, or indexed annuity. The calculator will then provide you with a personalized quote for the selected annuity type.

Factors to Consider When Choosing an Immediate Annuity

Before purchasing an immediate annuity, it’s essential to carefully consider your financial goals, risk tolerance, and time horizon.

As you delve deeper into annuities, you might come across information about Annuity 60 Day Rollover 2024. Understanding the different aspects of annuities, like Annuity Is Sequence Of Mode Of Payment 2024 , can help you make informed decisions.

Key Factors to Consider

- Financial Goals:What are your financial goals for retirement? Do you need a guaranteed income stream to cover essential expenses or supplement other sources of income? An immediate annuity can help you achieve your financial goals if they align with your need for guaranteed income.

- Risk Tolerance:How comfortable are you with risk? Fixed annuities offer guaranteed income payments, while variable and indexed annuities carry more risk but have the potential for higher returns. Choose an annuity that aligns with your risk tolerance.

- Time Horizon:How long do you need the income from the annuity? If you need income for the rest of your life, an immediate annuity can provide longevity protection. If you only need income for a specific period, other financial products may be more suitable.

Annuity decisions can be complex. You might find yourself asking, Annuity Or Lump Sum 2024 ? It’s important to consider your overall financial goals and risk tolerance. You might also want to explore how annuities can be used to supplement Annuity Health Insurance 2024.

Immediate Annuity Alternatives: Immediate Annuity Calculator Usaa

Immediate annuities are not the only financial products that offer guaranteed income. Consider these alternatives:

Alternative Financial Products

- Traditional Pensions:Traditional pensions provide a guaranteed stream of income after retirement, often based on your years of service and salary. These pensions are becoming less common, but they can provide a reliable source of income for those who are eligible.

- Social Security:Social Security is a government-funded program that provides retirement benefits to eligible individuals. It’s a valuable source of income for many retirees, but it’s not typically enough to cover all expenses.

- Fixed-Income Investments:Fixed-income investments, such as bonds and CDs, offer a guaranteed rate of return and can provide a predictable income stream. However, the interest rates on fixed-income investments can fluctuate, and they may not offer the same level of longevity protection as an immediate annuity.

Closing Notes

Retirement planning requires careful consideration of various factors, including your risk tolerance, time horizon, and financial goals. Immediate annuities, particularly those offered by USAA, can play a significant role in achieving your retirement aspirations. By utilizing the Immediate Annuity Calculator USA, you can gain valuable insights into how these products can help secure your future financial well-being.

Annuity options are evolving. Understanding Annuity Is 2024 can help you navigate the landscape. It’s also crucial to consider the potential impact of Medicaid on your annuity choices. Immediate Annuity Medicaid Compliant is a key topic to research.

Key Questions Answered

What are the different types of immediate annuities offered by USAA?

USAA offers fixed, variable, and indexed immediate annuities. Fixed annuities provide a guaranteed income stream, variable annuities offer growth potential but with some risk, and indexed annuities link returns to a specific index like the S&P 500.

Understanding how much an annuity might be worth in 2024 can be helpful. You can explore tools like Annuity 50k 2024 to get an idea of potential payouts. It’s also worth considering the potential costs associated with annuities, like Variable Annuity Sales Charge 2024.

Is the USAA Immediate Annuity Calculator free to use?

Yes, the USAA Immediate Annuity Calculator is free to use and accessible online. You can access it through the USAA website or mobile app.

What are the potential tax implications of immediate annuities?

The tax implications of immediate annuities can vary depending on the type of annuity and your individual circumstances. It’s essential to consult with a tax advisor to understand the tax implications for your specific situation.

Looking for information about annuities in 2024? You might be interested in learning about Annuity 712 2024. It’s important to understand the different types of annuities available, such as Immediate Annuity Singapore , and how they might fit into your financial plan.