Immediate Annuity Calculator Schwab sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Planning for retirement often involves navigating complex financial decisions. One tool that can aid in this process is an immediate annuity calculator. These calculators help individuals estimate the potential income stream they could receive from an immediate annuity, a financial product that provides a guaranteed stream of income for life.

Schwab, a well-known financial institution, offers an immediate annuity calculator that can be a valuable resource for individuals seeking to understand the potential benefits of this investment option. This guide explores the functionality of Schwab’s immediate annuity calculator and its role in retirement planning.

Variable annuities are different from fixed annuities and offer the potential for higher returns, but also come with greater risk. You can find more information about variable annuities in the Variable Annuity Prospectus 2024. To better understand how annuity calculations work, you can watch Annuity Calculation Youtube 2024 videos.

Introduction to Immediate Annuities

An immediate annuity is a type of insurance contract that provides a guaranteed stream of income payments for life, beginning immediately after the purchase. The payments are made in regular intervals, such as monthly or annually, and are designed to provide a steady source of income during retirement or other life stages.

Immediate annuities are popular among individuals seeking to convert a lump sum of money into a reliable income stream.

Core Characteristics of Immediate Annuities

- Guaranteed Income Payments:Immediate annuities offer a guaranteed stream of income for life, providing financial security and predictability. This eliminates the risk of outliving your savings.

- Lump Sum Investment:To purchase an immediate annuity, you need to make a lump sum payment, which is then invested by the insurance company. The amount of your initial investment will determine the size of your monthly or annual payouts.

- Variety of Payout Options:Immediate annuities offer various payout options, such as fixed payments, variable payments, or indexed payments. These options provide flexibility based on your individual risk tolerance and financial goals.

- Tax-Deferred Growth:The earnings on the annuity contract grow tax-deferred, meaning you won’t be taxed on the interest or investment gains until you begin receiving payments.

Difference Between Immediate and Deferred Annuities

Immediate annuities differ from deferred annuities in the timing of the income payments. While immediate annuities begin paying out immediately, deferred annuities offer payments at a later date, typically in the future, such as at retirement. Deferred annuities allow you to accumulate savings over time before receiving income, while immediate annuities provide immediate income.

Schwab’s Role in the Annuity Market

Schwab, a leading financial services company, offers a range of annuity products, including immediate annuities. They provide access to a diverse selection of annuity contracts from reputable insurance companies, allowing investors to compare and choose options that align with their individual needs and risk tolerance.

Schwab also offers financial guidance and support to help individuals understand and make informed decisions about annuity investments.

How an Immediate Annuity Calculator Works

An immediate annuity calculator is a tool that helps individuals estimate the potential income stream from an immediate annuity. It uses various inputs, such as age, principal amount, interest rate, and payout options, to calculate the monthly or annual payout amount.

Key Inputs for an Immediate Annuity Calculator

- Age:Your age at the time of purchasing the annuity is a crucial factor, as it influences your life expectancy and the potential duration of income payments.

- Principal Amount:The lump sum you plan to invest in the annuity determines the initial investment amount and, consequently, the potential payout amount.

- Interest Rate:The interest rate offered by the insurance company impacts the growth of your investment and the size of your payouts. Interest rates can vary based on market conditions and the type of annuity contract.

- Payout Options:The chosen payout option, such as fixed, variable, or indexed payments, affects the payment amount and the potential for growth or fluctuation.

Determining the Payout Amount

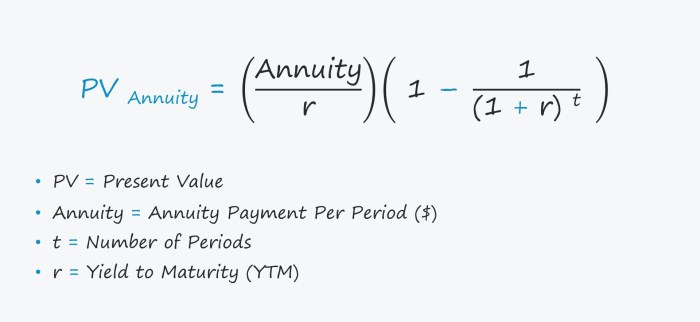

The calculator uses complex actuarial calculations to determine the payout amount. These calculations take into account factors such as mortality rates, investment performance, and the chosen payout option. The calculator estimates the present value of the future income stream based on the provided inputs and calculates the corresponding monthly or annual payout amount.

Variable annuities can be either fixed or open-ended. You can find more information about Variable Annuity Open Ended 2024 options. Many individuals consider annuities at age 65, and you can explore the specifics of Annuity 65 2024 offerings.

Factors Influencing the Payout Amount

- Interest Rates:Higher interest rates generally result in larger payouts, as the investment grows at a faster pace.

- Mortality Rates:The insurance company uses mortality rates to estimate the average lifespan of individuals with similar characteristics. Higher mortality rates can lead to larger payouts, as the insurance company expects to pay out for a shorter period.

- Investment Performance:For variable annuities, the payout amount is influenced by the performance of the underlying investments. Strong investment returns can lead to larger payouts, while poor performance can result in smaller payments.

Benefits of Using an Immediate Annuity Calculator: Immediate Annuity Calculator Schwab

An immediate annuity calculator offers several advantages for individuals considering annuity investments. It helps them understand the potential income stream from an annuity and make informed financial decisions.

Estimating Potential Income Stream

The calculator provides an estimated monthly or annual payout amount based on your specific inputs. This allows you to visualize the potential income stream you could receive from the annuity and assess its suitability for your financial needs.

Annuity returns can vary significantly, and you should understand the potential risks and rewards involved. You can find more information about 7 Annuity Return 2024 rates to get a better understanding of current market trends. If you’re considering a variable annuity, you might need a Variable Annuity License 2024 to sell these products.

Financial Planning and Retirement Income Projections

By using an immediate annuity calculator, individuals can incorporate annuity income into their financial planning and retirement income projections. They can evaluate how an annuity can supplement other retirement income sources and ensure financial stability during their later years.

Comparing Different Annuity Options

The calculator can be used to compare different annuity options, such as fixed, variable, and indexed annuities. By adjusting the inputs and comparing the resulting payouts, individuals can identify the annuity that best aligns with their risk tolerance and financial goals.

To calculate your potential annuity payout, you can use a variety of online tools. For example, Calculator.Net Annuity Payout 2024 provides a simple way to estimate your income stream. You can also use a Growing Annuity Calculator Present Value 2024 to understand how your annuity payments might increase over time.

Factors to Consider When Using an Immediate Annuity Calculator

While an immediate annuity calculator can be a valuable tool, it’s essential to consider certain factors when evaluating annuity options. Understanding these considerations can help you make informed decisions and avoid potential pitfalls.

Variable annuities and variable life insurance are two distinct financial products. If you’re considering either option, you should carefully compare their features and benefits. You can find a detailed comparison of Variable Annuity Vs Variable Life Insurance 2024 to make an informed decision.

Payout Options

- Fixed Payments:Fixed annuities provide a guaranteed stream of income payments for life, regardless of market fluctuations. They offer stability and predictability but may not keep pace with inflation.

- Variable Payments:Variable annuities offer payments that fluctuate based on the performance of the underlying investments. They have the potential for higher returns but also carry higher risk.

- Indexed Payments:Indexed annuities offer payments that are linked to the performance of a specific index, such as the S&P 500. They provide some growth potential while offering protection against significant losses.

Inflation

Inflation can erode the purchasing power of your annuity payments over time. It’s essential to consider the potential impact of inflation on your income stream and choose an annuity that provides some protection against inflation.

Taxes

Annuity payments are generally taxed as ordinary income. It’s important to understand the tax implications of annuity payments and factor them into your financial planning.

Fees and Expenses

Annuities often involve fees and expenses, such as administrative fees, surrender charges, and mortality charges. These fees can impact the overall return on your investment. It’s crucial to carefully review the fees associated with any annuity contract before making a decision.

Schwab’s Immediate Annuity Calculator: Features and Functionality

Schwab’s immediate annuity calculator is a user-friendly tool that provides estimates of potential annuity payouts. It offers a range of features and functionality to help individuals explore different annuity options and make informed financial decisions.

An immediate annuity is a type of financial product that provides a guaranteed stream of income for life. You can use an Immediate Annuity Calculator to estimate your potential payouts. These annuities are often used by retirees to supplement their income and ensure they have a steady source of funds in their later years.

Features and Functionality

- Customizable Inputs:The calculator allows you to adjust various inputs, such as age, principal amount, interest rate, and payout options, to reflect your specific circumstances.

- Multiple Payout Options:Schwab’s calculator supports various payout options, including fixed, variable, and indexed payments, allowing you to compare the potential payouts for different scenarios.

- Interactive Interface:The calculator features an interactive interface that allows you to adjust inputs and see the corresponding changes in the estimated payout amount in real-time.

- Detailed Reports:The calculator provides detailed reports that summarize the estimated payout amount, the underlying assumptions, and the potential tax implications.

Comparison to Other Annuity Calculators

Schwab’s immediate annuity calculator compares favorably to other calculators available in the market. It offers a user-friendly interface, comprehensive features, and detailed reports, making it a valuable tool for individuals seeking to understand annuity options.

Annuity rates can fluctuate based on various factors, including interest rates and market conditions. For example, the Annuity 9 2024 rate reflects the current market conditions. If you’re considering an annuity, you might want to explore a Annuity Calculator Based On Life Expectancy 2024 to get a more personalized estimate.

Examples of Use

Schwab’s calculator can be used to make informed financial decisions, such as:

- Estimating Retirement Income:You can use the calculator to estimate the potential income stream from an annuity and assess its suitability for your retirement income needs.

- Comparing Different Annuity Options:You can adjust the inputs and compare the estimated payouts for different annuity options, such as fixed, variable, and indexed annuities, to determine the best fit for your risk tolerance and financial goals.

- Evaluating the Impact of Interest Rates:You can explore how different interest rates affect the estimated payout amount and make informed decisions based on your expectations for future interest rate movements.

Alternatives to Schwab’s Immediate Annuity Calculator

While Schwab’s immediate annuity calculator is a valuable resource, there are other reputable online tools and resources available for calculating immediate annuity payouts. These alternatives offer different features and functionality, catering to various needs and preferences.

Reputable Online Resources, Immediate Annuity Calculator Schwab

- Immediate Annuity Calculator by Annuity.org:This calculator provides estimates of potential annuity payouts based on your age, principal amount, interest rate, and payout options. It offers a user-friendly interface and detailed reports.

- Annuity Calculator by Bankrate:Bankrate’s annuity calculator allows you to compare different annuity options and estimate the potential payouts. It provides information on fees and expenses associated with annuities.

- Annuity Calculator by Investopedia:Investopedia’s annuity calculator provides estimates of potential payouts for both immediate and deferred annuities. It offers a simple interface and basic functionality.

Comparison of Features and Functionality

The features and functionality of these alternatives vary. Some calculators offer more advanced features, such as the ability to adjust for inflation or consider tax implications. Others focus on providing basic estimates of potential payouts.

Choosing the Right Calculator

The best calculator for you will depend on your individual needs and preferences. If you’re looking for a comprehensive tool with advanced features, Schwab’s calculator or Annuity.org’s calculator might be suitable. If you need a simple calculator to get a basic estimate, Bankrate’s or Investopedia’s calculator could be sufficient.

Considerations Before Purchasing an Immediate Annuity

Before investing in an immediate annuity, it’s crucial to carefully consider various factors. Understanding the potential risks and drawbacks associated with annuities can help you make informed decisions and avoid potential pitfalls.

Important Factors to Consider

- Your Financial Goals:Immediate annuities are best suited for individuals seeking a guaranteed stream of income for life. Consider your financial goals and whether an annuity aligns with your overall financial plan.

- Risk Tolerance:Annuities can offer different levels of risk. Fixed annuities offer guaranteed payments but may not keep pace with inflation. Variable annuities offer potential for higher returns but also carry higher risk.

- Fees and Expenses:Annuities often involve fees and expenses, which can impact the overall return on your investment. Carefully review the fees associated with any annuity contract before making a decision.

- Liquidity:Annuities are generally illiquid, meaning it can be difficult to access your funds before the start of payments. Consider your liquidity needs and whether an annuity aligns with your short-term financial goals.

- Tax Implications:Annuity payments are generally taxed as ordinary income. Understand the tax implications of annuity payments and factor them into your financial planning.

Potential Risks and Drawbacks

- Inflation Risk:Fixed annuities offer guaranteed payments but may not keep pace with inflation, eroding the purchasing power of your income over time.

- Interest Rate Risk:Interest rates can fluctuate, potentially impacting the returns on your annuity investment. Lower interest rates can lead to lower payouts.

- Liquidity Risk:Annuities are generally illiquid, making it difficult to access your funds before the start of payments. This can be a drawback if you need to access your funds for unforeseen circumstances.

Consulting a Financial Advisor

Before making any investment decisions, it’s essential to consult with a qualified financial advisor. They can help you understand the complexities of annuities, assess your individual needs and risk tolerance, and recommend the most suitable annuity options for your financial goals.

There are various online tools available to help you calculate your annuity payouts, such as the Annuity Calculator Hl 2024. Understanding how annuities work is crucial before making a decision. For instance, a How Does A 3 Year Annuity Work 2024 article can provide insights into the mechanics of shorter-term annuities.

Epilogue

In conclusion, Schwab’s immediate annuity calculator offers a user-friendly and informative tool for individuals seeking to explore the potential benefits of immediate annuities. By providing a clear understanding of the factors that influence annuity payouts, the calculator empowers individuals to make informed decisions about their retirement income planning.

Remember, it’s essential to consult with a financial advisor before making any investment decisions, as they can provide personalized guidance based on your individual circumstances.

Query Resolution

How accurate are immediate annuity calculators?

Immediate annuity calculators provide estimates based on current market conditions and actuarial assumptions. While they offer valuable insights, it’s crucial to remember that actual payouts may vary depending on factors such as interest rate fluctuations, mortality rates, and investment performance.

What are the tax implications of immediate annuities?

The tax treatment of annuity payments depends on the specific type of annuity purchased. Generally, a portion of each payment is considered a return of principal (non-taxable) and the remaining portion is considered income (taxable). Consult with a tax advisor to understand the specific tax implications of your annuity.

Are immediate annuities suitable for everyone?

Immediate annuities may be a suitable option for individuals seeking guaranteed income for life, but they are not suitable for everyone. It’s essential to consider your risk tolerance, investment goals, and overall financial situation before making a decision. Consulting with a financial advisor can help determine if an immediate annuity aligns with your financial objectives.