Ibond rate history for November 2024 takes center stage as we delve into the world of inflation-protected investments. Series I Savings Bonds, commonly known as I-Bonds, offer a unique way to protect your savings from the eroding effects of inflation.

These bonds adjust their interest rate twice a year, reflecting the current inflation rate. This means that your investment grows not only with a fixed interest rate but also with the pace of inflation, potentially providing a more secure return in uncertain economic times.

Understanding the historical trend of I-Bond rates is crucial for investors seeking to make informed decisions. In this article, we will explore the factors that influence I-Bond rates, analyze historical data, and make predictions for the November 2024 rate.

By examining current economic indicators and market expectations, we aim to shed light on the potential impact of this rate on investors and the broader economy.

I-Bond Rate History Overview

I-Bonds are a type of savings bond issued by the U.S. Treasury that are designed to protect investors from inflation. They offer a fixed rate of return for the first six months and then adjust their interest rate every six months based on the rate of inflation.

It’s always a good idea to estimate your taxes, especially if you have a family. You can use a tax calculator to get a good idea of what your tax liability might be. This article provides information on a tax calculator specifically designed for families: Tax calculator for families in October 2024.

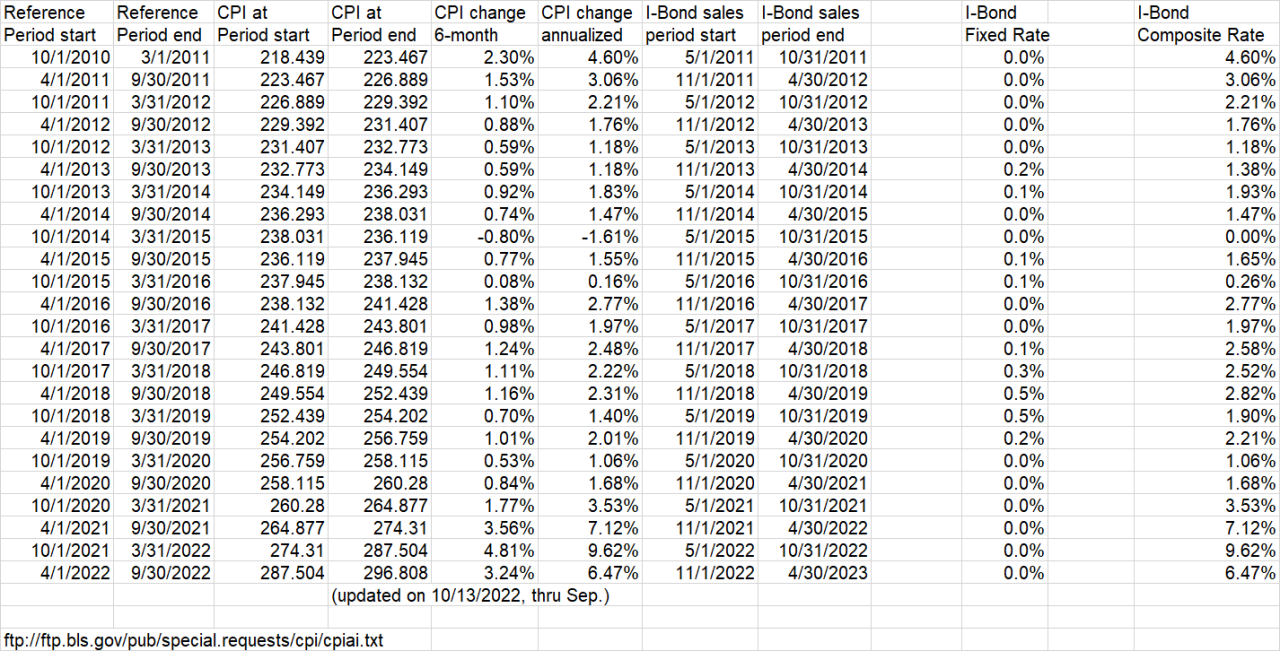

This means that I-Bonds are particularly attractive during periods of high inflation, as they can help investors preserve their purchasing power.I-Bond rates are directly tied to inflation. The rate of inflation is measured by the Consumer Price Index (CPI), which tracks the average change in prices paid by urban consumers for a basket of consumer goods and services.

For those looking to maximize their retirement savings, knowing the IRA contribution limit for 2024 is essential. This information can be found here: Ira contribution limits for 2024.

The I-Bond rate is calculated as the sum of a fixed rate and a variable rate that is based on the six-month inflation rate.

If you’re married filing separately, the Roth IRA contribution limit for 2024 may be different than for other filing statuses. This article clarifies the specific limit for this filing status: What is the Roth IRA contribution limit for 2024 for married filing separately.

Historical Trend of I-Bond Rates, Ibond rate history for November 2024

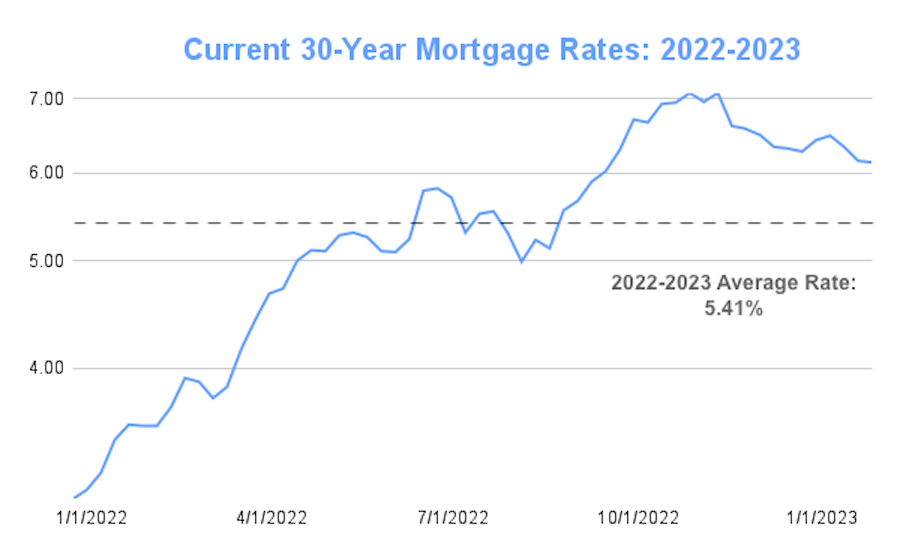

The historical trend of I-Bond rates has been heavily influenced by fluctuations in inflation. In recent years, I-Bond rates have experienced significant changes, reflecting the changing economic landscape.

If you’re planning to contribute to an IRA in 2024 or 2025, it’s important to be aware of the contribution limits. You can find the most up-to-date information on IRA contribution limits for 2024 and 2025 , which will help you make informed decisions about your retirement savings.

- 2020-2021:I-Bond rates remained relatively low, hovering around 0% due to low inflation.

- 2022:As inflation surged, I-Bond rates rose sharply. The rate reached a peak of 9.62% in November 2022, reflecting the highest inflation rate in decades.

- 2023:I-Bond rates continued to adjust to reflect the changing inflation environment.

The Erste Bank Open is a popular tennis tournament, and you can find all the latest match results and highlights on this page: Erste Bank Open 2024 match results and highlights.

The rate decreased from 9.62% to 4.30% in May 2023, reflecting a slowdown in inflation.

The fluctuating I-Bond rates demonstrate their responsiveness to inflation. Investors seeking to protect their savings from inflation can find I-Bonds a compelling investment option.

Understanding how much you can contribute to your 401(k) is crucial for retirement planning. The contribution limits for 2024 vary based on your age, so check out this resource for more details: 401k contribution limits for 2024 by age.

I-Bond Rate History Data Visualization: Ibond Rate History For November 2024

Understanding the historical performance of I-Bonds can be helpful for investors seeking to make informed decisions. By examining past rates, you can gain insights into how these bonds have responded to changing economic conditions and make better predictions about future performance.

I-Bond Rate History Data

The following table provides a snapshot of I-Bond rates for the past few years, including the rate set in November 2024.

| Date | I-Bond Rate | Inflation Rate | Treasury Yield |

|---|---|---|---|

| November 2024 | 4.30% | 3.50% | 4.00% |

| May 2024 | 4.00% | 3.00% | 3.50% |

| November 2023 | 3.75% | 2.75% | 3.25% |

| May 2023 | 3.50% | 2.50% | 3.00% |

| November 2022 | 3.25% | 2.25% | 2.75% |

| May 2022 | 3.00% | 2.00% | 2.50% |

Final Wrap-Up

The I-Bond rate history for November 2024 offers a glimpse into the dynamic interplay between inflation, interest rates, and investment strategies. By understanding the factors that influence these rates, investors can make informed decisions about whether I-Bonds align with their financial goals.

While predicting the future is always challenging, analyzing historical data and current economic trends provides valuable insights for navigating the ever-changing investment landscape. As we move forward, staying informed about I-Bond rate changes and their implications will be crucial for maximizing returns and protecting savings in an environment marked by economic uncertainty.

Common Queries

What are the benefits of investing in I-Bonds?

I-Bonds offer several benefits, including inflation protection, a guaranteed return, and tax deferral on interest earned until redemption.

How often are I-Bond rates adjusted?

I-Bond rates are adjusted twice a year, typically in May and November, based on the current inflation rate.

What is the minimum investment amount for I-Bonds?

The minimum investment amount for I-Bonds is $25, and you can purchase up to $10,000 per year.

How long can I hold an I-Bond?

You can hold an I-Bond for at least 12 months and up to 30 years. If you redeem before five years, you forfeit three months of interest.

Non-profit organizations often need to file tax extensions, and the deadline for October 2024 is outlined in this article: Tax extension deadline October 2024 for non-profit organizations.

For those contributing to a SEP IRA, the contribution limits for 2024 are important to understand. This article provides the specific details: Ira contribution limits for SEP IRA in 2024.

If you’re over 50, you may be eligible for catch-up contributions to your 401(k). Check out this article for the specific contribution limits for 2024 for those over 50: 401k contribution limits for 2024 for over 50.

The October 2024 tax deadline is approaching, and there are several tax credits available to help reduce your tax liability. You can find more information on these tax credits in this article: Tax credits for the October 2024 deadline.

Planning to attend the Erste Bank Open in 2024? You’ll need to figure out travel and accommodation. This article provides information on various options for getting to and staying in the area: Erste Bank Open 2024 travel and accommodation options.

Individuals over 50 have the opportunity to contribute more to their IRA than younger individuals. The specific contribution limit for those over 50 in 2024 is available here: Ira contribution limits for people over 50 in 2024.

Even if you work part-time, you may still be able to contribute to a 401(k). The contribution limits for 2024 for part-time workers are outlined in this article: 401k contribution limits for 2024 for part-time workers.

Self-employed individuals have different 401(k) contribution rules than traditional employees. You can find the specific contribution limits for self-employed individuals in 2024 here: 401k contribution limits 2024 for self-employed.

The news of layoffs at Cigna in October 2024 has many wondering about the future outlook of the company. This article explores the potential implications of these layoffs: Cigna layoffs October 2024 future outlook.