Ibnr Insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Ibnr, which stands for Incurred But Not Reported, refers to claims that have occurred but haven’t been reported to the insurer yet.

When you’re traveling and need to file a claim, knowing how to navigate the Aon Travel Claim process can be helpful. Make sure to keep all relevant documentation for a smooth experience.

This intriguing concept plays a crucial role in the world of insurance, as it directly impacts the financial stability and profitability of insurance companies.

Allstate is a well-known insurance provider, and if you need to file an auto claim, you can access their Allstate Auto Claims resources online or through their customer service.

The significance of IBNR lies in its ability to influence the accuracy of an insurer’s financial reporting. By understanding the intricacies of IBNR, we can delve into the world of insurance reserves, claim frequency and severity, and the methods used to estimate these elusive claims.

If you’re a Verizon customer with Asurion phone insurance and need to file a claim, you can find information on their Asurion Phone Claim Verizon website.

This exploration will shed light on the challenges insurers face in managing IBNR risk and its impact on financial statements.

State Farm offers a convenient State Farm Claim Center where you can manage your claims online, making the process easier and more efficient.

Introduction to IBNR Insurance

IBNR, which stands for “Incurred But Not Reported,” is a crucial concept in the insurance industry. It refers to claims that have occurred but haven’t yet been reported to the insurer. These claims represent a significant financial liability for insurers, as they need to set aside sufficient reserves to cover these potential future payouts.

State Farm is a leading insurance company, and if you need assistance with a claim, their State Farm Claims Customer Service team is available to help you through the process.

Significance of IBNR Reserves

IBNR reserves are essential for insurers to ensure their financial stability and solvency. They serve as a buffer against unexpected claims and help maintain the insurer’s ability to meet its obligations to policyholders. Adequate IBNR reserves are crucial for:

- Meeting future claims:IBNR reserves provide the financial resources to pay for claims that are yet to be reported.

- Maintaining financial stability:By setting aside reserves, insurers can mitigate the impact of unexpected claims on their financial performance.

- Ensuring solvency:Sufficient IBNR reserves help insurers maintain their ability to meet their financial obligations and avoid insolvency.

Examples of IBNR Claims

IBNR claims can arise in various insurance types. Here are some examples:

- Health insurance:A policyholder may have a medical procedure performed but not report the claim immediately, resulting in an IBNR claim.

- Property insurance:A homeowner may experience a minor water damage incident but delay reporting it until a larger issue arises, creating an IBNR claim.

- Liability insurance:A driver involved in an accident may not report the incident immediately, leading to an IBNR claim if the other party later files a claim.

Factors Affecting IBNR Reserves

Several factors can influence the size of IBNR reserves. These factors can be categorized into external and internal elements that impact claim frequency and severity.

Understanding the concept of Personal And Advertising Injury is crucial, especially for businesses. It covers situations where someone’s reputation or privacy is harmed due to your actions, even if unintentional.

Key Factors Influencing IBNR Reserves

The following factors significantly affect IBNR reserves:

- Claim frequency:The number of claims reported in a given period directly impacts IBNR reserves. Higher claim frequency often indicates a larger pool of potential IBNR claims.

- Claim severity:The average cost of claims also plays a crucial role. Higher claim severity implies that even a small number of unreported claims can significantly impact IBNR reserves.

- Economic conditions:Economic downturns can lead to increased claim frequency and severity, as people may be more likely to file claims due to financial hardship.

- Regulatory changes:New regulations or changes in existing ones can affect claim reporting and processing, potentially influencing IBNR reserves.

- Insurer’s underwriting practices:The insurer’s risk selection and pricing policies can influence the likelihood and severity of claims, thus impacting IBNR reserves.

- Data quality and availability:Accurate and comprehensive data on past claims is essential for accurate IBNR estimation. Data limitations can lead to significant inaccuracies in IBNR calculations.

Impact of Claim Frequency and Severity

Claim frequency and severity have a direct impact on IBNR reserves. A higher frequency of claims suggests a larger pool of potential IBNR claims, while higher claim severity implies that each unreported claim could result in a substantial payout.

Active military personnel and their families can access healthcare through Tricare, and understanding how to file Tricare Claims is important for receiving proper coverage.

Insurers need to carefully consider both factors when estimating IBNR reserves.

If you’re a Geico customer and need assistance with a claim, their Geico Claims Customer Service team is available to help you navigate the process.

Role of Economic Conditions and Regulatory Changes

Economic conditions and regulatory changes can significantly impact IBNR reserves. For example, an economic recession may lead to an increase in claims due to job losses and financial stress. Regulatory changes, such as new reporting requirements, can affect claim reporting patterns, impacting IBNR estimates.

Assurant provides phone insurance, and if you need to file a claim for a damaged phone, you can visit the Assurant Phone Claim website for instructions and support.

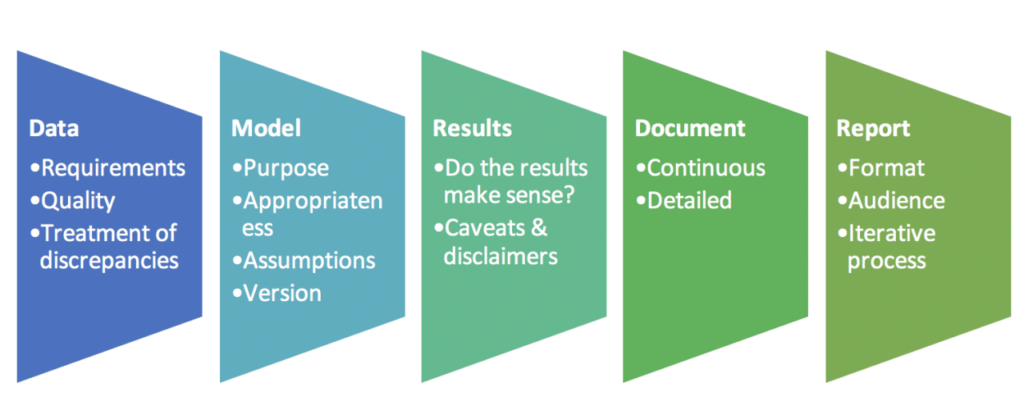

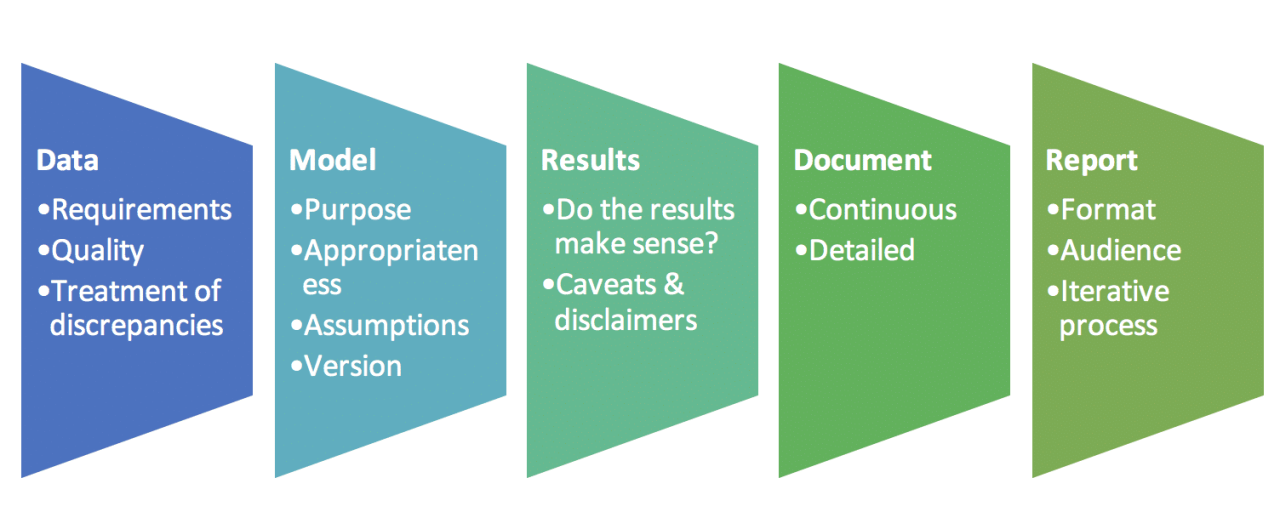

Methods for Estimating IBNR Reserves

Insurers employ various methods to estimate IBNR reserves, each with its own strengths and weaknesses. The choice of method depends on factors such as the type of insurance, data availability, and the insurer’s risk appetite.

Comparison of IBNR Estimation Methods

Here are some common methods used for IBNR estimation:

| Method | Advantages | Disadvantages |

|---|---|---|

| Chain Ladder Method | Simple to implement, widely used, requires minimal data | Assumes a consistent pattern in claim development, sensitive to data quality |

| Bornhuetter-Ferguson Method | Combines historical data with expected ultimate losses, more robust than chain ladder | Requires judgment in setting expected ultimate losses, can be sensitive to parameter assumptions |

| Cape Cod Method | Accounts for both paid and incurred losses, provides a more comprehensive view | More complex than other methods, requires significant data and expertise |

| Regression Analysis | Can incorporate multiple factors influencing IBNR, provides statistically robust estimates | Requires extensive data and statistical expertise, can be sensitive to model assumptions |

Real-World Examples of IBNR Estimation Methods, Ibnr Insurance

The chain ladder method is often used for estimating IBNR reserves in property and casualty insurance, while the Bornhuetter-Ferguson method is commonly applied in health insurance. The Cape Cod method is typically used for more complex lines of insurance, while regression analysis is often employed for specialized claims or when detailed data is available.

Unfortunately, car insurance fraud is a serious issue, and it’s important to be aware of the potential consequences. If you suspect someone is committing Car Insurance Fraud , it’s crucial to report it to the appropriate authorities.

Challenges in IBNR Estimation

Estimating IBNR reserves accurately is a complex and challenging task for insurers. Several factors can contribute to inaccuracies in IBNR estimates, potentially impacting financial reporting and solvency.

In legal terms, Detrimental Reliance occurs when someone makes a decision based on a promise or representation, only to be harmed when that promise isn’t fulfilled.

Challenges Faced by Insurers in Estimating IBNR

Insurers face various challenges in estimating IBNR reserves:

- Data quality and availability:Accurate and comprehensive data on past claims is crucial for accurate IBNR estimation. Missing or inaccurate data can significantly impact the reliability of estimates.

- Uncertainty and risk:IBNR estimation involves inherent uncertainty, as it relies on predictions about future claims. Insurers need to consider the potential impact of unforeseen events and changing claim patterns.

- Complexity of claims:The complexity of claims, particularly in areas like liability insurance, can make it difficult to accurately estimate IBNR reserves.

- Time lags in claim reporting:The time it takes for claims to be reported can vary significantly, making it challenging to estimate IBNR reserves accurately.

Impact of Data Quality and Availability

The quality and availability of data significantly impact the accuracy of IBNR estimates. Missing or inaccurate data can lead to biases in the estimation process, resulting in over- or underestimation of IBNR reserves. Insurers need to invest in data management and quality control to ensure the reliability of their IBNR estimates.

Role of Uncertainty and Risk

IBNR estimation is inherently uncertain, as it involves predicting future events. Insurers need to carefully consider the potential impact of unforeseen events, such as natural disasters or economic downturns, on their IBNR estimates. Risk management strategies are crucial to mitigate the impact of uncertainty and ensure the adequacy of IBNR reserves.

Managing IBNR Risk: Ibnr Insurance

Insurers can implement various strategies to manage IBNR risk and improve the accuracy of their estimates. These strategies involve enhancing data collection and analysis, leveraging actuarial expertise, and adopting sound risk management practices.

Strategies for Managing IBNR Risk

Here are some strategies insurers can employ to manage IBNR risk:

- Improve data collection and analysis:Insurers can enhance their data collection processes to ensure comprehensive and accurate data on past claims. Advanced analytics techniques can help identify trends and patterns in claim reporting, improving IBNR estimation.

- Leverage actuarial expertise:Actuarial professionals have specialized knowledge and skills in IBNR estimation. Insurers can benefit from their expertise in developing robust IBNR models and evaluating the adequacy of reserves.

- Implement sound risk management practices:Insurers should adopt a comprehensive risk management framework that addresses IBNR risk. This includes identifying and assessing IBNR risk, developing mitigation strategies, and monitoring the effectiveness of risk management efforts.

- Use scenario analysis:Insurers can conduct scenario analysis to assess the potential impact of different economic and regulatory scenarios on their IBNR estimates. This helps them understand the range of potential outcomes and adjust their reserves accordingly.

- Develop a strong claims management system:Efficient claims management processes can help reduce the time lag in claim reporting, improving the accuracy of IBNR estimates. Insurers should invest in systems and processes that facilitate timely and accurate claim reporting.

Role of Actuarial Expertise in IBNR Management

Actuarial expertise plays a vital role in managing IBNR risk. Actuaries can develop sophisticated models to estimate IBNR reserves, assess the adequacy of reserves, and advise insurers on risk management strategies. Their knowledge of statistical methods, claim patterns, and insurance regulations is crucial for accurate IBNR estimation and risk mitigation.

Impact of IBNR on Financial Reporting

IBNR reserves have a significant impact on an insurer’s financial statements, affecting profitability, solvency, and overall financial performance. Accurate IBNR estimation is essential for ensuring the reliability of financial reporting and maintaining the insurer’s financial stability.

Impact of IBNR Reserves on Profitability and Solvency

IBNR reserves affect profitability and solvency in the following ways:

- Profitability:IBNR reserves are recorded as a liability on the insurer’s balance sheet. Overestimating IBNR reserves can reduce profitability by increasing expenses and reducing net income. Conversely, underestimating IBNR reserves can lead to future financial strain if actual claims exceed the estimated reserves.

- Solvency:Adequate IBNR reserves are essential for maintaining an insurer’s solvency. Insufficient reserves can increase the risk of insolvency if actual claims exceed the estimated reserves. Regulators closely monitor IBNR reserves to ensure that insurers have sufficient capital to meet their obligations.

Implications of IBNR Miscalculations for Financial Reporting

Miscalculations in IBNR reserves can have significant implications for financial reporting. Overestimating IBNR reserves can distort the insurer’s financial performance by artificially reducing profitability. Conversely, underestimating IBNR reserves can lead to a misrepresentation of the insurer’s financial position and expose them to financial risks.

Accurate IBNR estimation is essential for ensuring the reliability and transparency of financial reporting.

Closing Notes

In conclusion, navigating the complexities of IBNR insurance is essential for any insurer. By embracing effective strategies for managing IBNR risk, insurers can mitigate potential financial uncertainties and ensure their long-term stability. The importance of accurate IBNR estimation cannot be overstated, as it directly impacts financial reporting, profitability, and ultimately, the overall health of the insurance industry.

If you have a Choice Home Warranty and need to file a claim, you can find helpful information and guidance on their Choice Home Warranty Claim website.

Query Resolution

What are some common examples of IBNR claims?

If you’re a T-Mobile customer and need to file a claim, you can visit the My Tmo Claim Com website for information and guidance. It’s a convenient way to manage your claims process and get the support you need.

Examples include car accidents where the driver doesn’t report the incident immediately, medical claims where the full extent of injuries isn’t known right away, or insurance claims for natural disasters where the damage is initially underestimated.

Celsius is known for its energy drinks, but if you experience any issues with their products, you can find information on how to file a Celsius Claim on their website.

How do insurers use IBNR reserves?

Kemper Insurance offers a variety of insurance products, and if you need to file a claim, it’s helpful to familiarize yourself with the Kemper Insurance Claims process to ensure a smooth experience.

Insurers set aside IBNR reserves to cover the estimated cost of these unreported claims. These reserves act as a safety net, ensuring that the insurer has enough funds to pay out claims even if they are reported later.

What are the main challenges in estimating IBNR?

Challenges include predicting claim frequency and severity, dealing with incomplete data, and accounting for factors like inflation and economic conditions.

What are some strategies for managing IBNR risk?

Strategies include improving data collection and analysis, using advanced actuarial models, and developing risk mitigation plans.