How will tax brackets affect my 2024 income? This question is on the minds of many as we approach the new year. Understanding how tax brackets work is crucial for navigating financial decisions and maximizing your after-tax earnings.

This guide delves into the intricacies of tax brackets, explaining how they influence your income and providing strategies to minimize your tax liability.

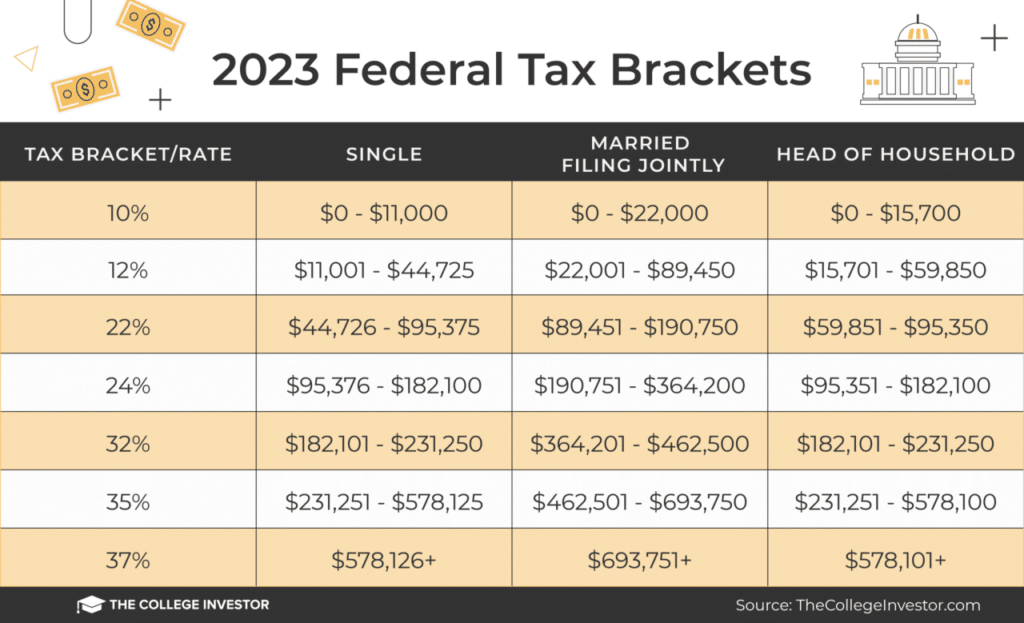

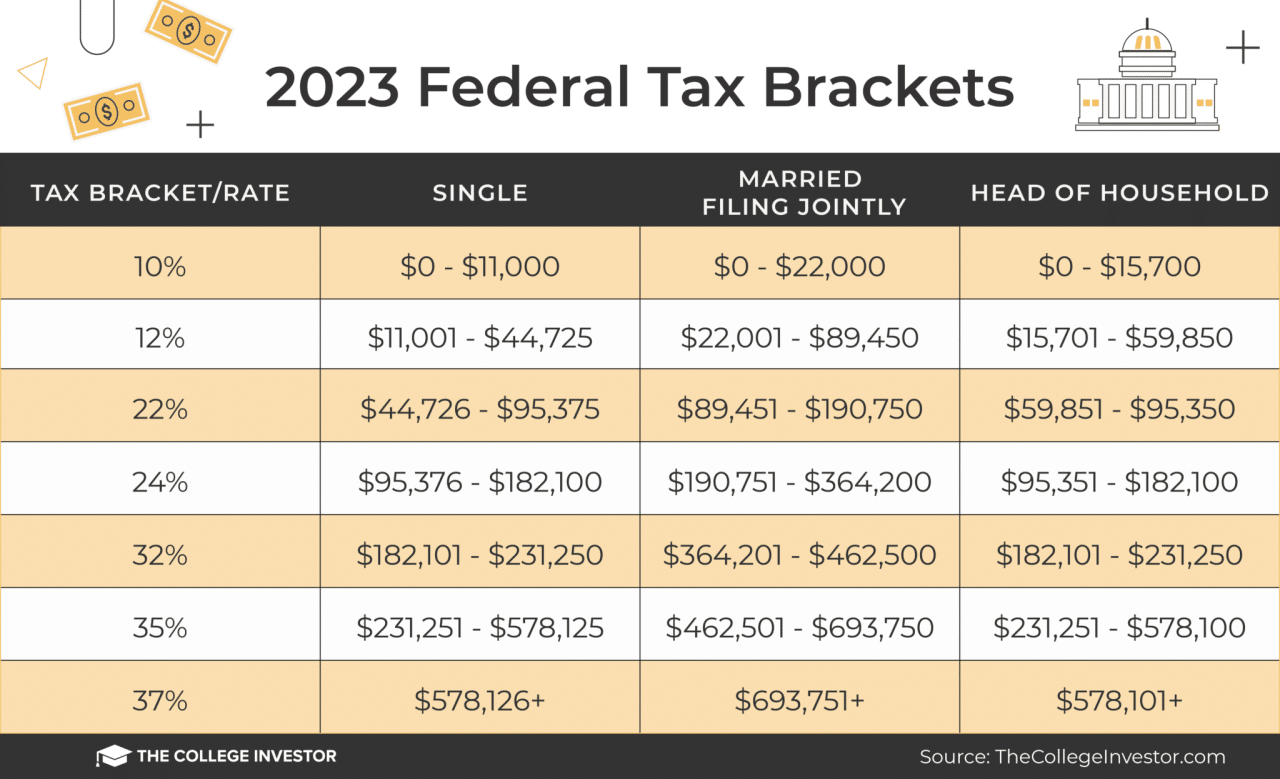

The United States employs a progressive tax system, meaning that higher earners pay a larger percentage of their income in taxes. This system is divided into tax brackets, each with a different tax rate. As your income increases, you move into higher tax brackets, leading to a greater tax burden.

While this may seem daunting, understanding how tax brackets work empowers you to make informed financial choices and potentially reduce your tax liability.

Impact of Tax Brackets on Income

Tax brackets are a system used by the government to determine how much income tax you owe. Each tax bracket has a different tax rate, and your income determines which bracket you fall into. Understanding how tax brackets work is crucial for managing your finances and planning for the future.

The Bills’ performance against the Texans was full of surprises, and you can find out the top three takeaways from the game in the Top 3 things we learned from Bills at Texans | Week 5. If you’re looking for the latest score and how to watch the Cowboys vs.

Steelers game, you can find all the information you need in the Cowboys vs. Steelers score today: Live updates, how to watch.

How Income Changes Affect Tax Brackets

The tax bracket you fall into depends on your taxable income. As your income increases, you may move into a higher tax bracket, which means you’ll pay a higher tax rate on a portion of your income. This is often referred to as “marginal tax rates.” It’s important to note that you don’t pay the higher tax rate on all of your income; it only applies to the portion that falls within that specific tax bracket.

The Bears dominated the Panthers, improving their record to 3-2. You can find a recap of the game in the Rapid Recap: Bears improve to 3-2 with rout of Panthers. Alabama’s fall in the rankings opened the door for Big Ten teams to climb the ladder.

You can see the latest college football rankings in the College Football Rankings: Alabama falls, Big Ten teams stack top.

Marginal Tax Rates Explained, How will tax brackets affect my 2024 income?

Marginal tax rates are the rates applied to each additional dollar of income you earn. Imagine the tax brackets are like steps on a ladder. As you climb the ladder, you reach a higher step, which represents a higher tax rate.

The Jets fell short in their London matchup against the Vikings, and you can read all about it in the Jets-Vikings Game Recap | Green & White Fall Short in London. The Seahawks’ comeback effort ultimately fell short, and you can find a detailed analysis of the game in the Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss.

For example, if you earn $50,000 and the tax rate for that bracket is 12%, you’ll pay 12% tax on the portion of your income that falls within that bracket. However, if you earn an additional $10,000, and that pushes you into the next bracket with a 22% rate, you’ll only pay 22% on the additional $10,000, not on your entire income.

Examples of How Raises and Bonuses Affect Tax Liability

Let’s look at some real-world examples:

- Imagine you receive a $5,000 raise. If this pushes your income into a higher tax bracket, you’ll pay a higher tax rate on the $5,000 raise, but not on your entire income.

- Similarly, if you receive a bonus, the portion of the bonus that falls within a higher tax bracket will be taxed at the higher rate.

It’s crucial to remember that while a raise or bonus may seem like a significant increase, the actual impact on your take-home pay may be less due to the higher tax rate on the additional income.

The Ravens and Bengals battled it out in a hard-fought game, and you can get all the details in the Postgame Notes and Quotes: Ravens at Bengals. The Giants pulled off a convincing win against the Seahawks, and our instant analysis breaks down the key factors that led to their victory.

You can read more about it in the Instant Analysis: Giants defeat Seahawks, 29-20.

Closing Notes: How Will Tax Brackets Affect My 2024 Income?

Navigating the complexities of tax brackets can feel overwhelming, but armed with knowledge and the right strategies, you can optimize your financial well-being. By understanding how tax brackets affect your income, you can make informed decisions about your earnings, deductions, and tax planning.

Remember, seeking professional advice from a qualified tax professional can provide valuable insights and ensure you are taking advantage of all available tax benefits. With careful planning and a proactive approach, you can navigate the tax landscape confidently and maximize your financial potential in 2024 and beyond.

Q&A

How often are tax brackets adjusted?

Tax brackets are typically adjusted annually for inflation. The Internal Revenue Service (IRS) uses the Consumer Price Index (CPI) to determine the adjustments.

What happens if I receive a large bonus or income increase?

A large bonus or income increase can push you into a higher tax bracket for that portion of your income. However, it doesn’t mean that all of your income is taxed at the higher rate. Only the portion of your income that falls within the higher bracket is taxed at the higher rate.

Are there any tax deductions for education expenses?

Yes, there are several tax deductions available for education expenses, such as the American Opportunity Tax Credit and the Lifetime Learning Credit. The eligibility requirements and benefits vary, so it’s important to consult with a tax professional to determine which deductions apply to your situation.

What is the difference between a deduction and a credit?

A tax deduction reduces your taxable income, while a tax credit directly reduces your tax liability. Both can lower your overall tax burden, but they work in different ways.

The Commanders delivered a decisive victory over the Browns, with a final score of 34-13. You can find a full recap of the game, including stats and highlights, in the Commanders 34, Browns 13 | Final Score, Stats & Game Recap.

If you’re looking for information on how to watch the Raiders vs. Broncos game, you can find all the details in the How to watch the Las Vegas Raiders vs. Denver Broncos NFL game.

The Texans pulled off a surprising upset against the Bills, winning with a score of 23-20. You can find the final score, key stats, and game highlights in the Texans 23, Bills 20 | Final score, stats to know + game highlights.

The Jaguars and Colts put on a thrilling show, with the Jaguars emerging victorious with a score of 37-34. You can read a full game report in the Game Report, 2024 Week 5: Jaguars 37, Colts 34.

The Packers secured a win against the Rams thanks to some crucial turnovers. You can find a recap of the game in the Recap: Turnovers help Packers defeat Rams, 24-19. Michigan football had a lot to learn from their game against Washington, and you can read about the key takeaways in the Michigan football: What we learned vs.

Washington: ‘Don’t let this.

The Miami Dolphins had a tough game, and you can find out what the players had to say in the Miami Dolphins Postgame Quotes 10/6. It’s always interesting to hear the players’ perspectives on the game, and this article gives you a glimpse into their thoughts.