How will a recession in October 2024 affect inflation? This question weighs heavily on the minds of economists, investors, and everyday citizens alike. The potential for a recession in the near future, coupled with the ongoing battle against inflation, creates a complex economic landscape.

The possibility of a stimulus check in October 2024 has sparked a lot of debate, with political parties taking different stances on the issue. To understand the political landscape surrounding this potential stimulus, you can read this article which explores the various viewpoints.

Understanding the interplay between these two forces is crucial for navigating the financial uncertainties ahead.

A recession, characterized by a significant decline in economic activity, can have a profound impact on inflation. As consumer spending shrinks and businesses reduce investment, demand for goods and services falls, potentially leading to lower prices. However, the impact on inflation is not always straightforward.

Students may be eligible for a stimulus check in October 2024. To learn more about the potential stimulus check and eligibility criteria, you can read this article which provides details about the potential program.

Recessions can also disrupt supply chains, leading to shortages and higher prices for certain goods. The complex interplay between demand and supply, coupled with the actions of policymakers, will ultimately determine how a recession influences inflation.

Individuals with disabilities may be eligible for a tax rebate in October 2024. To learn more about the potential tax rebate and eligibility criteria, you can read this article which provides details about the potential program.

Economic Impact of a Recession

A recession in October 2024 could have significant implications for the US economy, impacting various sectors and influencing inflation trends. While predicting the exact magnitude and duration of a recession is challenging, understanding its potential effects can help policymakers and businesses prepare for the challenges ahead.

If a stimulus check is approved, many are wondering if low-income families will be prioritized. To learn more about the potential for a stimulus check targeted towards low-income families, you can read this article which discusses the potential implications.

Consumer Spending and Business Investment

Recessions are typically characterized by a decline in economic activity, which often leads to a decrease in consumer spending and business investment. As individuals and businesses become more cautious about the future, they tend to reduce their expenditures. This can create a vicious cycle, further slowing economic growth and potentially exacerbating the recession.

The likelihood of a stimulus check in October 2024 depends on several factors, including economic conditions, political will, and public opinion. To learn more about the key factors that will determine the likelihood of a stimulus, you can read this article which explores the various factors at play.

Unemployment Rates and Job Creation

Recessions often result in job losses and higher unemployment rates. As businesses face declining demand and profitability, they may be forced to lay off workers to reduce costs. This can lead to a rise in unemployment, which can further dampen consumer spending and economic activity.

The possibility of economic stimulus plans in October 2024 is being discussed by policymakers. To learn more about the potential plans being considered, you can read this article which explores the various proposals.

Government Revenue and Spending

A recession can also have a significant impact on government revenue and spending. As economic activity slows down, tax revenues tend to decline, putting pressure on government budgets. At the same time, governments may need to increase spending on social programs and unemployment benefits to support those affected by the recession.

A recession can have a significant impact on various industries. To learn more about which industries might be most affected by a potential recession in October 2024, you can read this article which examines the potential impact on different sectors.

This can lead to a widening budget deficit and potentially higher government debt.

If a stimulus check is approved, there will be a process for applying. To learn more about the potential application process for a stimulus check in October 2024, you can read this article which provides information about the application process.

Inflationary Pressures

The relationship between recession and inflation is complex and can vary depending on the specific circumstances. While recessions are often associated with lower inflation, there are instances where inflation can actually increase during a recessionary period.

Recession and Inflation

Recessions typically lead to a decline in demand, which can put downward pressure on prices. However, there are factors that can contribute to inflationary pressures during a recession, such as supply chain disruptions, commodity price increases, and government policies.

Supply Chains and Commodity Prices

Recessions can disrupt supply chains, leading to shortages of goods and services. This can drive up prices as businesses struggle to meet demand. Additionally, commodity prices can fluctuate significantly during economic downturns, impacting the cost of production and consumer prices.

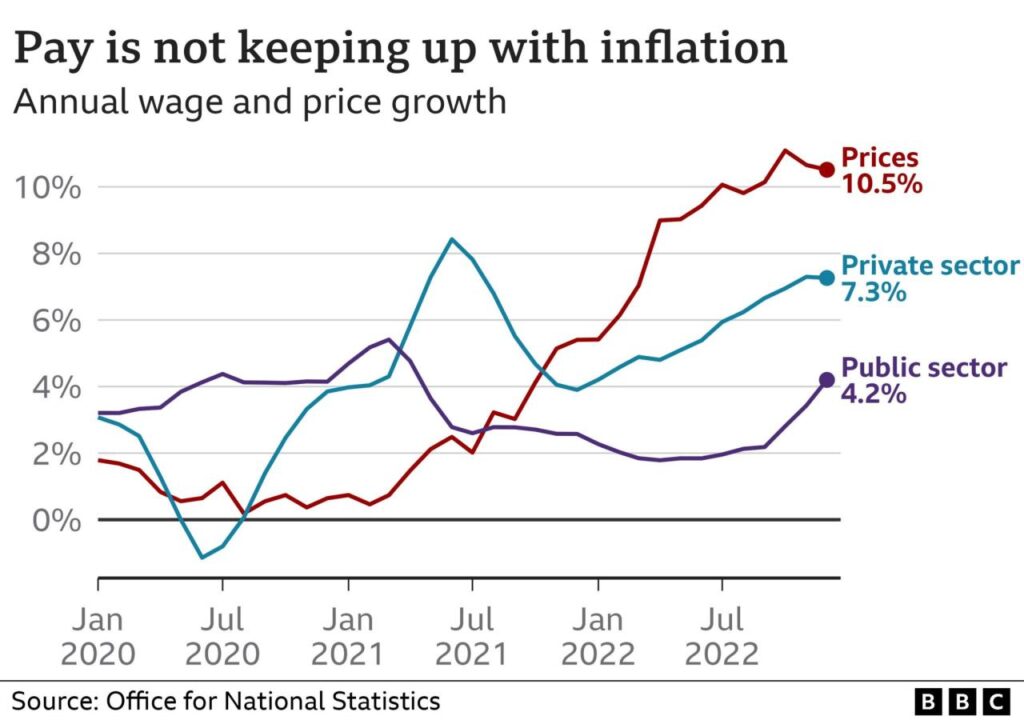

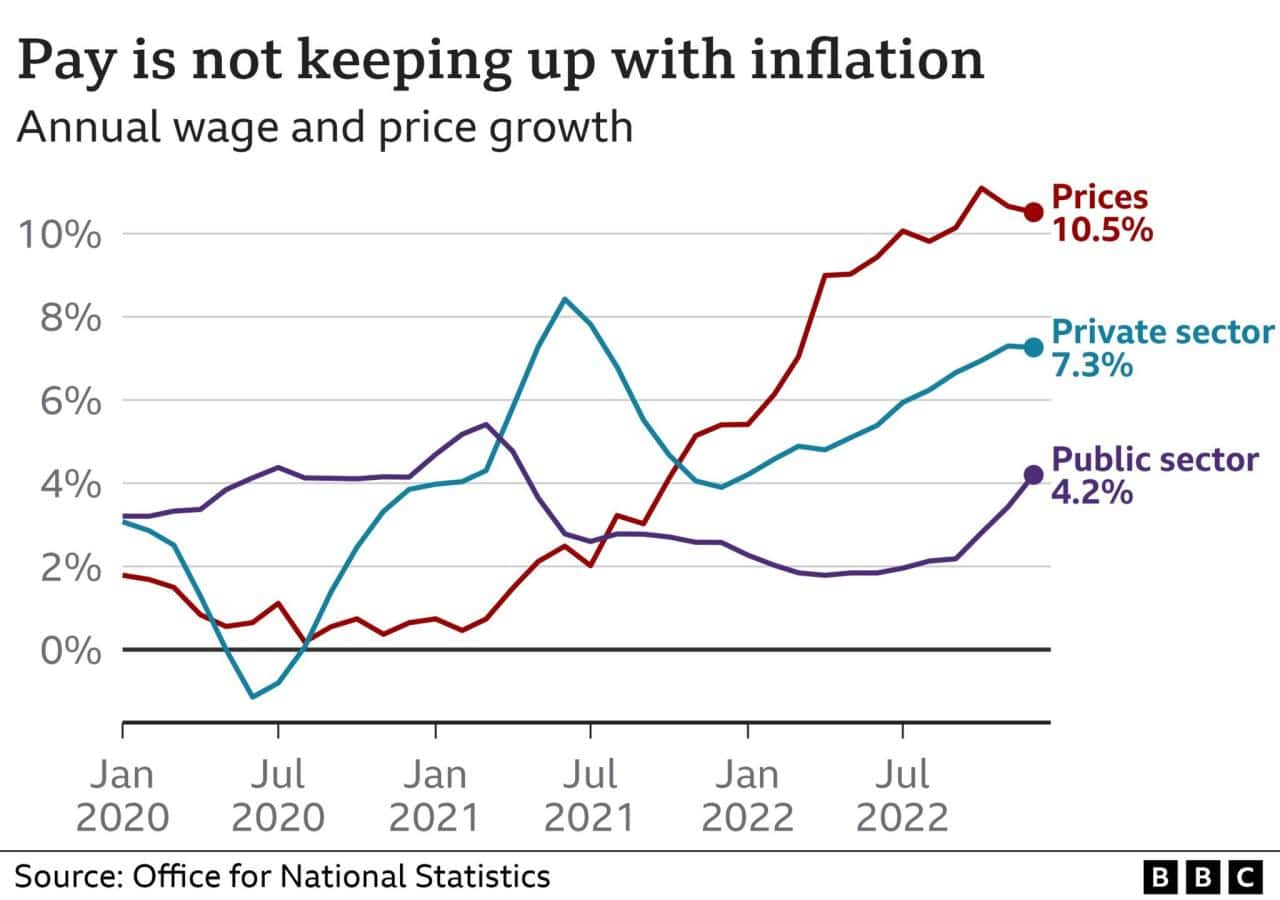

Wages and Labor Costs

While recessions often lead to lower wages and labor costs, there are scenarios where inflation can still rise. If labor shortages persist or if there are significant increases in energy prices, wages may rise despite a recessionary environment, contributing to inflation.

The question of whether or not there will be a stimulus check in October 2024 is a major talking point. To get an understanding of the current situation and the likelihood of a stimulus check, you can read this article which provides insights into the possibility of a stimulus.

Monetary and Fiscal Policy Responses

Policymakers often employ monetary and fiscal policy tools to address recessions and manage inflation. The Federal Reserve and the government can use these measures to stimulate economic growth and stabilize prices.

Federal Reserve Response

The Federal Reserve can respond to a recession by lowering interest rates to encourage borrowing and investment. This can help to stimulate economic activity and prevent a deeper recession. However, lowering interest rates can also lead to higher inflation if it fuels excessive borrowing and spending.

Fashion and design trends are constantly evolving. To get a glimpse of what’s expected in the world of fashion and design in October 2024, you can check out this article which explores the latest trends.

Fiscal Policy Measures

Fiscal policy measures, such as tax cuts or increased government spending, can also be used to address a recession. These measures can boost consumer spending and business investment, helping to stimulate economic growth. However, fiscal stimulus can also contribute to higher inflation if it leads to excessive government borrowing and spending.

Government Policies and Consumer/Business Behavior

Government policies can influence consumer and business behavior during a recession. For example, tax breaks for businesses can encourage investment, while unemployment benefits can provide a safety net for those who have lost their jobs. These policies can help to mitigate the negative impacts of a recession and support economic recovery.

The economic outlook for the third quarter of 2024 is a hot topic, with many wondering about the potential for a recession. To get a better understanding of what experts are predicting, check out this analysis of the economic landscape.

Historical Examples

Examining historical recessions can provide valuable insights into the relationship between recessions and inflation. While each recession is unique, there are common themes and patterns that emerge.

Healthcare workers may be eligible for a tax rebate in October 2024. To learn more about the potential tax rebate and eligibility criteria, you can read this article which provides details about the potential program.

Impact of Past Recessions on Inflation

Historical data suggests that recessions can have varying impacts on inflation. Some recessions have been accompanied by deflation, while others have seen inflation persist or even accelerate. The 2008 financial crisis, for example, led to a period of deflation, while the 1970s oil crisis resulted in stagflation, a combination of high inflation and slow economic growth.

Effectiveness of Economic Policies

The effectiveness of economic policies implemented during previous recessions has varied. Some policies, such as interest rate cuts and fiscal stimulus, have been successful in stimulating economic growth and reducing unemployment. However, other policies, such as price controls, have been less effective or even counterproductive.

Businesses may be eligible for a tax rebate in October 2024. To learn more about the potential tax rebate and eligibility criteria, you can read this article which provides details about the potential program.

Table of Economic Indicators

| Recession | Year | Unemployment Rate (%) | Inflation Rate (%) | Real GDP Growth (%) |

|---|---|---|---|---|

| Great Recession | 2007-2009 | 10.0 | -0.4 | -3.8 |

| 2001 Recession | 2001 | 4.7 | 2.8 | -0.3 |

| 1990-1991 Recession | 1990-1991 | 7.5 | 4.2 | -1.2 |

Industry-Specific Impacts

Recessions can have a significant impact on specific industries, depending on their sensitivity to economic cycles and their role in the overall economy.

Finding a new job after being laid off can be tough, especially in a challenging economic climate. There are a number of resources available to help you find your next opportunity, though. Check out this article for tips and advice on navigating the job search after a layoff.

Impact on Specific Industries

Industries that are heavily reliant on consumer spending, such as retail and hospitality, are often more vulnerable to recessionary pressures. Manufacturing industries can also be affected, as businesses may reduce production in response to lower demand. On the other hand, industries that provide essential goods and services, such as healthcare and utilities, may be less affected by recessions.

Vulnerability to Recessionary Pressures

| Industry | Vulnerability to Recession | Potential Impact on Inflation |

|---|---|---|

| Retail | High | Increased competition, lower prices |

| Manufacturing | Moderate | Lower demand, reduced production |

| Healthcare | Low | Stable demand, potential price increases |

Effects on Specific Sectors

| Sector | Potential Effects on Prices | Potential Effects on Consumer Demand |

|---|---|---|

| Energy | Increased volatility, potential price increases | Reduced demand, potential shift to alternative energy sources |

| Housing | Lower prices, reduced demand | Increased affordability, potential shift in preferences |

| Transportation | Lower prices, reduced demand | Increased reliance on public transportation, potential shift in preferences |

Global Implications

A recession in the United States can have significant global economic implications, as the US is a major player in the world economy. The impact can be felt through various channels, including international trade, investment flows, and currency exchange rates.

Global Economic Implications

A US recession can lead to a slowdown in global economic growth, as other countries experience reduced demand for US goods and services. This can also affect global financial markets, leading to volatility and potential capital flight.

Impact on International Trade and Investment

Recessions can disrupt international trade flows, as businesses reduce their exports and imports. Investment flows can also be affected, as investors become more risk-averse and seek safer investment opportunities.

Inflation in Other Countries, How will a recession in October 2024 affect inflation?

A US recession can also influence inflation in other countries. For example, if the US dollar weakens, it can make imports more expensive in other countries, potentially leading to higher inflation.

Layoffs can have a significant impact on individuals and communities. To understand the potential social consequences of layoffs in October 2024, you can read this article which examines the social implications of job losses.

Concluding Remarks

The potential impact of a recession in October 2024 on inflation remains a subject of ongoing debate. While a recession could lead to lower prices due to decreased demand, it could also trigger supply chain disruptions and higher prices for certain goods.

The ultimate outcome will depend on a multitude of factors, including the severity of the recession, the effectiveness of policy responses, and the resilience of global supply chains. As we move closer to October 2024, it will be essential to closely monitor economic indicators and policy decisions to better understand the potential impact on inflation.

Helpful Answers: How Will A Recession In October 2024 Affect Inflation?

What are the potential causes of a recession in October 2024?

A recession in October 2024 could be triggered by a variety of factors, including rising interest rates, geopolitical instability, supply chain disruptions, or a decline in consumer confidence.

How might a recession impact the stock market?

Recessions typically lead to a decline in stock market values as investors become more risk-averse and companies experience reduced profits.

What steps can individuals take to prepare for a potential recession?

Individuals can prepare for a potential recession by building an emergency fund, reducing debt, and diversifying their investments.