How to prepare for the October 2024 tax deadline is a crucial topic for individuals and businesses alike. This deadline marks the final point for filing your taxes, and failing to meet it can result in penalties and interest charges.

Understanding the requirements, gathering necessary documents, and choosing the right filing method are essential steps to ensure a smooth and successful tax filing experience.

The October 2024 tax deadline encompasses a wide range of considerations, from understanding your filing obligations to utilizing available deductions and credits. It’s a process that requires meticulous planning and attention to detail. Whether you’re a seasoned tax filer or a first-timer, this guide aims to equip you with the knowledge and tools needed to navigate the tax landscape confidently.

Gathering Necessary Documents and Information

Before you can begin filing your taxes, you need to gather all the necessary documents and information. This ensures accuracy and helps you claim all eligible deductions and credits.

Retirement savings goals vary based on age, and it’s important to understand the contribution limits that apply to you. This article breaks down the 401k contribution limits for 2024 based on different age groups, ensuring you can make informed decisions about your retirement savings.

Essential Documents Checklist

This checklist includes common documents required for tax preparation. You may need additional documents depending on your individual circumstances.

Catch-up contributions allow older workers to boost their retirement savings. This article provides information on the catch-up contribution limits for 2024, allowing you to maximize your retirement savings.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN):This is essential for identifying yourself and claiming your income and deductions.

- Form W-2:This form reports your wages, salaries, and withholdings from your employer.

- Form 1099-NEC:This form reports non-employee compensation, such as payments for freelance work or independent contracting.

- Form 1099-INT:This form reports interest income from banks and other financial institutions.

- Form 1099-DIV:This form reports dividend income from investments.

- Form 1099-G:This form reports unemployment compensation, state and local tax refunds, and certain other government payments.

- Form 1098-T:This form reports tuition payments made to educational institutions.

- Form 1098-E:This form reports student loan interest paid.

- Form 1098-C:This form reports canceled debt.

- Form 1095-A:This form reports information about your health insurance coverage through the Affordable Care Act Marketplace.

- Form 1095-B:This form reports information about your health insurance coverage through your employer or another group plan.

- Form 1095-C:This form reports information about your health insurance coverage through a self-insured health plan.

- Property Tax Bills:These are required for deducting property taxes on your federal income tax return.

- Home Mortgage Interest Statement:This statement details the interest paid on your mortgage during the year.

- Child Tax Credit Documentation:This may include your child’s Social Security number and other relevant information.

- Other Relevant Documents:This may include receipts for charitable donations, medical expenses, or other deductible expenses.

Obtaining Missing or Incomplete Documents

If you are missing or have incomplete documents, here are some steps you can take to obtain them:

- Contact Your Employer:If you are missing your W-2 form, contact your employer and request a copy.

- Contact the Issuer:If you are missing a 1099 form, contact the issuer of the payment and request a copy.

- Check Online Accounts:Many financial institutions allow you to access tax documents online.

- Request Transcripts from the IRS:You can request tax transcripts from the IRS, which contain information about your income, withholdings, and payments.

- Contact the IRS:If you have difficulty obtaining a document, you can contact the IRS for assistance.

Resources and Websites

There are various resources and websites that can provide you with information about tax preparation:

- Internal Revenue Service (IRS):The IRS website is a great source of information about tax laws, forms, and publications.

- Tax Software Companies:Many tax software companies offer free resources and guides on their websites.

- Financial Institutions:Banks and other financial institutions often provide tax information on their websites.

- Tax Professional Associations:Associations like the American Institute of Certified Public Accountants (AICPA) and the National Society of Tax Professionals (NSTP) offer resources and information for taxpayers.

Choosing the Right Filing Method

You have your documents ready, now it’s time to decide how you’ll submit your tax return. The IRS offers several filing methods, each with its own advantages and disadvantages. Let’s explore your options.

Finding the right credit card for everyday spending can save you money and rewards. This article highlights the best credit cards for everyday spending in October 2024, helping you choose the card that best suits your needs.

Online Filing

Online filing is the most popular method, and for good reason. It’s convenient, efficient, and often the least expensive option. Here’s a breakdown of the pros and cons:

Advantages

- Convenience:File from your computer or mobile device, anytime, anywhere.

- Speed:Online returns are typically processed faster than paper returns.

- Accuracy:Many online programs have built-in error-checking features to help you avoid mistakes.

- Cost-effective:Many online filing options are free or offer affordable pricing, especially for simple returns.

- E-signature:You can electronically sign your return, eliminating the need for paper signatures.

Disadvantages

- Technical requirements:You’ll need a computer or mobile device with internet access.

- Security concerns:Be sure to use reputable online filing services to protect your personal information.

- Limited support:While online filing services often have help centers, you may not have access to personalized support.

- Not suitable for complex returns:Online filing may not be the best option if you have a complicated tax situation.

Mail Filing

If you prefer the traditional approach, you can file your taxes by mail. This method is suitable for those who are comfortable with paper forms and prefer a more hands-on approach.

The October 2024 tax deadline is fast approaching, and it’s essential to file your taxes on time. This article offers guidance on how to file your taxes by the deadline, ensuring you avoid penalties and maintain compliance.

Advantages

- No technical requirements:You don’t need a computer or internet access.

- Control over your return:You have complete control over the information you provide on your return.

- More flexibility:You can take your time to review and prepare your return.

Disadvantages

- Time-consuming:Gathering the necessary forms, completing them by hand, and mailing them can be time-consuming.

- Potential for errors:Handwritten returns are more prone to errors, which can lead to delays and penalties.

- Slower processing:Paper returns take longer to process than electronic returns.

- Risk of loss or damage:Your return could get lost or damaged in the mail.

Professional Assistance

If you have a complex tax situation, you may want to consider hiring a tax professional. They can help you navigate the tax code, ensure you claim all eligible deductions and credits, and file your return accurately.

Advantages

- Expertise:Tax professionals are knowledgeable about the tax code and can provide guidance on complex tax situations.

- Accuracy:They can help you avoid errors and ensure your return is filed correctly.

- Time-saving:They can handle the filing process for you, saving you time and effort.

- Peace of mind:Knowing that your return is being handled by a professional can provide peace of mind.

Disadvantages

- Cost:Hiring a tax professional can be expensive.

- Limited availability:Tax professionals may be busy during tax season, so you may need to book an appointment in advance.

Tax Deductions and Credits

Tax deductions and credits are valuable tools that can help reduce your tax liability. By understanding these benefits, you can potentially save money on your taxes.

Layoffs are always a sensitive topic, and Geico’s recent decision to lay off employees in October 2024 raises ethical considerations. This article delves into the ethical implications of these layoffs, exploring the company’s responsibility to its employees and the impact on the affected individuals.

Standard Deduction vs. Itemized Deductions

The standard deduction is a set amount that you can deduct from your taxable income, while itemized deductions allow you to deduct specific expenses. You can choose the method that results in the lower tax liability.

Independent contractors need to complete and submit the W9 form to receive payments. This article provides information on the W9 form for independent contractors in October 2024, ensuring you understand the requirements and complete the form correctly.

Common Tax Deductions

- Homeownership Deductions:This includes deductions for mortgage interest, property taxes, and real estate taxes.

- Medical Expenses:You can deduct medical expenses exceeding a certain percentage of your Adjusted Gross Income (AGI).

- Charitable Contributions:Deductible amounts are typically capped at a percentage of your AGI.

- State and Local Taxes (SALT):This deduction allows you to deduct up to $10,000 in state and local taxes, including property taxes and income taxes.

- Student Loan Interest:Deductible up to $2,500 of interest paid on student loans.

Common Tax Credits

- Earned Income Tax Credit (EITC):This credit is available to low- and moderate-income working individuals and families. The credit amount depends on your income and family size.

- Child Tax Credit:You can claim this credit for each qualifying child under the age of 17. The credit amount is a certain dollar amount per child.

- American Opportunity Tax Credit (AOTC):This credit is available for the first four years of higher education. The credit amount is a percentage of the first $2,000 of qualified education expenses.

- Premium Tax Credit (PTC):This credit is available to help individuals and families afford health insurance purchased through the Marketplace. The credit amount depends on your income and the cost of your health insurance plan.

Avoiding Common Tax Filing Mistakes

It’s crucial to be aware of common tax filing mistakes to ensure accuracy and avoid potential penalties. A few simple steps can help you navigate the tax season with ease and confidence.

Understanding the 401k contribution limits is crucial for maximizing your retirement savings. This article outlines the contribution limits for both 2024 and 2025, helping you plan your retirement contributions effectively.

Understanding Common Errors

Common errors can range from simple oversights to more complex misunderstandings of tax laws. It’s essential to be informed about these potential pitfalls and take steps to prevent them.

The Erste Bank Open is a prestigious tennis tournament, and fans are eager to know about the venue and court surface. This article provides all the details about the venue and court surface for the Erste Bank Open 2024, helping you plan your attendance.

- Incorrect Personal Information:Ensure your Social Security number, name, and address are accurate on all tax forms. Mistakes here can lead to delays in processing and potential issues with refunds.

- Missing or Incorrect Forms:Filing the wrong forms or missing required forms can result in penalties. For example, if you claim certain deductions or credits, you may need additional forms to support your claims.

- Math Errors:Simple math mistakes can easily occur, especially when dealing with complex calculations. Double-check your calculations to avoid errors that could lead to an underpayment or overpayment.

- Deduction and Credit Mistakes:Misunderstanding the eligibility requirements for deductions and credits can lead to incorrect claims. Carefully review the rules and ensure you meet the criteria before claiming any deductions or credits.

- Incorrect Filing Status:Choosing the wrong filing status can impact your tax liability. Ensure you select the status that best reflects your current situation, such as single, married filing jointly, or head of household.

- Failure to File on Time:Filing your taxes late can result in penalties, even if you owe no taxes. Plan ahead and submit your return before the deadline to avoid late filing penalties.

Double-Checking Calculations, How to prepare for the October 2024 tax deadline

Double-checking your calculations is crucial to ensure accuracy. Use a tax preparation software or consult with a tax professional to verify your figures. You can also cross-reference your calculations with official IRS guidelines and publications.

Self-employed individuals have unique retirement savings options, including Roth IRAs. This article provides information on the Roth IRA contribution limit for self-employed individuals in 2024, helping you maximize your tax-advantaged savings.

“Take the time to review your tax forms carefully before submitting them. Double-check all numbers and ensure they are accurate.”

The Roth IRA is a popular retirement savings option, and it’s essential to know the contribution limits. This article provides information on the Roth IRA contribution limit for 2024, helping you plan your retirement savings effectively.

Reviewing Tax Forms

Before submitting your tax return, review all forms thoroughly. Look for any inconsistencies, errors, or missing information. Pay close attention to the following:

- Social Security number:Ensure it’s accurate on all forms.

- Income:Verify all income sources are reported correctly.

- Deductions and credits:Double-check the eligibility requirements and ensure you’ve claimed all applicable deductions and credits.

- Filing status:Confirm that you’ve chosen the correct filing status.

- Signature:Sign and date all forms.

Managing Tax Obligations Throughout the Year

Proactively managing your tax obligations throughout the year can help minimize surprises come tax season and potentially reduce your overall tax liability. It involves a combination of smart financial planning, accurate record-keeping, and utilizing available tax benefits.

Retirement savings are essential, and Roth IRAs offer tax-advantaged growth. This article provides details on the Roth IRA contribution limits for 2024, allowing you to maximize your retirement savings potential.

Tax Planning Strategies

Effective tax planning involves strategically making financial decisions throughout the year to minimize your tax burden. Here are some key strategies:

- Maximize Deductions and Credits:Familiarize yourself with deductions and credits you qualify for, such as those for homeownership, charitable donations, education expenses, or child tax credits. These can significantly reduce your taxable income.

- Adjust Withholding:Review your W-4 form to ensure your withholdings are appropriate. Adjusting your withholdings can help avoid a large tax bill or refund at the end of the year.

- Consider Tax-Advantaged Accounts:Explore tax-advantaged retirement accounts like 401(k)s and IRAs or consider opening a health savings account (HSA) if eligible. These accounts offer tax benefits for saving and investing.

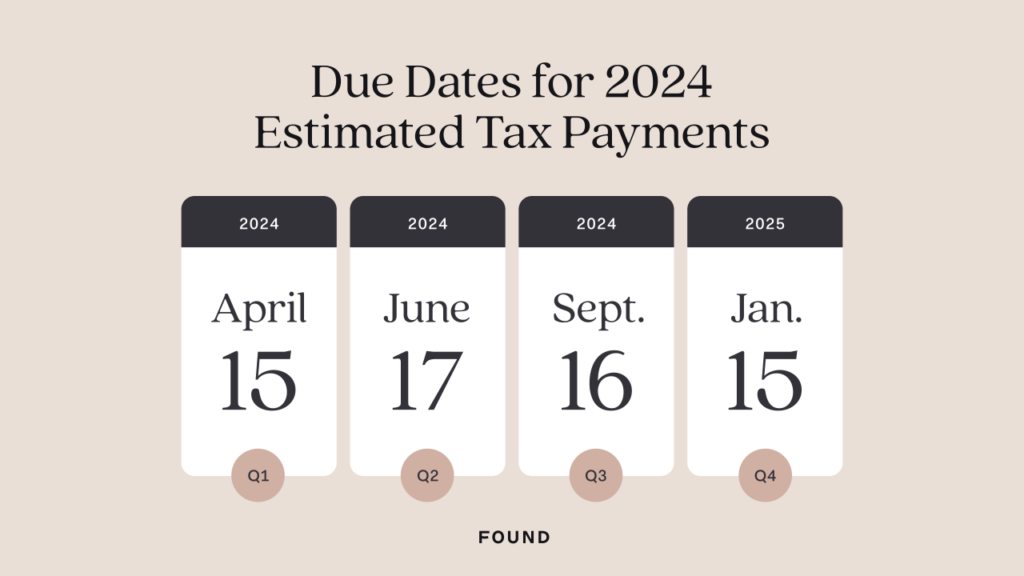

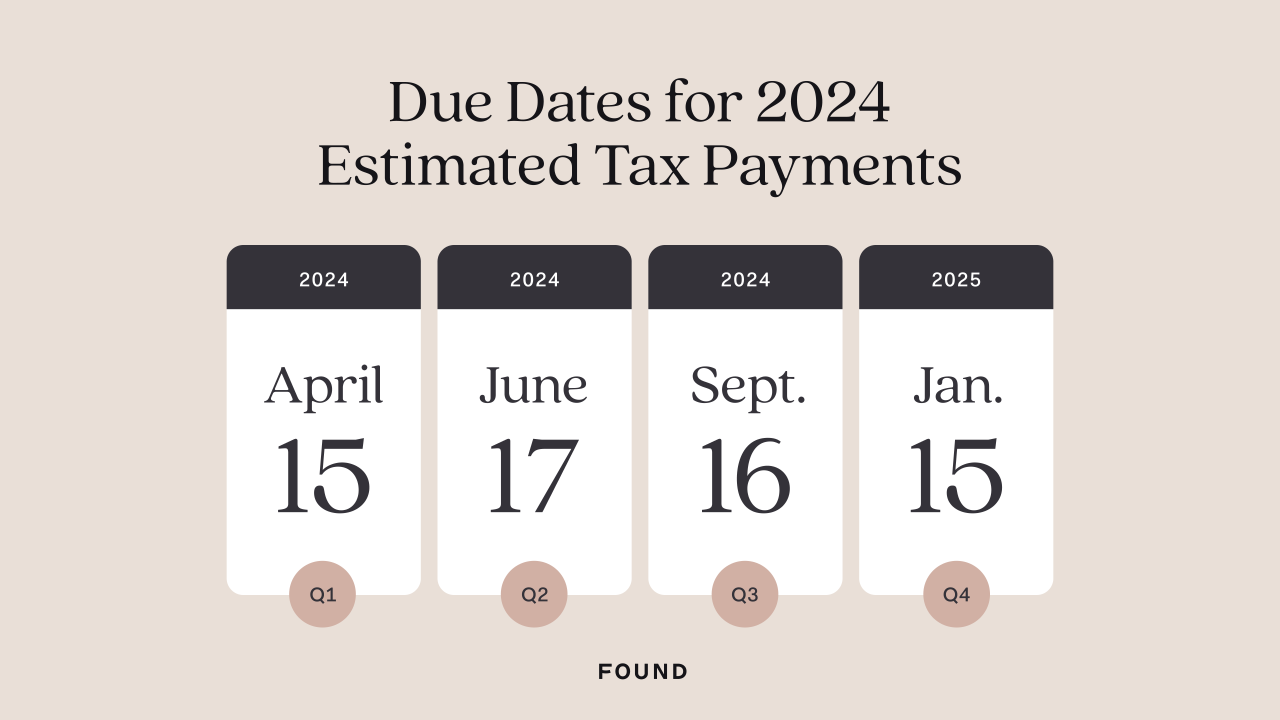

- Utilize Estimated Taxes:If you’re self-employed or have income not subject to withholding, you may need to make quarterly estimated tax payments to avoid penalties.

Record-Keeping and Budgeting

Accurate record-keeping is crucial for managing your tax obligations. It helps you track income, expenses, and deductions for accurate tax reporting.

For high earners, maximizing retirement savings is crucial. This article details the 401k contribution limits for 2024, allowing you to make the most of your retirement planning.

- Organize Receipts and Documents:Maintain a system for organizing all relevant financial documents, including receipts, invoices, bank statements, and investment records.

- Use Budgeting Tools:Utilize budgeting tools or software to track your income and expenses, making it easier to identify potential tax deductions and plan for future tax obligations.

- Keep Digital Records:Consider using cloud-based storage or a digital filing system to securely store your tax-related documents.

Importance of Professional Tax Advice

Consulting a qualified tax professional can provide valuable insights and guidance tailored to your specific circumstances.

Tax season is just around the corner, and it’s essential to be aware of the latest income tax rates. This article provides a breakdown of the income tax rates for October 2024, helping you understand your tax obligations and plan accordingly.

- Personalized Tax Planning:A tax professional can help develop a personalized tax plan that considers your income, expenses, and financial goals.

- Tax Optimization:They can identify potential tax deductions and credits you may be overlooking and recommend strategies to minimize your tax liability.

- Compliance and Avoidance of Penalties:Tax professionals can ensure you’re compliant with tax laws and help avoid penalties for late filing or underpayment.

Seeking Professional Tax Assistance

Navigating the complexities of tax laws and regulations can be overwhelming, even for those with a good understanding of their financial situation. Seeking professional tax advice can provide valuable insights and ensure you maximize your tax benefits while minimizing potential risks.

Tax professionals can offer a wide range of services, from basic tax preparation to complex financial planning and estate tax strategies. Their expertise can help you understand your tax obligations, identify eligible deductions and credits, and optimize your tax strategy for your unique circumstances.

Retirement planning is a long-term endeavor, and it’s essential to stay informed about contribution limits. This article provides information on IRA contribution limits for 2024 and beyond, allowing you to plan for your financial future.

Certified Public Accountants (CPAs) and Tax Preparers

CPAs and tax preparers are qualified professionals who can assist you with your tax obligations. While both are trained in tax law and regulations, they differ in their scope of services and qualifications.

If you were affected by the Capital One data breach, you might be eligible for a settlement payout. This article outlines the process for receiving your payout, including the timeline and required documentation.

- Certified Public Accountants (CPAs)are licensed professionals who have met stringent educational and experience requirements. They are qualified to provide a wide range of accounting and financial services, including tax preparation and planning.

- Tax Preparersmay not be licensed CPAs but are typically trained in tax preparation and have experience filing returns. They may specialize in specific areas of taxation, such as individual or business taxes.

Finding a Qualified Tax Professional

Finding a qualified and reliable tax professional is crucial. Here are some tips:

- Seek Recommendations:Ask friends, family, or colleagues for recommendations.

- Check Credentials:Ensure the tax professional is licensed and has the necessary credentials. You can verify licenses and credentials through professional organizations like the American Institute of Certified Public Accountants (AICPA).

- Research Online:Use online resources like the AICPA’s website or the Better Business Bureau to research tax professionals in your area.

- Schedule a Consultation:Before hiring a tax professional, schedule a consultation to discuss your specific needs and ask questions about their experience, fees, and services.

Final Wrap-Up

Preparing for the October 2024 tax deadline doesn’t have to be a daunting task. By following the steps Artikeld in this guide, you can streamline the process, minimize potential errors, and ensure your tax obligations are met efficiently. Remember, staying organized, seeking professional advice when needed, and staying informed throughout the year can make a significant difference in your tax experience.

Questions and Answers: How To Prepare For The October 2024 Tax Deadline

What are the potential consequences of missing the October 2024 tax deadline?

Missing the tax deadline can lead to penalties, interest charges, and even legal action. The specific consequences vary depending on the situation, but they can be substantial. It’s crucial to file your taxes on time to avoid these repercussions.

How can I find a qualified tax professional?

Look for certified public accountants (CPAs) or Enrolled Agents (EAs) who specialize in tax preparation. You can also ask for recommendations from friends, family, or financial advisors. The IRS website also provides a directory of tax professionals.

What are some common tax deductions and credits available to taxpayers in 2024?

Common tax deductions and credits include the standard deduction, itemized deductions (such as medical expenses, mortgage interest, and charitable contributions), and credits (such as the earned income tax credit and the child tax credit). The availability and eligibility criteria for these deductions and credits can vary depending on your individual circumstances.