How To Calculate Annuity PV Factor 2024 is a crucial concept in financial planning, helping you understand the present value of future cash flows. Whether you’re planning for retirement, taking out a loan, or analyzing investments, knowing how to calculate annuity PV factor can empower you to make informed financial decisions.

Calculating the present value of an annuity due can be helpful for financial planning. If you need help with this, you can check out this resource on how to calculate annuity due present value.

This guide will walk you through the fundamentals of annuity PV factor, providing step-by-step instructions and practical examples to ensure a clear understanding.

Hargreaves Lansdown offers an annuity calculator that can help you estimate your potential retirement income. You can find out more about Hargreaves Lansdown’s annuity calculator here.

Annuity PV factor, or present value factor, is a tool that helps us determine the current value of a series of equal payments received or paid over a period of time. It’s essentially a discount rate that reflects the time value of money, acknowledging that a dollar today is worth more than a dollar tomorrow due to factors like inflation and potential investment opportunities.

A PV annuity chart can be a useful tool for financial planning. You can find a helpful chart and learn more about PV annuity charts here.

This guide will cover the basics of annuity PV factor, including its formula, applications, and how to calculate it using financial calculators and spreadsheet software.

Understanding Annuity PV Factor

Annuity PV factor, or present value factor, is a crucial concept in finance that helps determine the current worth of a stream of future payments. It’s essentially a multiplier that discounts future cash flows to their present value, taking into account the time value of money.

Deciding between an annuity and an IRA can be tricky. To compare these options, you can read more about annuities versus IRAs here.

In simple terms, it tells you how much you’d need to invest today to receive a series of future payments.

Factors Influencing Annuity PV Factor

Several factors influence the annuity PV factor, which directly impact the present value of future payments. These factors include:

- Interest Rate:A higher interest rate means a higher discount rate, leading to a lower present value. This is because you could earn more by investing the money today at a higher rate.

- Number of Periods:The longer the period over which payments are received, the lower the present value. This is because the further into the future the payments are, the less they are worth today.

- Payment Amount:A larger payment amount naturally results in a higher present value. This is because you are receiving more money in the future.

Real-World Example

Imagine you’re considering a retirement plan that promises you $10,000 per year for 20 years starting at age 65. To determine the present value of this annuity, you’d need to calculate the annuity PV factor using the relevant interest rate and the number of periods.

Understanding the present value of an annuity can be helpful for financial planning. You can find examples and learn more about PV annuities here.

This factor would then be multiplied by the annual payment amount to arrive at the present value of the retirement plan.

Kathy’s annuity might be experiencing some changes in 2024. You can read more about what’s happening here.

Formula for Calculating Annuity PV Factor

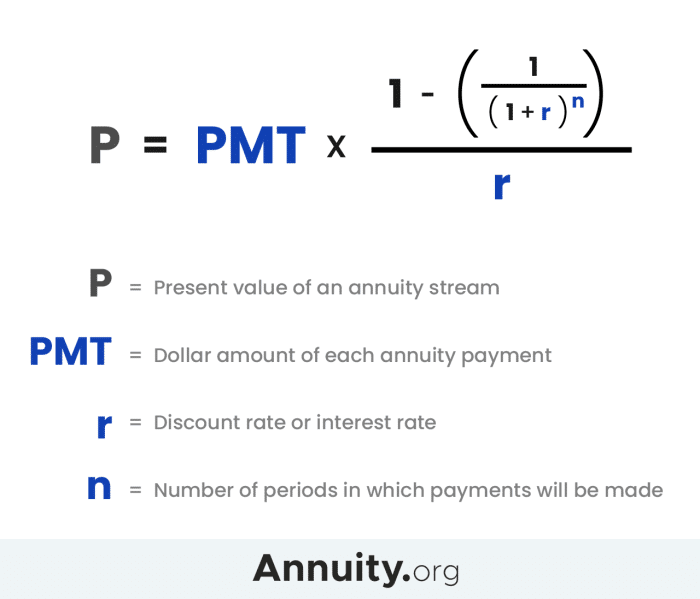

The formula for calculating the annuity PV factor is:

PV Factor = (1- (1 + r)^-n) / r

Where:

- rrepresents the interest rate per period.

- nrepresents the number of periods.

Step-by-Step Guide

- Identify the interest rate (r):This is the rate at which the money is discounted per period. It’s usually expressed as a decimal (e.g., 5% = 0.05).

- Determine the number of periods (n):This is the total number of periods over which the payments are made.

- Plug the values into the formula:Substitute the interest rate (r) and the number of periods (n) into the formula.

- Calculate the PV factor:Solve the equation to arrive at the annuity PV factor.

Annuity Types and PV Factor Calculation

There are two main types of annuities: ordinary annuities and annuities due. The calculation of the PV factor varies slightly depending on the type of annuity.

Annuity insurance is a complex subject, but it can provide financial security in retirement. Find out more about annuity insurance and its potential benefits.

Ordinary Annuity

An ordinary annuity involves payments made at the end of each period. The PV factor calculation remains the same as the formula provided earlier.

If you have a TI-84 calculator, you can use it to calculate annuities. Find out how to do this by visiting this page.

For example, consider a $1,000 ordinary annuity for 5 years at a 10% interest rate. The PV factor would be:

PV Factor = (1- (1 + 0.1)^-5) / 0.1 = 3.790786769

Annuity Due

An annuity due involves payments made at the beginning of each period. The PV factor calculation for an annuity due is slightly different. It involves multiplying the PV factor of an ordinary annuity by (1 + r).

Using the same example as before, the PV factor for a $1,000 annuity due for 5 years at a 10% interest rate would be:

PV Factor = (1- (1 + 0.1)^-5) / 0.1 – (1 + 0.1) = 4.169865446

An annuity is a financial product that provides regular payments over a period of time. You can learn more about annuities and see examples here.

Calculating Annuity PV Factor Using Financial Calculators: How To Calculate Annuity Pv Factor 2024

Financial calculators are designed to simplify complex calculations, including annuity PV factor calculations. Most financial calculators have dedicated keys for various financial functions, making the process efficient.

Steps Involved

- Input the interest rate (r):Use the appropriate key for entering the interest rate.

- Enter the number of periods (n):Use the designated key for the number of periods.

- Input the payment amount (PMT):Enter the amount of each payment.

- Calculate the present value (PV):Use the dedicated key for calculating present value. The calculator will display the present value of the annuity, which is the product of the annuity PV factor and the payment amount.

Comparison of Calculators, How To Calculate Annuity Pv Factor 2024

Financial calculators come with various features and functionalities. Some calculators may offer advanced features like memory functions, statistical calculations, or specific functions for different types of annuities. When choosing a financial calculator, consider your needs and budget.

Dreaming of a million-dollar annuity? It’s possible! You can learn more about annuities worth a million dollars and how to achieve this goal.

Calculating Annuity PV Factor Using Spreadsheet Software

Spreadsheet software like Microsoft Excel or Google Sheets provides a user-friendly environment for calculating annuity PV factors. You can create a spreadsheet formula to automate the calculation, saving time and effort.

Spreadsheet Formula

The formula for calculating annuity PV factor in a spreadsheet is:

=PV(rate, nper, pmt, [fv], [type])

Fixed annuities can provide a steady stream of income. You can learn more about fixed annuities and their potential benefits.

Where:

- rate: The interest rate per period.

- nper: The total number of periods.

- pmt: The payment amount per period.

- fv: (Optional) The future value of the annuity. If omitted, it’s assumed to be 0.

- type: (Optional) Specifies whether payments are made at the beginning or end of the period. 0 for end of period (ordinary annuity), 1 for beginning of period (annuity due).

Advantages of Spreadsheet Software

Using spreadsheet software for annuity PV factor calculation offers several advantages:

- Automation:The formula automates the calculation, eliminating the need for manual calculations.

- Flexibility:You can easily change inputs and see the impact on the PV factor.

- Visualization:Spreadsheets allow you to visualize the calculations and results in a clear and organized manner.

Applications of Annuity PV Factor in Financial Planning

Understanding the annuity PV factor is crucial for making informed financial decisions in various aspects of financial planning.

Retirement Planning

The PV factor helps determine the present value of future retirement income streams, enabling individuals to estimate how much they need to save to achieve their retirement goals. By discounting future retirement income to its present value, individuals can make informed decisions about their savings and investment strategies.

Loan Amortization

The PV factor is used to calculate the present value of loan payments, which helps determine the total amount borrowed and the interest paid over the loan’s lifetime. Understanding the PV factor allows borrowers to compare different loan options and make informed decisions about their financing.

Annuity 401k plans are a popular retirement savings option. You can learn more about them here and see how they might work for you.

Investment Analysis

The PV factor plays a vital role in investment analysis by discounting future cash flows from investments to their present value. This helps investors evaluate the profitability and compare different investment opportunities based on their present values. By considering the time value of money, investors can make informed decisions about their investment portfolios.

Epilogue

Understanding annuity PV factor is essential for anyone looking to make sound financial decisions. By grasping the concepts discussed in this guide, you can confidently calculate the present value of future cash flows, enabling you to make informed choices about investments, loans, and retirement planning.

A $60,000 annuity can be a significant source of income. You can find out more about $60,000 annuities and their potential benefits.

Whether you’re a seasoned investor or just starting your financial journey, mastering the calculation of annuity PV factor can provide you with valuable insights and empower you to achieve your financial goals.

While annuities and life insurance are related, they are not the same thing. Learn more about the differences between annuities and life insurance here.

Commonly Asked Questions

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity’s payments are made at the end of each period, while an annuity due’s payments are made at the beginning of each period. This difference affects the PV factor calculation, as the timing of payments influences their present value.

How does the interest rate affect the annuity PV factor?

A higher interest rate generally leads to a lower annuity PV factor. This is because a higher discount rate reduces the present value of future cash flows.

What are some real-world examples of how annuity PV factor is used?

Annuity PV factor is used in various financial scenarios, such as calculating the present value of a mortgage, determining the value of an investment that pays regular dividends, or assessing the cost of a retirement annuity.

Can I calculate annuity PV factor without using a financial calculator or spreadsheet software?

Annuity payments are a common way to receive income in retirement. To learn more about how annuities are used, you can visit this page.

Yes, you can calculate annuity PV factor manually using the formula provided in this guide. However, using a financial calculator or spreadsheet software simplifies the process and reduces the risk of errors.