How To Calculate Annuity On Casio Calculator 2024 – Navigating the world of financial planning can feel daunting, but with the right tools, even complex concepts like annuities become manageable. This guide will walk you through the process of calculating annuity values using a Casio calculator, equipping you with the knowledge to make informed financial decisions.

If you’re studying for the Jaiib exam, you might need to understand how to calculate annuities. You can learn more about the Annuity Formula Jaiib 2024 on our website.

Annuities are a series of regular payments made over a specific period, often used for retirement planning, loan repayment, and investment strategies. Understanding how to calculate the present and future values of annuities is crucial for making sound financial decisions.

Learning about annuities involves understanding how to calculate their values. Our guide on Calculating Annuity Values 2024 will help you master this important aspect.

This guide will cover the basics of annuities, the functionality of Casio calculators, and the steps involved in calculating annuity values. We’ll explore real-world examples to illustrate how these calculations can be applied in your personal financial planning.

Understanding Annuities

An annuity is a series of equal payments made over a specific period of time. Annuities are commonly used in financial planning, retirement savings, and loan repayment. They can be categorized into different types, each with its unique features and applications.

A growing annuity is a type of annuity where the payments increase over time. If you’re curious about how to calculate these payments, check out our article on Calculating Growing Annuity Payment 2024.

Types of Annuities

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

- Fixed Annuity:Payments remain constant throughout the annuity period.

- Variable Annuity:Payments fluctuate based on the performance of underlying investments.

Key Features of an Annuity

- Payment Period:The time interval between each payment.

- Interest Rate:The rate at which the annuity grows or earns interest.

- Future Value:The total value of the annuity at the end of the payment period.

Real-World Scenarios

- Retirement Savings:Annuities can be used to provide a steady stream of income during retirement.

- Loan Repayment:Mortgages and auto loans are examples of annuities where regular payments are made over a set period.

- Investment Strategies:Annuities can be used to generate regular income from investments.

Casio Calculator Basics

Casio calculators are widely used for financial calculations, including annuity computations. Understanding the basic functions of a Casio calculator is crucial for performing these calculations efficiently.

Basic Functions

- Arithmetic Operations:Casio calculators support basic arithmetic operations like addition, subtraction, multiplication, and division.

- Memory Functions:They allow you to store and retrieve values for later use.

- Financial Calculations:Casio calculators offer dedicated functions for financial calculations, including present value (PV), future value (FV), payment (PMT), interest rate (I/Y), and number of periods (N).

Accessing Financial Calculator Mode

- Turn on the calculator.

- Press the “MODE” button.

- Use the arrow keys to navigate to the “COMP” mode and press “ENTER”.

- The calculator is now in financial calculator mode.

Common Symbols and Indicators, How To Calculate Annuity On Casio Calculator 2024

- PV:Present Value

- FV:Future Value

- PMT:Payment

- I/Y:Interest Rate per Year

- N:Number of Periods

- CPT:Calculate

Calculating Annuity on Casio Calculator: How To Calculate Annuity On Casio Calculator 2024

Using a Casio calculator, you can easily calculate the present value and future value of an annuity. This section provides a step-by-step guide on how to perform these calculations.

If you have questions about annuities, you’re not alone. Our article on Annuity Questions And Answers 2024 addresses some of the most common inquiries.

Calculating Present Value

- Enter the payment amount (PMT) and press “PMT”.

- Enter the interest rate (I/Y) and press “I/Y”.

- Enter the number of periods (N) and press “N”.

- Press the “CPT” button followed by “PV” to calculate the present value.

Example:

Suppose you want to calculate the present value of an annuity with a payment of $1,000 per year, an interest rate of 5%, and a period of 10 years. You would input the following values into the calculator:

- PMT = 1000

- I/Y = 5

- N = 10

After pressing “CPT” and “PV”, the calculator will display the present value of the annuity.

Understanding how to calculate an annuity is essential for anyone considering this financial product. Our article on How Calculate Annuity 2024 provides step-by-step instructions.

Calculating Future Value

- Enter the payment amount (PMT) and press “PMT”.

- Enter the interest rate (I/Y) and press “I/Y”.

- Enter the number of periods (N) and press “N”.

- Press the “CPT” button followed by “FV” to calculate the future value.

Example:

Let’s say you want to calculate the future value of an annuity with a payment of $500 per month, an interest rate of 3%, and a period of 5 years (60 months). You would input the following values into the calculator:

- PMT = 500

- I/Y = 3

- N = 60

After pressing “CPT” and “FV”, the calculator will display the future value of the annuity.

X Share Annuity is a specific type of annuity that might be of interest to you. Learn more about it in our article on X Share Annuity 2024.

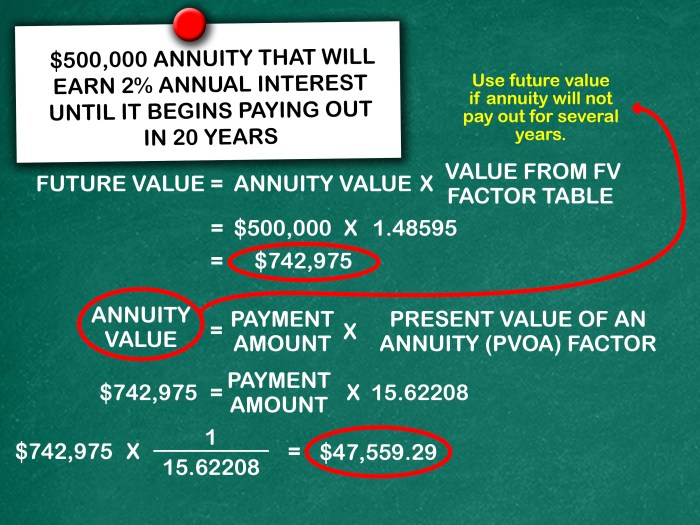

Annuity Formulas and Calculations

The calculation of present value and future value of an annuity involves specific formulas that take into account the payment amount, interest rate, and number of periods.

Wondering what an annuity is and how it works? Our article on Annuity Kya Hai 2024 explains everything you need to know in a clear and concise manner.

Formulas

- Present Value of an Ordinary Annuity:

PV = PMT- [1 – (1 + i)^-n] / i

When you receive annuity payments, you might wonder if they are taxable. You can find the answer to the question Is Annuity Income Taxable 2024 on our website.

- Future Value of an Ordinary Annuity:

FV = PMT- [(1 + i)^n – 1] / i

When it comes to retirement planning, choosing between an annuity and a drawdown can be a tough decision. Our article on Annuity Or Drawdown 2024 explores the pros and cons of each option.

Relationship between Parameters

The present value and future value of an annuity are directly influenced by the payment amount, interest rate, and number of periods. A higher payment amount, interest rate, or number of periods will result in a higher future value and a lower present value.

Annuity Formula Table

| Formula | Input | Output |

|---|---|---|

| PV = PMT

Annuity payments can provide a sense of security during retirement. But are they guaranteed? Our article on Is Annuity Guaranteed 2024 explores this question.

|

PMT, i, n | Present Value |

| FV = PMT

Looking for a real-world example to help you grasp annuity calculations? Check out our article on Calculate Annuity Example 2024. It breaks down the steps and shows you how it works.

|

PMT, i, n | Future Value |

Applications of Annuity Calculations

Annuity calculations have various applications in financial planning and decision-making. Understanding these applications can help individuals make informed financial choices.

A living annuity is a popular choice for retirement planning. It’s essential to understand the tax implications. You can find the answer to the question Is A Living Annuity Taxable 2024 on our website.

Retirement Planning

Annuity calculations are crucial for retirement planning. They help determine the amount of savings needed to generate a desired income stream during retirement. By calculating the present value of future retirement income needs, individuals can estimate how much they need to save to achieve their financial goals.

Annuity payments from LIC can be a valuable source of income. It’s important to know whether they are taxable. Our article on Is Annuity Received From Lic Taxable 2024 provides the answer.

Loan Repayment

Annuity calculations are used to determine the monthly payments for loans like mortgages and auto loans. By understanding the relationship between the loan amount, interest rate, and loan term, borrowers can make informed decisions about their loan options.

Investment Strategies

Annuity calculations are also used in investment strategies. For example, investors can use annuity calculations to determine the future value of a series of regular investments, such as monthly contributions to a mutual fund. This helps investors understand the potential growth of their investments over time.

Summary

Calculating annuities using a Casio calculator empowers you to gain control over your financial future. By understanding the principles behind annuity calculations and utilizing the practical steps Artikeld in this guide, you can confidently analyze various financial scenarios and make informed decisions about your investments, savings, and long-term financial goals.

Remember, financial planning is a journey, and with the right tools and knowledge, you can navigate it with confidence and achieve your desired outcomes.

Frequently Asked Questions

What are the different types of annuities?

Annuities can be classified as fixed or variable, immediate or deferred, and single premium or periodic premium. Each type has unique features and benefits, so it’s important to understand the differences before making a decision.

Annuity income can be a significant part of your retirement income. It’s essential to know whether it’s taxable. You can find the answer to the question Is Immediate Annuity Income Taxable 2024 on our website.

How accurate are annuity calculations on a Casio calculator?

Casio calculators are designed for financial calculations and provide accurate results when used correctly. However, it’s always recommended to double-check your calculations and consult with a financial advisor for complex financial planning.

Can I use other calculators besides Casio for annuity calculations?

Annuity is a financial product that provides a steady stream of income over a period of time. It’s a popular choice for retirement planning, and you can find out more about it in our article on Annuity Is Ordinary 2024.

Yes, many other calculators, including scientific and financial calculators from other brands, can be used for annuity calculations. The specific functions and steps may vary depending on the calculator model.