How To Calculate Annuities 2024: A Guide delves into the world of annuities, providing a comprehensive understanding of these financial instruments. Annuities, essentially a stream of regular payments, are often used for retirement planning, estate planning, and other financial goals.

This guide will explore the different types of annuities, the key features that define them, and how to calculate their present value and future payments.

Understanding how to calculate annuities empowers individuals to make informed financial decisions. Whether you’re seeking to secure your retirement income or plan for future financial needs, this guide will provide the knowledge and tools necessary to navigate the complexities of annuities.

Understanding Annuities

Annuities are financial products that provide a stream of regular payments over a period of time. They are often used for retirement planning, but can also be used for other financial goals, such as estate planning or income generation. Annuities are complex financial products, and it is important to understand the different types and their features before making a decision.

The Jaiib exam covers various financial topics, including annuities. You can find information about annuity formulas and calculations specifically designed for the Jaiib exam in Annuity Formula Jaiib 2024.

Types of Annuities

Annuities can be classified into different types based on their payment terms, interest rates, and guarantees. Some common types of annuities include:

- Immediate annuities: These annuities begin paying out immediately after the purchase. They are typically used for retirement income or to provide a guaranteed stream of income.

- Deferred annuities: These annuities start paying out at a future date, such as when the annuitant reaches retirement age. They are often used to save for retirement or to accumulate wealth over time.

- Fixed annuities: These annuities offer a fixed interest rate, which means that the payments will remain the same throughout the life of the annuity. They provide guaranteed income, but the returns may not keep pace with inflation.

- Variable annuities: These annuities invest in a portfolio of stocks, bonds, or other assets. The payments are not guaranteed and can fluctuate based on the performance of the underlying investments. They offer the potential for higher returns, but also carry more risk.

If you’re looking for a comprehensive tool to calculate the value of a lifetime annuity, Annuity Calculator Lifetime 2024 provides a detailed analysis based on your individual circumstances.

- Indexed annuities: These annuities offer a minimum guaranteed return, but also have the potential to earn higher returns based on the performance of a specific index, such as the S&P 500.

Key Features of Annuities

The key features of an annuity include:

- Payment terms: This refers to the frequency and duration of the payments. Annuities can pay out monthly, quarterly, annually, or over a specific period of time.

- Interest rates: The interest rate determines the rate of return on the annuity. Fixed annuities have a guaranteed interest rate, while variable annuities have a variable interest rate that fluctuates based on market conditions.

- Guarantees: Some annuities offer guarantees, such as a minimum guaranteed return or a guaranteed death benefit. These guarantees can provide peace of mind, but they may come with higher fees.

Tax Implications of Annuities

The tax implications of annuities can vary depending on the type of annuity and the individual’s tax situation. In general, the payments from an annuity are taxed as ordinary income. However, the growth of the annuity may be tax-deferred, meaning that it is not taxed until it is withdrawn.

It is important to consult with a tax advisor to understand the tax implications of annuities and how they differ from other investments.

Calculating Annuity Payments

Calculating annuity payments involves determining the present value of a stream of future payments. This requires considering factors such as the interest rate, the payment period, and the number of payments. There are various formulas and methods used to calculate annuity payments.

If you’re looking to calculate the value of your retirement annuity, you can find helpful resources online. For example, Calculating Retirement Annuity 2024 provides information and tools that can help you estimate your potential retirement income.

Present Value of an Annuity

The present value (PV) of an annuity represents the current value of a series of future payments, discounted back to the present time. The formula for calculating the present value of an ordinary annuity is:

PV = PMT

BMO is a well-known financial institution offering annuity products. You can use Annuity Calculator Bmo 2024 to estimate the potential returns from a BMO annuity.

- [1

- (1 + r)^-n] / r

Where:

- PV is the present value of the annuity

- PMT is the periodic payment amount

- r is the interest rate per period

- n is the number of periods

Annuity Payment Formulas

Different annuity payment formulas are used based on the specific type of annuity and the desired outcome. Some common formulas include:

- Future value of an annuity: This formula calculates the future value of a series of payments made over a specified period, considering the interest earned.

- Annuity due: This formula calculates the present value of an annuity where payments are made at the beginning of each period, instead of the end.

- Perpetuity: This formula calculates the present value of an annuity that continues indefinitely, with a constant payment stream.

Using Financial Calculators and Spreadsheets

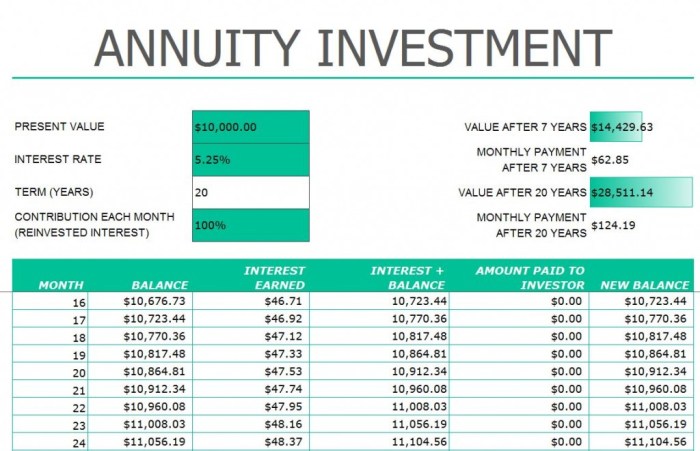

Financial calculators and spreadsheet software can be helpful tools for calculating annuity payments. These tools offer built-in functions that simplify the calculations and provide accurate results.

For example, Microsoft Excel has the PV function, which can be used to calculate the present value of an annuity. You can simply input the payment amount, interest rate, number of periods, and the function will calculate the present value.

Factors Affecting Annuity Calculations

Several factors can influence annuity calculations, including interest rates, inflation, time value of money, mortality rates, and life expectancy.

When working with annuities, understanding the accounting principles is crucial. Calculating Annuity In Accounting 2024 provides insights into how annuities are treated in accounting.

Interest Rates

Interest rates play a crucial role in determining the present value of an annuity. Higher interest rates result in a lower present value, as the future payments are discounted at a higher rate. Conversely, lower interest rates lead to a higher present value.

The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees. You can learn how to calculate your TSP annuity by visiting Calculating Tsp Annuity 2024.

Inflation

Inflation erodes the purchasing power of money over time. When calculating annuity payments, it is important to consider the impact of inflation on the future value of the payments. For example, if inflation is high, the payments received in the future may not have the same purchasing power as they would have today.

Time Value of Money

The time value of money concept recognizes that money received today is worth more than the same amount of money received in the future. This is due to the potential for earning interest or returns on the money. When calculating annuity payments, the time value of money is taken into account by discounting future payments back to the present.

The interest rate can significantly impact the value of an annuity. For instance, you can explore Annuity 8.5 Percent 2024 to see how a higher interest rate can affect your returns.

Mortality Rates and Life Expectancy

Mortality rates and life expectancy are important factors for annuity calculations, particularly for annuities that provide lifetime payments. The insurer uses these factors to estimate the expected lifespan of the annuitant and determine the appropriate payout amount.

Key Assumptions

When calculating annuities, several key assumptions need to be made, such as:

- The interest rate will remain constant over the life of the annuity.

- The annuitant will live for a specific number of years.

- Inflation will remain at a certain rate.

These assumptions can impact the accuracy of the calculations, so it is important to consider the potential risks and uncertainties.

Excel is a powerful tool for financial calculations, including annuity calculations. You can learn how to calculate annuities in Excel by visiting Calculating Annuity In Excel 2024.

Annuity Applications and Examples

Annuities are versatile financial products that can be used in various financial scenarios. They are commonly used for retirement planning, estate planning, and income generation.

Retirement Planning, How To Calculate Annuities 2024

Annuities are often used as a source of retirement income. They can provide a guaranteed stream of payments for life, which can help retirees meet their expenses and maintain their lifestyle.

Estate Planning

Annuities can be used as part of an estate plan to provide income for beneficiaries after the death of the annuitant. They can also be used to create a legacy for future generations.

The HP12c calculator is a popular tool for financial calculations, including annuities. You can learn how to use the HP12c calculator to calculate annuities by visiting Calculate Annuity Hp12c 2024.

Other Financial Scenarios

Annuities can also be used in other financial scenarios, such as:

- Income generation: Annuities can provide a steady stream of income for individuals who need to supplement their existing income.

- Long-term care planning: Annuities can be used to cover the costs of long-term care, such as nursing home expenses.

- Charitable giving: Annuities can be used to create charitable trusts that provide income for a specific cause.

Comparison of Annuity Types

| Type of Annuity | Features | Suitability |

|---|---|---|

| Immediate Annuity | Guaranteed income, starts immediately | Retirement income, guaranteed stream of payments |

| Deferred Annuity | Growth potential, starts at a future date | Retirement savings, wealth accumulation |

| Fixed Annuity | Guaranteed interest rate, stable income | Risk-averse investors, guaranteed payments |

| Variable Annuity | Potential for higher returns, fluctuating income | Risk-tolerant investors, potential for growth |

| Indexed Annuity | Minimum guaranteed return, potential for higher returns | Investors seeking growth with downside protection |

Hypothetical Scenario

Consider an individual named John, who is planning for retirement in 10 years. John wants to ensure a steady stream of income during retirement and is considering incorporating an annuity into his financial plan. He has saved $200,000 and estimates he will need $5,000 per month in retirement income.

For those with joint life insurance policies, you can find a dedicated calculator for joint life annuities. Check out Annuity Calculator Joint Life 2024 to learn more.

By purchasing a deferred annuity with a guaranteed interest rate, John can secure a future income stream that will provide him with financial security during retirement.

Considerations for Choosing an Annuity

Choosing an annuity involves careful consideration of several factors, including the advantages and disadvantages of annuities compared to other investment options, the features and fees offered by different annuity providers, and a checklist of factors to consider when selecting an annuity.

Want to learn more about how annuities work and their potential benefits? You can check out Annuity How It Works 2024 to get a better understanding of this financial tool. Annuities can be a helpful way to supplement retirement income, but it’s important to understand the different types of annuities and how they work before making any decisions.

Advantages and Disadvantages

Annuities offer both advantages and disadvantages compared to other investment options.

Annuities can be a complex financial product. Some argue that they may not always be the best option for everyone. You can find information about the potential downsides of annuities in Annuity Is Bad 2024.

- Advantages: Guaranteed income, tax-deferred growth, protection from market risk, death benefit options.

- Disadvantages: Limited liquidity, potential for lower returns compared to other investments, high fees.

Features and Fees

Annuity providers offer a wide range of features and fees, so it is important to compare different options before making a decision.

Annuities are a common financial product, and it’s important to understand their potential benefits and drawbacks. You can find more information about annuities in Is Annuity Income 2024.

- Features: Guaranteed interest rates, investment options, death benefit options, living benefit options.

- Fees: Surrender charges, administrative fees, mortality and expense charges.

Checklist for Selecting an Annuity

When selecting an annuity, it is important to consider the following factors:

- Provider’s reputation: Choose a reputable provider with a strong track record.

- Investment options: Consider the investment options available and their potential for growth.

- Guarantees: Understand the guarantees offered and their limitations.

- Fees: Compare the fees charged by different providers and choose an option with reasonable fees.

- Flexibility: Consider the flexibility of the annuity, such as the ability to withdraw funds or change the payment terms.

Ending Remarks: How To Calculate Annuities 2024

By understanding the different types of annuities, their key features, and how to calculate their present and future values, you can make informed decisions about incorporating annuities into your financial plan. Whether you’re looking to secure your retirement income, plan for your children’s education, or simply invest for the future, annuities can be a valuable tool.

Remember to carefully consider your individual needs and goals when choosing an annuity, and consult with a financial advisor if needed.

FAQ Insights

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments. Fixed annuities offer stability, while variable annuities offer potential for higher returns but also carry more risk.

How do taxes affect annuities?

The tax treatment of annuities depends on the type of annuity and how it is structured. In general, withdrawals from an annuity are taxed as ordinary income, but there may be tax-deferred growth during the accumulation phase.

What are the fees associated with annuities?

Annuities can come with various fees, including administrative fees, mortality and expense charges, and surrender charges. It’s crucial to understand all fees associated with an annuity before making a decision.

How do I choose the right annuity provider?

Consider factors like the provider’s reputation, investment options, fees, and guarantees. It’s also essential to research the provider’s financial stability and customer service.