How To Calculate A Growing Annuity 2024: A Comprehensive Guide – Unlocking the potential of growing annuities, this guide provides a clear and concise explanation of how to calculate their future value, taking into account the various factors that influence their growth.

Whether you’re planning for retirement, saving for a specific goal, or simply seeking to understand this powerful financial tool, this guide will equip you with the knowledge and tools necessary to make informed decisions.

Growing annuities offer a unique way to build wealth over time, providing consistent income streams that increase with inflation. This guide delves into the intricacies of calculating the future value of a growing annuity, exploring the key variables involved and their impact on the final outcome.

While annuities can provide a guaranteed income stream, it’s important to understand that they can have limitations. For example, an annuity is not indefinite duration , and the payments may cease after a certain period.

We’ll also discuss the practical applications of growing annuities, highlighting their benefits and drawbacks for various financial goals.

Understanding Growing Annuities

A growing annuity, also known as an increasing annuity, is a type of investment that provides a stream of payments that grows over time. This growth can be attributed to a predetermined rate of increase or a variable rate linked to market performance.

When calculating an annuity, you’ll need to consider the interest rate and the number of payments. Calculating an annuity factor can be a helpful tool for this purpose.

Growing annuities are often considered a valuable tool for retirement planning and other long-term financial goals, as they can help you outpace inflation and achieve your financial objectives more effectively.

An annuity can provide a regular income stream for a set period of time. You can learn more about an annuity of 1000 per month and its potential benefits.

Defining a Growing Annuity

A growing annuity is an investment that provides regular payments, which increase over time at a specified rate. The key characteristics of a growing annuity include:

- Regular Payments:Growing annuities typically involve a series of consistent payments made at regular intervals, such as monthly, quarterly, or annually.

- Growth Rate:The payments increase over time at a predetermined rate, which can be fixed or variable.

- Time Period:Growing annuities have a defined time period, such as a specific number of years or until a certain age is reached.

Distinguishing Growing Annuities from Fixed Annuities

The primary difference between a fixed annuity and a growing annuity lies in the payment structure. A fixed annuity provides a constant stream of payments throughout its duration, while a growing annuity offers payments that increase over time. The growth rate of a growing annuity can be determined by a fixed percentage or linked to a market index, offering the potential for higher returns than a fixed annuity.

To understand the potential return on an annuity, you can use a calculator. An annuity calculator CNN can provide estimates based on different scenarios.

Factors Influencing Growth Rate

Several factors can influence the growth rate of a growing annuity, including:

- Interest Rates:The prevailing interest rates in the market can significantly impact the growth rate of an annuity. Higher interest rates generally lead to higher growth rates.

- Inflation:Inflation can erode the purchasing power of your payments over time. Growing annuities can help offset inflation by increasing payments in line with the rate of inflation.

- Investment Performance:If the growth rate of your annuity is linked to a market index, the performance of that index will determine the growth rate of your payments.

- Annuity Type:Different types of growing annuities have different growth rate structures. For example, a fixed-indexed annuity’s growth rate may be linked to a specific index, while a variable annuity’s growth rate can fluctuate based on market conditions.

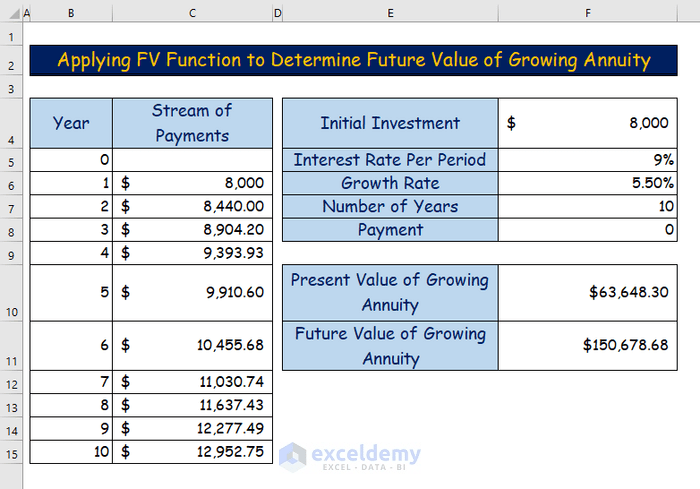

Calculating Future Value of a Growing Annuity

The future value of a growing annuity represents the total amount you will receive from the annuity at the end of its term. This calculation takes into account the initial payment, the growth rate, the interest rate, and the duration of the annuity.

Formula for Calculating Future Value

FV = P- [(1 + r)^n – (1 + g)^n] / (r – g)

There are many different types of annuities available. Annuity 60000 might be a good option for those looking for a high payout.

Where:

- FV = Future Value

- P = Initial Payment

- r = Interest Rate

- g = Growth Rate

- n = Number of Periods

Example Calculation, How To Calculate A Growing Annuity 2024

| Year | Payment | Interest Rate | Future Value |

|---|---|---|---|

| 1 | $1,000 | 5% | $1,000 |

| 2 | $1,050 | 5% | $2,105 |

| 3 | $1,102.50 | 5% | $3,262.75 |

| 4 | $1,157.63 | 5% | $4,475.06 |

In this example, we assume an initial payment of $1,000, an interest rate of 5%, a growth rate of 5%, and a period of 4 years. The future value at the end of year 4 is calculated to be $4,475.06.

Factors Affecting Growing Annuity Calculations: How To Calculate A Growing Annuity 2024

Several factors can significantly impact the future value of a growing annuity. Understanding these factors can help you make informed decisions about your investment strategy.

Annuities can be a good way to supplement your retirement income. However, it’s important to understand the different types of annuities available. For example, you might want to look into fixed annuities or variable annuities.

Impact of Interest Rates

Higher interest rates generally lead to a higher future value of a growing annuity. This is because the interest earned on your payments compounds over time, resulting in greater overall growth. For example, if the interest rate is 6% instead of 5%, the future value of the annuity in the previous example would be $4,660.96, reflecting a higher return due to the increased interest rate.

An annuity can be a valuable tool for retirement planning. 8 Annuity income secrets can help you understand how to maximize your benefits.

Growth Rate Influence

The growth rate of the annuity plays a crucial role in determining its future value. A higher growth rate leads to faster increases in your payments, resulting in a higher future value. In the previous example, if the growth rate were 6% instead of 5%, the future value at the end of year 4 would be $4,750.71, showcasing the impact of a higher growth rate.

To understand how annuities work and how they can benefit you, it’s helpful to explore various examples. Calculate annuity examples can help you visualize the potential returns and understand the mechanics involved.

Time Period Impact

The time period over which the annuity grows also influences its future value. The longer the time period, the more time your payments have to compound, leading to a higher future value. In the previous example, if the annuity term were 5 years instead of 4, the future value would be even higher, demonstrating the power of compounding over a longer period.

It’s also important to understand the tax implications of annuities. Annuity payments are taxable , so it’s important to factor that into your financial planning.

Applications of Growing Annuities

Growing annuities are versatile financial instruments with a wide range of applications. Their ability to provide increasing payments over time makes them suitable for various financial goals.

Retirement Planning

Growing annuities are often used for retirement planning as they can provide a steady stream of income that grows over time. This can help retirees maintain their standard of living and offset the effects of inflation. The increasing payments can help retirees keep pace with rising costs and ensure they have sufficient funds to meet their needs throughout retirement.

If you’re considering an annuity, it’s a good idea to use an annuity calculator. An annuity calculator compounded monthly can help you estimate your potential payouts.

Other Financial Goals

Growing annuities can also be used for other financial goals, such as:

- College Savings:Growing annuities can provide a steady stream of funds to help pay for college expenses. The increasing payments can help offset the rising cost of education and ensure that your child has access to the resources they need to pursue their educational goals.

If you’re interested in learning more about how to calculate annuities, there are many resources available online. For example, you can learn how to calculate an annuity in Excel using a spreadsheet.

- Long-Term Care:Growing annuities can provide financial security for long-term care expenses. The increasing payments can help cover the costs of assisted living, nursing home care, or other long-term care services.

- Legacy Planning:Growing annuities can be used to create a legacy for your heirs. The increasing payments can provide a stream of income for your beneficiaries after your death.

Tools and Resources for Calculating Growing Annuities

Several online calculators and software programs can help you calculate the future value of a growing annuity. These tools can provide valuable insights into your potential returns and help you make informed investment decisions.

Annuities can be a complex financial product. It’s important to do your research and understand the risks involved before investing in one. An annuity is a series of payments , so it’s important to make sure you’re comfortable with the terms and conditions.

Online Calculators

Many websites offer free online calculators that can be used to calculate the future value of a growing annuity. These calculators typically require you to input the initial payment, growth rate, interest rate, and time period. Some calculators may also allow you to adjust for inflation or other factors.

When looking for information about annuities, you may come across various terms and concepts. One such concept is that an annuity is a stream of payments , which is crucial to understand its function.

Financial Software

Financial software programs, such as Quicken or Mint, can also be used to calculate the future value of a growing annuity. These programs often offer more advanced features, such as the ability to track your investments, create budgets, and plan for retirement.

Consulting a Financial Advisor

While online calculators and software can be helpful, it is always advisable to consult with a qualified financial advisor before making any investment decisions. A financial advisor can provide personalized advice based on your individual circumstances and help you choose the right investment strategy for your financial goals.

If you’re looking for a guaranteed stream of income, you might want to consider an annuity. An annuity is a financial product that provides regular payments for a set period of time. You can find out more about how annuities work by reading about what an annuity is.

Closure

Understanding how to calculate a growing annuity is crucial for anyone seeking to maximize their financial potential. By grasping the fundamental principles and factors that influence growth, you can make informed decisions about your investment strategies. Whether you’re seeking to secure your retirement, achieve specific financial goals, or simply explore the world of annuities, this guide provides a solid foundation for your journey.

Armed with this knowledge, you can navigate the complexities of growing annuities with confidence and make informed choices that align with your financial aspirations.

Common Queries

What is the difference between a fixed annuity and a growing annuity?

A fixed annuity provides a predetermined, fixed rate of return, while a growing annuity offers a variable rate of return that increases over time, typically tied to an inflation index or other market benchmarks.

How do I find a reputable financial advisor to help me with growing annuities?

You can seek recommendations from trusted friends or family members, research online financial advisor directories, or consult with your bank or credit union for referrals. It’s essential to choose a financial advisor who is qualified, experienced, and has a good track record.

What are the tax implications of growing annuities?

Tax implications vary depending on the type of growing annuity and the specific tax laws in your jurisdiction. It’s essential to consult with a tax professional to understand the tax treatment of your annuity and how it will impact your overall financial planning.