How To Calculate A Deferred Annuity 2024: A Step-by-Step Guide – Deferred annuities offer a way to secure a future income stream, but understanding how to calculate their value is crucial. This guide provides a comprehensive overview of the factors influencing deferred annuity calculations, outlining the steps involved and the methods used to determine your future payments.

From the time value of money to the impact of interest rates, investment growth, and inflation, we’ll explore how these variables play a role in determining the ultimate value of your deferred annuity. We’ll also delve into the impact of personal factors like age, gender, and health, as well as investment choices, fees, and tax implications, providing you with the knowledge to make informed decisions about your financial future.

Annuities come in a variety of forms, each with its own unique features and benefits. To learn more about the different types of annuities available in 2024, visit this resource: Annuity Kinds 2024. This information will help you choose the type of annuity that best suits your individual needs and financial goals.

Understanding Deferred Annuities: How To Calculate A Deferred Annuity 2024

A deferred annuity is a financial product that provides a stream of income payments at a future date, typically after a specified period of time. It’s a contract between you and an insurance company where you make regular payments or a lump sum investment, and in return, the insurance company guarantees to pay you a certain amount of money at a later date.

If you’re looking for information on annuities and need help understanding the terminology, this resource can help you unscramble the word “annuity” and its related concepts: Annuity Unscramble 2024. This resource can help you gain a better understanding of annuities and how they work.

Deferred annuities offer a way to save for retirement or other long-term financial goals, with the advantage of tax-deferred growth and guaranteed income payments.

Annuity payments are often reported on Form 1099. To learn more about the tax reporting requirements for annuities in 2024, visit this link: Annuity 1099 2024. Understanding the tax reporting aspects of your annuity is crucial for accurate tax filing.

Key Features of Deferred Annuities, How To Calculate A Deferred Annuity 2024

- Deferred Payments:Unlike immediate annuities, where payments start immediately, deferred annuities provide payments at a later date, allowing you to accumulate wealth over time.

- Tax-Deferred Growth:The earnings from your annuity investment grow tax-deferred, meaning you won’t pay taxes on them until you start receiving payments.

- Guaranteed Income Payments:Deferred annuities typically offer guaranteed income payments for life, providing financial security in retirement.

- Flexibility:You can choose from various options for your annuity, such as the payment frequency, the length of the payout period, and the investment options available.

Deferred Annuities vs. Immediate Annuities

The key difference between deferred and immediate annuities lies in the timing of the income payments. Immediate annuities begin paying out right away, while deferred annuities delay payments until a specified future date.

Annuity 95-1 is a specific type of annuity that offers certain guarantees and features. To learn more about this type of annuity in 2024, visit this link: Annuity 95-1 2024. This information can help you determine if this type of annuity is a good fit for your financial needs.

- Immediate Annuities:Ideal for those who need income immediately, such as retirees or individuals with an immediate need for funds. They are generally purchased with a lump sum payment.

- Deferred Annuities:Suitable for individuals with a longer time horizon, such as those saving for retirement. They allow for tax-deferred growth and flexibility in investment options.

Factors Influencing Deferred Annuity Calculations

Several factors influence the calculation of a deferred annuity, including the amount of the initial investment, the time period before payments begin, the interest rate, and the type of annuity chosen.

- Initial Investment:The amount you initially invest will directly affect the future income payments. A larger initial investment will typically result in higher income payments.

- Time Period:The longer the period before payments begin, the more time the investment has to grow, potentially leading to higher income payments.

- Interest Rate:The interest rate earned on the investment plays a significant role in determining the future income payments. Higher interest rates generally lead to higher income payments.

- Annuity Type:Different types of deferred annuities, such as fixed annuities or variable annuities, offer different investment options and payout structures, which can affect the calculation of income payments.

Calculation Components

Calculating a deferred annuity involves considering various factors that influence the future income payments. These factors interact with each other, and understanding their role is crucial for accurate calculations.

Factors Affecting Deferred Annuity Calculations

- Initial Investment:This is the starting point for the calculation, representing the principal amount invested in the annuity.

- Time Period:The length of time between the initial investment and the start of income payments is a critical factor. The longer the period, the more time the investment has to grow.

- Interest Rate:The interest rate earned on the investment determines the rate at which the principal amount grows over time. Higher interest rates lead to faster growth.

- Inflation:Inflation erodes the purchasing power of money over time. It’s important to consider inflation when calculating future income payments to ensure they maintain their value.

- Fees and Charges:Annuities often come with fees and charges, which can impact the overall return on investment. These fees should be factored into the calculations.

- Investment Growth:If the annuity is invested in the market, the investment growth rate can influence the future income payments. Higher growth rates generally lead to higher income payments.

Time Value of Money

The time value of money is a fundamental concept in deferred annuity calculations. It recognizes that money received today is worth more than the same amount of money received in the future due to its potential earning capacity. The time value of money is incorporated into deferred annuity calculations through discounting and compounding.

While some annuities provide income for life, others have a specific term. To learn more about the different options available and whether an annuity can provide lifetime income in 2024, check out this resource: Is Annuity For Life 2024.

This information will help you determine the type of annuity that aligns with your long-term financial goals.

Interest Rates, Investment Growth, and Inflation

Interest rates, investment growth, and inflation are interconnected factors that influence deferred annuity calculations. Interest rates represent the cost of borrowing money, and they can impact the growth of the annuity investment. Investment growth refers to the increase in the value of the annuity investment over time, and it can be influenced by various factors, including market performance and investment choices.

Annuity is often described as a life insurance product that provides a stream of income. To understand more about this aspect of annuities in 2024, visit this resource: Annuity Is A Life Insurance Product That 2024. This information will help you grasp the relationship between annuities and life insurance.

Inflation erodes the purchasing power of money, making it crucial to consider its impact on future income payments.

Calculating the potential returns on your annuity can be done using a basic annuity calculator. This resource provides access to a basic annuity calculator in 2024: Annuity Calculator Basic 2024. This tool can help you estimate the potential income stream from your annuity investment.

Calculation Methods

Several methods are commonly used to calculate deferred annuity payments. Each method has its advantages and disadvantages, and the best choice depends on the specific circumstances and preferences of the individual.

Understanding the discount factor is crucial when evaluating annuities. This link can guide you through the process of calculating the annuity discount factor for 2024: Calculate Annuity Discount Factor 2024. This knowledge will be invaluable in determining the true value of your annuity.

Common Calculation Methods

- Present Value Method:This method involves discounting future income payments to their present value, using a specific discount rate that reflects the time value of money. The present value represents the amount of money that needs to be invested today to generate the desired future income stream.

- Future Value Method:This method calculates the future value of the initial investment, taking into account the interest rate and the time period. The future value represents the amount of money that will be available at the time of the first income payment.

Shopping around for annuity quotes can be a smart move to ensure you’re getting the best possible rates. This website provides access to online annuity quotes in 2024: Annuity Quotes Online 2024. Comparing quotes from different providers can help you find the most competitive rates for your needs.

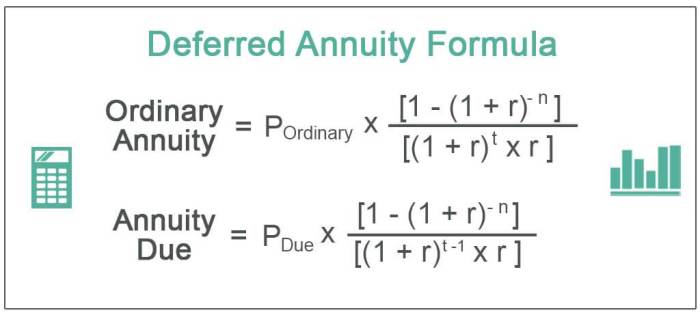

- Annuity Formula:This method uses a mathematical formula to calculate the annuity payment based on the initial investment, the interest rate, the time period, and the number of payments.

Step-by-Step Guide: Present Value Method

Here’s a step-by-step guide for calculating a deferred annuity using the present value method:

- Determine the future income payments:Decide on the amount of income you want to receive each year or month.

- Establish the time period:Determine the number of years or months before payments begin.

- Select a discount rate:Choose a discount rate that reflects the time value of money and the risk associated with the investment.

- Calculate the present value:Use a present value calculator or formula to calculate the present value of the future income payments, discounted back to the present time.

- Determine the initial investment:The present value represents the initial investment required to generate the desired income stream.

Comparing Calculation Methods

Each calculation method has its strengths and weaknesses. The present value method is useful for determining the initial investment required, while the future value method helps visualize the growth of the investment over time. The annuity formula provides a precise calculation of the annuity payment based on specific parameters.

Factors Affecting Annuity Payments

Various factors can influence the amount of annuity payments you receive. These factors can be broadly categorized into personal characteristics, investment choices, and fees and charges.

Calculating the rate of an annuity can be complex, but this resource can help you understand the process: Calculating An Annuity Rate 2024. This information will empower you to evaluate the potential returns on your annuity investment.

Personal Characteristics

- Age:Younger individuals generally receive lower annuity payments than older individuals because they have a longer life expectancy. This reflects the longer period over which they will receive income payments.

- Gender:Women typically receive lower annuity payments than men because they have a longer life expectancy.

- Health:Individuals with good health generally receive higher annuity payments because they are expected to live longer and receive payments for a longer period.

Investment Choices

- Fixed Annuities:These annuities offer a guaranteed interest rate, providing a predictable income stream. The payments are fixed for the life of the annuity, regardless of market fluctuations.

- Variable Annuities:These annuities allow you to invest in a variety of market-based investment options, such as stocks or bonds. The income payments are not guaranteed and can fluctuate based on the performance of the chosen investments.

- Indexed Annuities:These annuities offer a return linked to a specific market index, such as the S&P 500. They provide potential for growth while offering some downside protection.

Fees and Charges

- Administrative Fees:These fees cover the costs of managing and administering the annuity contract.

- Mortality and Expense Charges:These charges reflect the cost of providing guaranteed income payments and managing the risk associated with the annuity.

- Surrender Charges:These charges may apply if you withdraw your investment from the annuity before a certain period. They are designed to discourage early withdrawals.

Tax Implications

Deferred annuities offer tax-deferred growth, meaning you don’t pay taxes on the earnings until you start receiving payments. However, there are specific tax implications associated with withdrawals and distributions from deferred annuities.

Annuities often involve compound interest, which can lead to significant growth over time. To learn more about how compound interest works with annuities in 2024, visit this link: Is Annuity Compound Interest 2024. Understanding the power of compound interest can help you maximize your annuity’s potential.

Income Tax

When you start receiving annuity payments, they are generally taxed as ordinary income. This means that the income portion of each payment is taxed at your ordinary income tax rate.

The tax treatment of annuity payments can vary depending on the type of annuity. To understand how annuity payments are taxed in 2024, you can find detailed information here: Is Annuity Payments Taxable 2024. This resource will provide you with valuable insights into the tax implications of your annuity payments.

Capital Gains Tax

If you withdraw your investment from a deferred annuity before reaching age 59 1/2, you may have to pay a 10% penalty on the earnings, in addition to ordinary income tax. This penalty is waived if you meet certain exceptions, such as having a qualifying disability or using the funds for a first-time home purchase.

Tax Treatment of Withdrawals and Distributions

The tax treatment of withdrawals and distributions from deferred annuities depends on the type of annuity and the circumstances of the withdrawal. Generally, withdrawals from a deferred annuity are considered taxable income, and they may be subject to a 10% penalty if taken before age 59 1/2.

Tax implications are an important factor to consider when exploring annuities. This article provides valuable insights into whether or not annuities are taxable in 2024: Annuity Is Taxable Or Not 2024. Understanding the tax treatment of your annuity is essential for effective financial planning.

Strategies for Minimizing Tax Burden

- Consider a Roth IRA:Contributions to a Roth IRA are made with after-tax dollars, but withdrawals in retirement are tax-free. This can be a tax-efficient alternative to a deferred annuity, especially if you expect to be in a higher tax bracket in retirement.

- Use a Qualified Withdrawal:If you meet certain exceptions, you may be able to withdraw funds from your annuity without incurring a penalty. These exceptions include qualified disability, medical expenses, and first-time home purchases.

- Maximize Your Annuity’s Growth:The longer your investment grows tax-deferred, the less of your earnings will be subject to income tax. Consider investing in a deferred annuity that offers a high growth potential.

Illustrative Examples

To illustrate the calculation of a deferred annuity, let’s consider a few scenarios with different variables:

Scenario 1:

| Variable | Value |

|---|---|

| Initial Investment | $100,000 |

| Time Period | 10 years |

| Interest Rate | 5% |

| Annuity Payment | $16,288.95 |

In this scenario, a $100,000 investment earning a 5% annual interest rate for 10 years would generate an annuity payment of $16,288.95 per year. This payment amount is calculated using a present value formula that discounts the future income stream back to the present time.

Scenario 2:

| Variable | Value |

|---|---|

| Initial Investment | $50,000 |

| Time Period | 20 years |

| Interest Rate | 7% |

| Annuity Payment | $7,407.35 |

In this scenario, a $50,000 investment earning a 7% annual interest rate for 20 years would generate an annuity payment of $7,407.35 per year. This example demonstrates the impact of a longer time period and a higher interest rate on the annuity payment.

Hypothetical Case Study:

Imagine a 45-year-old individual named Sarah who wants to save for retirement. She decides to invest $50,000 in a deferred annuity with a guaranteed interest rate of 4% per year. She chooses a payout period of 20 years, starting at age 65.

Using a present value calculation, she determines that her annual annuity payment will be approximately $5,381.60. This example highlights the importance of starting early and taking advantage of tax-deferred growth to secure a comfortable retirement income.

Conclusive Thoughts

By understanding the factors that influence deferred annuity calculations and employing the appropriate methods, you can gain valuable insights into the potential returns and benefits of this financial instrument. This knowledge empowers you to make informed decisions, ensuring your financial security and peace of mind in the years to come.

Whether you’re considering a deferred annuity for retirement planning or other financial goals, this guide provides the foundation you need to navigate the complexities of this financial tool and make the most of your investment.

Essential Questionnaire

What are the benefits of a deferred annuity?

Deferred annuities offer tax-deferred growth, guaranteed income in retirement, and the potential for higher returns than traditional savings accounts.

What are the risks associated with deferred annuities?

An annuity and an IRA are not the same thing, though they can both be useful for retirement planning. To learn more about the differences and similarities between these financial tools, check out this article: Is Annuity Same As Ira 2024.

This resource can help you understand how these options can fit into your overall financial strategy.

Risks include potential for lower returns than expected, early withdrawal penalties, and the possibility of losing principal if the annuity provider fails.

If you’re looking for information on the current rates for 3-year annuities in 2024, you can find it here: Annuity 3 Year Rates 2024. This resource can help you understand how these rates compare to other options and make an informed decision about your financial future.

How do I choose the right deferred annuity?

Consider your financial goals, risk tolerance, and time horizon. Consult with a financial advisor to determine the best option for your individual circumstances.