How Stimulus Check Amounts Vary by Income Level in Florida, a topic that has been at the forefront of discussions, is a complex issue with significant implications for residents across the state. The stimulus checks, intended to provide financial relief during challenging economic times, were distributed based on individual income levels, creating a tiered system that impacted different households in varying ways.

Investigate the pros of accepting Stimulus Checks Payment Amounts in Florida in your business strategies.

Understanding how these stimulus check amounts varied based on income is crucial for gaining insight into the distribution of financial assistance and its potential effects on the Florida economy. This analysis delves into the intricate details of the stimulus program, examining the eligibility criteria, the specific amounts received by different income brackets, and the broader economic implications of this financial intervention.

Stimulus Check Eligibility in Florida

Florida, like many other states, has implemented various economic relief measures in response to the COVID-19 pandemic. One of the most prominent forms of assistance has been the distribution of stimulus checks, which aim to provide financial support to individuals and families facing economic hardship.

Check Understanding the California Stimulus Check Payment Formula to inspect complete evaluations and testimonials from users.

This article delves into the specifics of stimulus check eligibility in Florida, exploring the criteria, income limitations, and additional programs that might provide further financial assistance.

Eligibility Criteria for Stimulus Checks

To qualify for stimulus checks in Florida, residents must meet certain eligibility criteria, including residency requirements and income limitations.

Obtain access to Stimulus Checks Application Process in Florida to private resources that are additional.

- Residency Requirements:Individuals must be legal residents of Florida to be eligible for stimulus checks. This typically means having a permanent address in the state and meeting any other residency requirements established by Florida law.

- Income Limitations:The eligibility for stimulus checks is often based on income levels. Specific income thresholds are set by the federal government, and Florida may have its own guidelines. Individuals exceeding these income limits may not qualify for the full stimulus check amount or may not be eligible at all.

It’s important to note that the specific eligibility criteria for stimulus checks can vary depending on the program and the year of issuance. It’s advisable to consult official sources, such as the Florida Department of Revenue or the Internal Revenue Service (IRS), for the most up-to-date information.

Browse the multiple elements of Stimulus Check Payment Amounts for People with Disabilities in California to gain a more broad understanding.

Examples of Eligible Individuals

Here are some examples of individuals who might be eligible for stimulus checks in Florida:

- Low-income workers:Individuals earning below the established income thresholds may be eligible for stimulus checks. This could include those employed in sectors like retail, hospitality, or food service.

- Unemployed individuals:Individuals who have lost their jobs due to the pandemic and are receiving unemployment benefits may also qualify for stimulus checks.

- Seniors and disabled individuals:Seniors and individuals with disabilities who meet the income requirements could be eligible for stimulus checks, especially if they rely on fixed incomes like Social Security or retirement benefits.

- Families with children:Families with children may be eligible for additional stimulus payments per dependent child, as Artikeld by federal guidelines.

It’s important to remember that eligibility for stimulus checks can be complex and may depend on individual circumstances. Consulting with financial advisors or government resources can help individuals determine their eligibility and understand the specific requirements.

Stimulus Check Amounts Based on Income Level

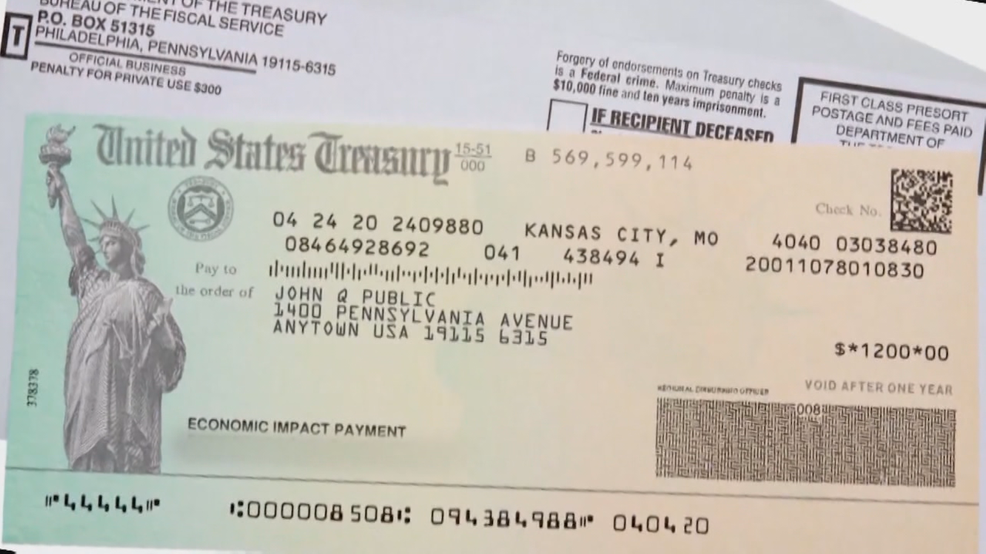

The amount of stimulus check an individual receives in Florida is typically determined by their income level. The federal government sets income brackets, and the corresponding stimulus check amount is calculated based on these brackets.

Stimulus Check Amount Calculation

The stimulus check amount is calculated based on a formula that considers the individual’s income level and other factors, such as dependents. For instance, the stimulus check amount might be reduced or eliminated for individuals exceeding certain income thresholds. The exact formula and deductions may vary depending on the specific stimulus program and the year of issuance.

| Income Bracket | Stimulus Check Amount |

|---|---|

$0

|

$1,400 |

$75,001

|

Gradually reduced from $1,400 to $0 |

| $150,001 or higher | $0 |

It’s important to note that this table provides a general overview of stimulus check amounts based on income levels. The actual amounts may vary depending on the specific stimulus program, the year of issuance, and individual circumstances.

Comparison with Other States

While Florida’s stimulus check amounts are generally consistent with federal guidelines, there may be variations in other states. Some states may have implemented additional programs or initiatives that provide higher stimulus check amounts or different eligibility criteria. It’s advisable to research the specific stimulus programs in other states to understand the differences.

Impact of Stimulus Checks on Florida’s Economy

Stimulus checks have had a significant impact on Florida’s economy, providing much-needed financial support to residents and stimulating economic activity. The impact can be observed across various sectors, including consumer spending, business activity, and job creation.

Consumer Spending

Stimulus checks have boosted consumer spending in Florida, as individuals have used the funds for essential expenses, such as rent, utilities, and groceries. This increased spending has supported businesses in various sectors, including retail, restaurants, and healthcare.

Business Activity

The influx of stimulus funds has also stimulated business activity in Florida. Businesses have been able to invest in inventory, expand operations, and hire new employees. This has led to increased production, sales, and economic growth in various sectors.

Job Creation

Stimulus checks have also contributed to job creation in Florida. Businesses that have received a boost from increased consumer spending and business activity have been able to create new jobs, reducing unemployment rates and supporting economic recovery.

Impact on Specific Sectors

The impact of stimulus checks has been felt across different sectors of Florida’s economy:

- Tourism:Stimulus checks have helped support the tourism industry in Florida, as individuals have been able to travel and spend money on leisure activities. This has boosted revenue for hotels, restaurants, and attractions.

- Retail:The retail sector has benefited significantly from increased consumer spending fueled by stimulus checks. Businesses have seen higher sales, particularly in areas like clothing, electronics, and home goods.

- Housing:Stimulus checks have also impacted the housing market in Florida. Individuals have been able to use the funds for down payments, rent payments, and home improvements, contributing to increased demand and activity in the real estate sector.

It’s important to acknowledge that the impact of stimulus checks on Florida’s economy has been multifaceted. While they have provided much-needed relief and stimulated economic activity, there have also been concerns about potential inflation and long-term economic sustainability.

Alternative Financial Assistance Programs

In addition to stimulus checks, Florida offers a range of alternative financial assistance programs to help residents facing economic hardship. These programs provide support for various needs, including unemployment, food, and housing assistance.

Unemployment Benefits

Florida’s unemployment benefits program provides financial assistance to individuals who have lost their jobs through no fault of their own. The program provides weekly payments to eligible individuals, helping them cover basic expenses while they search for new employment.

Food Assistance

The Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, provides food assistance to low-income families and individuals. The program provides electronic benefits that can be used to purchase groceries at participating retailers.

Housing Assistance

Florida offers various housing assistance programs, including rental assistance, mortgage assistance, and housing counseling. These programs aim to help individuals and families maintain stable housing and avoid homelessness.

Eligibility Requirements and Benefits, How Stimulus Check Amounts Vary by Income Level in Florida

The eligibility requirements and benefits of these programs vary depending on the specific program and the individual’s circumstances. It’s essential to consult official sources, such as the Florida Department of Children and Families or the Florida Housing Finance Corporation, for detailed information about eligibility criteria, benefit amounts, and application procedures.

Future Stimulus Measures

The possibility of future stimulus measures in Florida remains uncertain, as it depends on various factors, including the state’s economic conditions, federal policies, and political considerations.

Find out about how Stimulus Checks Payment Amounts in Florida can deliver the best answers for your issues.

Potential Measures

Potential future stimulus measures in Florida could include:

- Additional stimulus checks:The state might consider providing additional stimulus checks to individuals and families facing economic hardship, similar to the federal stimulus programs.

- Extended unemployment benefits:Florida could extend the duration of unemployment benefits for individuals who have been unemployed for an extended period.

- Tax relief:The state might consider implementing tax relief measures, such as reducing income taxes or property taxes, to provide financial relief to residents.

- Investment in infrastructure:Florida could invest in infrastructure projects, such as road improvements, public transportation, or broadband expansion, to create jobs and stimulate economic growth.

The likelihood of these measures being implemented depends on various factors, including the state’s budget, the severity of the economic downturn, and political support. It’s important to stay informed about potential future stimulus measures through official government channels and news sources.

Preparing for Future Stimulus Measures

While the specifics of future stimulus measures are uncertain, individuals and businesses can take steps to prepare for potential economic changes:

- Track economic indicators:Stay informed about key economic indicators, such as unemployment rates, inflation, and GDP growth, to understand the overall economic climate.

- Review financial situation:Evaluate personal or business finances, including income, expenses, and debt levels, to assess financial stability and identify potential areas for improvement.

- Consider saving:If possible, consider saving a portion of income to create a financial buffer for unexpected expenses or economic downturns.

- Seek professional advice:Consult with financial advisors or business consultants for personalized guidance on financial planning and navigating economic uncertainties.

Staying informed, being proactive, and seeking professional advice can help individuals and businesses navigate potential future economic changes and prepare for potential stimulus measures.

For descriptions on additional topics like Stimulus Check Payment Amounts for Those with Investment Income in California, please visit the available Stimulus Check Payment Amounts for Those with Investment Income in California.

Ultimate Conclusion: How Stimulus Check Amounts Vary By Income Level In Florida

The distribution of stimulus checks in Florida, based on income levels, provides a unique lens through which to examine the state’s economic landscape and the impact of government intervention. By analyzing the eligibility criteria, the varying amounts received, and the potential economic effects, we gain a deeper understanding of how this financial assistance program shaped the lives of Floridians during a time of economic uncertainty.

The insights gleaned from this analysis can serve as valuable information for policymakers, economists, and individuals alike, informing future economic strategies and providing a roadmap for navigating similar situations in the future.

Common Queries

What are the income limitations for stimulus check eligibility in Florida?

The income limitations for stimulus check eligibility in Florida are determined by federal guidelines, not state-specific regulations. The exact income thresholds vary based on filing status and family size.

How do I apply for stimulus checks in Florida?

Stimulus checks were automatically distributed by the federal government based on tax information. There was no separate application process specific to Florida.

Are there any alternative financial assistance programs available in Florida?

Yes, Florida offers various financial assistance programs, including unemployment benefits, food assistance through SNAP, and housing assistance programs. Eligibility criteria and benefits vary based on individual circumstances.

What are the potential future stimulus measures in Florida?

While there are no concrete plans for future stimulus measures in Florida, the possibility of additional financial assistance or economic relief programs remains under consideration by policymakers, depending on future economic conditions.