How Much Will A 2 Million Annuity Pay 2024 – How Much Will A 2 Million Annuity Pay in 2024? This question is on the minds of many individuals planning for their retirement. Annuities, financial products that provide a stream of income for a set period, can be a valuable tool for securing financial stability during your golden years.

However, understanding how much you can expect to receive from a $2 million annuity requires careful consideration of factors like interest rates, inflation, and the type of annuity you choose.

If you’re looking for an annuity that provides a monthly income of $10,000, you can check out our article on Annuity 10000 Per Month 2024.

This article will delve into the intricacies of annuities, exploring different types, factors affecting payouts, and the process of calculating your potential income. We’ll also discuss important considerations for choosing an annuity and the tax implications involved. By the end, you’ll have a comprehensive understanding of how a $2 million annuity could contribute to your retirement plan.

Understanding Annuities

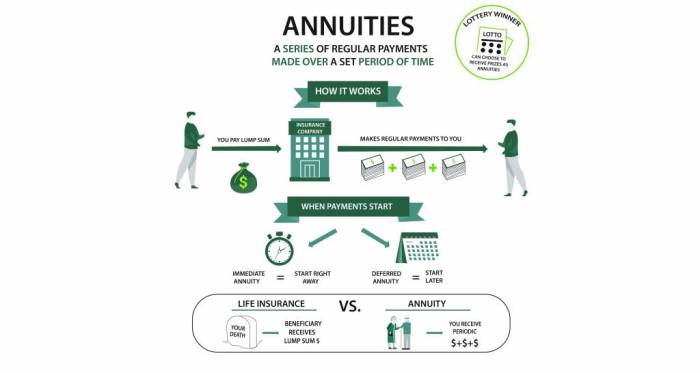

An annuity is a financial product that provides a stream of regular payments over a set period of time. They are often used in retirement planning to provide a steady income stream during your golden years. There are several types of annuities, each with its own set of features, benefits, and drawbacks.

Let’s delve into the different types and explore their potential in your retirement planning.

Types of Annuities

Annuities can be broadly categorized into three main types: fixed, variable, and indexed annuities.

Choosing the right financial product can be a difficult decision. Our article on Is Annuity Right For Me 2024 can help you decide if an annuity is suitable for your needs.

- Fixed Annuities: These annuities guarantee a fixed rate of return for the life of the contract. This means you know exactly how much income you will receive each month. Fixed annuities are generally considered less risky than variable or indexed annuities, as they are not subject to market fluctuations.

If you’re looking for some lighthearted humor about annuities, you can check out our article on Annuity Jokes 2024.

However, they may also offer lower returns compared to other annuity types.

- Variable Annuities: These annuities invest your money in a variety of sub-accounts, similar to mutual funds. The value of your annuity will fluctuate based on the performance of these sub-accounts. Variable annuities can offer the potential for higher returns than fixed annuities, but they also carry a higher risk of losing money.

If the market performs poorly, your annuity payments could be reduced.

- Indexed Annuities: These annuities offer returns that are linked to the performance of a specific index, such as the S&P 500. Indexed annuities provide some protection against market downturns, as your returns are capped at a certain percentage. However, they also have a lower potential for growth compared to variable annuities.

Annuity is primarily used to provide a steady income stream for retirement, but it can also be used for other purposes like paying for healthcare expenses or funding a child’s education. Check out our article on An Annuity Is Primarily Used To Provide 2024 for more details.

Benefits and Drawbacks of Annuities

Annuities can offer several benefits for retirement planning, but they also have some drawbacks that should be considered.

- Benefits:

- Guaranteed income stream: Annuities can provide a reliable source of income for life, even if you outlive your savings.

- Protection against inflation: Some annuities, like indexed annuities, offer protection against inflation, ensuring your payments keep pace with rising costs.

- Tax advantages: Annuity payments are often taxed favorably, especially for those in a lower tax bracket.

- Drawbacks:

- Limited access to funds: Once you invest in an annuity, you may have limited access to your funds until you reach a certain age or meet specific conditions.

- High fees: Annuities can come with high fees, which can erode your returns over time.

- Complexity: Understanding the different types of annuities and their terms and conditions can be complex, requiring careful research and consideration.

Examples of Annuity Use in Retirement Planning

Annuities can be used in various ways to support your retirement planning:

- Income replacement: Annuities can provide a regular income stream to replace lost wages from your job.

- Supplementing Social Security: Annuities can help supplement Social Security benefits and provide a more comfortable retirement lifestyle.

- Long-term care planning: Some annuities offer riders that can provide financial support for long-term care expenses.

- Legacy planning: Annuities can be structured to provide income for beneficiaries after your death.

Factors Affecting Annuity Payments

The amount of money you receive from an annuity depends on several factors, including your age, the interest rate, investment performance, and the type of payout option you choose. Let’s examine these factors in more detail.

If you want to know how to calculate the lump sum value of an annuity, you can read our article on Calculate Annuity Lump Sum 2024.

Key Factors Influencing Annuity Payouts

- Age: The older you are when you purchase an annuity, the lower your monthly payments will be. This is because you are expected to live longer, so the insurance company needs to spread out the payments over a longer period.

Annuity can be a flexible option for your retirement planning. You can find more information about the flexibility of annuities in our article on Is Annuity Flexible 2024.

- Interest Rates: Interest rates play a significant role in determining annuity payouts. Higher interest rates generally lead to higher annuity payments. However, interest rates are subject to fluctuations, which can impact your returns.

- Investment Performance: For variable and indexed annuities, the performance of the underlying investments directly impacts your annuity payments. If the market performs well, your payments could be higher. Conversely, poor market performance could lead to lower payments.

Impact of Inflation on Annuity Payments

Inflation can erode the purchasing power of your annuity payments over time. If the rate of inflation is higher than the growth rate of your annuity, your payments will not be able to keep up with the rising cost of living.

If you’re using Excel, you can calculate the annuity factor using the PV function. You can find a step-by-step guide on Calculating Annuity Factor In Excel 2024.

Some annuities, like indexed annuities, offer protection against inflation, but this protection is not always guaranteed.

Annuity contracts can be issued by various insurance companies. You can find information about annuities issued by LIC in our article on Is Annuity Lic 2024.

Different Payout Options

The way you choose to receive your annuity payments can also affect the amount you receive. Common payout options include:

- Lump-sum payments: You can receive your entire annuity as a single lump sum payment. This option provides flexibility but may expose you to investment risk.

- Monthly payments: You can receive your annuity as a series of monthly payments for a specified period, such as your lifetime or a set number of years.

- Combination of payments: You can choose a combination of lump-sum and monthly payments to meet your specific needs.

Calculating Annuity Payments

Calculating the estimated monthly payments from a $2 million annuity can be complex and requires considering factors like your age, interest rates, and payout options. Let’s explore how to calculate these payments and the limitations of online calculators.

An annuity can be designed to provide payments to multiple individuals. This is known as a joint and survivor annuity. You can learn more about this type of annuity in our article on Annuity Joint And Survivor 2024.

Estimating Monthly Payments

To calculate the estimated monthly payments from a $2 million annuity, you can use online annuity calculators or consult with a financial advisor. However, it’s crucial to understand that these calculations are only estimates and may not reflect the actual payments you receive.

Annuity payments can be structured in various ways. For example, you can receive a fixed amount of $300,000 annually. Our article on Annuity 300k 2024 delves deeper into this specific type of annuity.

Factors like interest rate fluctuations and investment performance can impact the final payout.

Online Annuity Calculators

Online annuity calculators can provide a quick and easy way to estimate your annuity payments. However, they often have limitations, such as:

- Simplified assumptions: Calculators often use simplified assumptions about interest rates, investment performance, and your life expectancy, which may not accurately reflect your specific situation.

- Limited options: Some calculators may not offer all the payout options available, such as the option to receive a lump-sum payment.

- No personalized advice: Online calculators cannot provide personalized financial advice, which is crucial for making informed decisions about annuities.

Table of Estimated Monthly Payments

| Annuity Type | Payout Option | Estimated Monthly Payment |

|---|---|---|

| Fixed Annuity | Lifetime payments | $10,000 |

| Variable Annuity | Lifetime payments | $8,000

If you’re looking for information about annuities in Hindi, we have an article on Annuity Meaning In Hindi 2024.

|

| Indexed Annuity | Lifetime payments | $9,000

Calculating annuity payments can be complex. You can find a step-by-step guide on How To Calculate Annuity Calculator 2024 to help you understand the process.

|

| Fixed Annuity | Lump-sum payment | $2,000,000 |

| Variable Annuity | Lump-sum payment | $2,000,000 (subject to market fluctuations) |

| Indexed Annuity | Lump-sum payment | $2,000,000 (subject to index performance) |

Considerations for Choosing an Annuity

Choosing the right annuity can be a significant decision, as it can impact your financial well-being in retirement. Carefully considering the terms and conditions of the annuity contract, selecting a reputable provider, and comparing fees are crucial steps in this process.

Annuity is a financial product that provides regular payments over a set period of time. You can learn more about it by reading our article on Annuity Is 2024. If you’re interested in calculating the potential payments, we have a Annuity Calculator Basic 2024 available.

Understanding Annuity Contract Terms

It’s essential to thoroughly understand the terms and conditions of the annuity contract before you invest. Pay close attention to the following aspects:

- Guarantee period: This is the period during which the annuity payments are guaranteed. After the guarantee period, payments may be subject to market fluctuations or other factors.

- Fees: Annuities often come with various fees, such as administrative fees, surrender charges, and mortality charges. Make sure you understand all the fees associated with the annuity and their impact on your returns.

- Death benefit: Some annuities offer a death benefit, which provides a payout to your beneficiaries if you die before the annuity period ends.

- Withdrawal options: Understand the rules and penalties associated with withdrawing money from your annuity before the specified period.

Selecting a Reputable Annuity Provider

Choosing a reputable annuity provider is crucial to ensure the security of your investment. Consider the following factors:

- Financial stability: Choose a provider with a strong financial track record and a good rating from independent agencies.

- Customer service: Look for a provider with a history of excellent customer service and a commitment to providing clear and understandable information.

- Product offerings: Make sure the provider offers a range of annuity products that meet your specific needs and risk tolerance.

Comparing Annuity Fees, How Much Will A 2 Million Annuity Pay 2024

Fees can significantly impact your annuity returns, so it’s essential to compare the fees associated with different annuity products. Consider the following types of fees:

- Administrative fees: These are fees charged for managing the annuity account.

- Surrender charges: These are penalties charged for withdrawing money from your annuity before the specified period.

- Mortality charges: These are fees charged to cover the cost of providing death benefits.

- Investment fees: Variable and indexed annuities often have investment fees associated with the underlying sub-accounts.

Tax Implications of Annuities: How Much Will A 2 Million Annuity Pay 2024

The tax treatment of annuity payments can vary depending on the type of annuity and your specific circumstances. Understanding the tax implications of annuities is crucial for making informed decisions about your retirement planning.

Tax Treatment of Annuity Payments

Annuity payments are generally taxed as ordinary income. This means they are taxed at your marginal tax rate, which can vary depending on your income level.

Inherited annuities can be subject to taxation. Our article on How Is Inherited Annuity Taxed 2024 explains the tax implications of inherited annuities.

Tax Benefits and Drawbacks

- Tax benefits:

- Tax-deferred growth: In many cases, the earnings on your annuity grow tax-deferred until you begin receiving payments. This can help you accumulate more wealth over time.

- Tax-free withdrawals: Some annuities offer tax-free withdrawals for certain purposes, such as long-term care expenses.

- Tax drawbacks:

- Taxable income: Annuity payments are generally taxed as ordinary income, which can increase your tax liability in retirement.

- Tax penalties: Early withdrawals from annuities may be subject to tax penalties.

Tax Considerations for Retirees with Large Annuity Payments

Retirees with large annuity payments may need to consider strategies to minimize their tax liability. These strategies may include:

- Tax-loss harvesting: Selling investments at a loss to offset capital gains and reduce your tax liability.

- Charitable giving: Making charitable donations to reduce your taxable income.

- Roth conversions: Converting traditional IRA or 401(k) assets to a Roth IRA to avoid paying taxes on withdrawals in retirement.

Closing Notes

Ultimately, the amount your $2 million annuity will pay in 2024 depends on a variety of factors. It’s crucial to carefully consider your individual needs, risk tolerance, and financial goals when selecting an annuity. By understanding the different types of annuities available, the factors influencing payouts, and the tax implications, you can make an informed decision that aligns with your retirement objectives.

Consulting with a financial advisor can also provide valuable guidance and personalized recommendations.

General Inquiries

What are the risks associated with annuities?

Like any investment, annuities carry certain risks. For example, variable annuities are subject to market volatility, meaning the value of your investment can fluctuate. Fixed annuities, while offering guaranteed payments, may not keep pace with inflation. It’s essential to understand the risks associated with the specific annuity you’re considering.

Can I withdraw from my annuity before retirement?

The terms of your annuity contract will dictate your withdrawal options. Some annuities allow for early withdrawals, but they may come with penalties. It’s important to review the terms and conditions carefully before making any withdrawals.

What are the tax implications of annuity withdrawals?

The tax treatment of annuity withdrawals depends on the type of annuity and the specific terms of your contract. Generally, the portion of your withdrawals representing your contributions is tax-free, while the portion representing earnings is taxed as ordinary income.