How much can I contribute to a Roth IRA in 2024 if I am over 50? This question is on the minds of many Americans as they seek to secure their financial future. As you approach retirement, maximizing your retirement savings is crucial, and Roth IRAs offer a unique opportunity to do just that.

This article will explore the contribution limits, eligibility requirements, and tax benefits associated with Roth IRAs for those aged 50 and over in 2024.

Understanding the nuances of Roth IRA contributions is essential for making informed financial decisions. This guide will delve into the specific contribution limits for those over 50, known as the “catch-up” contribution, and discuss how these limits differ from those for younger individuals.

We’ll also explore the income limitations that may impact your eligibility for Roth IRA contributions and highlight the key tax advantages of this retirement savings strategy.

Roth IRA Contribution Limits for 2024

Retirement savings plans like Roth IRAs offer tax advantages, allowing you to save for retirement and potentially withdraw your funds tax-free in the future. To maximize your retirement savings, it’s important to understand the contribution limits for Roth IRAs, especially if you’re over 50 and eligible for catch-up contributions.

If you’re married and saving for retirement, you might be wondering what is the 401k contribution limit for 2024 for married couples. This limit can vary depending on your individual circumstances.

Contribution Limits for 2024

The maximum amount you can contribute to a Roth IRA in 2024 is $7,500. This limit applies to all individuals, regardless of their age.

Retirement planning can be tricky, but knowing the 401k contribution limits 2024 vs 2023 can help you adjust your savings strategy.

Catch-Up Contributions for Those Aged 50 and Over, How much can I contribute to a Roth IRA in 2024 if I am over 50

Individuals aged 50 and over can contribute an additional $1,500 to their Roth IRA in 2024. This “catch-up” contribution allows older individuals to boost their retirement savings.

Comparison of Roth IRA and Traditional IRA Contribution Limits

The contribution limits for Roth IRAs and traditional IRAs are the same in 2024. Both allow for a maximum contribution of $7,500, with an additional $1,500 catch-up contribution for those aged 50 and over. The primary difference between Roth and traditional IRAs lies in how they are taxed.

Retirement savings are a crucial part of financial planning. Make sure you understand what are the IRA contribution limits for 2024 to maximize your contributions.

Roth IRAs allow you to contribute after-tax dollars, meaning you pay taxes on the money you contribute. However, your withdrawals in retirement are tax-free. Traditional IRAs, on the other hand, allow you to contribute pre-tax dollars, meaning you don’t pay taxes on your contributions until you withdraw them in retirement.

Not everyone qualifies for the same tax benefits. Knowing who is eligible for the standard deduction in 2024 can help you determine if you’re eligible for this tax break.

Eligibility for Roth IRA Contributions

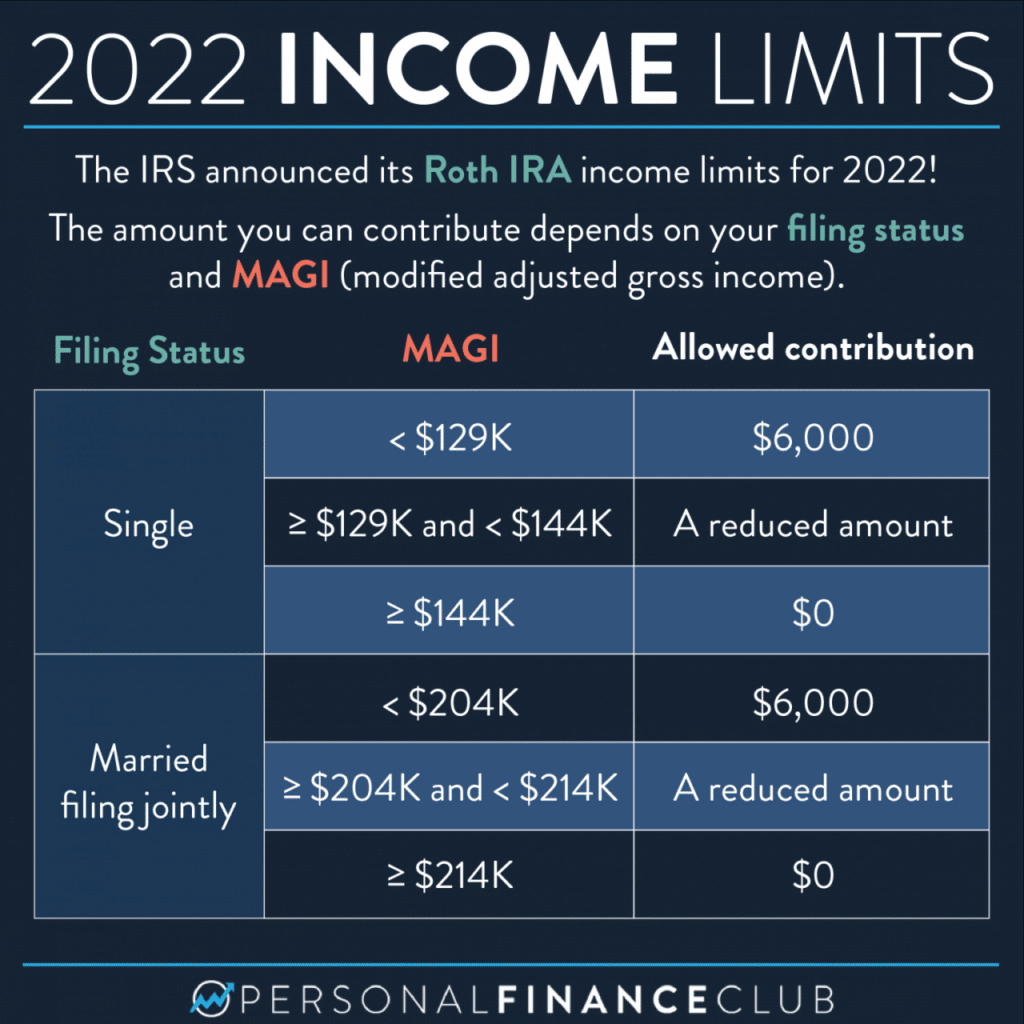

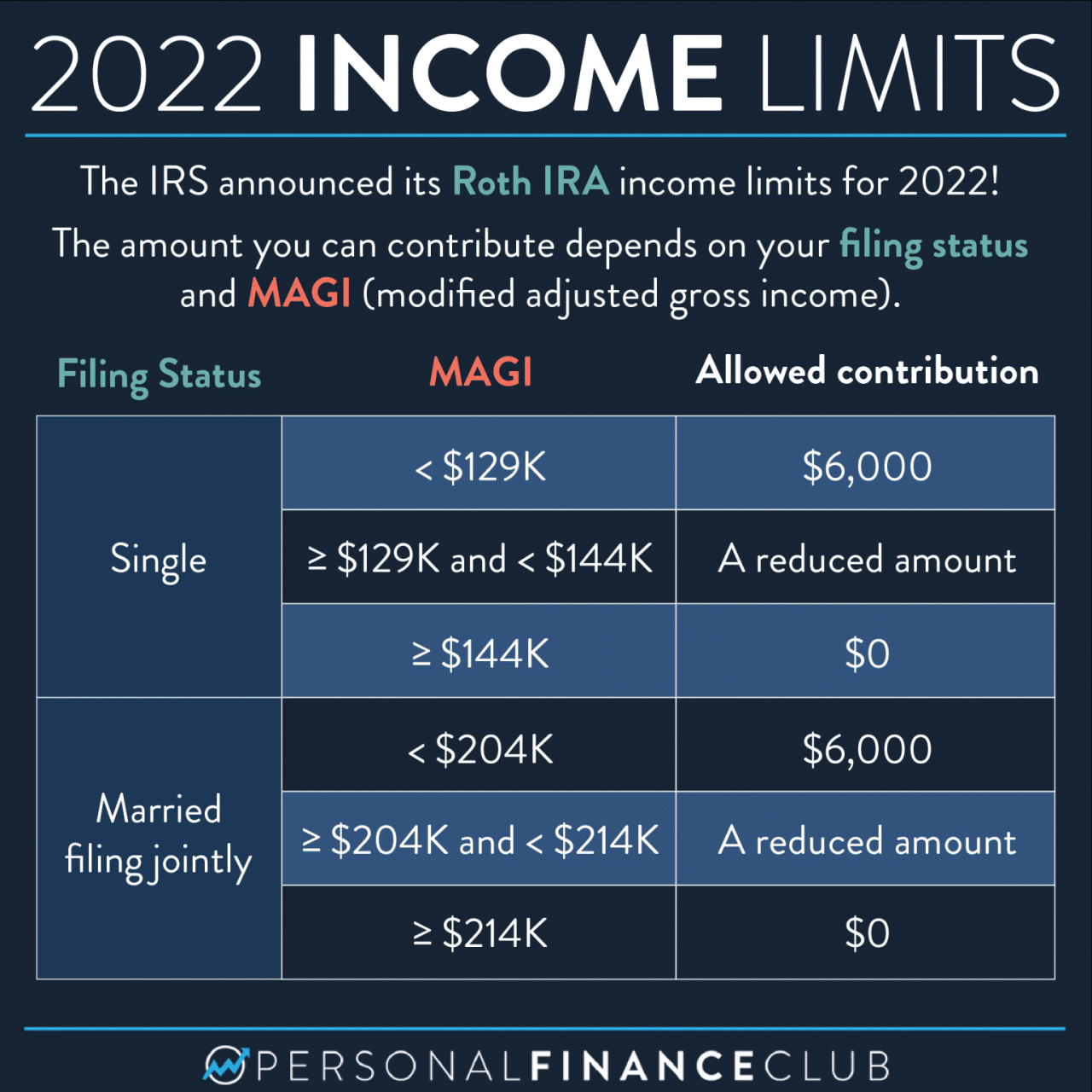

While you can contribute the maximum amount allowed in 2024, you may not be eligible to contribute to a Roth IRA at all, depending on your income. The eligibility for Roth IRA contributions is based on your modified adjusted gross income (MAGI), which is your adjusted gross income (AGI) with some modifications, such as adding back certain deductions.

Income Limits for Roth IRA Contributions

The income limits for Roth IRA contributions in 2024 are based on your filing status. If your MAGI exceeds the limit for your filing status, you cannot contribute to a Roth IRA.

Tax season is coming up, and knowing your tax brackets for single filers in 2024 can help you plan ahead and avoid any surprises.

- Single filers: $153,000

- Married filing jointly: $228,000

- Head of household: $189,000

- Qualifying widow(er): $228,000

- Married filing separately: $114,000

If your MAGI falls between the limit and the phase-out range, you may be able to contribute a reduced amount to a Roth IRA.

If you’re married filing separately, you’ll want to know the standard deduction for married filing separately in 2024 to ensure you’re getting the correct tax benefits.

The phase-out range for Roth IRA contributions is the range of income where you can contribute a reduced amount.

For example, if you are single and your MAGI is $145,000, you can contribute a reduced amount to a Roth IRA. If your MAGI is $155,000 or higher, you cannot contribute to a Roth IRA.

Driving for business? You’ll want to keep track of your mileage. The October 2024 mileage rate for business use can help you calculate your tax deductions.

Tax Benefits of Roth IRAs

Roth IRAs offer unique tax advantages that can significantly benefit your retirement savings. These advantages stem from the fact that Roth IRA contributions are made with after-tax dollars, while withdrawals in retirement are tax-free.

Tax-Free Withdrawals in Retirement

The primary benefit of a Roth IRA is that qualified withdrawals in retirement are tax-free. This means you won’t have to pay any federal or state income taxes on the money you withdraw, including both your contributions and any earnings.

Retirement savings can add up! Knowing what is the maximum IRA contribution for 2024 can help you maximize your contributions and reach your financial goals.

This can result in significant tax savings during retirement, especially if your tax bracket is higher in retirement than it is now.

Your age can impact your retirement savings options. Check out the 2024 401k contribution limits for all ages to see how much you can contribute based on your age.

“Qualified withdrawals” are withdrawals made after you reach age 59 1/2, have held the account for at least five years, and are taken for a qualified reason, such as retirement, disability, or a first-time home purchase.

Planning for retirement? You’ll want to know the 401k contribution limit for 2024 vs 2023 to make the most of your savings. The limits have changed, so make sure you’re maximizing your contributions.

Comparison to Traditional IRAs

Traditional IRAs differ from Roth IRAs in terms of their tax treatment. Contributions to traditional IRAs are tax-deductible, meaning you can deduct them from your taxable income in the year you make the contribution. However, withdrawals in retirement are taxed as ordinary income.

IRA contributions can be a great way to save for retirement. Figuring out how much can I contribute to my IRA in 2024 can help you maximize your retirement savings.

- Roth IRA:Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

- Traditional IRA:Contributions are tax-deductible, but withdrawals in retirement are taxed as ordinary income.

The choice between a Roth IRA and a traditional IRA depends on your individual circumstances and tax situation. If you expect to be in a higher tax bracket in retirement, a Roth IRA may be more advantageous. However, if you expect to be in a lower tax bracket in retirement, a traditional IRA may be more beneficial.

Small business owners have different retirement saving options. Learn about the 401k contribution limits for 2024 for small businesses to maximize your retirement savings.

Considerations for Contributing to a Roth IRA: How Much Can I Contribute To A Roth IRA In 2024 If I Am Over 50

Contributing to a Roth IRA can be a smart move for your retirement savings, but it’s essential to consider several factors before making a decision. The benefits of a Roth IRA are significant, but it’s important to weigh these against other retirement savings options and your individual financial circumstances.

Saving for retirement is important, and knowing what is the maximum 401k contribution for 2024 can help you reach your retirement goals.

Factors to Consider

When deciding whether to contribute to a Roth IRA, consider these factors:

- Your current income and tax bracket:Roth IRA contributions are made with after-tax dollars, meaning you won’t receive a tax deduction for your contributions. However, your withdrawals in retirement are tax-free. If you expect to be in a higher tax bracket in retirement, a Roth IRA can be beneficial.

- Your expected future income:If you anticipate your income to be lower in retirement, a Roth IRA might be less advantageous. This is because you’ll have already paid taxes on your contributions, and your withdrawals will be tax-free.

- Your time horizon:The longer you have to save for retirement, the more beneficial a Roth IRA can be. This is because your investments have more time to grow tax-free.

- Your risk tolerance:Roth IRAs offer the potential for tax-free growth, which can be advantageous for those with a higher risk tolerance.

- Your other retirement savings options:You should compare the benefits of a Roth IRA with other retirement savings options, such as a traditional IRA or a 401(k).

Comparison with Other Retirement Savings Options

Here’s a comparison of Roth IRAs with other retirement savings options:

| Option | Contribution Type | Tax Deduction | Tax-Free Withdrawals | Other Considerations |

|---|---|---|---|---|

| Roth IRA | After-tax | No | Yes | Contribution limits, income restrictions |

| Traditional IRA | Pre-tax | Yes | No | Contribution limits, may be tax-deductible |

| 401(k) | Pre-tax or Roth | Yes (pre-tax) | Yes (Roth) | Employer matching contributions, contribution limits |

Examples of Roth IRA Contributions for Retirement Planning

Here are some examples of how Roth IRA contributions can be used for retirement planning:

- Early Retirement:If you plan to retire early, a Roth IRA can be a valuable tool. This is because your withdrawals will be tax-free, which can help you maintain your standard of living in retirement. For example, if you retire at age 55 and plan to live for another 30 years, a Roth IRA can provide you with a steady stream of tax-free income.

Planning to file jointly with your spouse? You’ll need to know what is the 2024 standard deduction for married filing jointly to ensure you’re taking advantage of all the tax benefits you’re entitled to.

- Long-Term Savings:Roth IRAs are excellent for long-term savings goals, such as funding your dream vacation or paying for your grandchildren’s education. This is because your investments have more time to grow tax-free, and you can withdraw your contributions tax-free and penalty-free at any time.

For example, if you contribute $5,500 annually to a Roth IRA for 30 years and earn an average annual return of 7%, you could have over $500,000 saved by the time you retire.

- Tax-Free Income:Roth IRAs can provide you with tax-free income in retirement. This can be especially beneficial if you expect to be in a higher tax bracket in retirement. For example, if you are in the 22% tax bracket in retirement, you could save thousands of dollars in taxes each year by withdrawing from a Roth IRA instead of a traditional IRA.

How to Contribute to a Roth IRA

Contributing to a Roth IRA involves making regular deposits to your account, allowing your investments to grow tax-free. There are various ways to contribute to a Roth IRA, and understanding these options is crucial for maximizing your retirement savings.

Opening a Roth IRA Account

To start contributing to a Roth IRA, you need to open an account with a financial institution that offers Roth IRA options. These institutions can include banks, credit unions, brokerage firms, or online investment platforms.

Self-employed individuals have a different tax deadline than those who work for someone else. The October 2024 tax deadline for self-employed individuals gives you a bit more time to file, but don’t forget to plan accordingly.

- Choose a Financial Institution:The first step is selecting a financial institution that aligns with your investment goals and preferences. Consider factors such as account fees, investment options, customer service, and ease of use.

- Complete an Application:Once you’ve chosen a financial institution, you’ll need to complete an application to open a Roth IRA account. This typically involves providing personal information, such as your name, address, Social Security number, and employment details.

- Fund Your Account:After your account is opened, you can start making contributions. You can fund your Roth IRA with cash, checks, or electronic transfers.

Examples of Online Platforms

Several online platforms offer Roth IRA accounts, providing a convenient and accessible way to manage your retirement savings. Here are some examples:

- Fidelity Investments:Fidelity offers a wide range of investment options, including mutual funds, ETFs, and individual stocks, making it suitable for various investment strategies. They provide comprehensive resources and tools for managing your Roth IRA.

- Vanguard:Vanguard is known for its low-cost index funds, making it an attractive option for investors seeking to minimize fees. Their platform is user-friendly and offers a range of educational resources.

- Charles Schwab:Schwab provides a wide range of investment choices, including mutual funds, ETFs, and individual stocks. They also offer access to financial advisors and research tools.

Last Point

In conclusion, understanding the nuances of Roth IRA contributions for those over 50 is vital for maximizing your retirement savings. The “catch-up” contribution allows you to boost your contributions, while the tax benefits of Roth IRAs offer a significant advantage in retirement.

By carefully considering your individual financial situation and exploring the various options available, you can make informed decisions about your retirement savings strategy and ensure a secure financial future.

Commonly Asked Questions

What are the tax implications of withdrawing money from a Roth IRA?

Withdrawals from a Roth IRA are tax-free in retirement, provided you meet certain conditions, such as being at least 59 1/2 years old and having held the account for at least five years.

Can I contribute to both a traditional IRA and a Roth IRA in the same year?

Yes, you can contribute to both a traditional IRA and a Roth IRA in the same year, but your total contributions to both types of IRAs cannot exceed the annual contribution limit.

Is there an age limit for contributing to a Roth IRA?

There is no age limit for contributing to a Roth IRA. You can continue to contribute to a Roth IRA even after you reach retirement age.